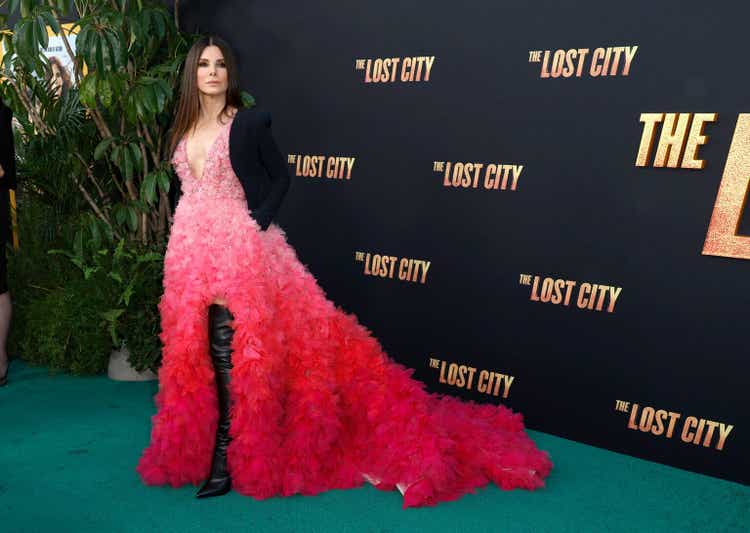

Folks stroll previous the headquarters of the Folks’s Financial institution of China (PBOC), the central financial institution, in Beijing, China September 28, 2018.

Jason Lee | Reuters

BEIJING — Scores company Fitch not expects China to chop its coverage price this yr, and has pushed again its expectations for a discount to subsequent yr because the U.S. Federal Reserve retains its rates of interest excessive.

Fitch now forecasts China will preserve its one-year medium-term lending facility (MLF) unchanged this yr at 2.5%, and lower it to 2.25% subsequent yr. In March, the scores company had forecast one lower for 2024.

“There are a few components behind this. First on the exterior facet, issues across the change price towards the U.S. greenback, due to altering expectations for the Fed, restrain the [People’s Bank of China],” Jeremy Zook, Fitch Scores’ head of sovereign ranking in Asia Pacific, mentioned throughout a presentation Wednesday.

Subsequent yr, “because the Fed begins to chop coverage charges we predict that ought to give a bit extra space for the PBOC to maneuver,” he mentioned. Zook expects Beijing to make higher use of fiscal coverage this yr.

The Fed final week held regular on its key rate of interest and indicated only one lower by the top of the yr. That contrasts with investor expectations heading into 2024 that the Fed would quickly ease financial coverage after aggressively mountaineering charges.

Tighter Fed coverage has stored the U.S. greenback robust towards the Chinese language yuan, which is near re-touching lows final seen in 2008, in response to Wind Data information. A weaker Chinese language foreign money will increase the stress of capital outflows.

“Additionally there do appear to be issues round financial institution internet curiosity margins being fairly low, and this additionally poses challenges for the PBOC,” Zook mentioned. Web curiosity margin (NIM) is a measure of financial institution profitability because it calculates the distinction between the curiosity the monetary establishment receives from debtors and the way a lot it should pay on deposits.

The final time China lower the one-year MLF was in August 2023, in response to official information accessed by Wind Data.

The Folks’s Financial institution of China units the MLF each month and makes use of it to information the benchmark mortgage prime price (LPR), which is the main reference for monetary establishments’ lending charges.

PBOC Governor Pan Gongsheng mentioned in a speech earlier on Wednesday that financial coverage would stay “supportive,” and famous the yuan’s change price has “remained mainly steady beneath advanced circumstances,” in response to a CNBC translation of the Chinese language transcript.

He famous that main developed economies have repeatedly postponed a shift of their financial coverage, and that “the rate of interest hole between China and the U.S. stays at a comparatively excessive stage.”