Dragon Claws

ETF Overview

The VanEck IG Floating Rate ETF (NYSEARCA:FLTR) seeks to replicate the performance of the MVIS US Investment Grade Floating Rate Index which consists of U.S. dollar denominated floating rate notes issued by corporate issuers and rated investment grade.

FLTR has ~$1.31 billion in net assets and charges an expense ratio of 0.14%. The fund is fairly diversified and holds 128 different securities. No individual security makes up more than 2.83% of the fund.

FLTR has a modified duration of 0.02 and currently has a yield to maturity of 6.48%. The weighted average maturity of the fund is currently 3.3 years.

Historical Performance

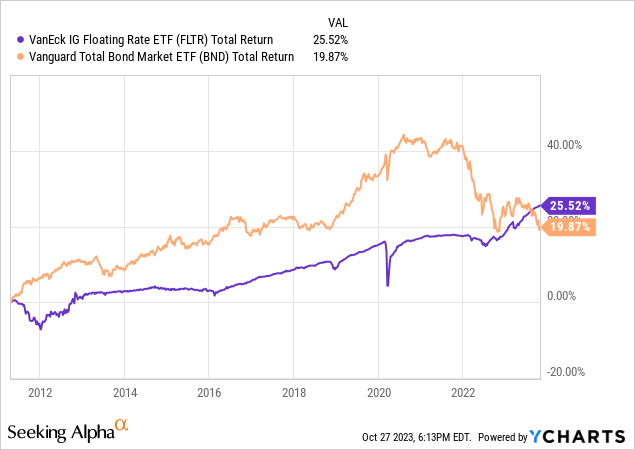

FLTR launched in April 2011 and has outperformed the total bond market which can be proxied with the Vanguard Total Bond Market ETF (BND). Since inception, FLTR has delivered a total return of 25.5% compared to 19.9% for BND during the same period. However, FLTR only overtook BND recently as the intense bond market sell-off has hurt BND.

FLTR has done an excellent job in meeting its objective which is to provide investors a fixed income option that benefits from rising interest rates.

Low Management Fee

As many of you know, I am generally not a fan of high fee ETFs and have recently written a number of pieces highlighting high fee ETF products to avoid:

INFL: Consider A Lower Cost Approach To Bet On Inflation

HNDL: Avoid Due To High Fees And Complexity

SLX: Why I Am Not A Buyer

FM: Why I Am Not A Buyer

FLTR is a different story as the fund charges a management fee of just 0.14% which I view as very reasonable given the challenges than individual investors have in terms of building a diversified corporate floating rate portfolio on their own. Comparably, the iShares Floating Rate Bond ETF (FLOT) is very similar and charges a management fee of 0.15%.

High Quality Holdings

FLTR hold high quality bonds. ~15% of the fund is invested in AA rated bonds, ~53% is invested in A rated bonds, and ~29% is invested in BBB rated securities.

VanEck

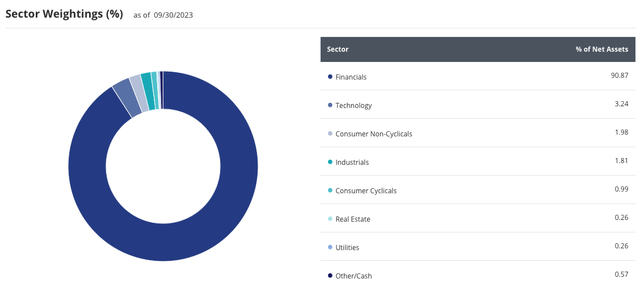

High Concentration of Financial Sector Issuers

One of the drawbacks to this ETF is the high concentration of financial sector holdings. The reason for this is that banks make up the majority of the floating rate high grade corporate bond market. While I am generally positive on the outlook for financial services companies right now, I would prefer to be more diversified from a sector point of view.

VanEck

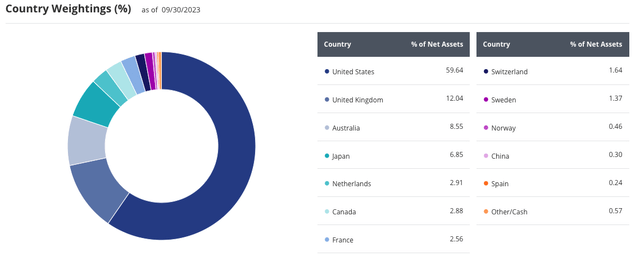

Diversified Country Exposure

FLTR is broadly diversified across geographic regions with positions in the U.S. representing ~60% of exposure. I view the high level of geographic diversification as a positive as the financial services sector exposure is spread out over more economies.

