Digital Imaginative and prescient./DigitalVision through Getty Pictures

Chinese language shares are beneath strain, because the area has suffered from roughly $12 billion in internet inflows for the reason that begin of June. As such, I made a decision to evaluate the iShares China Giant-Cap ETF’s (NYSEARCA:FXI) prospects attributable to its systematic linkage to China’s broader monetary panorama.

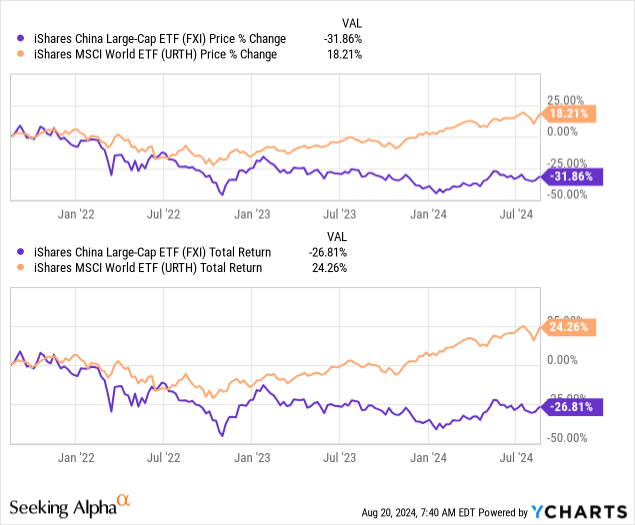

Moreover, in an unanticipated flip of occasions, the FXI ETF has underperformed the MSCI World ETF (URTH) up to now three years. Subsequently, the query turns into: Does the FXI ETF current a “purchase the dip” alternative, or are Chinese language large-cap shares a no-go zone?

To deal with the central query, I launched into a scientific evaluation. Furthermore, I phased in just a few idiosyncrasies to make sure full alignment.

Herewith are my newest ideas concerning the iShares China Giant-Cap ETF.

What Is FXI ETF?

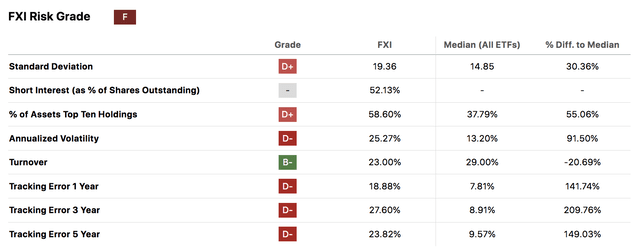

The iShares China Giant-Cap ETF is a market-cap-weighted ETF that invests within the Hong Kong Inventory Alternate’s high 50 constituents. The ETF typically produces outcomes much like its benchmark, the FTSE China 50 Index. Nevertheless, occasional monitoring errors would possibly happen as a result of car’s consultant sampling strategies, bills, and securities lending actions.

Sidenote: In my expertise, monitoring errors can come up by means of illiquidity, variations in cross-country settlement instances, and intensive use of American Depository Receipts as a substitute of the underlying devices.

Monitoring Error (In search of Alpha)

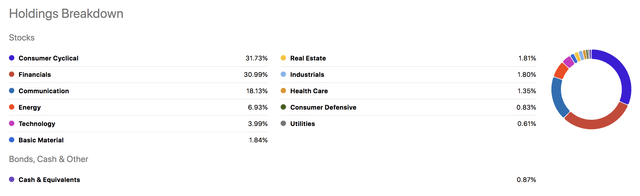

Moreover, a look at FXI’s present sectoral publicity illustrates a tilt towards shopper discretionary and monetary companies shares, suggesting it has cyclical attributes.

Sector Composition (In search of Alpha)

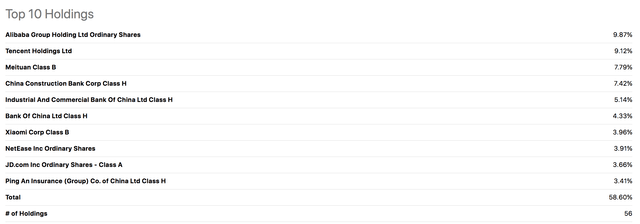

FXI ETF’s constituent composition exhibits that the car typically limits its focus threat to beneath 10% per constituent. Though a market-cap-weighted ETF, it tries to scale back its focus threat by setting publicity boundaries.

