jetcityimage/iStock Editorial via Getty Images

Ford (NYSE:F) has been on an interesting saga for investors since the pandemic started in 2020. Supply-chain issues, spiking vehicle prices, entering the electric vehicle [EV] market as rapidly as possible, and now a disruptive UAW union strike in the autumn of 2023 are just a few of the variables to contemplate. Estimates of the ongoing strike cost on Ford run around $2 billion so far in direct losses, after 5 weeks of picketing.

I know it’s hard to grasp and analyze all of the juggling balls for investors. And, after a price decline from $20 last year to under $12 today, it is tempting to jump on board with some share purchases. However, my biggest 2024 investment concern for Ford shares is the real prospect of a recession beginning soon, with sales and income experiencing a huge hit.

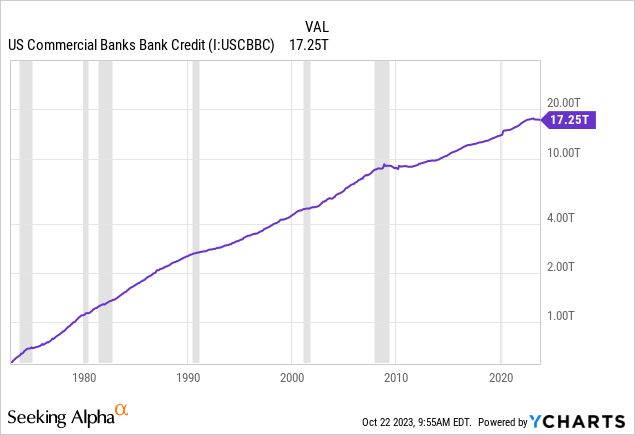

The still inverted U.S. Treasury yield curve, with the greatest spread reached since 1982 earlier in 2023 between 3-month bills and 30-year bonds, is a huge warning about impending recession. M2 money supply has been contracting by as much as -4% YoY, its worst growth rate since the 1930s Depression. Plus, total bank credit in the financial system is now backpedaling by -2% YoY, its worst setup since the end of the Great Recession during 2009-10.

YCharts – U.S. Bank Commercial Credit, Since 1972, Recessions Shaded

So, if a recession in auto sales/loan demand is next, you will want nothing to do with a Ford ownership position in my view. Let me explain why, by reviewing past recession performance in the stock. Trust me, it’s not a pretty picture for bulls.

Recession Performance

Ford historically does horribly as an investment during recession for some obvious reasons. Lower car demand and sales vs. high fixed costs in the business model are the primary culprits. When sales turn down, minor profit margin levels during good times morph into major losses and cash burn.

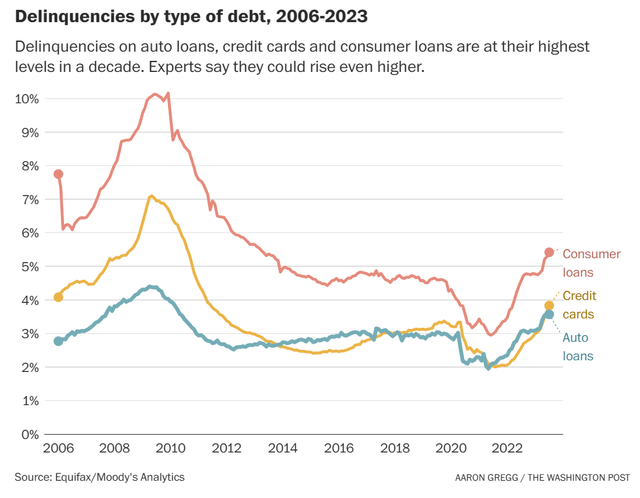

Another issue for the major automakers with finance divisions, rising interest costs to originate new loans (like this year) alongside repayment problems on previous loans are a secondary drag on shareholder worth. Already in the middle of 2023, car loan delinquencies rates are running well ABOVE 10-year averages, and a recession has not really started yet. This is an early indication of rising defaults and repossession expenses to come.

