As a Actual Property Tax Strategist, I assessment 1000’s of tax returns yearly. All through my profession, I’ve detected a standard space for errors: depreciation.

Depreciation is a elementary software for actual property traders. Improperly reporting it in your tax sheets might result in paying 1000’s of {dollars} additional in taxes. That’s why on this article, I’m offering 5 vital gadgets you should assessment in your depreciation schedules to make sure you’re getting essentially the most out of your properties.

Reporting Depreciation

First, in case you have any revenue generated by a long-term rental property owned by you or by a single-member LLC, you should report it on Schedule E of Kind 1040.

All strange and essential bills associated to your property, together with depreciation, might be deducted.

However what’s depreciation, anyway?

Briefly, depreciation represents a rental property’s declining worth over time. We all know that actual property tends to understand, however depreciation nonetheless applies and truly helps us pay much less on our taxes. There are a number of depreciation strategies, but it surely’s essential to abide by what the IRS permits. The IRS prescribes an extended algorithm and rules on depreciating property, together with a typical helpful lifetime of 27.5 years for many residential rental properties.

Like I mentioned, depreciation is nice as a result of it offsets a few of the prices you incur all year long and lowers your tax foundation. That’s why reviewing these subsequent 5 matters are so essential!

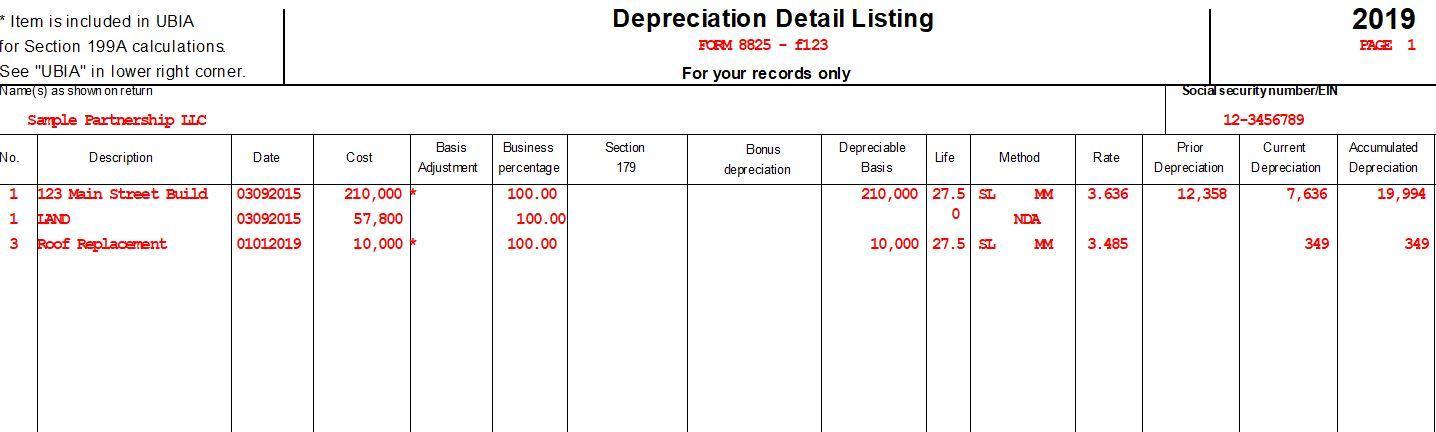

Earlier than we get began, right here’s a visible of what a depreciation schedule seems to be like:

5 Gadgets To Overview On Your Depreciation Schedule

1. Overview All Listed Totals

It appears apparent, however the very first thing you should do is verify the property’s complete depreciable worth. For essentially the most half, you’re simply ensuring the overall is lower than the acquisition value. Take into account that some prices akin to inspections, due diligence charges, and extra will likely be included in your depreciable foundation however the complete ought to by no means equal or quantity to greater than your buy value.

For example, if the depreciable worth equals $200,000 however your buy value totaled $150,000, you need to seek the advice of along with your tax skilled.

Errors over depreciable worth happen all the time, particularly when figuring out land values. Since land isn’t depreciable, the answer is to make use of a ratio towards the overall worth of the property, then multiply by the acquisition value for a decrease land worth that helps cut back the tax foundation. This is similar technique a county tax assessor makes use of.

However say, for instance, a tax preparer makes use of an precise land worth of $50,000 as a substitute of making use of a ratio. With the constructing included, the overall tax foundation equals $160,000.

The issue? The shopper paid $120,000 for the property. This error by accident gave the shopper an additional $40,000 on their foundation!

An terrible mistake like this may be prevented by merely being vigilant concerning the numbers posted in your depreciation schedule.

2. Make Positive Land Is Accounted For

To develop additional on the subject of land, it’s essential that your depreciation schedule accounts for it, regardless of it not being depreciable.

