Ross Tomei/iStock via Getty Images

A bit about SEGRO

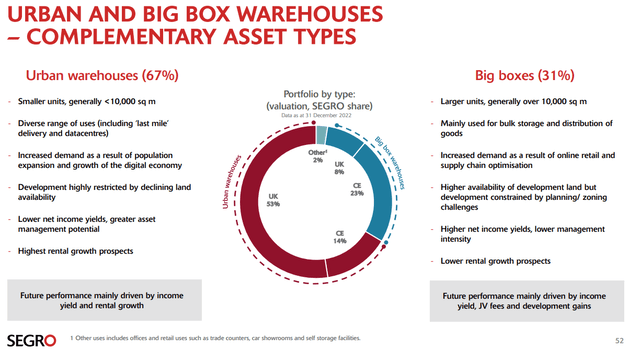

SEGRO plc (OTCPK:SEGXF) is a FTSE100 company with a $12bn market cap and a dividend yield of 3.5%. It’s a REIT (property owning business) with assets in the UK and Europe, the focus of which is in Logistics. Space is split as follows, two-thirds of assets in Urban warehouses which lends the asset base to last mile logistics but also things like data centres. These assets are on prime real estate, in prime areas, located close to densely populated and supply constrained hubs. The other third of the business is in big box centres, these are mostly used for bulk storage and distribution, out of town and away from the masses you wouldn’t consider this as prime real estate but more strategic in nature. You can think of it like this – a large online retailer stores most stock in the big box distribution centres, which are found on or very near to important transport hubs and links, from there it’s able to deliver to the smaller urban warehouses where stock specific requirements are met for the stores in the close cities or towns. Deliveries can then be made directly from these urban sites to customers or to individual stores where necessary. Urban sites are arguably better investments because of the prime land they’re on which is both scarce and expensive. This attracts both premium rental and valuation as customers looking to improve their own business performance jockey for space. Scarcity also prevents competition and sharp increases in supply which tends to keep space occupied and sought after (for multiple uses). Big Box space is easier to replicate, lots of space outside the major metros and so competition is tougher but by nature these boxes are ‘simpler, lower maintenance’ assets which also reduces cost and effort. They also play a pivotal role in the overall product offering so customers can seamlessly transport products and goods across the supply chain.

SEGRO Asset Split (Company Presentation)

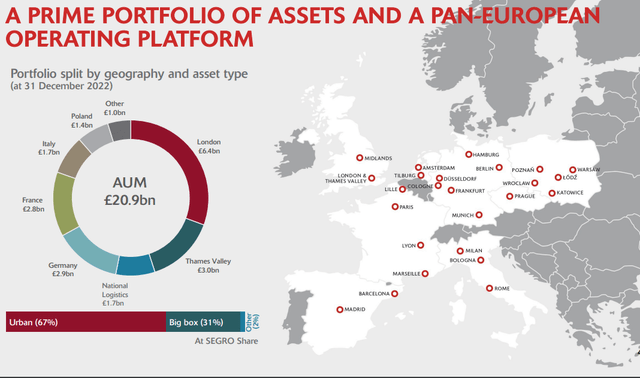

To really understand the sheer quality of the asset base one needs to see where the assets are held and who they’re rented to. This is not a small fry company. The address list is prime real estate in London, Paris, Barcelona, Rome, Madrid, Berlin, Prague, Warsaw etc it’s a list where any property owner would want to be invested.

Asset exposure (Company Presentation)

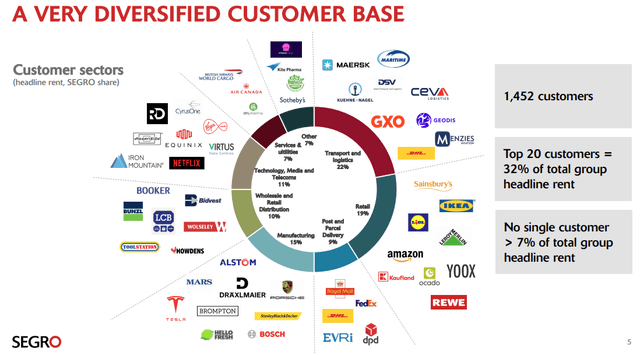

The rental list is equally impressive too. Netflix (NFLX), Tesla (TSLA), Equinix (EQIX), Iron Mountain (IRM), Amazon (AMZN) and FedEx (FDX) are some of the American companies that rent space from them. You’ll recognise the names and see them as large quality businesses. With just on 1500 customer relationships the income stream is both high quality and diversified with no single customer greater than 7% of rental income.

