David Beckworth directed me to an interesting debate at a recent Brookings panel. Olivier Blanchard and Ben Bernanke presented a paper that evaluated various factors in the recent inflation surge, highlighting the role of supply issues related to food, energy, shortages, etc. To be clear, they noted that some of the supply bottlenecks occurred due to previous over-stimulus of demand. They also argued (correctly in my view) that inflation moves from transitory to permanent when it becomes embedded excessive wage growth. The initial inflation surge was high prices relative to wages; the current problem is excessive wage growth.

In his discussion, Jason Furman presented a slide showing his interpretation of their framework for aggregate demand shocks:

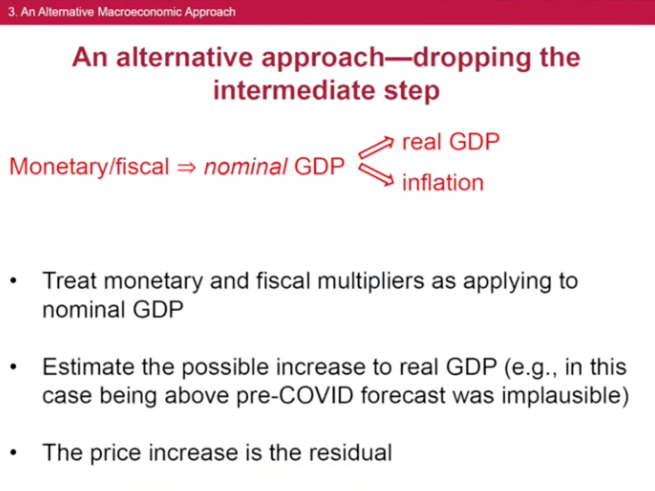

He contrasted that with his preferred framework for the analysis:

Long time readers will recognize that this is also my preferred way of thinking about demand shocks. By itself, real GDP tells us almost nothing about demand. In contrast, NGDP is a reasonable proxy for aggregate demand. (That doesn’t stop pundits from occasionally citing real output and/or real consumption data as “demand,” even though that’s an EC101-level error.)

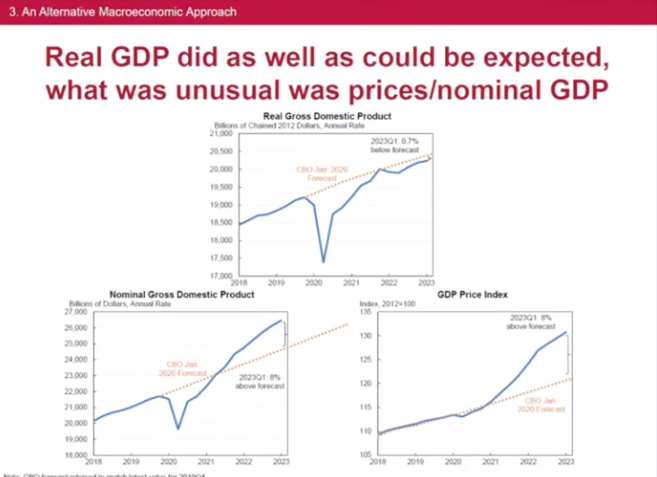

In the subsequent discussion, Bernanke objected that the implications of rising NGDP were ambiguous, as one could imagine a scenario where both the AS and AD curve shifted upward (less AS, more AD, no change in output.) Thus stable RGDP and rising NGDP does not necessarily imply that the problem is primarily excess demand. He may have been reacting to this slide from Furman:

In an accounting sense, it looks like the inflation problem is 100% nominal, with real GDP roughly on trend. If I’m not mistaken, Bernanke’s argument is that in a counterfactual where NGDP rose less strongly, it is possible that output would have been lower (due to COVID, Ukraine, etc.) and we still would have experienced some excess inflation (albeit presumably less than what we actually experienced.)

Here’s why I prefer Furman’s approach: Prior to COVID, unemployment was roughly 3.5%, and hence the economy was probably close to equilibrium. In that case, we should not have been aiming for fast NGDP growth to reduce unemployment below 2019 levels. Rather, we should have aimed for NGDP growth of roughly 2% plus the Fed’s estimate of trend RGDP growth after 2019. In fact, we got a couple trillion dollars in excess NGDP growth, roughly 8% above trend. It would be shocking if that sort of rapid growth in nominal spending had not created high inflation, given that we were already near full employment in early 2020.

That doesn’t mean that Bernanke’s theoretical observation is incorrect. Rather, I am suggesting that his point is probably of limited relevance for this particular episode. Perhaps COVID reduced aggregate supply by 1% or 2% between early 2020 and today, and the powerful demand stimulus boosted output by a roughly equal amount, leaving RGDP close to trend. If NGDP had grown at trend, perhaps output would be 1% or 2% lower than current levels.

What seems implausible is that the change in aggregate supply over the past three years is anything close to the 8% overshoot of demand. That sort of rapid growth in nominal spending is not a necessary condition for inflation (supply shocks can also boost the CPI), but it seems to me that it’s pretty close to a sufficient condition for high inflation in the absence of some sort of truly extraordinary boost in aggregate supply.

So while Bernanke is right that fast rising NGDP doesn’t definitively prove that excess demand is the cause of the recent inflation overshoot, given plausible estimates of shifts in the AS curve, it seems highly likely that the 8% NGDP overshoot is by far the most important cause of high inflation.

Furman also made some very good observations about the difficulties involved in separating supply and demand shocks. For instance, congestion at the ports seems like a “supply problem.” But most of this congestion was not caused by a physical problem at the ports. According to Furman, import volumes at US ports were far higher in 2021 than in 2019. Instead, it was the extraordinarily large demand for goods during 2021 (partly driven by stimulus checks) that was causing congestion at the ports. So in a sense even the “bottleneck” problems were partly excess demand, even though they looked like a supply problem. (Again, Blanchard and Bernanke acknowledged this problem in their paper.)

In EC101, we are taught that P and Y, considered in isolation, tell us nothing about supply and demand shocks. NGDP is different. It measures prices times output, or total nominal expenditure. Thus NGDP is a fairly direct read on aggregate demand. Instead of looking at all sorts of sectors (food, energy, services, labor, investment, durables, exports, etc.), NGDP provides a simple and elegant way of thinking about total demand in the economy.

Yes, the Fed doesn’t directly target NGDP. But there is no plausible interpretation of the Fed’s dual mandate where—if starting from equilibrium—it is appropriate to have NGDP growth either far above 4% or far below 4%. In 2008-09, we went roughly 8% below trend (which was then 5%), and in the past three years we’ve gone roughly 8% above. When the deviations in NGDP are that large, it’s reasonable to say that the problem is primarily demand.

P.S. Of course, I favor NGDP targeting, which is another reason to prefer Furman’s framing of the issue. But I’d prefer his approach even if the Fed sticks to its current “dual mandate” approach. As St. Louis Fed President Jim Bullard once observed, the implications of FAIT (if symmetrical) are pretty similar to NGDP level targeting.