Oselote

Introduction

Fresnillo plc (OTCPK:FNLPF) is the world’s largest silver producer at 60M oz’s forecasted for 2024. Plus, they also plan to mine 625K oz’s of gold. They are truly a monster company.

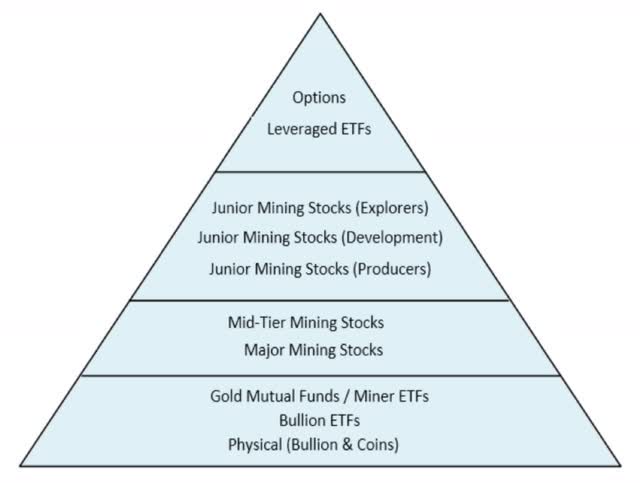

Normally, a stock this large would not be on my radar. However, all silver miners are cheap at the moment. It seems odd to say that Fresnillo is cheap, but it is. The potential upside for Fresnillo is what you would normally expect from a Junior.

Whenever I can find a quality producer on sale, I don’t hesitate to buy it. Why? Because it reduces the overall risk of your portfolio. I want to own as many quality producers as I can, but I won’t overpay. As the saying goes, the entry price is everything. I have been known to wait for years for a stock to come down in price before I will buy it.

Right now there are several mid-tier producers (Capricorn, Gold Road, and Bellevue) that I wouldn’t mind owning, but won’t pay their current valuations. To be able to buy Fresnillo at its current valuation is a steal IMO. Although, this is based on my expectation that silver prices are going higher.

I always like to make a caveat that investing to silver miners is speculative investing. The reason why is for two reasons. First, returns are primarily based on the price of silver. Second, a myriad of things can (and usually do) go wrong.

Stock Name | Symbol (US) | Type | Category | Share Price (US) | FD Shares | FD Mkt Cap (9/7/2023) |

Fresnillo plc | (FNLPF) | Silver | Major | $6.90 | 737M | $5B |

Company Overview

Fresnillo is a major with an FD market cap of $5 billion and is the largest silver producer at around 60 million oz’s per year (guidance for 2023 is 57M to 64M oz). They plan to expand silver production when their flagship Juanicipio mine ramps up to full production in 2024. This is a very profitable company at current gold/silver prices. They have large resources, at 2 billion oz’s of silver and 38 million oz’s of gold. If you consider their gold production (635,000 oz’s in 2023) as an offset, they are a low-cost silver producer.

A 60 million oz silver producer with low cash costs could be worth an incredible amount if silver prices reach $50 or $75. I wish I would have bought this stock at $1.60 back in 2008. Today it trades at $6.90. Fresnillo should easily triple in value if silver prices rise, and perhaps much more. It pays about a 2% dividend. One shareholder owns 75% of the shares and would like to be paid dividends. All operations (8 operating mines) are currently in Mexico, with exploration also in Chile and Peru.

They do have $950 million in debt, but also have about $900 million in cash, plus high free cash flow (currently at around $300M at $23 silver/$1900 gold). One red flag for this stock is that it trades on the OTC pink sheets in the US (London is its main exchange). Why doesn’t it trade as an ADR, or at least on the OTCQX?

I would expect them to acquire MAG Silver, which currently owns 44% of the Juanicipio project. However, MAG Silver has a market cap of $1 billion. When you include a 25% premium, that is a price tag of almost $1.25 billion. Why would Fresnillo pay $1.25 billion for less than half of Juanicipio, when its own market cap is only $5 billion?

Juanicipio is one of the best silver mines in the world and is going to be a cash cow. It will produce around 12M oz’s a year at 10 to 15 opt (ounce per ton) for 20 years, and at low costs. That mine alone is worth their current FD market cap, when you consider that over the life of that mine, silver prices are likely to increase in value substantially, creating huge margins.

Company Info

Cash: $890 million

Debt: $959 million

Current Silver Resources: 2 billion oz.

Current Silver Production: 60 million oz.

Current All-in Costs (breakeven): $20 per oz

Current FCF multiple: 16

Estimated Future Silver Reserves: 1 billion oz.

Estimated Future Silver Production: 60 million oz.

