marekuliasz

Introduction

With rates expected to decline sometime in the near future, I think the REIT sector (VNQ) will benefit as it has experienced a lot of volatility in the past year. Some are predicting rate cuts as early as March. And while I don’t know nor try to predict when they will happen, I do think it will happen sometime this year.

Many of my readers know I’m a huge fan of REITs and a large portion of my portfolio is concentrated in the sector. I like and understand the business model. Plus, it’s a way I get to invest in real estate without owning any physical properties or dealing with pesky tenants.

But I’m not knocking those who own properties as this can be very lucrative. One REIT that I came across recently was Four Corners Property Trust (NYSE:FCPT). In this article I discuss what I like about this REIT and why they should be on your watchlist if you don’t already own them.

Brief Overview

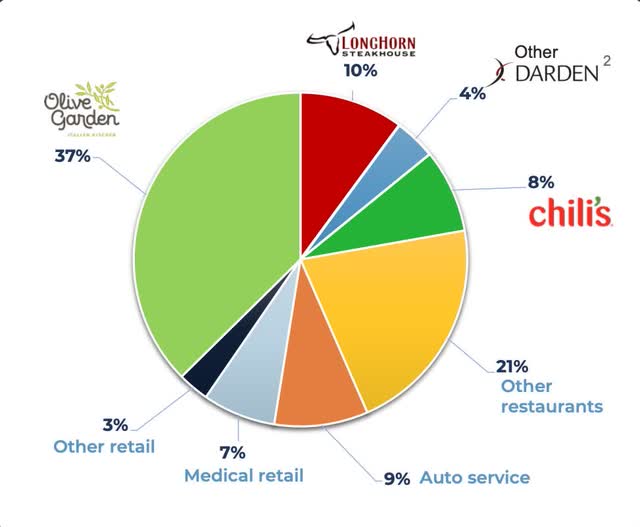

Four Corners Property Trust is a REIT that primarily invests in the real estate of restaurants. Some of their biggest tenants are Olive Garden, Chili’s, Burger King, and one of my personal favorites, Cheddar’s. They also invest in the medical & auto industries which makes up less of their total portfolio. Currently, the REIT owns 1,106 properties across 47 states. They also have other well-known, investment-grade tenants like Verizon (VZ) and one of my favorite dividend stocks, Starbucks (SBUX).

FCPT investor presentation

But as you can see the company has a large focus in restaurants with most of their ABR coming from this segment. Some may see this as a risk as many restaurants along with other businesses suffered during the COVID-19 pandemic, but this is something that is unlikely to happen again for the foreseeable future.

But as previously mentioned they also have a focus in the medical & auto industries which are considered e-commerce and recession resistant. No matter what happens everyone needs their medical supplies or something for their automobiles. Some of their tenants in this industry includes O’Reilly Automotive (ORLY) and Advance Auto Parts (AAP). Once again this shows the high-quality of tenants in FCPT’s portfolio.

Some of their medical tenants include DaVita (DVA) and VillageMD. They also have a focus on dental and veterinary clinics as well. So, the company is pretty well-diversified outside of the restaurant space. They’re also diversified geographically across 47 states. Fast-growing states like Texas & Florida are their top two states with the most properties.

Acquisition Spree

One thing that jumped out at me was not only the growth of the company, but the amount of acquisitions the company has made over the past year. YTD the company has added a record 90 properties, and 31 in Q3 alone!

So far FCPT has deployed $322 million of capital making acquisitions YTD, quite impressive to say the least. Especially with the challenging economic backdrop and cap rates not being as attractive currently. Additionally, 59% of the acquisitions made in the quarter were to investment-grade tenants. So, the company is not only growing their portfolio, but strengthening it as well.

Although they don’t have a very long track record, the company has grown its portfolio at an impressive rate since spinning off from Darden Restaurants (DRI) in 2015 from 418 properties to the 1,106 currently.

FCPT investor presentation

Furthermore, these acquisitions were funded with equity raised in late 2022 & early 2023 and these had a cap rate of 6.7%. They’ve also been disposing of their underperforming Red Lobster properties recently. The chain has faced some challenges over the years.

Some of these (challenges) were due to labor costs, but the chain has also been suffering losses in profits and have been implementing turnaround initiatives. A few months back they also hired a new CEO to expedite and help with the process.

Honestly, I can’t tell you the last time I’ve been to a Red Lobster. It was definitely considered a high-end restaurant to go to back in the day but now it doesn’t seem that way.

YTD the REIT has disposed of 3 of the chain’s properties for $15 million, a small gain for the REIT. I like the acquisitions and dispositions they have been making despite the macro environment, and I expect this to continue as interest rates decline and cap rates improve.

They’ve also been further diversifying and strengthening their portfolio outside of the restaurant segment with 37% of new acquisitions in the medical retail & 23% in the auto service industries.

Latest Earnings

The company reported Q3 earnings back in early November. FFO of $0.41 was in-line and revenue of $64.84 million beat estimates by $0.3 million. AFFO of $0.42 was flat quarter-over-quarter while both FFO & revenue increased 2.5% and 6.8% respectively.

Year-over-year FFO and revenue are up from $0.30 and $48.7 million while AFFO was still flat at $0.41. For the 9 months ended, FCPT brought in $1.24, a penny higher than the $1.23 for the nine months ended in 2022.

But in the chart below you can see this increased to $109.8 million from $99.6 million, a double-digit increase of roughly 10%. This is also up from $8.2 million at the end of 2015 so you can see the company has grown impressively in the 9 short years.

Author creation

Furthermore, Four Corners collected 99.9% of its base rent for Q3 and their total portfolio was 99.8% occupied. Some of their restaurant tenants also reported strong same-store sales in the quarter.