Washington Post Article – U.S. Consumer Loan Delinquency Rates, Since 2006

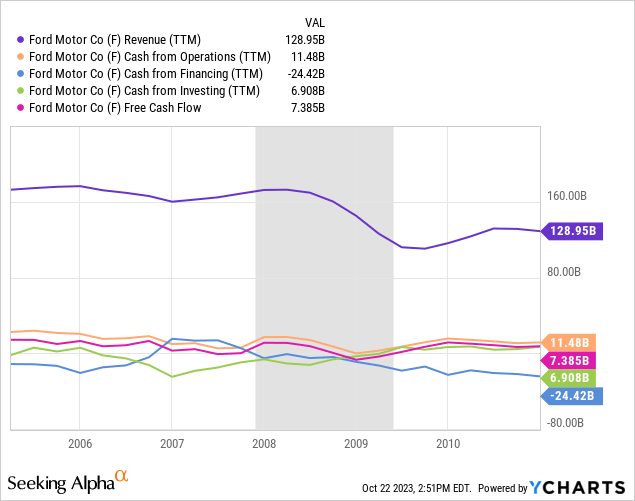

A good example of a typical recession’s effect on Ford operations is the 2008-09 period. I have graphed how declining revenues affected cash from operations, on top of the big negative numbers that showed up from the finance/investing divisions on loan defaults into 2010. In terms of “free” cash flow generated by the business, it was more than cut in half between 2005-06 and 2009-10.

YCharts – Ford, Trailing Annual Sales & Cash Flow, 2005-10, U.S. GDP Recession Shaded

Now let’s travel back in time and review how the Ford share price reacted to official U.S. recessions in GDP output, adjusting nominal results to changes in general inflation. Warning: if you are a Ford shareholder, I hope you can handle Halloween scares and potential losses in your brokerage account.

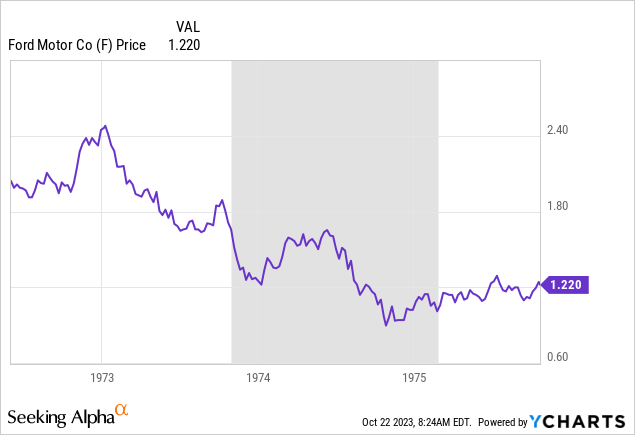

YCharts data for Ford goes back to the early 1970s. So, we can take a peek at the zigzags in stock price before, during, and after each recession span since then.