Diversified Tenant Roster (Company Presentation)

The opportunity

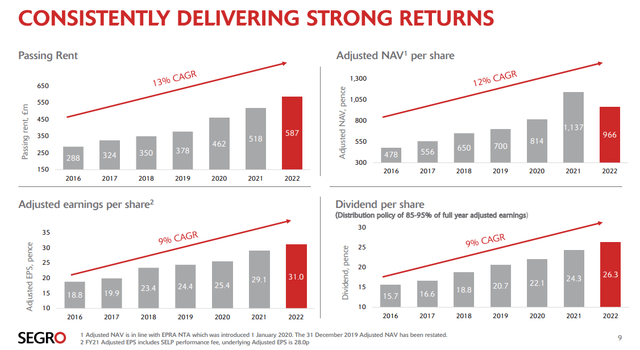

Segro has been an incredible business over the years. Much like Prologis (PLD) in the USA we have a best-in-class company that’s delivered steady growth in earnings and dividends for many years as can be seen below.

Historical returns (Company Presentation)

Despite this however its share price hasn’t followed suit of late. Like many companies that are exposed to ‘the economy’ and ‘interest rates’ its share price has floundered and much like REITs the world over they have struggled with both negative market perception and declining property values. The result of which has been a 1year decline of 47% in the company’s share price and at current levels of $9.46/£7.77 this has resulted in the subsequent increase in the dividend yield to around 3.5%.

Looking at the charts above and digesting the share returns one can clearly see that there is a large disconnect that’s taken place. Rental income is rising, earnings are rising, dividends are rising but the share price is falling. Let’s address the reasons why.

First, property values have had a large leg down since central banks across the globe began raising interest rates last year – this can seen in the top right graph above there the adjusted Net Asset Value (NAV) fell from £11.37 to £9.66 per share in 2022. That’s a 15% decline in a single year, but still considerably higher than pre covid levels (£7.00).

I glean the following from this, during covid the surge in online shopping pushed the perceived value of companies and assets correlated to it considerably higher only to see that dissipate once the world reopened and people realised that we wouldn’t ‘stay home forever’. Much like tech stocks values became distorted for a time and have now ‘normalised’.

Low (almost zero) interest rates meant people could borrow cheaply and bid up these assets and rental incomes at even those high valuations could justify the return on capital deployed. Higher rates ended that. Suddenly if your borrowing costs rocket the returns you need to earn to justify the asset purchase need to rise too to make that spread work. In physical assets like property this can only happen in two ways. 1) rentals must rise or 2) property values must fall. The latter has clearly happened here and has probably been cushioned somewhat by the fact the former has kept rising steadily despite what’s happening in the economy at present.

There has also been an absolute de-rating that has taken place. We can see that in 2021 the NAV for this cycle peaked at £11.37, the share price at the same time peaked at £13.90. So, at its peak the company traded at a premium to its NAV of 22% this has reversed sharply to a now current discount to the lower NAV of 20%. This clearly demonstrates how the perception of the company’s quality had gotten out of kilter with reality (22% premium to elevated NAV) and has now swung full circle to a 22% discount to a depressed NAV.

This swing has been huge, and it happened quickly and violently, however I think it’s gone too far and we find ourselves now in a situation where you can buy some of the best logistics real estate on the planet at a discount.

Valuation

Companies with real assets are easier to value in my mind then those that sell widgets or provide services. Real assets are tangible. In the case of property, you can value the land it’s on, get a quote for how much it would cost per square metre or square foot to construct and then have a sense for how much you can rent that property out for. In many instances this is what Segro does with the piece of the portfolio that is held for development. In fact, before they develop a project a large part of it is ‘pre-let’ so they can actually quantify cash flow for the asset before they even break ground. You can then look at your cost of borrowing do all the sums and then decide if this investment is worthwhile.

