FreshSplash/E+ via Getty Images

Intro

Flexsteel Industries, Inc. (NASDAQ:FLXS) is a US-based producer of upholstered furniture ranging from the likes of sofas to loveseats to sofa beds to bedding units. Flexsteel has multiple ways (such as through dealers and various e-commerce channels including its own website) in which it gets its products to market.

If we pull up an intermediate chart of the furniture manufacturer, we see that shares are in a bull market. We state this because of the uptrending slope of the multi-year trendline since 2020 plus the fact that shares earlier this year delivered an intermediate golden cross (crossing of the stock’s 10-week moving average above its corresponding 40-week average).

As chartists, we believe that every piece of information that could possibly affect the trajectory of Flexsteel’s share price action has already been embedded in the technical chart. Shares have rallied close to 7% over the past three months thus continuing their pattern of higher lows & higher highs. Therefore, let’s delve into Flexsteel’s recent Q4 report and fiscal 2023 trends to see if we believe the company’s investment case (Regarding the company’s profitability & related trends) will remain bullish for some time to come.

FLXS Intermediate 5-Year Chart (Stockcharts.com)

Q4 Trends

Both top-line sales and operating profit grew in the fourth quarter with sales reaching $105.8 million & operating profit growing to $4.2 million. The strong operating profit number was down to good control of SG&A costs & an expansion of Flexsteel’s gross margin which came in at 19.9% for the quarter. Furthermore, it is evident that Flexsteel’s rising sequential revenues led to gross margin expansion as efficiencies took place as a result.

Suffice it to say, it is vital that gross margins remain elevated so profitability can be protected somewhat going forward. This is so important because Flexsteel’s trailing EBIT margin comes in only at a mere 2%. In fact, in fiscal 2023, SG&A costs made up almost 86% of the company’s gross profit which means near-term margin expansion must continue to keep bottom-line profitability elevated.

From a full-year perspective, sales fell by 27% but EBIT grew by almost $2 million. Although demand continues to lag pre-pandemic levels, Flexsteel’s commitment to innovation & its development of value-adding products remains very strong and demonstrates a strong willingness to surmount pricing pressures in its markets.

Although the big box channel for example only made up 5% of the company’s total turnover in Q4, more product offerings are expected to accelerate the growth rate in this channel in fiscal 2024. Recent new offerings include the Flex modular furniture solution, ‘Zecliner’ which is the company’s fresh sleep recliner & the upholstered furniture brand ‘Charisma’ launched late last year which is tailored to a younger demographic.

Although all of the above new additions have gained traction, you feel that Flexsteel will have to keep on pushing the boat out (with respect to innovating effectively) in order to consistently win business in its markets. Take the ‘Charisma’ brand for example. Although management pointed out on the recent Q4 earnings call that gaining market share in this space was a big possibility (due to a big competitor having closed its doors), we must remember that one’s success in this market (budget-price sofas) is largely predicated on price and no more. This begs the question: will this brand be able to increase the company’s operating margins over time especially if inflation remains elevated which will only increase costs on the front-end?

Concerning EPS Revisions

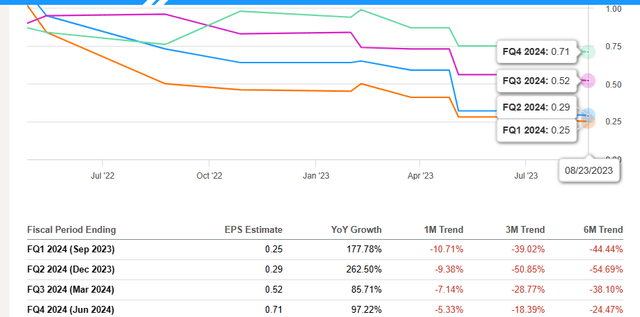

If we pull up a chart of how consensus views earnings expectations over the upcoming four quarters of fiscal 2024, we see that the bottom-line estimates for Q1 & Q2 have been revised down by 10%+ & 9%+ respectively. Although we see better revisions over the latter part of the year, from experience, the more near-term quarters are the most accurate when predicting earnings as they take account of near-term trends present in the market.

Given that shares of Flexsteel remain relatively cheap from a valuation standpoint, the market has not been discounting the share price accordingly from these recent bearish EPS revisions. Nevertheless, we need stability here over the near term in this area as otherwise, the stock’s established trend of higher highs and higher lows will swiftly come to an end.

Flexsteel EPS Consensus Revisions (Seeking Alpha)

Conclusion

Therefore to sum up, although Flexsteel has momentum on its side with respect to its recent share-price action and encouraging Q4 numbers, we believe innovation needs to remain buoyant to keep winning share in its markets. Furthermore, recent bearish forward-looking EPS revisions are sure to act as a headwind to share-price growth if we continue to see downward EPS revisions over time. Therefore, Flexsteel for us at present is a ‘Hold’. We look forward to continued coverage.