Key Takeaways

- Franklin filed an S-1 with the SEC to launch an ETF targeted on XRP.

- A ultimate determination is predicted by October 2025 for many filings.

Share this text

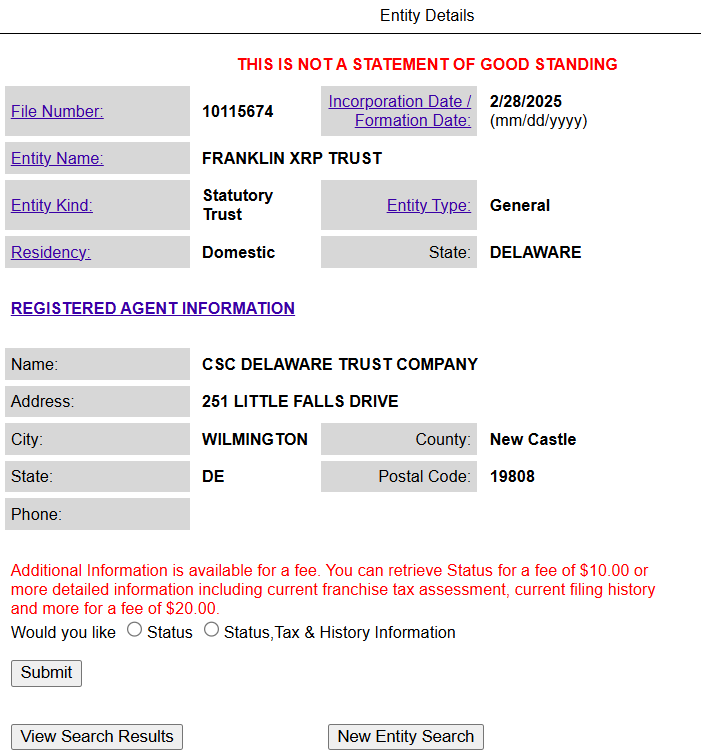

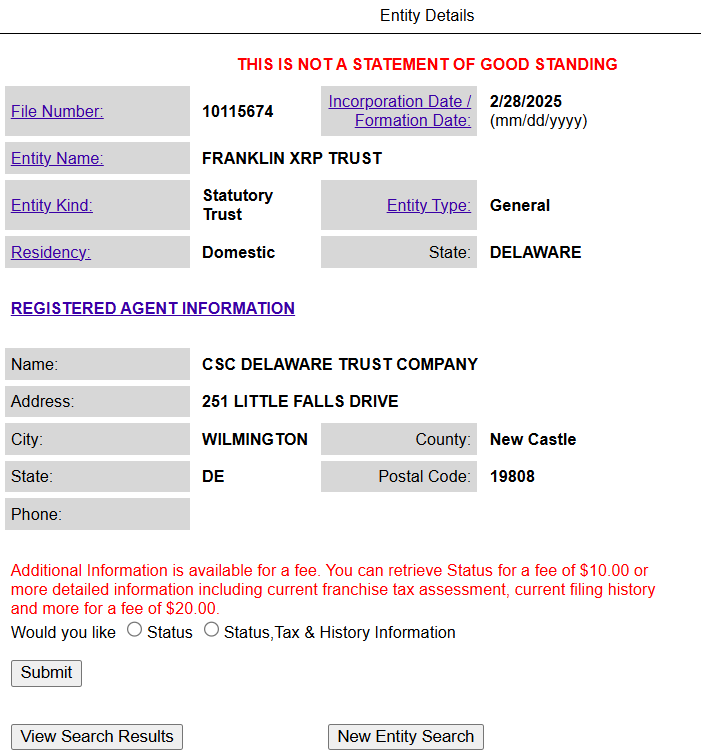

Franklin Templeton has filed an S-1 registration kind with the SEC for an XRP ETF, following the February registration of the Franklin XRP Belief in Delaware.

The brand new submitting with the SEC formally locations the entity amongst a rising variety of asset managers vying for an XRP ETF, together with Bitwise, 21Shares, Canary Capital, Grayscale, and WisdomTree.

The proposed fund, which might commerce on the CBOE BZX Trade, goals to supply traders publicity to XRP, at present the fourth largest crypto asset by market cap. The ETF’s ticker image has but to be decided, based on a Tuesday submitting.

Coinbase Custody would function the custodian for the fund’s XRP holdings, whereas Coinbase would act because the prime dealer. CSC Delaware Belief Firm would function trustee.

The shares could be supplied repeatedly at internet asset worth, with solely licensed members in a position to create or redeem creation models. The fund would use the CME CF XRP-Greenback Reference Charge to find out its internet asset worth.

Franklin Holdings will sponsor the fund and has agreed to pay most odd working bills in alternate for a sponsor’s price. The belief is structured as an rising development firm beneath the JOBS Act.

The submitting marks the newest try and launch a spot crypto ETF following earlier Bitcoin and Ethereum ETF approvals. The SEC might want to evaluate and approve the submitting earlier than the fund can start buying and selling.

The SEC acknowledged a number of XRP ETF filings in current weeks, beginning with Grayscale’s XRP ETF utility on February 14, initiating a 240-day evaluate interval.

This was additionally the primary time the SEC responded to a request to launch an funding product that instantly holds XRP, the crypto asset that’s nonetheless beneath regulatory scrutiny because of the SEC’s ongoing authorized battle with Ripple Labs over its classification as a safety

Different filings, together with these from WisdomTree, Canary Capital, and CoinShares, have been additionally formally accepted for evaluate. These filings are actually within the public commentary section, which is a part of the SEC’s evaluate course of.

Share this text