1973-75 Recession

YCharts – Ford, Price Changes, 1972-75, Recession Shaded

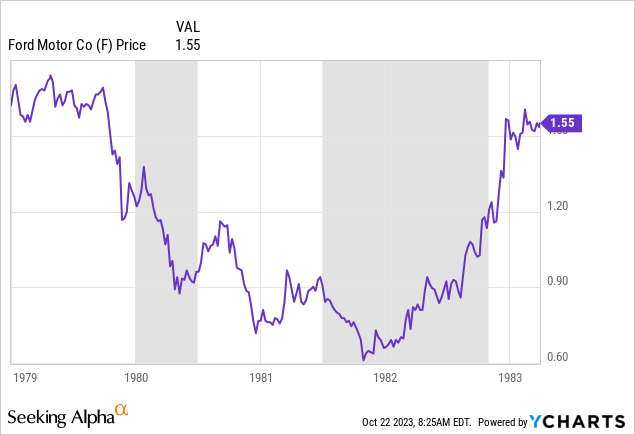

1980 and 1981-82 Recessions

YCharts – Ford, Price Changes, 1979-83, Recessions Shaded

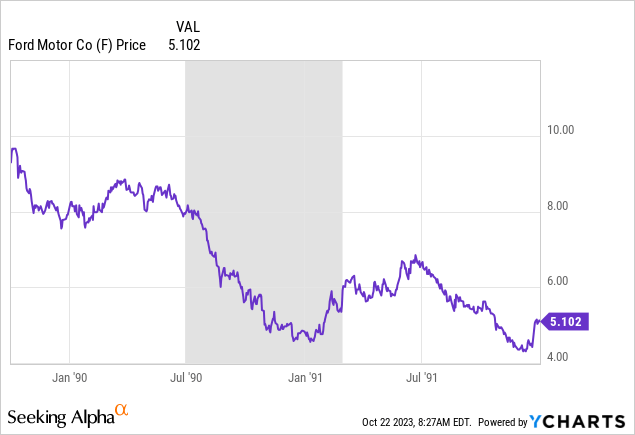

1990-91 Recession

YCharts – Ford, Price Changes, 1989-91, Recession Shaded

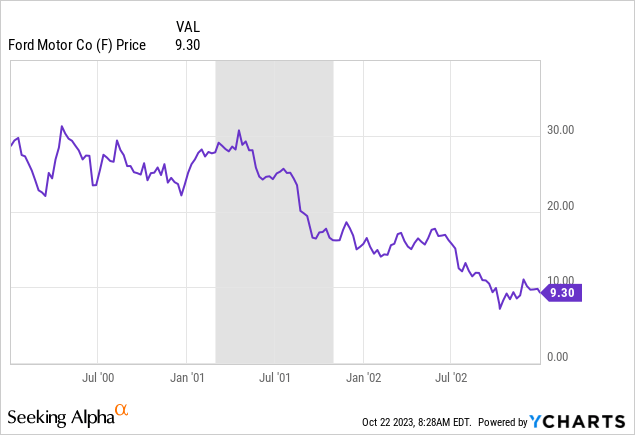

2001 Recession

YCharts – Ford, Price Changes, 2000-02, Recession Shaded

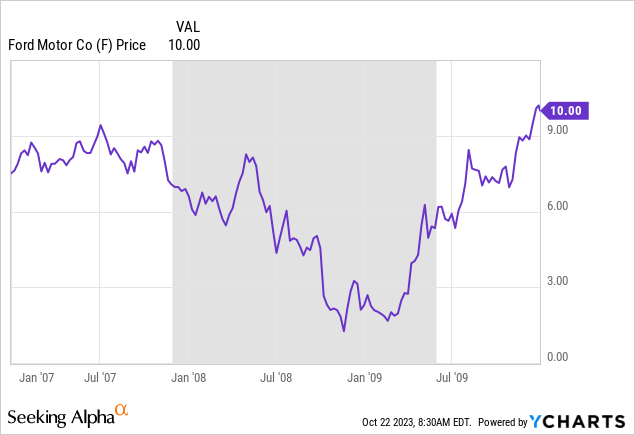

2008-09 Recession

YCharts – Ford, Price Changes, 2007-09, Recession Shaded

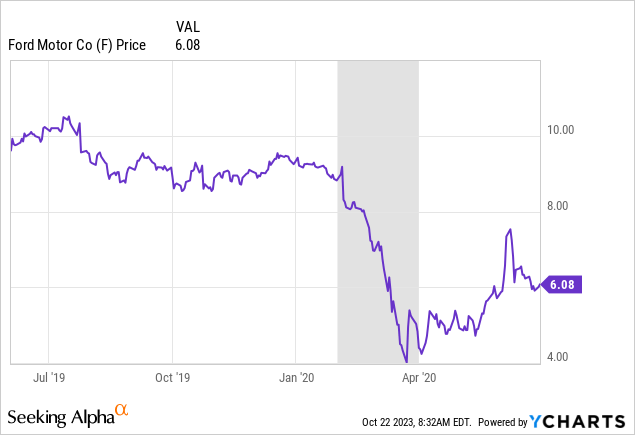

2020 Recession

YCharts – Ford, Price Changes, 2019-20, Recession Shaded

Final Thoughts

We can debate whether a recession is next or something more positive, like a “soft landing” where the economy slows but real GDP does not turn down. My personal view is a recession is getting close to 100% likely in the months ahead from the unexpected rise in long-term borrowing costs since early summer and now pressure on crude oil prices to jump (from Middle East turmoil). Had interest rates behaved over the last 3-4 months, I would have been more willing to consider the soft-landing idea for 2024.

