erlucho

Introduction

Let me start this article by briefly highlighting my bio on Seeking Alpha.

Leo Nelissen is an analyst focusing on major economic developments related to supply chains, infrastructure, and commodities.

[…] Leo aims to provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities.

I’m not doing this to promote myself but to explain to newer readers why I often take detours from covering dividend (growth) companies.

A big part of my research relies on understanding the “big picture.”

This includes inflation, economic growth, and major secular trends like economic re-shoring, the energy transition, and other developments.

Freeport-McMoRan Inc. (NYSE:FCX) has been on my radar for more than a decade, as it is not only one of the world’s largest copper miners, which tells us so much about economic developments, but also one of the key beneficiaries from the ongoing net-zero trend benefitting copper demand for decades to come.

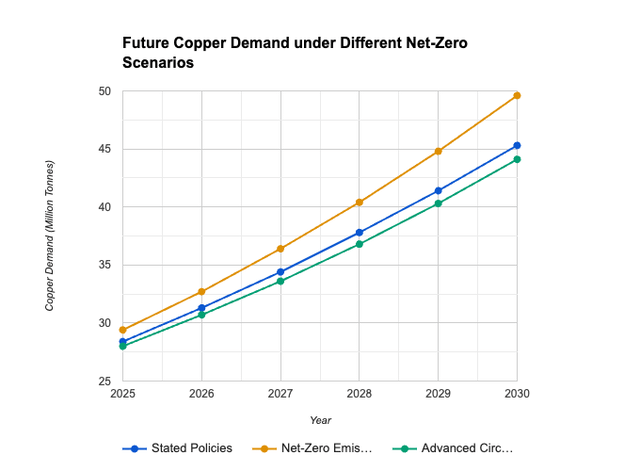

Looking at the chart below, we see that under current policies, global copper demand could rise from roughly 30 million tons in 2025 to roughly 45 million tons by 2030.

Leo Nelissen (Raw Data: International Copper Association)

My most recent article was written on January 5, titled Copper’s Golden Ticker: Unveiling Freeport-McMoRan’s Bull Case.”

Here’s a part of the takeaway:

Despite cyclical weaknesses, the company remains well-positioned to capitalize on the growing demand for copper, driven by global electrification investments.

Meanwhile, recent disruptions in copper supply, coupled with increasing demand, raise concerns for a potential market shift from surplus to deficit.

[…] With a positive long-term outlook and a seemingly undervalued stock, FCX presents an appealing opportunity for investors, poised to deliver robust returns as global economic conditions improve.

The reason I’m writing this article is to cover new developments, including recently released Q4 2023 earnings, which gave us a ton of valuable info.

On top of that, we’ll also discuss new economic developments that could hint at higher cyclical demand and potentially indicate a very bullish stock price upswing.

Also, in light of what I said at the very start of this article, even if you don’t care for FCX, I believe we’ll discuss a lot of topics that have far-reaching impacts on other industries as well.

So, let’s get to it!

FCX Reported Fantastic Operational Numbers

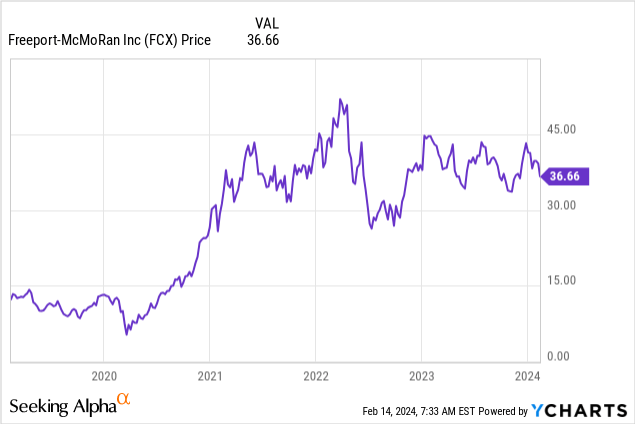

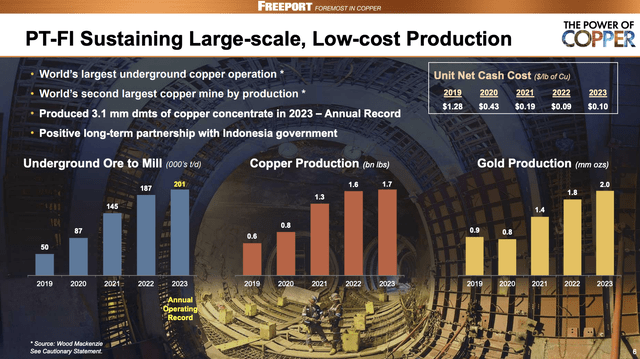

Although its stock price may not suggest it, Freeport reported a strong and outstanding fourth quarter/full year, with notable achievements in operational performance.

