COROIMAGE/Moment via Getty Images

Many companies thrived during the terrible COVID-19 pandemic. Companies such as DocuSign (DOCU), Zoom (ZM) and Peloton (PTON) rose to colossal heights as these companies benefited greatly during that time.

However, the majority came crashing down and investors who bought during the pandemic are now likely holding significant losses, if still holding at all.

Today, I’d like to discuss a founder-led company that debuted in 2019 at a little over $20 bucks a share and rose above $300 dollars a share during the peak of the pandemic hype. Like the previously mentioned companies, this company sank as well and is trading near its IPO price today.

The company is Fiverr International Ltd. Let’s dig into the details to see if this company is worth owning after the COVID-19 pandemic.

The Company

Fiverr International Ltd. (NYSE:FVRR) is a technology company that helps freelancers find work as well as connect business owners and individuals to a larger online talent pool. The company’s mission is to revolutionize how the world works together. For buyers, this is a great way to get help from a freelancer on a specific project without needing to fill a full-time role. For sellers, this marketplace helps the individual reach a larger audience and work where and when she or he so desires.

The company was established in 2010 when the company’s founders, Micha Kaufman and Shai Wininger developed an idea to create an online marketplace for people to buy and sell digital services offered by freelancers. The company’s services started at five dollars and went up from there which is where the company got its name.

The company offers a variety of freelance services such as graphics and design, writing, photography, marketing, and many more including AI services. I’ve used Fiverr before for one-off graphic designs and have been happy with the results.

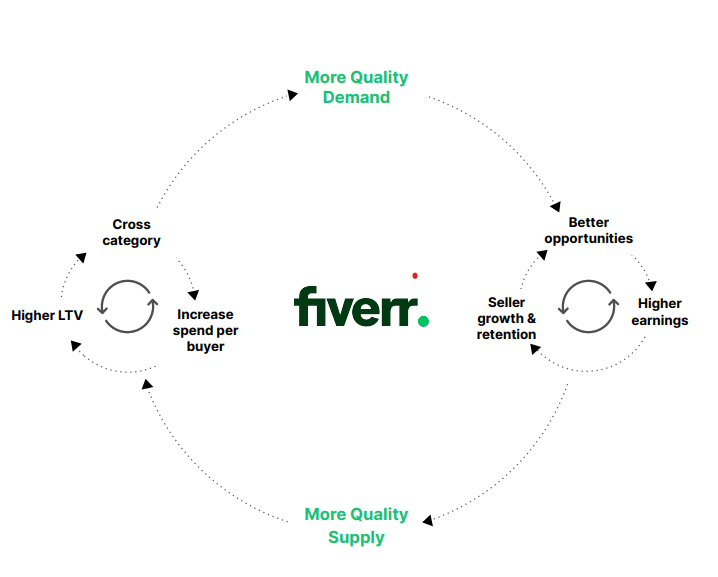

The gig economy seems to be growing, both domestically and internationally which sets up companies such as Fiverr in a prime position to take advantage of this movement. I believe Fiverr finds itself in a promising position due to their first mover advantage which has created the flywheel effects illustrated in the graphic below:

Investor Presentation

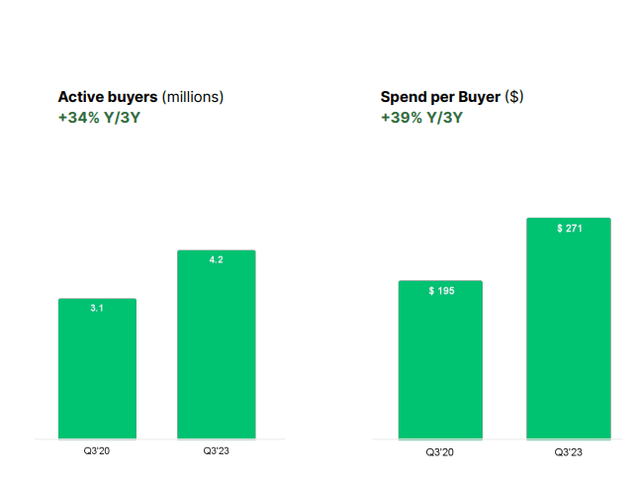

More demand within a marketplace attracts quality sellers and obviously buyers want quality so the cycle repeats. Clearly Fiverr seems to be doing something right as the number of active buyers is increasing as is the spend per buyer as shown in the graphic below:

Investor presentation

Moat and Opportunity

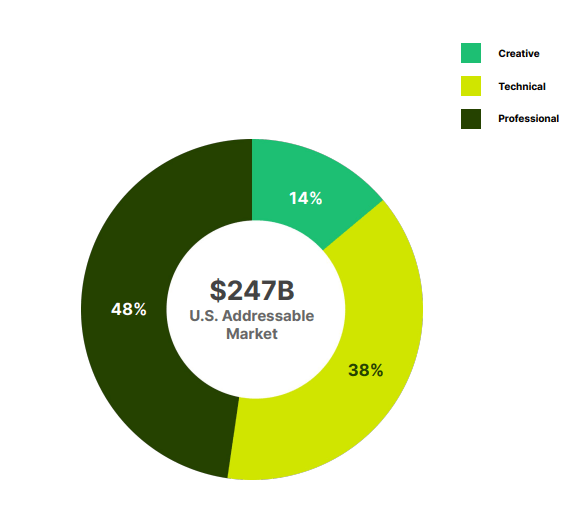

Fiverr believes within the United States there is an addressable market of $247 billion as the below graphic illustrates:

Investor presentation

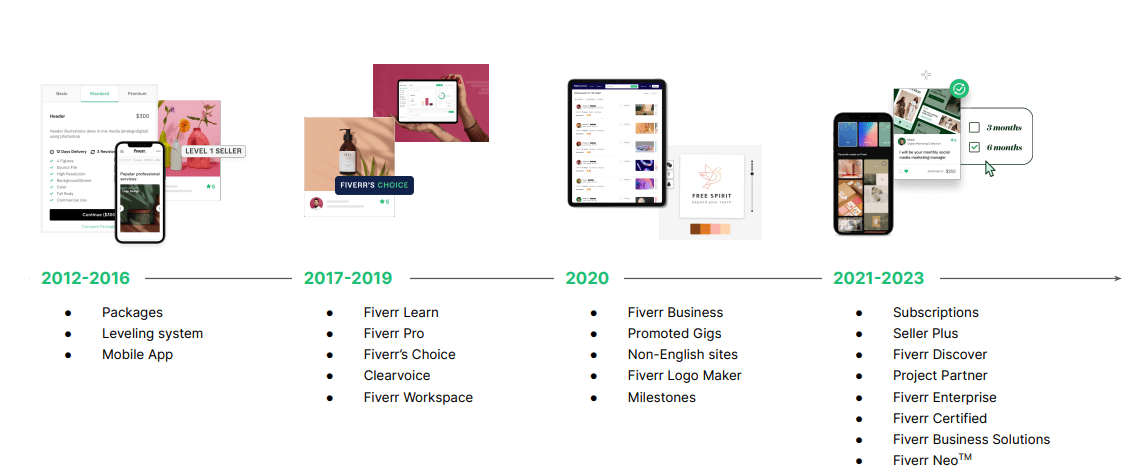

The company has noted several strategies in place to continue to drive long-term growth. To start, the company plans to continue to innovate with technology and services. As the below illustrates Fiverr has continued to innovate and create new products:

Investor Presentation

In researching freelancer platforms, Fiverr and Upwork (UPWK) seemed to be top sites most often mentioned. In my research, although both were cited as excellent marketplaces, I found consistently among users that Fiverr was better for beginners and for one-time projects. Upwork had more professionals and was better for long-term projects. I think with Fiverr’s latest products such as Fiverr Pro and Fiverr Neo the company is working to compete more closely with Upwork. Fiverr Neo in particular seems exciting as the company’s CEO stated, “The vision for Fiverr Neo is quite wild. We imagine Neo will serve as a personalized recruiting expert that can help our customers more accurately scope their projects and get matched with freelance talent, just like a human recruiter, only with more data and more brain power.”

As a potential buyer, I can see the benefits of Fiverr Neo as it can be overwhelming trying to find a specific expert on an individual project. I think this could help make the decision easier for the buyer which will ultimately keep the buyer using Fiverr’s marketplace.

These products such as Fiverr Neo and Fiverr Pro will hopefully bring Fiverr up-market bringing additional buyers and sellers onto the platform.

Another lever to drive future growth is expanding Fiverr’s gig catalog. One promising addition to me is artificial intelligence. Some may view AI was a negative to the business as AI could create graphics, scripts, and automatic various tasks. This will be the case to some extent however, I believe AI can be beneficial to both buyers and sellers on the platform. Kaufman stated as much on the latest earnings call in which he said, “…AI integration, both internally as a team and how it makes us move faster, more efficient, but also in our products to make the lives of our customers better and get what they’re trying to do faster.”