Chili’s reported same-store sales of 6.0% while Olive Garden & Longhorn Steakhouse reported sales of 6.1% and 8.1% respectively. And as interest rates ease in the coming months which I suspect, these will likely see a higher increase.

Although, I expect that to come later in the year, around the second half. So, not only has FCPT had a record acquisition year, up 16% from last year, but their portfolio was well-occupied during a very challenging environment.

Quality Balance Sheet

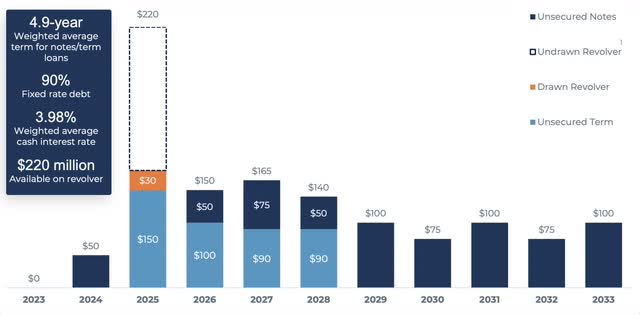

Despite being smaller with a market cap of only $2.28 billion at the time of writing, the REIT’s balance sheet is strong with well-laddered debt maturities. They also sport an investment-grade credit rating of BBB from both Fitch and Moody’s.

Besides the debt due this upcoming June, FCPT doesn’t have to worry about any maturing debt until November of next year. They also had $237 million of available capacity, with a net-debt-to EBITDA of 5.6x and fixed charge coverage ratio of a healthy 4.7x. So, as you can see the company’s fixed charges and debt are well-covered by earnings.

FCPT investor presentation

Strong Dividend Growth

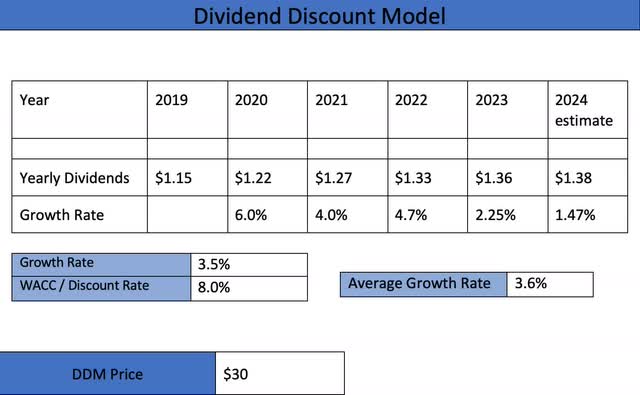

FCPT has also impressively grown its dividend and even maintained and raised during COVID. They also recently conducted a small increase a few months ago from $0.34 to $0.345 bringing the annual payout to $1.38. I expect when the REIT reports Q4 earnings AFFO will be in a range of $0.40 to $0.42, and their annual AFFO in a range of $1.65 to $1.67.

Using the lower end this still gives FCPT a safe AFFO payout ratio of nearly 84%. I do prefer to see lower payout ratios, preferably below 80%, but REITs are required to pay out a lot of their earnings so above 80% isn’t out of the norm. Anything above 90% is when I start to get worried. But as the macro environment eases, I expect this to come down a bit.

Valuation

Wall Street also seems to like Four Corners Property Trust, rating the stock a buy with a price target of $26.17. This is roughly $1 above the share price at the time of writing. Since COVID, the REIT has pretty much traded sideways, but I think as they continue to grow, their share price will follow.

Using the Dividend Discount Model and next year’s estimate, I have a price target of slightly above $30 for the REIT. This implies you do get some double-digit upside. Their forward P/AFFO ratio of roughly 15x is also below their 5-year average and if rates decline, I expect the stock to trade near or around 17x.

DDM author creation

Risk Factors

One risk investing in Four Corners Property Trust is that they are concentrated in the restaurant space. And restaurants can be susceptible to economic downturns such as recessions. Although we’ve avoided one so far, talks of an incoming one are still out there. And if one does occur, FCPT’s financials could suffer if one comes to fruition.

Being heavily-focused on restaurants, FCPT also faces the same risk as many consumer staples like Pepsi (PEP) and Walmart (WMT), the rise and popularity of GLP-1 drugs. Management addressed this concern during Q3 earnings and is very aware that this could affect behavioral changes in consumers.

And that this may have a minor effect on tenants with the desire to eat less because of the drugs. While it remains to be seen what the future holds for these weight-loss medications, they do have the potential to someday change and reduce food consumption trends. If so, this could impact FCPT’s portfolio.

Bottom Line

Since the spin-off, Four Corners Property Trust has been focused on growing its portfolio with record acquisitions in the third quarter. Despite the challenging backdrop, the REIT has done well increasing revenues and maintaining a high occupancy of 99.8%. They’ve also managed to collect nearly 100% of rent over the same period showing their financial strength and strong management team.

Additionally, they have a strong balance sheet with an investment-grade rating and a healthy net-debt-to EBITDA of 5.6x. And although some may consider the REIT riskier due to its focus in the restaurant segment, they are also diversified in the medical & auto industries, both who are considered recession resistant.

Furthermore, they offer some nice upside to my price target of roughly $30 using the DDM model, and if rates decline in 2024 as I suspect, FCPT may see some nice capital appreciation. The REIT looks to have a bright future ahead and is one you should consider, or at least add to your watchlist.

I’ll be watching the REIT as well to see what the Fed does in the coming months. There’s also the risk of a recession which could affect the company due to its concentration. For reasons mentioned in this article and the potential upside, I rate FCPT a speculative buy.