For example, the successful ramp-up of underground operations initiated in 2019 contributed significantly to the company’s performance throughout 2023.

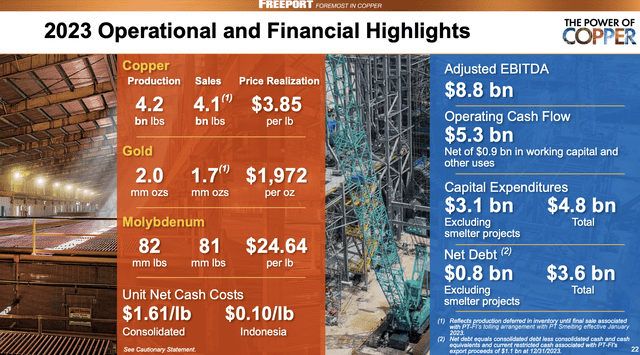

On a full-year basis, the company generated $8.8 billion in EBITDA and operating cash flows exceeding $5 billion, indicating its ability to generate substantial earnings and cash flow from its operations, even in unfavorable economic conditions (read: an environment of subdued prices).

Despite facing challenges such as higher unit net cash costs compared to the previous year, FCX effectively managed its costs, with unit net cash costs averaging $1.52 per pound in the fourth quarter, slightly below guidance.

Freeport-McMoRan

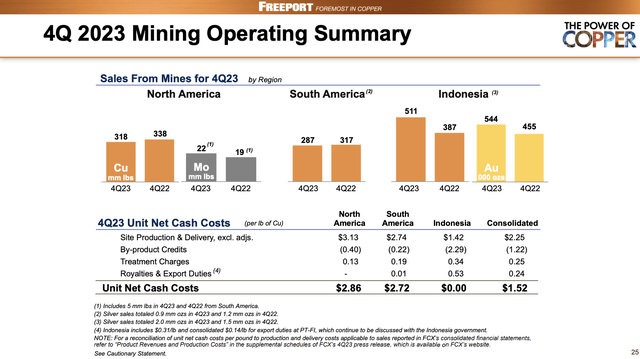

During the fourth quarter, FCX continued its strong performance, surpassing sales estimates and maintaining robust gold production levels.

Although shipments in the quarter were slightly below expectations, the company achieved better-than-guided unit net cash costs, with notable performance in Indonesia, where gold credits offset copper production costs.

Operational focus in the U.S. centered on increasing mining rates and improving asset efficiencies, while a strong performance in underground mining operations in Indonesia contributed to significant increases in ore mined and production levels.

In 4Q23 alone, the company mined 511 million pounds of copper in Indonesia, up from 387 million pounds in the prior-year quarter. It also mined more than 540 thousand ounces of gold.

Freeport-McMoRan

Operationally, the company’s successful transition to underground mining in Indonesia marked a significant operational milestone.

The shift, initiated in 2020, transformed FCX’s mining operations into the world’s largest underground mining complex, which benefits both volumes and margins.

[…] the fourth quarter performance in Indonesia was exceptional. Underground ore mined averaged over 214,000 tons per day, and that was 8% higher than the year ago period combined with strong wage and recoveries, our copper and gold production in the fourth quarter was over 20% higher than last year’s fourth quarter.

We completed the installation of a new SAG mill at PT-FI in December, and that will provide additional opportunities for us going forward. And the team is just doing outstanding work, sustaining and optimizing value from this large resource position. – FCX 4Q23 Earnings Call.

Freeport-McMoRan

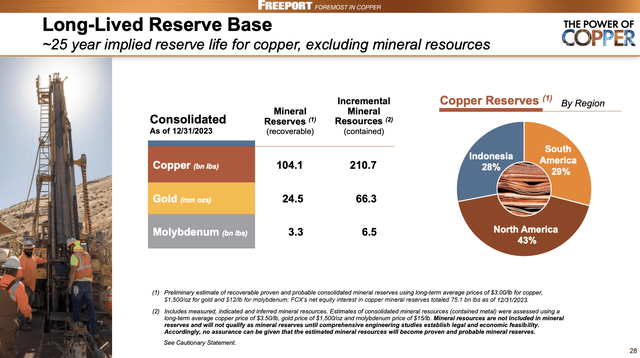

On top of that, the company has roughly 25 years of reserves, which significantly lowers supply risks that miners face with mines closer to the end of their useful lives.