Finally, Fiverr has the potential to expand globally which would further enhance growth for the company.

I’m not sure I would state Fiverr has a moat, but I do believe they have a first mover advantage. In today’s economy I believe what’s important for companies like Airbnb, Rover, and other industry disrupters, is to benefit from the first mover advantage as they have the most sellers or providers which bring buyers which in turn creates the flywheel effects previously mentioned. As long as Fiverr can keep innovating and retaining buyers and sellers, they’ll continue to be a dominant player in the gig economy.

Management

Micha Kaufman is the current CEO of Fiverr and as noted above is one of the company’s co-founders.

Ofer Katz is the company’s Chief Financial Officer. Katz has held numerous leadership positions at such as companies as Wix, Adallom Technologies, and Wilocity.

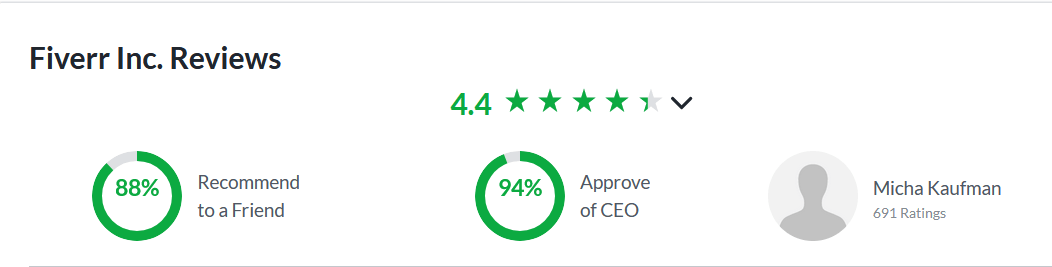

As you can see from these Glassdoor ratings, Fiverr is viewed as a great place to work and employees at the company certainly approve of Kaufman:

Glassdoor

As I’ve stated previously, I’m a big believe in founder CEOs due to their propensity to focus on the long term and I like when senior leadership has skin in the game. I like that both Katz and Kaufman hold shares in Fiverr with Kaufman holding nearly 5%.

To me, this quote from Kaufman on the company’s last earnings call is precisely what a long-term investor should want to hear from such a founder-led CEO, “…We’re optimizing growth and profitability profile and putting a sustainable path to maximizing long-term shareholder value.”

Financials

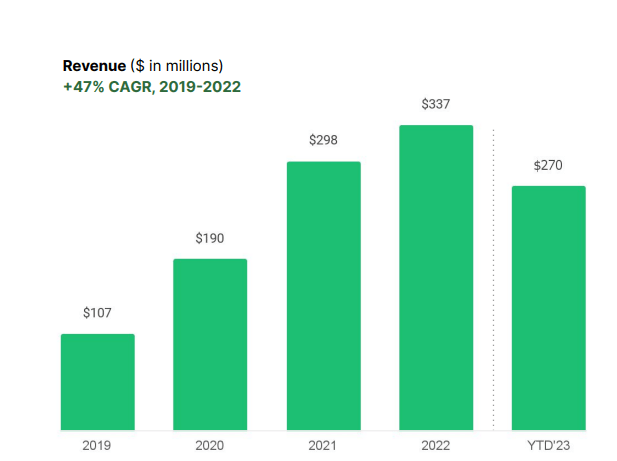

Fiverr has managed to grow revenue at a CAGR of 47% between 2019 and 2022 as the below illustrates:

Investor Presentation

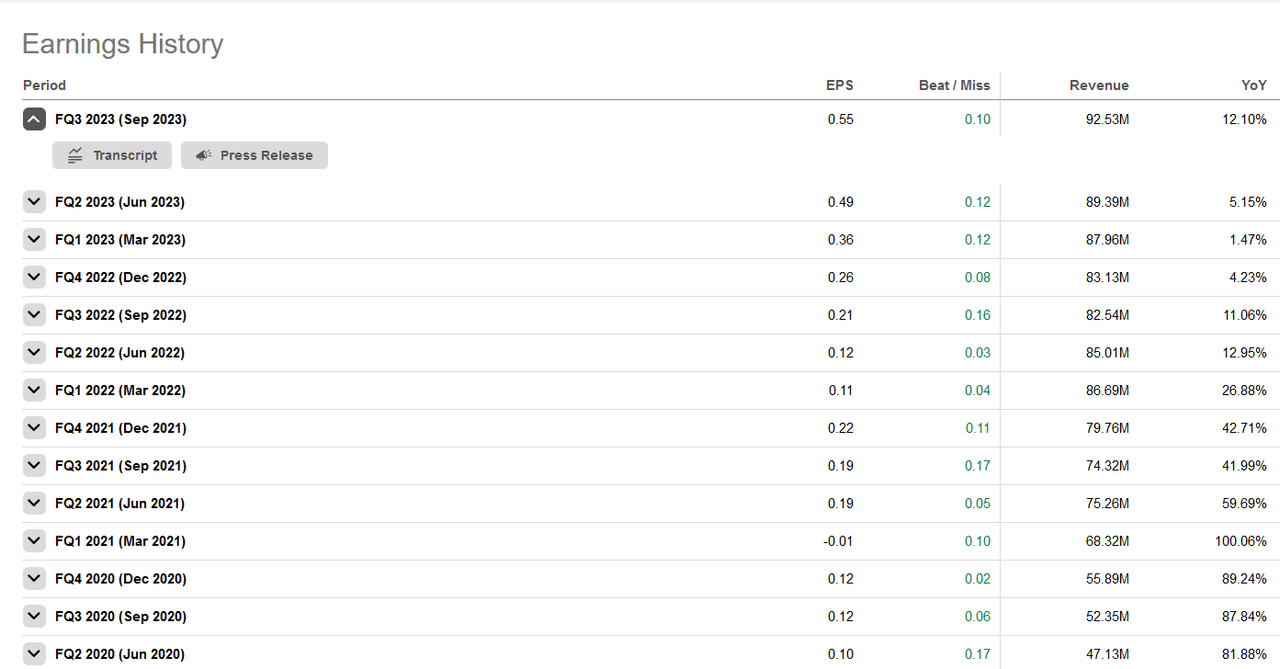

While many investors would be happy with such growth you can see from this earnings history that revenue growth has slowed compared to when the COVID-19 pandemic had Fiverr thriving:

Seeking Alpha

For the current quarter, Fiverr delivered revenues of roughly $93 million, which is a 12% increase compared to Q3 2022. Fiverr’s annual active buyers were at 4.2 million and spend per buyer was $271 which is a 4% year-over-year increase.

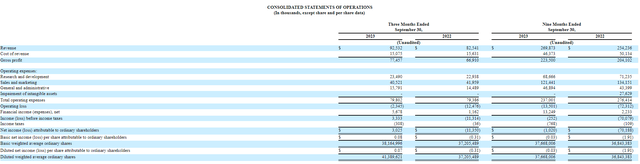

The company delivered a profitable quarter as well, as net income was roughly $3 million. Far better than the $11.3 million dollar loss compared to the prior year quarter as you can see below:

SEC.gov

I think its positive to see the company cut costs and deliver a profitable quarter. Also, you can see even for the 2023 9-month period the company is nearly profitable. Long gone are the days of low to zero interest rates when companies can focus purely on growth thus I think it’s smart Fiverr’s management team is striving to achieve GAAP profitability.

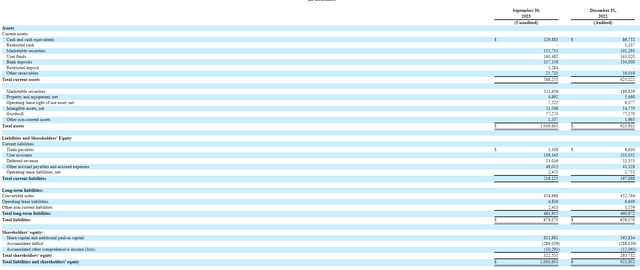

Fiverr has a decent balance sheet you can see below:

SEC.gov

The company’s cash balance has grown since December 2022 and the client’s current assets can clearly cover the firm’s current liabilities.

Risks

Fiverr faces numerous risks but today I’m going to discuss the two main concerns I have about the company.

First, I think competition in the gig marketplace is heating up. There are now companies such as Upwork, Toptal, PeoplePerHour, Freelancer, and numerous other companies now competing in this space. I do think Fiverr has a first mover advantage yet with more companies entering the gig company Fiverr must continue to execute or else buyers and sellers will go elsewhere.

