Brett_Hondow/iStock Editorial through Getty Photographs

There’s worth available in pure-play REITs, as a singular focus does away with distractions whereas enabling administration to hone in and excellent their ability set. This simplicity additionally makes them simpler to worth. Maybe that is why Realty Revenue Corp. (O) spun off Orion Workplace REIT (ONL) final 12 months to focus extra on its retail facet.

This brings me to 4 Corners Properties Belief (NYSE:FCPT) which focuses on the retail service area. This text highlights why FCPT seems to be engaging on the present value for revenue and progress, so let’s get began.

Why FCPT?

4 Corners Property Belief is a internet lease REIT whose restaurant portfolio is leased to main manufacturers similar to Olive Backyard, Chili’s and Crimson Robin. At current, the corporate has possession pursuits in 954 properties which might be diversified throughout 46 states within the continental U.S.

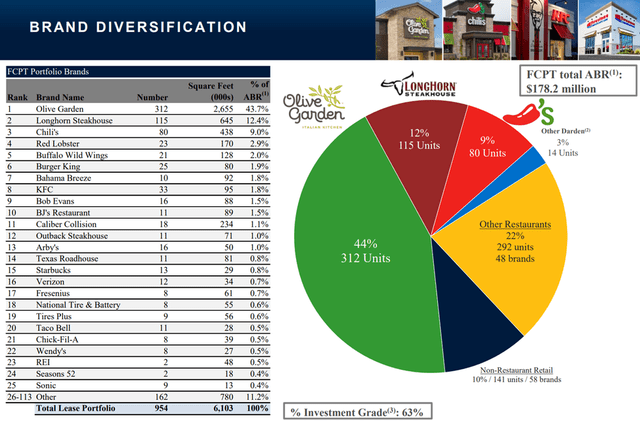

It was spun-off from Darden Eating places (DRI) again in 2015, and since then, has diminished its publicity from 100% to 68%. As proven beneath, FCPT is primarily uncovered to well-known manufacturers similar to Olive Backyard, LongHorn Steakhouse, and Chili’s, which mix to make up 65% of its annual base hire.

FCPT Portfolio Combine (Investor Presentation)

A key benefit of FCPT is its triple-net leases, during which the tenant is accountable for paying property taxes, insurance coverage, and upkeep. This leads to larger margins for the corporate in comparison with different actual property sectors, and is mirrored by FCPT’s 75.6% working margin (with depreciation addback) over the trailing twelve months, sitting properly above the ~65% vary for buying middle REITs. Over time, I’d count on for FCPT’s op margin to development within the 80-90% vary because it continues to scale up.

In the meantime, FCPT is demonstrating strong fundamentals, with a 99.9% occupancy price with a weighted common remaining lease time period of 9.0 years, placing it on par with the ~10 years of friends Realty Revenue Corp. and Nationwide Retail Properties (NNN). It collected 99.7% of its rents within the first quarter, and noticed respectable 12.9% and eight.1% YoY rental income and FFO per share progress.

This was pushed by a mix of each inner and exterior progress by way of accretive acquisitions, with 18 properties acquired in the course of the first quarter for $42 million and a mean money yield of 6.7% and remaining lease time period of seven.6 years.

Wanting ahead, FCPT maintains loads of flexibility to proceed its progress trajectory. That is mirrored by $308 million in obtainable liquidity, of which $58 million is in money and $250 million is on undrawn capability on its revolving line of credit score. That is additionally supported by moderately low leverage with internet debt to EBITDAre of 5.7x, and notably, Fitch just lately upgraded FCPT by one notch to a strong BBB flat credit standing.

Additionally encouraging, administration is positioning the corporate in direction of the rising medical retail section, as this section presently represents 33% of its lively acquisition pipeline, with a lot of the remainder (51%) comprised of informal eating properties.

Dangers to FCPT embrace macroeconomic uncertainty, which might impression its tenants. I see the impression, if any, as being muted, nonetheless, contemplating their low value factors. As well as, larger rates of interest might increase FCPT’s price of debt. This might additionally profit FCPT in that it pushes extremely levered opponents out of the bidding course of, because the CEO famous throughout Q&A session of the current convention name:

We discovered just a few alternatives that I’d describe as we’ve been hanging across the hoop on offers, the place the vendor had gone with a extra levered purchaser and as that levered consumers’ debt repriced, the unique purchaser dropped out, and we have been capable of decide up properties on the rebound.

I see worth in FCPT on the present value of $26.40, after the current drop from the $30-level. At current, FCPT trades at an affordable ahead P/FFO of 16.35, sitting properly beneath its regular P/FFO of 19.5 lately. It additionally sports activities a 5.0% dividend yield that is properly lined by an 83% payout ratio (based mostly on first quarter FFO/share of $0.40).

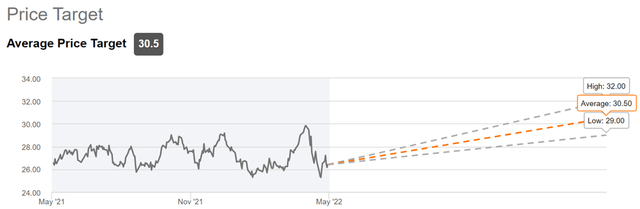

Promote facet analysts have a consensus Purchase ranking with a mean value goal of $30.50. This interprets to a possible one-year whole return of 21% together with dividends.

FCPT Value Goal (Searching for Alpha)

Investor Takeaway

FCPT is a high quality internet lease REIT with a diversified portfolio of well-known tenants. Its robust fundamentals and balanced capital construction present loads of assist for future progress, and administration has proven its willingness to adapt its property acquisitions in direction of new classes. I imagine the present share value presents a horny entry level for dividend and worth buyers.