VanEck

My Preferred Floating Rate Investment Right Now

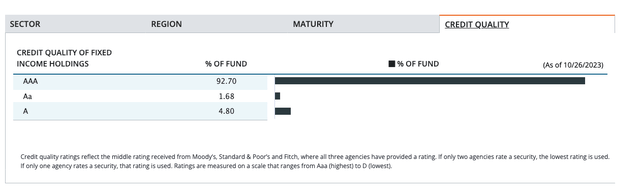

While I believe FLTR represents a reasonable way to get high quality floating rate exposure, I prefer to invest in AAA rated CLOs which are also floating rate in nature.

My preferred vehicles to access AAA rated CLOs are the BlackRock AAA CLO ETF (CLOA) and the Janus Henderson AAA CLO ETF (JAAA).

CLOA and JAAA carry management fees of 0.20% and 0.24% respectively. These funds very little duration exposure and each have yield to maturities of ~7.2%. Thus, these funds which only invest in AAA rated CLOs provide investors with ~70bps of additional yield compared to FLTR.

In addition to providing investors with more yield than FLTR, I believe these AAA CLO ETFs also carry significantly less credit risk as the vast majority of the fund is invested in AAA rated securities.

AAA CLOs are very safe and no AAA rated tranche has ever defaulted.

Janus Henderson

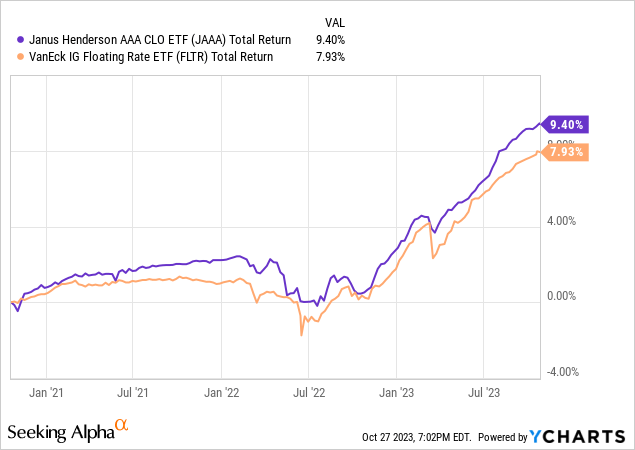

AAA CLO ETFs Historical Performance vs FLTR

While these AAA CLO ETFs are a relatively new product , JAAA has the longest history and has outperformed FLTR on a total return basis by ~1.5% October 2020 (this is when JAAA launched)

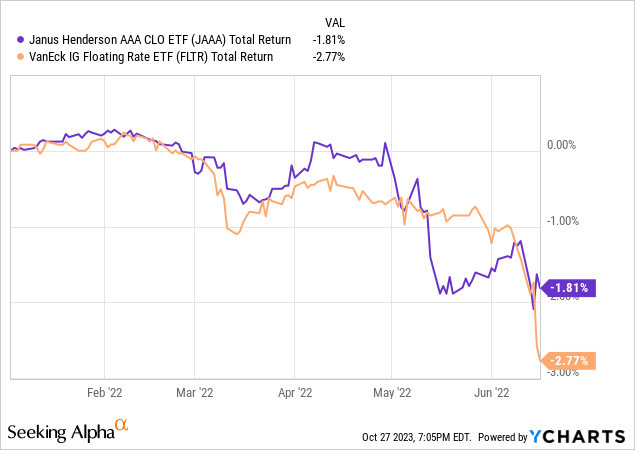

Moreover, during the period of financial market stress in 2022 due to rising rates JAAA significantly outperformed FLTR suggest it is a less risky investment.

Conclusion

FLTR is generally a solid ETF and has done an excellent job achieving its objectives. FLTR carries a low management fee and is well diversified geographically. However, the fund is highly exposed to the financial sector.

My preferred floating rate investment in AAA CLOs which can be accessed through JAAA or CLOA. I prefer AAA CLO ETFs given the relatively higher yields and safer asset quality compared with FLTR.