I just wrote a story on why sliding prices for smaller-sized companies in the Russell 2000 index during 2023 is very concerning (believe it or not thousands of individual equities are reaching for new 52-week lows in October). I am forecasting both a recession and bear market in U.S. equities to appear into the new year. Ford’s stock will not be able to escape selling from either situation in my view. On top of the UAW strike hiking its cost structure (long and short term), I believe falling auto sales and climbing loan defaults will almost surely push the company into large operating losses soon.

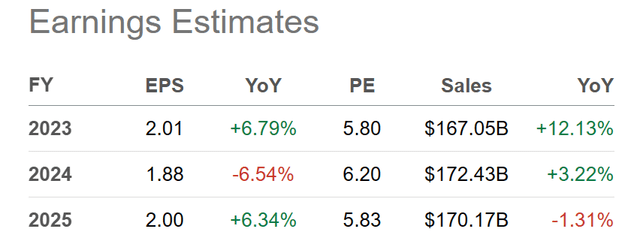

In my view present Wall Street analyst forecasts for 2024-25 are outlandishly high, with investors now setting themselves up for huge earnings and sales disappointment perhaps starting in Q4 2023.

Seeking Alpha Table – Ford, Analyst Estimates for 2023-25, Made October 21st, 2023

The mean “average” Ford share price decline, measured from a few months before recession (close to where we sit today) to the eventual quote bottoms during economic downturns in the overall economy, was on the magnitude of -52% over 7 different instances since 1973.

A similar dump would put Ford closer to $7 per share if measured from the July high quote above $15. Using previous recession data, a final bottom range of $3 to $9 is projected. Nevertheless, if we use the $12.60 peak a month ago, even lower projections for price are possible over the next 6-12 months. From today, it really depends on the severity and length of recessionary auto demand/loan repayment rates approaching.

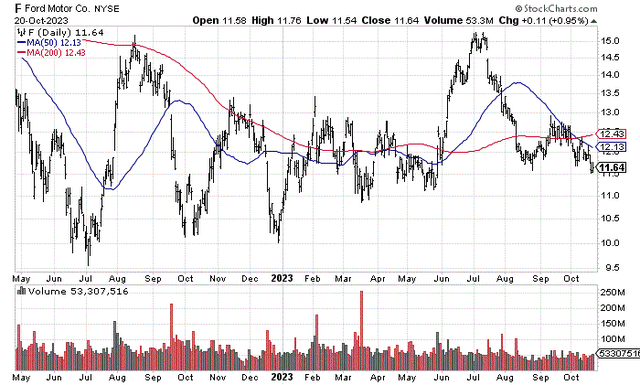

In terms of the current technical trading chart, extremely weak buying volume has been part of the story since August. In addition, price is trading below both its important 50-day and 200-day moving averages. Any decline below $10 a share could encourage extensive institutional selling from both new technical lows and psychological price-level logic.

StockCharts.com – Ford, 18 Months of Daily Price & Volume Changes

How could this forecast be proven wrong? You may have to pray for a goldilocks scenario with peace breaking out between Russia/Ukraine, in the Middle East, and China/Taiwan for starters. Consumers and businesses desperately need some sort of confidence booster. The UAW strike has to be settled ASAP, interest rates and inflation need to decline in America, and consumers would have to spend like drunken sailors in 2024, despite holding record debts amid rising refinance conditions.

Since this scenario seems rather unlikely to me, I rate Ford shares a Sell for a 12-month outlook. I fully expect its share quote to reach far lower levels before any meaningful rebound.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.