Secondly, I think Fiverr can be impacted by macroeconomic conditions. When the economy is strong, I think Fiverr with do well as SMB business is thriving. Yet, if SMB business is struggling, I think that will impact Fiverr more than Upwork because they hire for longer term projects and these individuals have more professional experience. However, I do think Fiverr is working to correct this issue as Kaufman on the company’s Q3 2023 earnings call stated, “…We are investing in going upmarket and acquiring or entertaining customers who the macro environment impacts less.”

I’m inclined to believe the economy will continue to grow in 2024 and SMB businesses will do well. This SMB growth coupled with going upmarket I think will help Fiverr rebound from a subpar 2023.

Valuation

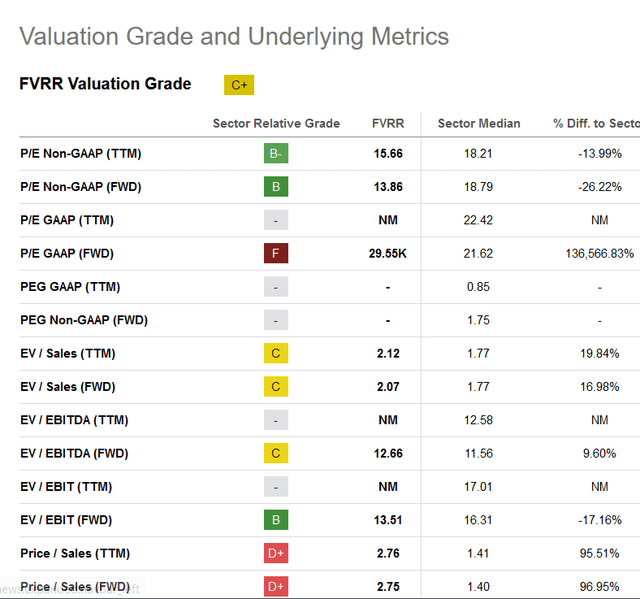

As you can see from the below valuation metrics from Seeking Alpha, the overall value grade for Fiverr is a “C+”:

Seeking Alpha

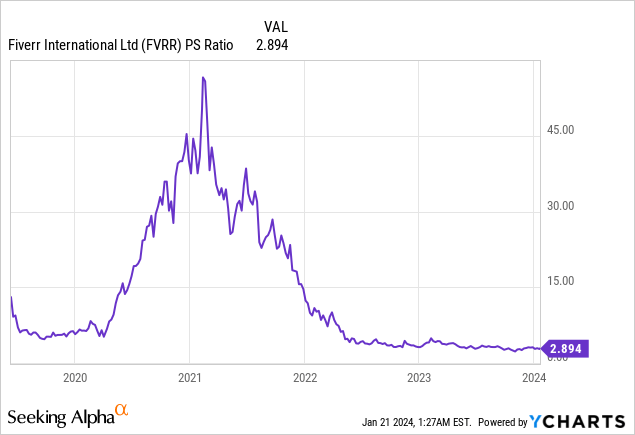

At this stage, I think Price to Sales is the more appropriate way to value Fiverr compared to Price to Earnings.

You can see above Price to Sales is 2.76 which is greater than the sector median however Fiverr is less expensive compared to rival Upwork and judging by this metric it’s at a very reasonable level now compared to prior years.

Given the company’s year-over-year revenue growth projections in the range of roughly 18% over the next three years, I think a reasonable price to sales ratio for Fiverr is 3.4 so I think if an investor wanted to initiate a position or add to an existing position this would be an excellent opportunity.

Conclusion

I can clearly see both the bull and bear arguments for Fiverr. Bears will state the company will never again reach those pandemic highs. The argument can be made AI will hurt the business and destroy many “gigs” within Fiverr’s marketplace. Lastly, you could conclude competition is heating up and Fiverr has lost its competitive advantage.

I’m of the opinion, Fiverr still has a dominant position in the gig economy and I believe the gig economy is growing and will continue to grow in the decade to come.

Fiverr has a founder-led CEO focusing on the long-term and maximizing shareholder value.

Fiverr is as reasonable as it has ever been from a valuation perspective and those looking for incredulous revenue growth rates are dreaming because an unpredictable Black Swan event created such rates in prior years.

Fiverr is a certainly risky stock but my vote is that as one of the dominant leaders in the gig economy, with a passionate and focused founder-led CEO, Fiverr will once again deliver returns and reward the patient long-term investors.