One other aspect observe: You will discover that the ETF at the moment has 56 constituents. In my expertise, an ETF will use buffering and packeting to easy the car’s rebalancing course of and keep away from extreme turnover concurrently.

Constituents (In search of Alpha)

Headwinds

Buyers Shedding Religion In Chinese language Shares

As talked about within the introduction, investor outflows from China have been extreme, totaling a reported $12 billion since June. To take it a notch additional, BNN Bloomberg reported that China would possibly face its first annualized internet outflow, which, in flip, led to native authorities suspending regional market knowledge releases.

One thing appears fishy right here, proper?

China Investor Outflows (Bloomberg)

How will China’s inventory outflows impression the FXI ETF?

Some would possibly think about my opinion oversimplified, however I imagine in parsimony.

Regardless of internet hosting just a few high quality firms (or what I think about high quality firms), knowledge transparency considerations, political affect, and financial turmoil (mentioned later) would possibly result in a sell-off of Chinese language equities. Sadly, large-cap shares would possibly really feel the pinch attributable to their consultant liquidity and inclusion in structured autos just like the FXI ETF.

The abovementioned is a market-based remark. Nevertheless, let’s transfer right into a basic dialogue to see whether or not my assumption is legitimate.

Actual Financial Elements

Salient Options

Whereas monetary markets and financial variables can show weak correlations, long-term inventory whole returns often correlate with a area’s actual financial efficiency, at the least from a scientific vantage level.

Apart: In my expertise, correlations between GDP progress and inventory returns shall be low when a concurrent correlation is examined; I want researchers would use implied GDP as a substitute of realized GDP.

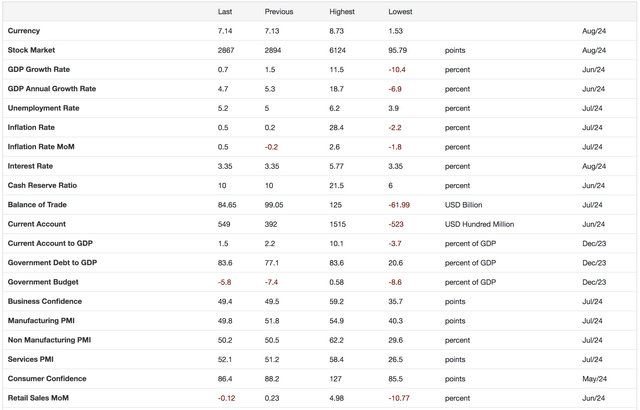

The subsequent diagram exhibits a time collection of a few of China’s core financial variables; a dialogue follows.

| Metric | Worth In 2024 | Worth In 2014 |

| Annual Actual GDP Development Forecast | 4.7% p/a till 2029 | 7.39% |

| Capital Flows | Questionable Outlook | Optimistic Outlook |

| Authorities Debt/GDP | 83.6% | 40% |

| Present Account/GDP | 1.5% | 2.1% |

Sources: Statista, Buying and selling Economics

In isolation, China’s actual GDP forecast is commendable. Nevertheless, its implied progress has slowed up to now ten years, possible attributable to its economic system maturing and political headwinds.

Moreover, China’s debt-to-GDP has doubled up to now decade and has exceeded the 80% threshold, which is taken into account worrisome for an rising market. Moreover, my outlook on a associated variable, China’s capital flows, is unfavorable primarily based on its latest internet fairness outflows and the Chinese language Communist Get together’s weakening ties with the Western world.

Other than its decelerating long-term trajectory, China has interim financial challenges.

The next diagram illustrates the nation’s interim threat elements by summarizing slowing short-term GDP progress, rising unemployment, waning shopper confidence, and sluggish retail gross sales.

Quick-term financial indicators (Buying and selling Economics)

Salient knowledge factors present that China’s economic system faces noteworthy challenges, which have rippled by means of its inventory market, resulting in FXI ETF’s demise.

Sadly, I can’t justify a rebound of FXI ETF as its portfolio is uncovered to extremely cyclical sectors equivalent to monetary companies corporations, shopper cyclical firms, and actual property. These sectors comprise greater than 60% of the car’s portfolio, which I deem unfavorable for now.

Potential Banking Disaster

Roughly 40 Chinese language banks had been lately hit with unhealthy money owed, leading to a TARP-esque mission during which bigger establishments (some state-owned) absorbed poisonous property.

Stories counsel that 40 Chinese language banks had been taken over within the first six months of 2024. The foundation trigger was the actual property sector, which felt the pinch of decrease collections and receding collateral values. Though a banking disaster hasn’t occurred, the occasion means that broad-based systematic threat is excessive.