Freeport-McMoRan

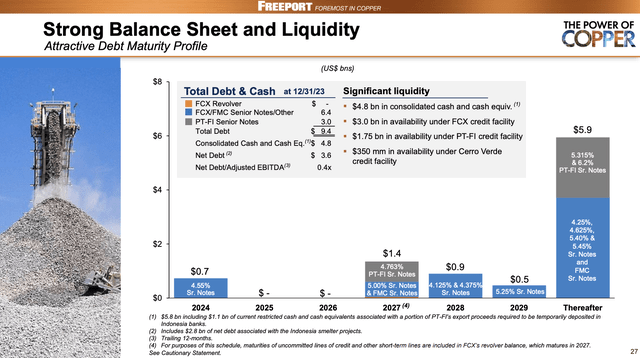

With that said, the company also reaffirmed its commitment to maintaining a strong balance sheet, returning cash to shareholders, and investing in value-enhancing growth projects.

The company’s financial policies prioritize disciplined capital management and prudent investment decisions to protect sustainable long-term value creation for shareholders.

After all, mining operations carry significant financial risks, as it is easy to waste huge amounts of money on risky expansions and whatnot.

In other words, with a solid financial foundation and a focus on operational improvements, FCX remains well positioned to capitalize on the market opportunities we’ll discuss in this article.

However, before we do that, let me give you some numbers that support financial stability.

- The company has just $700 million in debt maturities until 2027, which buys a lot of time in the current environment of elevated rates.

- The company has close to $5 billion in cash and cash equivalents.

- It has $3.0 billion available under its FCX credit facility, $1.8 billion available under its PT-FI credit facility, and $350 million available under the Cerro Verde credit facility.

- It has a net leverage ratio of just 0.4x EBITDA based on $3.6 billion in net debt.

Freeport-McMoRan

With all of this in mind, let’s take a closer look at the company’s assessment of market conditions and growth opportunities.

Why I’m Increasingly Bullish On FCX

In terms of market outlook, FCX remains optimistic about the copper market’s fundamentals, driven by supply disruptions and growing demand in key sectors such as energy infrastructure and electric vehicles.

Despite market volatility influenced by macroeconomic factors, FCX believes in the long-term strength of the copper market and anticipates higher copper prices in the future.

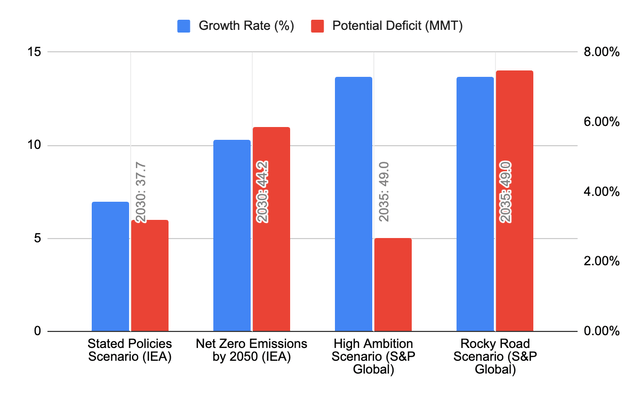

I cannot disagree with that, which is why I made the chart below.

As we can see below, based on four scenarios through 2030 and 2035, the copper market is expected to see supply deficits between 5 and 14 million metric tons, depending on the net-zero trend.

Leo Nelissen (Raw Data: IEA, S&P Global)

Here’s the table I used for my chart:

| Scenario | Copper Demand (MMT) | Growth Rate (%) | Supply Growth (MMT) | Potential Deficit (MMT) |

| Stated Policies Scenario (IEA) | 2030: 37.7 | 3.70% | 2030: 31.7 | 6 |

| Net Zero Emissions by 2050 (IEA) | 2030: 44.2 | 5.50% | 2030: 33.2 | 11 |

| High Ambition Scenario (S&P Global) | 2035: 49.0 | 7.30% | 2035: 44.0 | 5 |

| Rocky Road Scenario (S&P Global) | 2035: 49.0 | 7.30% | 2035: 35.0 | 14 |

Furthermore, Freeport-McMoRan also commented on current supply developments.

According to the company, despite forecasts of a surplus in 2023 due to the emergence of new mines, the market experienced a small deficit.

Stronger-than-expected demand from key markets such as the United States and China, coupled with supply shortfalls from significant mines globally, contributed to historically low copper inventories.

This is also favorably impacting the price of copper.

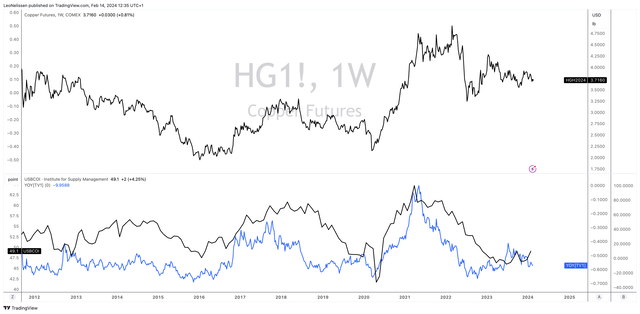

Using the chart below:

- The upper part of the chart below shows the prices of COMEX Copper futures. While copper prices haven’t gone anywhere since early 2021, they are unusually strong, given how weak cyclical economic indicators like the ISM Manufacturing Index are.