Inflation is real right, land costs rise consistently over time, so does labor costs and so too do things like cement and metal frames and all the other ‘components’ that are used to construct a property. This is why property assets rise over the time, the cost to replace them is rising constantly. To my mind then the way value of a company like this provided it has first class assets, a strong well managed balance sheet and A grade tenants is at least its replacement cost or NAV.

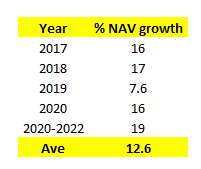

Replacement costs are tough to calculate on a constant real time basis but there are professional valuers out there that look at the portfolios and provide their best estimate as to what they are. The same applies to the NAV, these numbers are derived from external sources. The question of course is, can we trust the NAV? In this case the explosive jump in NAV in 2021 was a red herring courtesy of the ‘Covid bubble’ so it’s best to try and strip that out and look at longer term trends. Doing this we see that the company NAV as grown by the 12% or so the company put up in its results presentation over the last few years.

NAV Growth over time (Company Presentation and Analyst )

This growth happens on several fronts, first off, the natural escalation in property values due to replacement cost, increases over time. Secondly the absolute growth of the portfolio as the company buys or develops new properties and thirdly the dynamic market pricing based on supply and demand. This latter part is sometimes referred to as ‘yield’. This is roughly translated as the income you earn over the property value. A higher yield means greater return and a lower yield the opposite. This ‘yield’ is driven in real time mostly by the denominator or the value of the property as it tends to change quicker than rental income (long term contracts) especially as rates rise or economies slow down or grow faster.

In a steady state economy most variables that drive valuation are quite range bound and don’t oscillate too wildly. This allows companies to plan by investing in growth projects secured by funding either through the issue of shares or debt or a combination of the two. A feature of a REIT is that they issue shares to raise capital for growth. This is in most cases why rental growth tends to be higher than earnings growth but what we’re after here of course is earnings and dividends that are growing at least in line with inflation. For this we turn to the pipeline, and this is what it looks like at Segro.

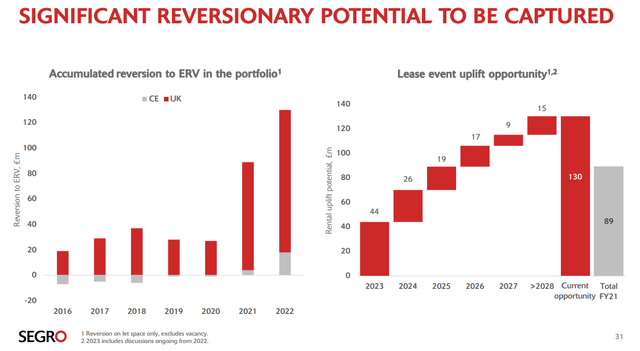

First off, most REITs enter into long term contracts (leases) with their clients oftentimes these can be for 5 years or longer. Rents are set and escalations agreed upon. At the anniversary of the contract new terms are discussed. What has been a feature for REITS in the logistics space in particular is that rents have lagged considerably due to fundamental changes in the market. The implication is that a new tenant leasing existing space would pay market related rentals which is in some cases 20-50% higher than what existing tenants in the space are paying. This implies that as contracts are renewed current tenants need to pay significantly more or potentially move out and lose the space to new tenants that are willing to pay current rates. If one looks at SEGRO the potential upside from this is large.

Income growth from rent reversions (Company Presentation)

