Our top story today looks at how profits at Goldman Sachs, Morgan Stanley and a clutch of other western banks in China fell sharply last year, as Covid-19 lockdowns and geopolitical tensions thwarted hopes that their operations in the country might finally start to be lucrative.

Credit Suisse, Deutsche Bank, Goldman Sachs and HSBC reported losses in their China-based units in 2022 and Morgan Stanley’s profits fell, figures published by the lenders and seen by the Financial Times show.

Among a group of seven Wall Street and European groups with investment banking units in mainland China, JPMorgan and UBS were the only banks whose profits rose, though HSBC’s unit lost less money than in previous years.

The western banks have spent years investing in small and often lossmaking operations in China in the hope that a foothold in the world’s second-largest economy would eventually prove profitable. But as relations between Washington and Beijing deteriorate, the figures show how difficult that bet has become.

Here are two other reads on China I recommend:

And here’s what else I’m watching today:

JPMorgan Chase: The Wall Street bank holds its investor day in New York.

Nato: The military alliance’s spring parliament session concludes with Ukraine defence minister Oleksii Reznikov due to speak.

EU-South Korea summit: European Commission president Ursula von der Leyen and European Council president Charles Michel meet South Korean president Yoon Suk Yeol to mark 60 years of diplomatic relations.

Results: Big Yellow, Ryanair, Wincanton and Zoom Communications report.

Who will win the US-China tech war? Join FT and Nikkei Asia journalists for a subscriber-exclusive webinar on May 25 and put your questions to the panel.

Five more top stories

1. Exclusive: Credit Suisse staff are preparing to sue the Swiss financial regulator Finma over $400mn of bonuses that were cancelled following the government-orchestrated takeover by UBS, which wiped out the bank’s additional tier 1 bonds. Thousands of senior bankers have a portion of their bonuses linked to the securities.

2. The chair of a UK parliamentary committee has backed calls for an audit into Teesworks, the flagship government-backed regeneration scheme overseen by the Conservative party’s most high-profile mayor, Ben Houchen, after an FT investigation raised concerns about the project. Read more from Labour MP Dame Meg Hillier’s letter to the FT.

More UK politics: The Labour party has urged Prime Minister Rishi Sunak to launch an ethics probe into claims that home secretary Suella Braverman asked civil servants to help her avoid penalty points on her driving licence for speeding.

3. Exclusive: The EU is planning more joint purchases of hydrogen and critical raw materials after its first attempt at aggregated gas purchases was oversubscribed. Demand from buyers matched more than 80 per cent of the bloc’s year-end target.

4. London’s Allen & Overy is planning to merge with New York’s Shearman & Sterling to form a law practice with combined revenues of about $3.4bn in one of the biggest transatlantic legal tie-ups in history. Read more about the “magic circle” firm’s bid to conquer the US market.

5. Volodymyr Zelenskyy upstaged the G7 summit and garnered support for Kyiv’s plans to end the war. The timing of the Ukrainian president’s arrival in Japan also presented a rare chance to ambush Brazil and India, which have both maintained ties with Moscow.

The Big Read

A class of chemicals known as PFAS (per- and polyfluoroalkyl substances) is critical to the production of everything from smartphones to firefighters’ suits — but especially to microchips. However, these “forever chemicals” so instrumental to chipmakers and the development of the world’s data-led economy also have the potential for significant health and environmental impacts.

We’re also reading . . .

Chart of the day

The Bank of England expects official figures on Wednesday to show a large drop in the headline inflation rate, which the central bank hopes will persuade companies to think twice before increasing prices or agreeing generous wage settlements.

Take a break from the news

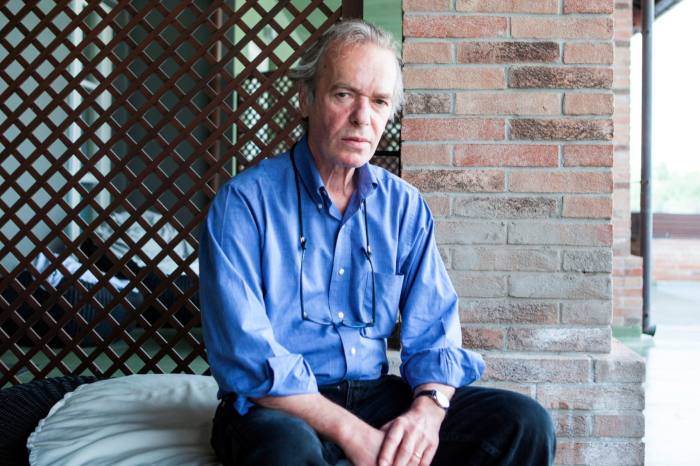

British author Martin Amis died aged 73 at his Florida home on Friday. Dubbed “the erstwhile Mick Jagger of British letters”, his best-known works satirised the excesses of Margaret Thatcher’s Britain and explored the crimes of Lenin and Stalin. Read the FT’s obituary of one of Britain’s most famous novelists.

Additional contributions by Vita Dadoo Lomeli

Recommended newsletters for you

Asset Management — Find out the inside story of the movers and shakers behind a multitrillion-dollar industry. Sign up here

The Week Ahead — Start every week with a preview of what’s on the agenda. Sign up here

![How to Buy Bitcoin Anonymously using Fiat [2022] | by Arpit Agarwal | The Capital | Nov, 2022 How to Buy Bitcoin Anonymously using Fiat [2022] | by Arpit Agarwal | The Capital | Nov, 2022](https://miro.medium.com/max/1080/1*qB-pYrpiJU9ae5sKtVGlUQ.png)