- The lower part of the chart below compares the ISM Manufacturing Index to the year-over-year price change of copper futures (blue line). As we can see, current prices make sense, given the downtrend of the ISM Index.

TradingView (COMEX Copper, ISM Index)

However, I believe if it wasn’t for the favorable supply situation, copper prices would trade at least $0.50 to $1.00 lower.

That said, the ISM Manufacturing Index looks like it’s attempting to bottom, which could be fantastic news for cyclical growth expectations.

This is what Bloomberg wrote when the ISM Index unexpectedly rose in January (emphasis added):

The 5.5-point increase in the orders index marked the largest monthly advance in more than three years, helped by robust demand in the last half of 2023. Production expanded for the first time in four months, while a gauge of customer inventories showed the leanest stockpiles since October 2022.

This could be the beginnings of growth,” Timothy Fiore, chair of the ISM manufacturing survey committee, said on a call with reporters. “We’ve been waiting for this, and I think we need to get through the quarter to really see it.”

Although the economy remains prone to elevated uncertainty due to sticky inflation and elevated rates, a further increase in the ISM Index could be highly beneficial for copper prices and add a cyclical tailwind to a long-term secular growth tailwind.

Valuation

As I always mention in articles about commodity-focused articles, it is hard to put a price tag on a company that heavily relies on the price of the commodities it mines.

The biggest issue is that analysts almost never price in a steep increase or decline in commodity prices, as none of them are willing to incorporate a macro thesis into their research. Most price targets are based on current prices and some form of output growth expectations and margin improvements.

That said, even based on the current macro environment, the stock appears to be too cheap.

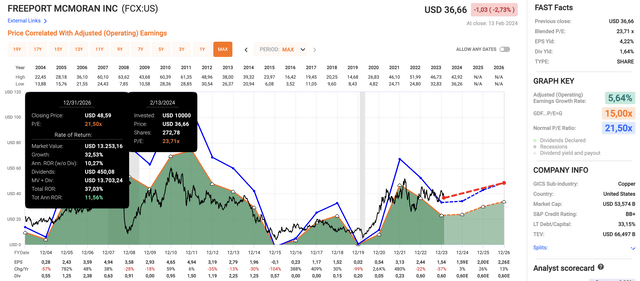

Using the data in the chart below:

- FCX is trading at a blended P/E ratio of 23.7x.

- Its normalized valuation is 21.5x earnings.

- After 37% EPS contraction in 2023, analysts expect an earnings recovery, with 3% growth in 2024, potentially followed by 26% growth in 2025 and 13% growth in 2026.

- The combination of a 21.5x multiple and these growth rates gives the stock a fair price target of roughly $49. This implies 11.5% annual returns through 2026. The current consensus price target is $46.

FAST Graphs

While the current situation is tough due to economic challenges, I believe FCX has a bright future, with potentially much higher returns than the implied 11.5% annual return rate if the ISM Index shows upside momentum in the months ahead.

Nonetheless, stocks like FCX need to be handled with care, as they come with significant volatility.

The only reason why I do not own FCX yet is my position in Caterpillar (CAT), which is highly correlated to basic material prices.

Takeaway

Amidst a backdrop of economic uncertainties and shifting market dynamics, my analysis of Freeport-McMoRan reveals a company poised for robust growth and value creation.

FCX’s strong operational performance, coupled with its strategic focus on capital management and shareholder returns, underscores its resilience and potential for long-term success.

Despite near-term challenges, including cyclical weaknesses and supply disruptions, FCX remains well-positioned to capitalize on the growing demand for copper, driven by global electrification investments.

With a solid financial foundation, promising growth prospects, and a favorable market outlook, FCX presents an appealing investment opportunity for those seeking exposure to the commodities sector.

Pros & Cons

Pros:

- Strong Operational Performance: FCX’s operational achievements, including successful underground mining operations and robust production levels, highlight its operational resilience and ability to generate substantial earnings even in challenging economic conditions.

- Favorable Market Outlook: With optimistic projections for the copper market driven by supply disruptions and growing demand in key sectors like energy infrastructure and electric vehicles, FCX stands to benefit from potential future increases in copper prices.

- Solid Financial Foundation: FCX’s commitment to maintaining a strong balance sheet, returning cash to shareholders, and investing in value-enhancing growth projects provides longer-term tailwinds.

Cons:

- Volatility: FCX, like many companies in the commodities sector, is subject to significant volatility due to fluctuations in commodity prices and market conditions, which may pose risks for investors seeking stable returns.

- Cyclical Weaknesses: Despite its strong performance, FCX remains prone to cyclical weaknesses in the commodities market, which could impact its financial performance and stock price in the short term.