Estimated Future Silver All-in Costs (breakeven): $23 per oz

Estimated Future FCF Multiple: 15

Current Gold Resources: 38 million oz.

Current Gold Production: 625K oz.

Current All-in Costs (breakeven): $1,700 per oz

Estimated Future Gold Reserves: 20 million oz.

Estimated Future Gold Production: 625K oz.

Estimated Future Gold All-in Costs (breakeven): $1,800 per oz

Scorecard (1 to 10)

Properties/Projects: 9

Costs/Grade/Economics: 7.5

People/Management: 9

Cash/Debt: 7.5

Location Risk: 6

Risk-Reward: 7.5

Upside Potential: 8

Production Growth Potential/Exploration: 7

Overall Rating: 7.5

Strengths/Positives

Significant upside potential.

Strong management.

Pure silver play.

Strong brand name.

Quality properties.

Risks/Red Flags

Dependence on higher PM prices (for large returns).

Location risk.

Speculation stock (high risk).

High debt.

Estimated Future Valuation ($75 Silver / $3,000 gold)

Silver production estimate for the long term: 60 million oz.

Silver All-In Costs (break-even): $23 per oz.

60M oz. x ($75 – $23) = $3.1 billion annual FCF (free cash flow).

Gold production estimate for the long term: 625K oz.

Gold All-In Costs (break-even): $1,800 per oz.

625K oz. x ($3,000 – $1,800) = $750 million annual FCF (free cash flow).

$3.1B + $750M = $3.85B (free cash flow).

$3.85 billion x 15 (FCF multiplier) = $58 billion.

Current FD market cap: $5 billion.

Upside potential: 1,000%.

Future Valuation Explained

This is an estimated return and will only occur if all assumptions are correct. A more likely outcome will be something less than this amount, although it is not crazy talk to expect silver to exceed $75 or the FCF multiple to reach 15.

My All-In Costs are the expected costs that will generate FCF.

I used a future FCF multiplier of 15, which I think is conservative for my expectations. I expect them to receive at least a 15 multiple.

I used a future PM price of $75 silver because I am a long-term investor who plans to wait for higher silver prices. I expect to see this level reached within 3–5 years. In fact, I use $100 silver for valuations on my website since that is my expected future price. I tone it down a bit to $75 on Seeking Alpha, which I think is more reasonable.

It is my opinion that gold drives the silver price, and that macroeconomics drives the gold price. The only reason I expect to see $100 in silver is that I expect to see at least $3,000 in gold.

A $75 or $100 silver price may seem like a pie-in-the-sky fantasy, but silver traded at $49 in 2011 when gold was at $1,935. If gold rises 50% from its current level, there is a good chance that silver will rise 150%. This is usually what happens as the GSR gets squeezed. Of course, this is an assumption.

Balance Sheet/Share Dilution

They currently have a weak balance sheet, with $890 million in cash and $959 million in long-term debt. They would claim to have a strong balance sheet since they are generating about $300 million in annual FCF. However, you never know if silver prices are going to crash and stay low. It’s better to have zero debt, but large companies find it too tempting to take advantage of the ability to borrow money.

Instead of paying dividends, I wish they would pay down their debt. They would get a higher FCF multiple with a clean balance sheet, which would benefits shareholders.

Risk/Reward

This risk/reward is pretty solid for Fresnillo. All they really need are higher silver prices and investors will come running. If you are a believer in higher silver prices, and you have a bias for owing quality producers, then this stock has to look tempting. I think the upside is a 5 to 10 bagger is silver prices blast off.

The risk is mainly with the silver price not going up (or going down), along with location risk in Mexico. It’s not a stretch to expect Mexico to raise their mining taxes and royalties. Plus, Mexico has had issues blocking roads and striking. As I stated at the beginning, this speculative investing because a lot can go wrong.

Investment Thesis

Fresnillo fits my strategy of owning as many quality producers as I can accumulate with good entry prices. The one thing we can count on with producers is that they will participate in rising silver prices. As silver trends from $30 to $50, and hopefully higher, we can expect Fresnillo to participate. Conversely, an exploration or development stock might be a laggard, and not participate. I want to make sure that I am overweight producers because these are the stocks I can count on to participate.

My investment thesis is straightforward, I want to own Fresnillo because as the price of silver increases so will their FCF. Then, when their FCF increases and the balance sheet improves (from having more cash), their FCF multiple should increase. So, we get a potential exponential boost to the share valuation. For example, for every dollar the price of silver rises, Fresnillo should increase in value at a higher percentage.

Strategy to Manage Risk

www.goldstockdata.com

Use this link to review my investing strategy. For Fresnillo, they fit my investing strategy of being overweight producers.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.