This article is an on-site version of our FirstFT newsletter. Sign up to our Asia, Europe/Africa or Americas edition to get it sent straight to your inbox every weekday morning

Today’s big scoop is on PwC, which is racing to contain the fallout from emails released by an Australian senate committee showing it had used confidential information received while working with the government to advise corporate clients on new anti-tax-avoidance rules.

The Big Four firm has flown some of its top executives, including global general counsel Diana Weiss and global head of tax Carol Stubbings, to Sydney, according to a person close to the firm with knowledge of the details.

Australian politicians have called for the partners who received the emails, as well as the clients that benefited from the information, to be named. The firm is preparing to contact the affected clients given the likelihood that the names will be released in the coming weeks.

The company is trying to understand the full extent of the involvement of partners outside Australia and whether there was a wider cultural problem at the firm, two people familiar with the situation said. Global chair Bob Moritz said the firm would support partners whose clients were affected, according to an internal note seen by the Financial Times.

And here’s what I’m keeping tabs on in the days ahead:

Economic data: The UK has flash gross domestic product figures for the first quarter today, while France releases its consumer price index for last month.

Biden hosts Sánchez: Spanish prime minister Pedro Sánchez meets the US president at the White House today, with Ukraine and defence on the agenda.

Results: Allianz, Norwegian Air, Richemont and Société Générale report today.

Elections: Turkey and Thailand hold general elections on Sunday, while Albania and Italy have local polls.

How do you think the scandal will affect PwC’s global reputation? Let us know at [email protected].

Five more top stories

1. Exclusive: The EU’s chief diplomat has warned that China will “take geopolitical advantage” of a Russian defeat in Ukraine and that Brussels needs to respond to Beijing’s ambitions to build a new world order. Read more from Josep Borrell’s private letter to EU foreign ministers.

2. Exclusive: UBS has prioritised integrating Credit Suisse’s investment bank and cutting costs, while a decision on the future of its Swiss domestic business is expected within months, according to people involved in the planning. Read more details on how the takeover is going.

3. Exclusive: Schroders has criticised Silver Lake’s planned €2.6bn takeover offer of Software AG, saying the deal “materially undervalues the company”. The London-based asset manager is the German corporate software group’s largest outside shareholder. Read the full story.

4. The US and China have held talks to try to stabilise relations between the countries, with US national security adviser Jake Sullivan meeting China’s top diplomat Wang Yi in Vienna. The White House called the discussions “candid, substantive and constructive”.

5. Elon Musk has hired a new Twitter chief executive. While the billionaire did not name his successor, he said that she would start in about six weeks.

How well did you keep up with the news this week? Take our quiz.

The Big Read

Germany is throwing billions of euros in subsidies at tech companies in a bid to boost the country’s semiconductor industry. While there have been massive investments by the likes of Intel and Infineon, the level of state support is beginning to reach levels that even chip investment advocates find excessive.

We’re also reading . . .

Chart of the day

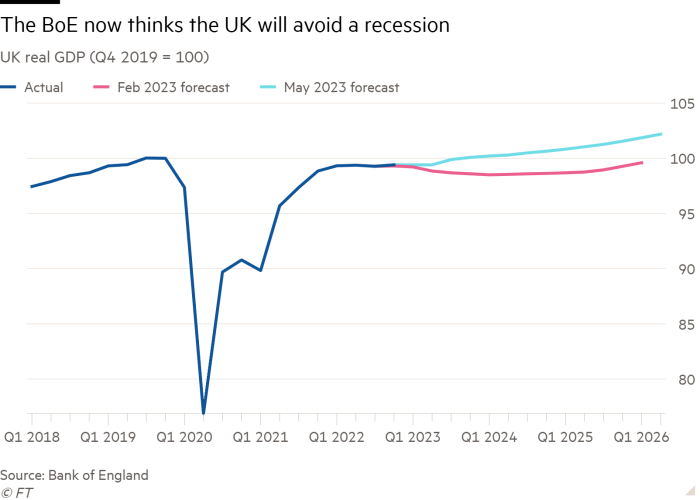

The Bank of England yesterday raised interest rates to their highest level in almost 15 years. In its latest assessment of the UK economic outlook, the central bank also dropped its previous prediction of a recession but accepted it had underestimated food price rises in its previous forecasts.

Take a break from the news

From a nine-litre watering can to an Hermès yak wool blanket, here are 32 must-have things from this weekend’s HTSI guest editor Kate Moss.

Additional contributions by Gordon Smith and Emily Goldberg

Recommended newsletters for you

Asset Management — Find out the inside story of the movers and shakers behind a multitrillion-dollar industry. Sign up here

The Week Ahead — Start every week with a preview of what’s on the agenda. Sign up here

Thank you for reading and remember you can add FirstFT to myFT. You can also elect to receive a FirstFT push notification every morning on the app. Send your recommendations and feedback to [email protected]