joeygil Frontline logo (Frontline)

Investment Thesis

In our previous analysis of Frontline Plc (NYSE:FRO) at the end of March 2023, we asked the question of whether shareholders could expect a feast or a famine.

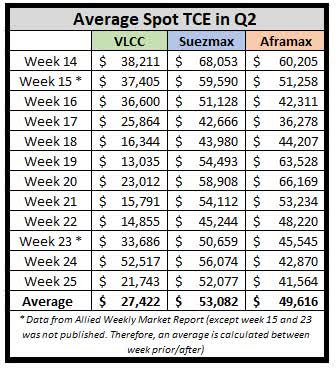

To accurately predict the forward freight market is fraught with difficulties, as the spot market for the VLCCs experiences huge swings even on a weekly basis.

To illustrate this, we noticed that the weekly estimated average TCE for VLCC in week 24 was $52,517 per day on a round voyage basis and dropped to just $21,743 the following week. That was the last week of Q2.

The smaller ships have experienced less volatility. In fact, just like what we saw two years ago in the dry bulk segment, strangely enough, the smaller vessels were making more money than the larger and more expensive vessels.

Average TCE for crude oil tankers in Q2 of 2023 (Data from Allied Shipbrokers, compilation by TIH)

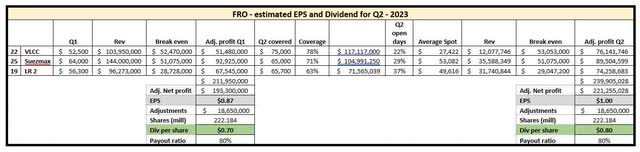

Some of the uncertainty is taken out of the equation, since FRO did communicate during the Q1 presentation that they did have about 70% of Q2 already covered.

Estimate of EPS and Dividend for Q2 of 2023

The adjusted net profit in Q1 was $193.3 million, which equated to an EPS of $0.87

From this, they declared a dividend of 0.70 per share.

We have used the data given by FRO for the days in Q2 that were covered already when they announced Q1, and used average estimates from the spot market for the balance of their fleet. Profitability is derived from TCE minus their break-even rates, which FRO regularly updates shareholders and investors with. It is not perfect, as it is impossible to know when the various vessels were fixed out and as we can see from the table above, the market makes big changes from week to week. In addition, we have made an adjustment to net profit for other income or expenses to come to the net profit for the quarter.

Here is our estimate for EPS and dividend for FRO for Q2 0f 2023.

TIH estimate of FRO’s EPS and dividend for Q2 of 2023 (Data from FRO and estimates from TIH)

FRO is expected to publish its Q2 around the end of August 2023.

Business development

We all know that supply and demand ultimately determine whether the future for crude and product oil tankers will be good, or not.

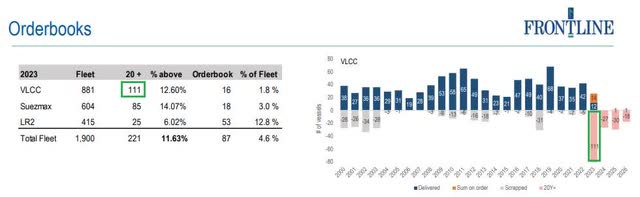

The supply side does look promising, with as much as 12.6% of the VLCC fleet becoming 20 years or older this year. Some of these still trade for now in cargoes from sanctioned countries. Hopefully, this will be dealt with strongly by regulators and authorities around the world.

The order book for the tanker fleet (Frontline Q1 of 2023 Presentation)

The demand side is, as usual, the hardest part to predict.

Electrification of vehicles will have a negative impact. By 2025, the replacement of fossil fuel-powered vehicles with electric vehicles is expected to reduce the need for crude oil by about 2.5 million barrels per day. The current consumption is 100 million barrels per day. There are changes taking place both in the aviation industry and the maritime industry to replace fossil fuels with low or no-carbon alternatives, but this will most likely take time to replace.

Utilization of the fleet might be reduced with the IMO amendments to MARPOL, which aims to reduce pollution, including GHG, from ships. From the 1st of January this year, ships have to calculate their energy efficiency and initiate collection of data for the reporting of their annual carbon intensity.

The goal is to reduce carbon intensity by 40% by 2030. Ships will be rated from A, being the best, to E being the worst.

Lower utilization takes place if owners decide to reduce the speed. With slower speed, there is a need for more vessels to transport the oil.

Shipowners are cautiously optimistic. There is no euphoria, as the low-order book is a clear testament to that. However, this could change, and herd mentality could once again return. Nevertheless, it will still take a couple of years before those new ships could enter service.

With regards to FRO and their ambition to grow their business, we witnessed last year their s attempt to become the world’s largest publicly listed company for crude oil tankers. They tried to merge, or just take control of Euronav (EURN) but decided in early January to terminate the $4.2 billion deal. FRO’s main shareholder John Fredriksen later the same month continued to purchase shares in EURN, so we are not sure if the last chapter on this potential deal has yet to be written.

He has also been building up a stake in International Seaways (INSW).

Perhaps that is his next target for a merger or takeover. Market consolidation is not a bad thing and M&A can be good for shareholders providing the price is right.

Conclusion

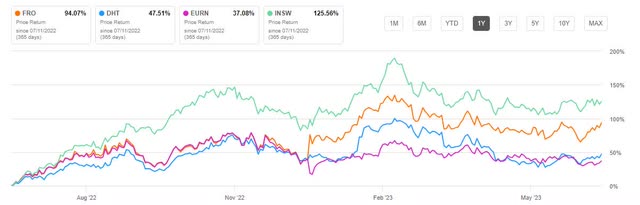

Our earlier stance had been that of a Hold. In hindsight, this was too conservative.

1-year return comparison for crude oil tanker stocks (SA)

Over the last year, all the crude oil tanker stocks have been a pretty good place to be invested in. Surely, a lot better than the sibling, the dry bulk stocks. The two “winners” have been FRO and INSW.

There are good reasons to be optimistic about the tanker’s stocks for the next couple of years with a high likelihood of good cash generation potential from all of them.

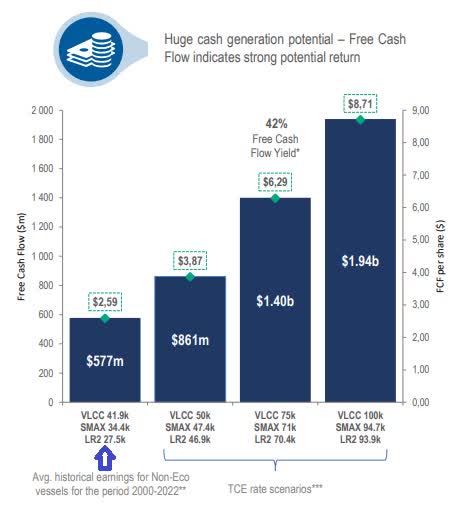

Frontline’s potential earnings (Frontline Q1 of 2023 Presentation)

Should the FCF per share be $3.87 per share, which is quite possible, and a payout ratio of 80%, the dividend of $3.10 over one-year period would leave investors with a strong yield of 19.5%

We do share the ship owner’s optimism and upgrade our stance from a Hold to a Buy