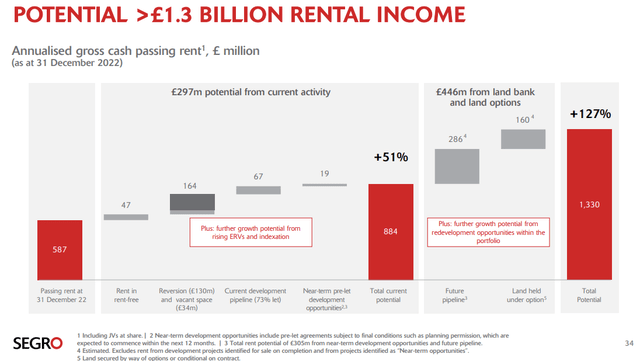

This chart is telling us that in 2021 these increases amounted to £89m of higher rent and that a further £130m can be captured once leases are renewed from now until 2028 or so. Considering that passing rent was £587m in 2022 that implies growth of 22% in income from old lease adjustments alone over the next 6 years. On top of this the portfolio is growing and in 2022 additional rental income from new developments equated to £46m. Looking beyond that to the medium-term pipeline that figure rises to a total of £884m. Of course, there is a land bank and land held under option to buy and extrapolating that into forecasts the company thinks that when it’s all said and done, they currently see a path to greater than £1.3bn in rental income.

SEGRO rental pipeline (Company Presentation)

This should result in steady earnings, NAV, and dividend growth for the for foreseeable future.

So how do we model that?

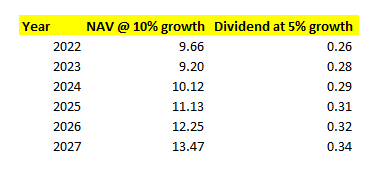

Well starting with the state of the market I’m going to assume that the worst of asset write downs are behind us and that from here the NAV will stabilise. On top of this I assume that operationally the business continues to perform well and that rental escalations and the top-notch tenant roster continue to support earnings growth.

Even if NAV drifts marginally lower again this year to say £9.20 (5% decline) from current share prices that extrapolates a return of 16% plus a dividend of 3.5% for 19.5% total return.

On top of this NAV should begin to rise again after its stabilised, remember, it’s grown by over 12% per annum historically so let’s assume that regains momentum backed by the massive pipeline above but we take it down a notch to 10% growth. Dividend growth hasn’t been impacted by the NAV volatility as it’s correlated to underlying earnings and dividends have grown by 9% per annum over the last 6yrs. We’ll reduce that to 5% to be conservative.

NAV and Div Growth forecasts (Analyst)

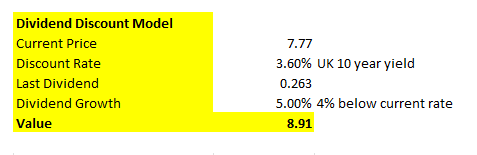

As a test we can also look at a dividend discount model for this stock as the purpose of REITS is to pay out cash

Dividend Discount Model (Analyst)

My average value of the two is £9.06 and I rate Segro as a buy.

What about debt

As mentioned above REITS finance their businesses by issuing shares, taking on debt or a combination of the two. Debt is a vital part of the funding program so the cost of it is crucial. In the case of Segro they have an average cost of debt of 2.5% at present with an average maturity of 8.6yrs. Ninety-five percent of it is either fixed or capped. The loan to value is also comfortable at 32% which implies a strong balance sheet with capacity to take on further debt to fund growth, if necessary.

Risks

Real estate is cyclical and as we saw last year subject to valuation moves which can be exaggerated by sharp or sudden fluctuations in interest rates or inflation. This caused a 15% decline in the NAV of Segro in 2022 as an example.

Higher interest rates do impact the ability of the company to finance acquisitions and repay loans. Recessions may impact the customers of the REIT too and they may have some difficulty in paying rent.

Diversified companies like this also have exposure to other currencies in this case the Euro and other countries – some of the European exposure is in Emerging Eastern Europe which may be considered higher risk than Western Europe.

Segro also develops property, there is a risk that these are not rented on time or at expected rental yields which could create volatility in returns.

Conclusion

From extreme over valuation to quite significant undervaluation SEGRO has gone full circle. The Covid premium has evaporated, and higher interest rates, inflation and recession concerns have subsequently resulted in a steep discount.

For a company with an incredible track record of excellence and a high-quality best in class portfolio this discount seems too wide and is providing long term investors with a great entry point.

The current discount to NAV should narrow and the NAV itself should continue to grow too which provides a consistent push higher to the share price over time. This coupled with a solid starting and growing dividend yield means longer term returns in the region of 12-15% per annum are certainly possible from this Blue-Chip logistics landlord in my opinion.

In my view Segro is a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.