dusanpetkovic/iStock via Getty Images

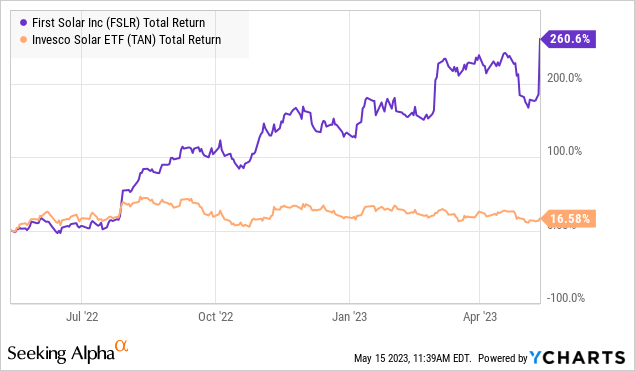

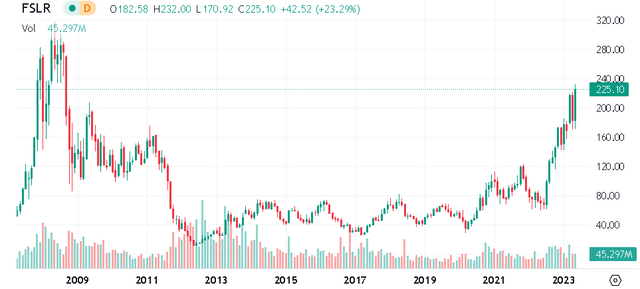

First Solar, Inc. (NASDAQ:FSLR) has quietly emerged as one of the best performers in the S&P 500 (SPX) for 2023 with shares up nearly 50%. The company is benefiting from a strong growth outlook for the solar industry with its expanding photovoltaic module manufacturing capacity expected to drive earnings momentum going forward.

We covered the stock last year, citing the clean-energy-focused Inflation Reduction Act (IRA) as a game-changer, highlighting several advantages for First Solar as the largest U.S. producer, well-positioned to consolidate its market leadership.

Our update today notes that the just-released guidance to qualify for full tax credits on renewable projects and solar developments have reinforced the bullish case for the stock, removing one layer of uncertainty. Even recognizing what has already been a spectacular rally in the stock over the past year, we see room for shares to climb even higher.

U.S. Solar Projects Domestic Content

The U.S. Treasury Department finalized key details that had been missing from the original provisions of the IRA. Specifically, the solar industry had been waiting on clarity for what qualifies as “domestic content” in terms of the composition of manufactured products made in the U.S.A eligible for the full tax credit.

The announced rules suggest that 40% of the components that go into products like solar modules and inverters be American-made while offering the flexibility to incorporate foreign inputs as long as the combined costs stay within the 40% threshold. The biggest implication here is that solar projects can claim the domestic content credit bonus even if the modules assembled in the U.S. are made with Chinese materials.

This resolution is seen as something of a compromise between solar project developers that favor cheap import options, against U.S. manufacturers like First Solar that likely would have preferred more stringent rules to drive out competition.

Still, our take is that this apparent regulatory middle-ground ends up being a net positive for First Solar because it maintains some advantage for the company’s U.S. operation, while also opening the door for stronger growth in the industry overall.

By this measure, First Solar gains as its customer base across utilities, distributors, and developers move forward with new projects given the higher degree of sourcing flexibility. Simply put, FSLR stands to capture a larger slice of the solar industry pie where the growth outlook for the next decade has just received a new boost.

IRA Still A Big Growth Driver For Solar

To recap, within the $369 billion allocated for “Energy Security and Climate Change” investments in the IRA over the next decade, upwards of $40 billion is directly targeted as subsidies for manufacturing facilities and through production tax credits of clean energy products that include solar panels along with wind turbines, batteries, and electric vehicles.

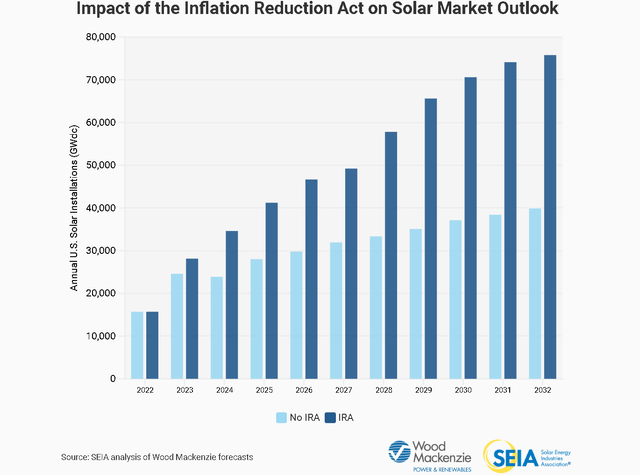

According to the Solar Energy Industries Association (SEIA), the impact of the IRA on the U.S. solar market is significant. Over the next ten years, the IRA is expected to drive an additional 222 GW of solar installations than if the legislation had not gone through. By 2032, the U.S. is forecast to have 5x more installed solar capacity than at the end of 2022.