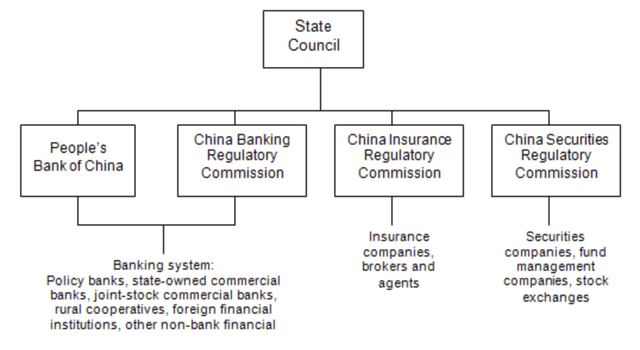

The next chart offers an exposition of China’s banking construction.

China’s Banking Construction (Journal of Financial Geography)

Roughly 30% of the FXI ETF’s portfolio contains monetary sector corporations, illustrating its publicity to China’s systematic threat. Moreover, peripheral and knock-on results often happen when the banking system is beneath strain, that means FIX’s different sectors would possibly really feel the pinch sooner or later.

A couple of examples of potential peripherals.

- Greater borrowing prices for company entities.

- Decrease shopper confidence.

- Lowered monetary and tangible asset values.

- A normal “struggle or flight” response, leading to risky monetary markets.

FXI’s Portfolio Attributes

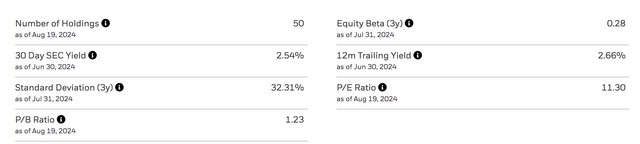

Let’s begin this part by inspecting the FXI ETF’s valuation metrics.

FXI ETF’s portfolio has a price-to-earnings ratio of 11.3x (P/E), almost half of the SPY ETF’s (SPY) P/E of 26.93x. Though many would possibly think about the ETF’s P/E indicative of relative worth, FIX ETF has a beta coefficient of merely 0.28x, suggesting it’s a low-volatility ETF. Subsequently, a decrease P/E is probably going justified.

iShares

I could not discover a delineation of the portfolio’s progress prospects by means of iShares. Thus, I collected knowledge from In search of Alpha to contextualize FXI’s progress trajectory.

The next diagram exhibits that a few of FXI’s constituents have skilled illustrious progress. Nevertheless, different firms have decelerated, revealing the disparity within the portfolio’s basic efficiency.

| Inventory | Income CAGR | Internet Revenue CAGR |

| Alibaba (BABA) | 7.3% | -22.05% |

| Tencent (OTCPK:TCEHY) | 5.78% | -6.72% |

| Meituan Class B (OTCPK:MPNGF) | 29.15% | 1.23x |

| China Building Financial institution Corp (OTCPK:CICHY) | 2.96% | 6.56% |

| Industrial and Industrial Financial institution of China (OTCPK:IDCBF) | 2.56% | 4.46% |

| Financial institution of China Class H (OTCPK:BACHF) | 3.56% | 5.82% |

| Xiaomi Company (OTCPK:XIACF) | 1.68% | -12.42% |

| NetEase Inc (NTES) | 10.93% | 32.75% |

| JD.com Inc (JD) | 8.91% | -5.02% |

| Ping An Insurance coverage (OTCPK:PNGAY) | -12.37% | -16.49% |

Supply: In search of Alpha (3-year CAGRs used)

By inspecting the ETF’s valuation and progress metrics, I did not see sufficient proof to conclude that FXI ETF possesses telling future worth.

