Teamjackson/iStock Editorial via Getty Images

Introduction

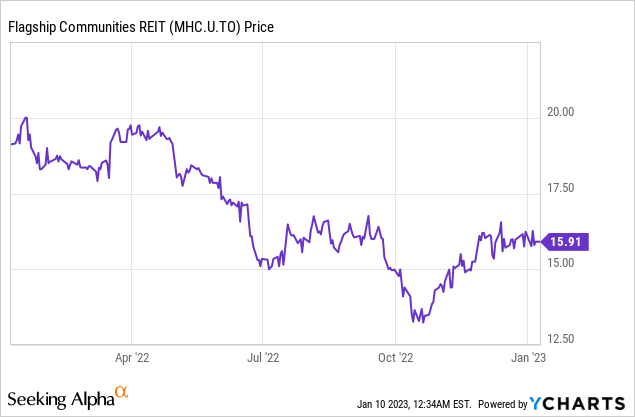

Flagship Communities (OTCPK:FLGMF) (MHC.UN:CA) (MHC.U:CA) is a relatively new REIT as it was only formed in the final quarter of 2020 to offer its shareholders exposure to manufactured housing communities in the US. The IPO was priced at US$15 and now, more than two years later, the share price is back where it started, despite a few years of growth and completing its most recent substantial capital raise at US$19.25 per share in 2021.

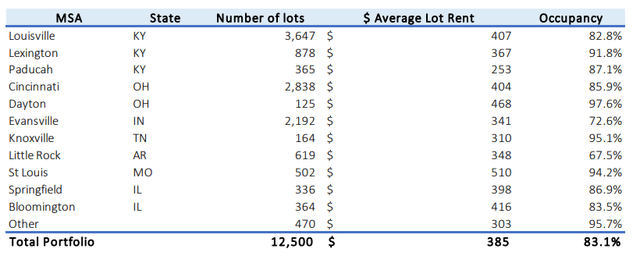

Flagship Communities Investor Relations

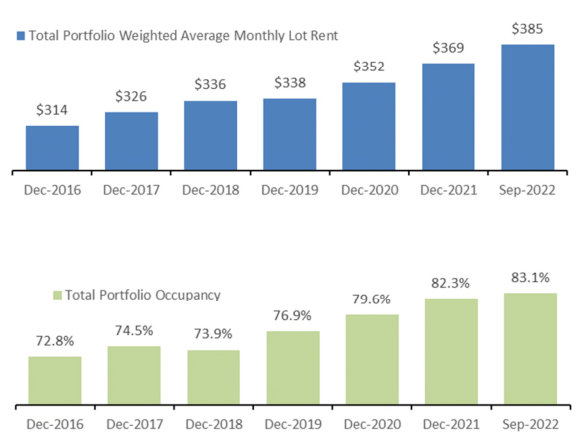

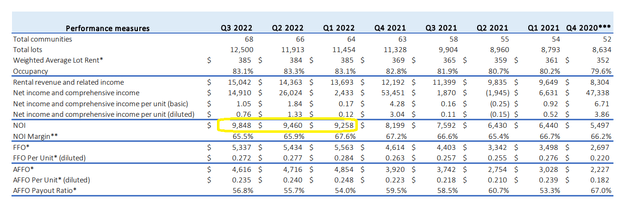

The REIT operates a total of 12,550 lots across 68 communities in a handful of States. The REIT was able to boost its occupancy ratio as well as the average monthly lot rent in almost every single year in the past six years.

Flagship Communities Investor Relations

The business model is pretty simple: the vast majority of the revenue is generated through leasing the lots to the home owners and in some rare cases, Flagship also owns the home on the lot. The key word for Flagship is ‘affordability’. The REIT focuses on Kentucky, Indiana, Ohio and Tennessee as its most important states. It is not a Sunbelt-focused operator focusing on retirees, but on the working class population looking for affordable housing.

Flagship’s most liquid listing is in Canada where it is trading with MHC.U and MHC.UN as ticker symbols. The U-listing has the USD as base currency but the CAD listing is more liquid. Both the U and UN listing should move in tandem although the illiquidity of the U listing may cause the spread to be larger. MHC reports its financial results in US Dollars, and I will use that currency throughout this article. There are currently 14.14 million units outstanding and an additional 5.47 million Class B units which can be converted into common units. The total unit count I will use to calculate the per-share performance is 19.7 million units.

Flagship’s FFO and AFFO are gradually increasing

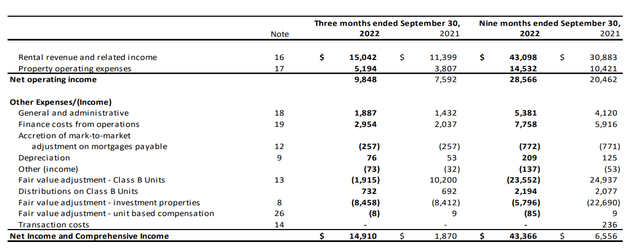

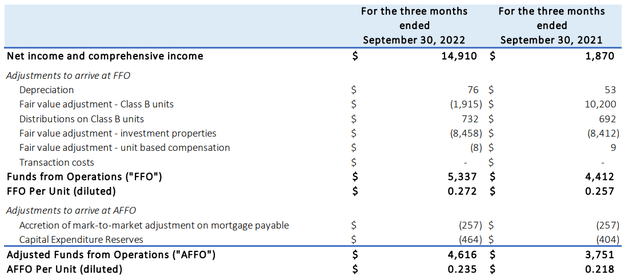

The REIT reported a total rental revenue of just over $15M during the third quarter, which resulted in a net operating income of $9.85M. While the net income of $14.9M looks great, it is obviously more important to have a look at how the FFO and AFFO results were evolving.

