hapabapa

Fortinet Stock’s Massive Share Plunge

It has been nearly a year since I initiated my coverage of leading cybersecurity solutions company Fortinet, Inc. (NASDAQ:FTNT). I assigned a Hold rating on FTNT in October 2022, broadly equivalent to a market-perform thesis. Accordingly, FTNT has performed largely in line, but still came in below the S&P 500’s (SP500) recovery since my previous update.

To be clear, FTNT’s recent massive battering with its disappointing forward guidance at its recent second-quarter or FQ2 earnings release contributed significantly to its recent underperformance. Despite that, I believe my previous thesis of FTNT as “far from being undervalued” makes sense, after all, suggesting that the market was overly optimistic. I cautioned investors that Fortinet’s “growth could peak in 2022,” corroborated by the company’s updated guidance.

As such, the amended outlook suggests Fortinet expects to report revenue of between $5.35B and $5.45B for a midpoint guidance of about $5.4B. The revised consensus estimates align with the company’s outlook as analysts penciled in an average projection of $5.4B, indicating a YoY revenue increase of 22.3%. While still remarkable for Fortinet, it indicates a substantial deceleration from FY22’s 32.2% increase, justifying the recent battering.

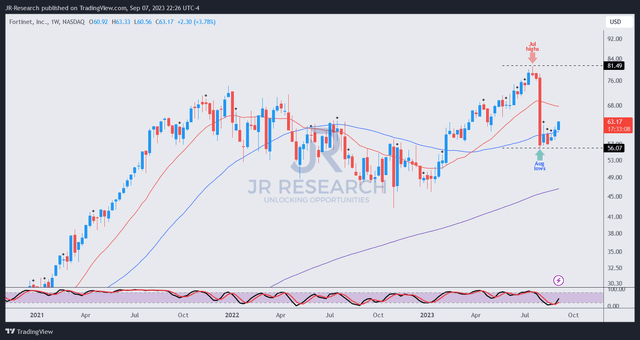

Some cybersecurity investors have likely bailed out with FTNT’s steepest decline in recent memory as they rotated to other “higher-growth” opportunities. The pessimism could also have spooked late buyers, as FTNT lost nearly 30% in that single fateful week in early August. As a result, FTNT fell back toward its early February 2023 lows in one week, knocking back about six months of meticulous buildup.

However, that’s where dip buyers like me are interested in assessing an opportunity to turn more bullish, with “blood flowing in the street.” Does it make sense? Let’s take a look.

Fortinet’s growth deceleration is not unexpected, as I had already cautioned it last year. As a result, buyers who didn’t heed FTNT’s valuation metrics likely didn’t reflect such a possibility as they continued to chase its upward momentum. However, price action investors know that chasing momentum can be a dangerous game. It feels good when it’s in your favor. However, when it swings hard and fast, the pain could be “unbearable,” as seen in FTNT’s hammering, causing a capitulation in its price action.

However, that capitulation has helped resolve its overvaluation over the past six months, returning it into a more reasonable zone. Accordingly, FTNT last traded at a forward EBITDA multiple of 29.1x, slightly below its 10Y average of 30.4x. It’s also broadly in line with Palo Alto Networks (PANW) stock’s 31.9x. Seeking Alpha’s Quant valuation grade of “D-” suggests a premium valuation, in line with my expectations. I don’t expect FTNT to generally trade in line with its SaaS peers, given its robust growth drivers, supported by the Quant’s best-in-class “A” growth grade.

As such, I believe it makes sense for Fortinet’s wide economic moat business model to deserve a premium grade as companies continue consolidating their vendors, given tighter enterprise budgets. Fortinet’s ability to leverage networking and cybersecurity solutions places it in an enviable position compared to its non-networking or pure-play peers, affording it a sustainable competitive advantage. Even though Microsoft (MSFT) has attempted to disrupt the zero-trust space with its recent entry, it is not expected to create a dent against Fortinet’s well-diversified hardware and software platform moat. Analysts’ estimates remain confident of the company’s growth drivers, underscored by the “A’ growth grade relative to its peers.

Furthermore, I gleaned robust buying support at FTNT’s recent August lows, indicating dip buyers have returned progressively to stem a further slide toward lower levels.

Is FTNT A Buy?

FTNT price chart (weekly) (TradingView)

As seen above, FTNT formed its early August lows after the post-earnings hammering and has not looked back. I assessed buying sentiment as robust, validating a bear trap (false downside breakdown).

As such, FTNT has continued to gain momentum on its upward recovery despite the volatility over the past week, suggesting robust buying support. Therefore, investors looking to add more exposure should consider capitalizing on FTNT’s recovery before it moves higher (note that the current entry-level is no longer optimal but still constructive).

As such, I’m ready to turn bullish on FTNT, as I expect it to outperform the market from here.

Rating: Upgraded to Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!