Peer-Based mostly Evaluation

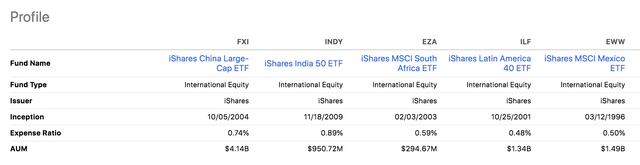

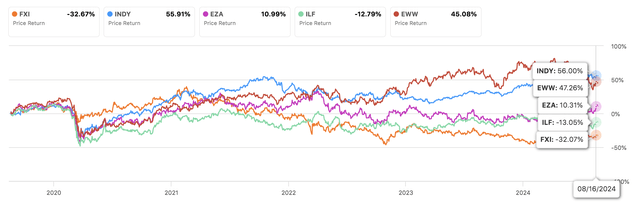

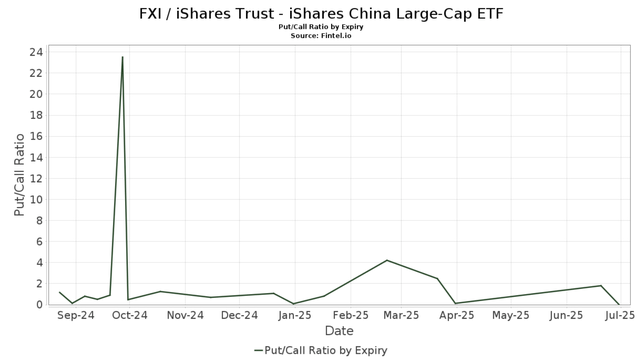

I carried out a peer-based research so as to add extra colour to the evaluation. Amongst my chosen friends are INDY ETF (INDY), EZA ETF (EZA), ILF ETF (ILF), and EWW ETF (EWW).

Though my chosen peer group has idiosyncratic variations, the set might be prudent for traders searching for rising progress.

Peer Evaluation (In search of Alpha)

FXI ETF’s expense ratio is the second highest within the pack, possible attributable to its extra intensive asset base. Nevertheless, I feel its expense ratio is noteworthy, particularly contemplating its worst-in-class efficiency up to now 5 years.

Peer Evaluation (In search of Alpha)

Moreover, FXI ETF’s dividend yield of two.6% is commendable, however related or higher yields can be found through autos with superior value momentum.

Peer Evaluation (In search of Alpha)

Technical Evaluation/Value Exercise

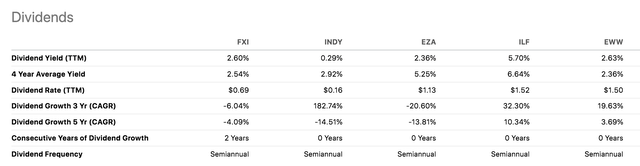

Having mentioned quite a few basic attributes, it’s time to study FXI ETFs’ market-based exercise to light up an argument for value discovery.

FXI ETF has gained momentum up to now six months, surging by almost 15%. Nevertheless, the ETF slipped by about 2% in early buying and selling on Tuesday, reflecting traders’ dissatisfaction with the info transparency and internet outflow information.

Moreover, FXI ETF trades above its 10-, 50-, 100-, and 200-day shifting averages, and its relative power index is in mid-zone territory. In isolation, this means that its market value might go both means.

In search of Alpha

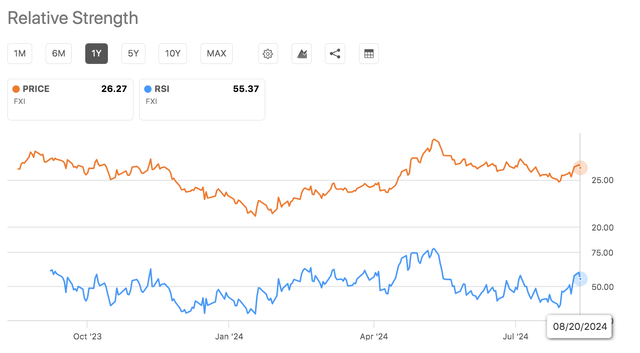

One other telling issue is FXI ETF’s Put/Name Ratio, which is at 0.87x, suggesting choices merchants are internet bullish concerning the ETF’s short-term prospects.

PUT/CALL (Fintel)

Some would possibly disagree, however I feel FXI ETF has reached a resistance degree and can quickly revert beneath its short-term shifting averages. Aside from its basic headwinds, the Put/Name and moving-average metrics might be countercyclical, which provides substance to my argument.

Ultimate Phrase

In abstract, I feel China’s economic system faces underrated headwinds. These headwinds have influenced the FXI ETF in previous years, however extra ache is probably going en route.

Regardless of internet hosting just a few promising constituents, FXI ETF’s asset base progress is dispersed. Moreover, the ETF faces interim challenges equivalent to internet investor outflows, knowledge transparency, and threat inside its banking sector.

Lastly, given the financial local weather, I am not keen on FXI ETF’s sectoral composition and market-based metrics. Subsequently, I’m cautious concerning the ETF’s prospects.