Receive free World updates

We’ll send you a myFT Daily Digest email rounding up the latest World news every morning.

Private equity fund managers are borrowing against asset portfolios to return cash to investors as they struggle to exit investments, adding another layer of debt to the loans financing their corporate buyouts.

Firms are increasingly resorting to the technique, called net asset value financing, because rising debt costs and concern over the economy are making it difficult for them to sell or list the companies they own.

Texas-based Vista Equity Partners and Sweden’s Nordic Capital have used NAV financing this year, while groups such as Carlyle, Hg Capital and SoftBank have previously turned to the mechanism to return cash to investors.

NAV financing is perceived as less risky than lending to a single company. It is also cheaper for the borrower, according to private equity executives.

But some analysts have voiced concerns that such borrowing heaps extra debt on buyout portfolio companies that are already grappling with higher borrowing costs and a weakening economic outlook.

Here’s what else I’m keeping tabs on today:

Economic data: Canada reports its consumer price index and the US releases retails sales and industrial production figures, both for last month.

Results: Earnings season picks up with some of the biggest US banks, including Bank of America, BNY Mellon, Charles Schwab, Morgan Stanley and PNC Financial Services reporting. Arbuthnot, Lockheed Martin, Novartis, Ocado, Prologis and Swedbank also report. Rio Tinto and Wise have trading updates.

Five more top stories

1. Large fund managers such as Fidelity and BlackRock are being blocked from buying more shares in popular stocks due to regulations that state “diversified” funds cannot put more than 25 per cent of their assets into large holdings. The limit is another unexpected result of the recent lopsided stock rally powered by just a handful of tech giants.

2. Italy’s Ermenegildo Zegna Group has poached LVMH executive Lelio Gavazza to run Tom Ford Fashion as the Milan-based group plans to expand its recently acquired brand in Europe and Asia. Gavazza, who oversaw sales and retail at jeweller Bulgari, will start his new role in September.

3. The EU, the US, Australia, Japan and South Korea have agreed to tighten monitoring of methane emissions by setting up a real-time database on such pollution from individual liquefied natural gas projects. Here’s more on the public-private initiative that hopes to combat global warming.

4. Exclusive: Thames Water’s biggest investor slashed the value of its stake last year. The Ontario Municipal Employees Retirement System, one of Canada’s biggest public sector pension funds, owns a 31 per cent stake, held through multiple vehicles including a Singapore-registered entity that cut its stake by nearly 30 per cent. Here’s why this could spell further trouble for the beleaguered UK utility.

5. Rolls-Royce is in a “good position” to build reactors for small nuclear power plants in the UK, according to Britain’s energy secretary, who is launching an international competition for the work today. Grant Shapps said the technology would help the country hit its target of producing 25 per cent of its electricity from nuclear by 2050, up from about 15 per cent currently. Read his full interview with the Financial Times.

More energy: Europe could face a gas crisis if Russia cuts remaining supplies and the continent experiences a cold winter, the International Energy Agency has warned.

The Big Read

In a country that seems to be struggling to keep up with its peers on everything from productivity to healthcare outcomes, Britain’s universities are punching above their weight. But alarm bells are sounding about the wider sector’s financial sustainability. Tuition fees are not keeping up with the rising costs of the country’s world-class higher education sector, prompting calls for a radical rethink.

We’re also reading . . .

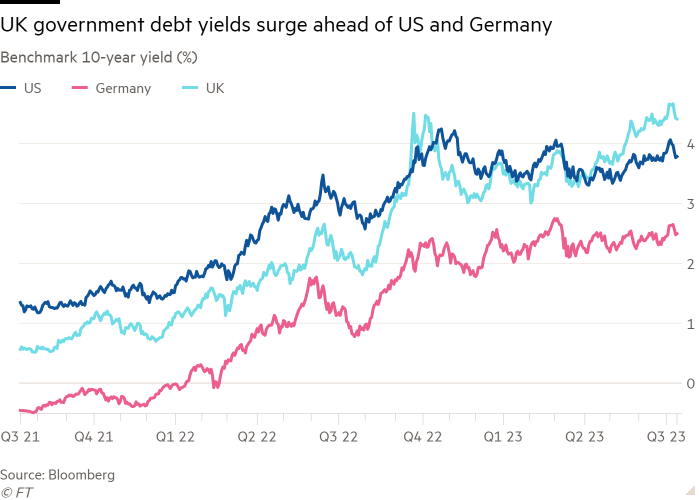

Chart of the day

An outsized inflation problem is pushing UK borrowing costs well above those of other big economies, piling further pressure on the government’s finances as it attempts to find buyers for record quantities of gilts. Despite Britain now offering some of the highest yields in the developed world, some big investors are not biting, fearing that even higher yields lie ahead.

Take a break from the news

Who is the all-time greatest chess player? An eye-catching run of success from Magnus Carlsen, the world No. 1, has revived the longstanding debate. Tell us what you think, and while you’re here, take a stab at this week’s chess puzzle below: white mates the king in three moves.

Additional contributions by Benjamin Wilhelm and Gordon Smith

Recommended newsletters for you

Asset Management — Find out the inside story of the movers and shakers behind a multitrillion-dollar industry. Sign up here

The Week Ahead — Start every week with a preview of what’s on the agenda. Sign up here