Daniel Balakov

Investment thesis

Futu Holdings (NASDAQ:FUTU) is an online brokerage platform providing investment experience primarily for retail investors. Besides the brokerage services, the company provides wealth management and corporate services, being active in IPO’s and employee stock ownership plans (ESOP). Futu’s founder and largest shareholder is Hua Li, a former Tencent employee. Hua Li’s computer science background and Tencent experience enabled him to create a customer friendly platform based on the community of traders and retail investors. Tencent is still a major backer of Futu and owns 35% stake in class B shares.

FUTU stock lost almost 80% of its value from its highs in June 2021. Uncertainty from the Chinese securities regulator about illegal cross-border brokerage services pushed down Futu shares into attractive valuation levels. Nevertheless, new set of rules for Chinese online brokerages provide clear pathway going forward, without hurting current mainland Chinese traders and retail investors. I believe that fundamentals and operational performance will eventually overcome negative sentiment around Futu’s stock and that valuation gap of over 45% should sooner or later close.

Bloomberg

Regulatory clarity clears big hurdle going forward

Since the regulatory crack-down on Chinese tech companies started, stocks of the online brokerages were especially hurt. The possibility that Futu could go out of the business due to one negative regulatory decision has been real. That’s why I consider a new set of rules adopted by the regulator as a positive development which gives Futu exact guardrails where and how it can operate. Based on these rules, existing onshore clients can still trade with the broker but can’t add new funds or open new accounts. Additionally, Futu has to remove its trading app from mainland China’s app stores. The slow churn of onshore clients will probably follow, but it won’t be as drastic as the market initially expected. In 2022, only 10% of new paying customers where from mainland China.

Regulatory uncertainty forced FUTU to start looking for markets outside onshore China. Besides China, FUTU is active in the US, Australia, Singapore, and Hong Kong. In 1Q2023 earnings call, management stated that the company plans to expand into Malaysia and strengthen Futu’s presence in Southeast Asia. Chinese ban on cross-border trading has been initially perceived as negative, but it pushed FUTU to be more diversified, internationally recognized business. To strengthen the overseas expansion, the company plans to increase its workforce by 15%. Malaysian market is attractive due to its high percentage of Chinese population and young and sophisticated workforce with only limited opportunities for brokerage services.

Previous expansions into the US or Singapore have showed future potential. In 1Q earnings call, the management of the company stated:

”Now for the first batch, two years clients, which we acquired two years ago, they have already surpassed our client’s acquisition cost, which may contribute to operating profit nowadays. I think we are extremely confident about our profitability and earning powers in the Singapore markets alone”.

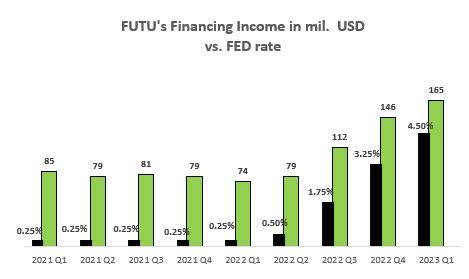

Fed rate hikes are positive for earnings

Futu’s earnings are positively correlated with the prevailing market interest rate as well as the volume of instruments traded on Futu’s platforms. Interest income Futu charges for margin financing and securities lending increases proportionately with FED discount rate. From FY2020 until FY2022, interest income derived from margin financing represented 17%, 30%, and 27% of total revenue. However, in 1Q 2023, financial income accounted for almost 52% of total revenue. Since 1Q 2023, FED increased its discount rate three times, from 4.5% to 5.25% and more rate hikes are expected by the market for the second half of 2023. Even though, there is not much optimism in Chinese stocks, current interest rate environment is positive for Futu’s earnings and investors will sooner or later separate grain from chaff and good companies from average ones.

Annual reports, www.tradingeconomics.com

Valuation

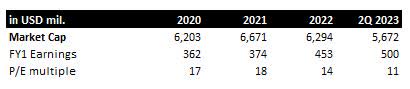

Futu trades at depressed 11x FY2023 earnings, which is a discount of 45% to average 3-year P/E of 16. If consensus revenues growth for the next three years of over 11% p.a. shows correct, then the current earnings multiple is undemanding. To strengthen the argument, Futu generates real GAAP earnings as opposed to adjusted earnings / EBITDA often used by other fin-tech companies. These earnings are used by the company for buy-backs. In March 2022, the company announced USD 500 million buy-back program valid until December 2023. As of December 2022, approximately USD 247 million has been left for additional purchases, which is 4.3% of the current market capitalization. Investors buying Futu shares at current levels will be rewarded with growing future earnings as well as hidden buying power coming from the company repurchasing its own shares. I find this risk / reward ratio quite compelling.

Annual reports

Geopolitical risk is still present

Investing in Chinese ADR’s via VIE structure (variable interest entities) always present hardly quantifiable risk of geopolitics and the investment in Futu is not an exception. At the times of increased nervousness between China and the US, especially in the question of Taiwan, geopolitical risk will be present. On the other hand, the best protection against any price decline is buying an asset at low prices. A low price of the asset should serve as a floor against severe decreases in value and I think that the current market value of Futu should fulfil this condition.

Summary

In the last twelve months, FUTU stock has been correctly punished by the market, but further reasons for negative performance have faded away. On the contrary, Futu’s earnings should grow due to higher interest income fueled by a current interest rate environment. Expansion into overseas markets should also have a positive impact on earnings in the next couple of quarters. Futu’s humble valuation leaves enough margin of safety for patient investors. Buying shares at today’s prices provides benefits of return to mean with only limited risk of future downfall.