What do I imply?

When you paid $200,000 for a rental property and all $200,000 is listed because the depreciable quantity, one thing is flawed. You’re basically stating that you’re, in reality, depreciating the land, because the buy value is the same as the depreciable quantity.

You can not do that. As talked about earlier, you need to use the county tax assessors ratio to find out a correct land worth in depreciation.

Within the occasion you fail to do that and proceed to deduct depreciation year-over-year, you’ll be going through severe again pay when the error is discovered and corrected.

3. Make Positive Renovation Bills Are Damaged Down When Doable

When you had a significant renovation, look to see whether it is listed as a lump sum quantity on the depreciation schedule. When you spent $40,000 on a renovation that included $10,000 value of landscaping and $5,000 on new home equipment, there could also be a extra advantageous manner of reporting it.

A significant renovation is assumed to be a 27.5-year enchancment, the identical helpful lifetime of a rental. Nevertheless, there are some enhancements which were assigned shorter lives.

Landscaping, for instance, falls right into a class generally known as land enhancements, which have a lifetime of 15 years. Moreover, any property with a lifetime of lower than 20 years can probably be expensed within the first 12 months of possession utilizing bonus depreciation.

There are many potential financial savings with renovations. I extremely advocate having a dialog about it along with your tax skilled.

Watch out for errors, although.

For example, we as soon as had a shopper who was thought of an actual property skilled (which means they might deduct limitless rental losses). They’d been shopping for 2-3 new leases annually, finishing main renovations on every. Their prior depreciation schedule listed “$82,000 Renovations over 27.5-years” for each property. This resulted in a depreciation deduction of about $2,980 for the 12 months.

Nevertheless, once we broke down the parts of the renovations, there was quite a lot of depreciation left on the desk:

- $8,000 – Landscaping

- $6,200 – Home equipment

- $2,000 – New fencing

- Whole: $16,200 – Property with a lifetime of fewer than 20 years, qualifying for 12 months one bonus depreciation

- Whole worth: $63,800

With these numbers, the shopper might have taken a a lot bigger depreciation deduction of $18,520 for the 12 months.

4. If You’re Utilizing Delayed Financing Strategies, Make Positive Your Tax Execs Know

When you run a delayed financing technique the place you place your renovation prices into escrow once you buy, your tax skilled may very well be shorting you on depreciation. It is because many tax professionals don’t notice the construction of any such transaction. They’re probably taking the total renovation quantity and lumping it into the acquisition value, then allocating the overall quantity between land versus constructing.

That is incorrect. The allocation ought to solely apply to the acquisition value. The renovation quantity needs to be accounted for individually.

Let’s say a shopper’s prior CPA took the total quantity of their HUD property — the place they pay as you go renovation prices to permit for earlier refinancing through the BRRRR technique — as their buy value. The totals would present $30,000 for the acquisition value and $40,000 for the renovation escrow (ignoring miscellaneous closing prices).

Their preliminary depreciation was calculated as:

$70,000 Buy value * 82% constructing worth (per the tax assessor’s ratio) = $57,400 depreciable worth at 27.5 years for a deduction of $2,087 per 12 months.

Nevertheless, due to the technique the shopper used, the depreciation ought to have been:

$30,000 buy value * 82% constructing worth = $24,600 depreciable worth at 27.5 years for a deduction of $895 per 12 months and a $40,000 renovation worth (which might have probably been damaged down additional as we did earlier) at 27.5 years for a deduction of $1,454 per 12 months. That quantities to a complete annual depreciation deduction of $2,350 per 12 months.

It may not seem to be loads, however this shopper had practically ten properties that had been all depreciated utilizing the standard, however inappropriate technique for his or her technique. As you may see, it resulted in a misplaced depreciation deduction of near $4,000 per 12 months, which might proceed throughout a number of years.

The excellent news is that we had been capable of right it by using Kind 3115 and recoup the deduction.

5. Be Conscious Of Service Dates

Your rental is eligible for depreciation when it’s “in service”, which means prepared and accessible for hire.

Regular vacancies or spans of non-occupancy for renovation don’t take a property out of service. When you had been to purchase a rental with tenants in it, subject them a 60-day discover to vacate, then spend 90 days on a renovation, the property continues to be in service all through that point.

Overview the dates listed to your rental asset and any renovation dates. Many preparers will ask for an in-service date, however gained’t ask if the rental was occupied when first bought. They’ll simply make the most of the acquisition date.

That’s why it’s essential to notice if a property is bought vacant. When you purchase on January 1st however require a six-month renovation, the property gained’t be in service till the top of these six months.

Conclusion

With tax day shortly approaching, it’s essential to assessment depreciation ideas and be sure to’re on high of your submitting necessities.

Hopefully, this guidelines has served as a helpful information for you and your small business!