Flagship Communities Investor Relations

You may immediately notice a small decrease in the FFO and AFFO despite an increased lot count, an increased rent price per lot and the stable occupancy.

Flagship Communities Investor Relations

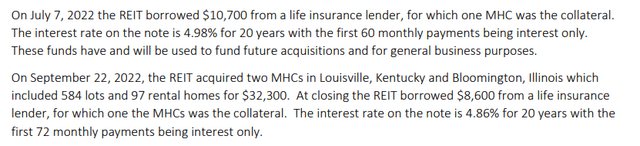

The culprit is the interest expenses as Flagship is clearly not immune for increasing interest expenses. The REIT continues to grow and pursues small bolt-on acquisitions in the very fragmented market of MHCs. Subsequent to the end of the third quarter, Flagship closed yet another acquisition, purchasing two MHCs in Kentucky and Illinois for a total of US$32.3M. Based on the current occupancy, I expect these new properties to contribute $1.5M in NOI in 2023. And in November, it announced it acquired a 100% occupied 100 lot resort-style MHC in Ohio.

The higher interest expenses are weighing on the FFO and AFFO, and now it’s up to Flagship to improve the performance of the acquired assets to ensure a positive contribution to the total result. During the third quarter, Flagship’s FFO came in at $5.3M while the AFFO was $4.6M or $0.235 per share.

Flagship Communities Investor Relations

This means the 9M 2022 AFFO per share already came in at $0.733, and for the entire financial year we can probably expect a result north of US$0.95 but lower than US$1. $0.97-$0.98 seems to be a fair expectation for Flagship at this point. It should be able to increase its rental income again in 2023 and that should further boost the AFFO per share by a low single digit percentage: don’t expect any miracles or sudden FFO and AFFO increases. A gradual annual AFFO increase of 2-3% is realistic.

Fortunately Flagship has locked in its mortgage interest rates. As of the end of 2021, the existing mortgages had an average cost of debt of 3.43% and had a weighted term to maturity in excess of 10 years. The new acquisitions came with a higher mortgage price tag and this pushed the average cost of debt to 3.68% as of the end of September.

I applaud Flagship for providing detailed breakdowns on its borrowing procedures as every new loan and mortgage is clearly documented. The terms of the two new loans obtained during the third quarter seemed okay.

Flagship Communities Investor Relations

Sure, the interest rates are higher, but Flagship has been able to secure the interest rates for 20 years. And during those 20 years, it should be able to further increase its net rental income and cash flows.

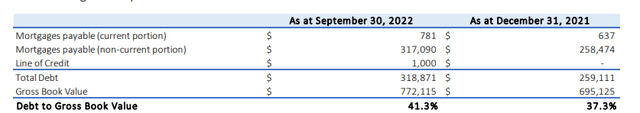

As of the end of September, Flagship’s debt to gross book value was 41.3%. This did not include the existing cash position, and I’m also not sure how the gross book value is a relevant metric. The book value of the investment properties was $754M and the net debt of $314M would represent an LTV ratio of 41.6%.

Flagship Communities Investor Relations

Of course it’s also important to understand how Flagship ended up with its $772M in asset value. According to the footnotes of the financial statements, the REIT used a capitalization rate of 4.72% and for every 0.25% increase (there appears to be a typo in the sensitivity analysis below as the ‘0.025%’ should be ‘0.25%’ and an increase in the capitalization rate should result in a decrease of the fair value) the book value would decrease by $40.4M. An increase of the capitalization rate to 5.22% would thus cause the book value to decrease to $674M which would result in the LTV ratio increasing to 46.6% (and that is obviously still manageable).

Investment thesis

In November, the REIT hiked its monthly distribution to US$0.0468 per unit, for an annualized distribution of $0.562 per year. Based on the current share price of $15.90, this represents a dividend yield of just over 3.5%. That’s not high, but keep in mind this represents a payout ratio of less than 60% of the AFFO. This means Flagship is currently retaining approximately $5-$6M per year, which could be used to pursue additional acquisitions on this highly fragmented market.

Having access to multi-year fixed rate debt will further improve the financial performance of Flagship as new communities will likely be acquired at higher capitalization rates to reflect the 4-5% cost of debt these days.

Flagship’s closest competitor would be UMH Properties (NYSE:UMH) (for a recent review of UMH Properties, check out Gen Alpha’s article) which is trading at approximately 16 times the 2023 FFO estimate of $0.99 per share. I am looking at Flagship from an AFFO perspective (and I expect $1.00-$1.02 in AFFO per share this year) and the FFO per share should be a tad higher at approximately $1.10-$1.15 per share. If I would use $1.12 per share and apply UMH’s multiple of 16.3 times the FFO, Flagship’s fair value should be north of US$18. Always work with limit orders due to the limited liquidity in Flagship’s stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.