wildpixel

Ford Motor Company (NYSE:F) stock has significantly underperformed the S&P 500 (SPX) (SP500) (SPY) since we downgraded it in our previous article. In addition, the Consumer Discretionary Select Sector SPDR ETF (XLY) has also been hit, suggesting a broad de-rating in Ford’s sector peers.

Tesla (TSLA) CEO Elon Musk’s recent warning about a severe recession has also added to a downcast Christmas for auto investors, as he warned about the threat to discretionary spending.

Ford’s recent price increase for its F-150 Lightning EV could hurt its sales cadence as Tesla went on the offensive to cut its prices. As such, investors could be concerned whether the increasingly bleak macroeconomic headwinds could portend lower sales for Ford in 2023, coupled with its price increase.

Furthermore, the used car market has been in shambles recently, as CarMax (KMX) reported disappointing earnings recently. Barron’s also cautioned about the spillover effect from the used car market, given its scale, and therefore, potentially hitting Ford’s leasing business.

Therefore, we believe the market could be pricing in a weak Q4 against Ford’s previous full-year EBIT guidance of $11.5B, reflecting increased execution risks as we head closer to a recession.

The risks of a recession on discretionary spending like automobiles are well known. Hence, we believe the de-rating on F’s valuation has already been reflected to a large extent. Notably, F is down nearly 45% YTD and underperforming the SPX markedly.

Still, the demand outlook has likely weakened further from Q3. Moreover, commodity prices remain on the high side despite the pullback from their June highs. Notwithstanding, the S&P GSCI Commodity Index (SPGSCI) has fallen closer to its January levels, suggesting that its medium-term bullish bias has weakened further. Whether it portends a sustained reversal from its bullish bias remains to be seen. But, we believe the pullback in global commodity prices is constructive for discretionary stocks.

However, the auto chips supply chain is still experiencing snags that could keep capacity tight through 2023. However, with fab capacity increasingly coming online, it should help elevate the supply chain dynamics if a recession further hits auto manufacturers’ demand.

However, the critical question is whether Ford’s EV capacity ramp could be impacted moving forward? We don’t think so. Note that Ford recently announced its intention to build its $6B battery facility with SK Innovation, which is sufficient to construct about 1M EVs per year. Therefore, we assessed that Ford remains committed to ramping up to its targeted annualized run rate of 2M EVs by 2026.

Moreover, Bloomberg recently reported that Ford and CATL (the world’s leading battery producers) “are considering building a battery manufacturing plant in Michigan or Virginia,” relying on CATL’s LFP batteries. Details on how they can leverage the production tax credits in the Inflation Reduction Act (IRA) are still being ironed out.

We believe investors need to consider how Ford has been making long-term plans to scale its battery production. These are noteworthy developments, suggesting that the company is focused on its medium- to long-term opportunities in the EV transformation. Hence, we have not seen any pullback in investments from CEO Jim Farley & his team, highlighting that Ford’s Model e (Ford’s EV segment) needs to restrain its forward cadence.

Notwithstanding, we concur a de-rating in F is necessary to reflect its near-term execution risks through a recession, given a hawkish Fed. But, with F’s NTM EBITDA of 9x, well below its 10Y average of 14.8x, bulls could argue that the market has priced in significant pessimism.

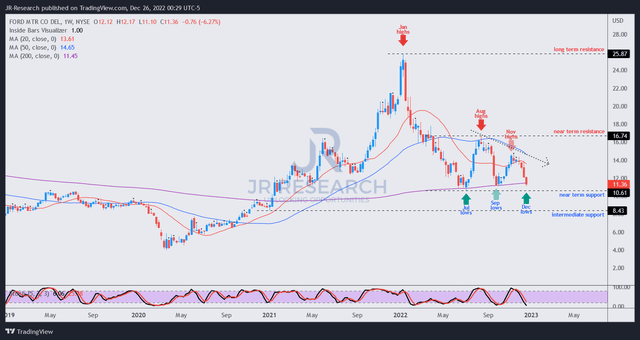

F price chart (weekly) (TradingView)

F’s medium-term trend is undoubtedly bearish, after buyers were decisively rejected at its August highs.

Sellers also prevented F from forming a recovery as it stanched further upward momentum at its November highs, corroborating F’s medium-term bearish bias.

Hence, could we be third time lucky as we picked both its previous lows in July and September, anticipating a rebound that occurred?

In favor of the bulls, we gleaned that F’s momentum is oversold as it re-tests its September lows. However, we have yet to glean a decisive bullish reversal, suggesting buyers have yet to return to trap the bears.

In favor of the bears, F’s well-established medium-term could force a decisive break of its July and September lows. Such a development will not be constructive for the bulls, indicating that the market likely anticipates worse downside risks in 2023 due to the recessionary headwinds.

Therefore, while we are ready to revise our rating back to a Buy, we urge investors to be wary of downside volatility and not to catch the falling knives if F’s 200-week moving average is decisively breached.

Stay safe, and Happy Holidays!