source: SEIA

FSLR is a Solar IRA Winner

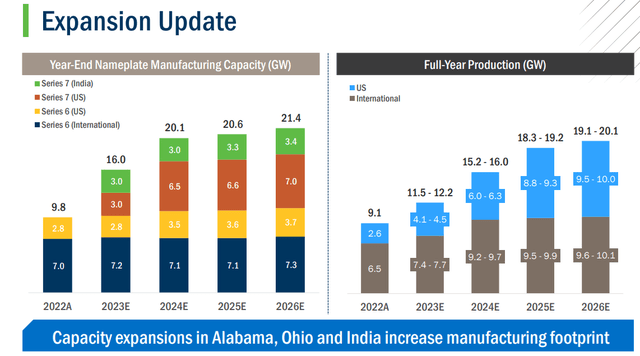

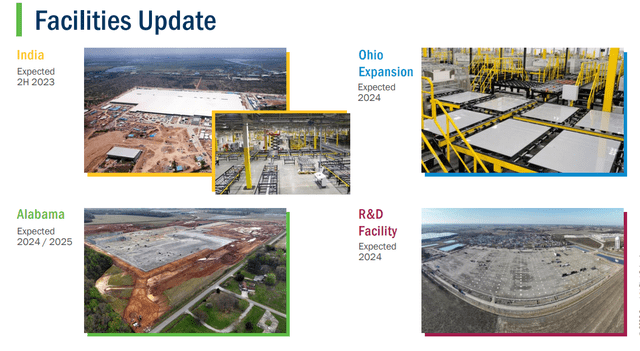

In our view, FSLR remains one of the largest beneficiaries of the IRA subsidies considering it already has an established U.S. manufacturing presence while other companies are only now considering such investments. From 9.1 GW of module production in 2022, FSLR management is guiding for that figure to more than double by 2025 across its U.S. and International footprint.

source: company IR

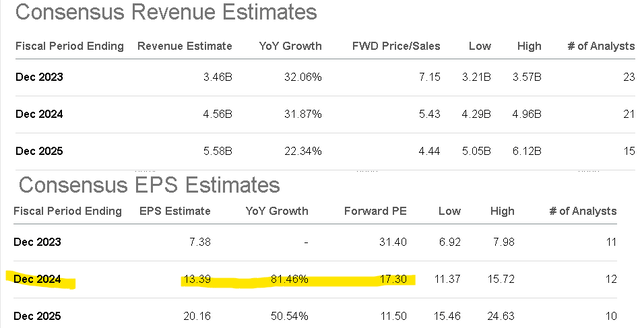

Naturally, the higher production targets translate into higher revenues. From the consensus estimates, FSLR is expected to average top-line growth averaging nearly 30% through 2025.

The other dynamic at play is the climbing earnings estimates. The forecast is for FSLR’s EPS to reach $7.38 this year, reversing a loss in 2022. That figure is then expected to nearly triple to $20.16 by fiscal 2025, with margins expanding not just from the related tax credits but also the improved cost efficiency of the next generation series 7 nameplate rollout.

Seeking Alpha

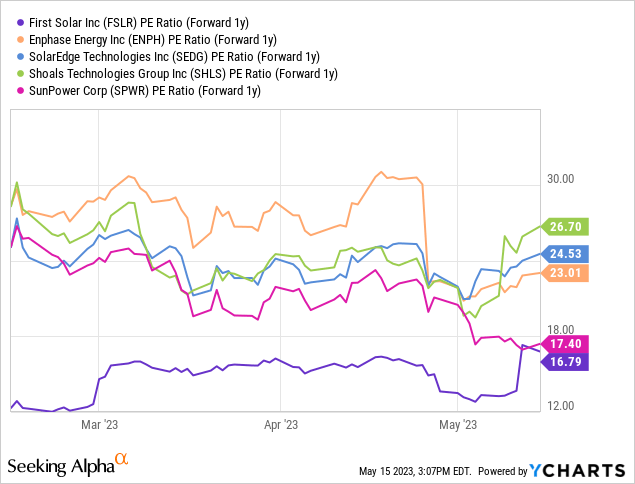

As it relates to valuation, the metric we’re focusing on is FSLR’s 1-year forward P/E currently at 17x, based on the consensus EPS estimate of $13.39 for 2024. Even with the current earnings multiple for 2023 at 31x appearing relatively pricey, we see more value looking ahead where that production capacity ramps up driving scale benefits and margins higher.

In our view, FSLR remains attractively priced considering shares are at a discount relative to industry peers like Enphase Energy, Inc. (ENPH), SolarEdge Technologies, Inc. (SEDG), and Shoals Technologies Group, Inc. (SHLS) trading at an average 1-year forward P/E closer to 25x.

Recognizing that the solar panel segment of the industry is more “commoditized” compared to more high-tech energy management solutions from names like ENPH; the bullish case for FSLR is that there is room for these spreads to converge higher. FSLR deserves a higher premium given its unique position as a U.S.-based PV module manufacturer.

What’s Next for FSLR

As we mentioned, shares of FSLR have repriced materially higher over the past year based on this expected IRA growth runway. At the same time, these developments, including the domestic content subsidy details, are incremental to the company’s organic growth momentum.

Beyond the Ohio factory expansion and separate site in Alabama, a new facility in India is expected to be completed in the second half of this year and represents the immediate growth catalyst.

This follows what was a softer-than-expected last reported Q1 earnings, where even as sales climbed by 49% year-over-year, EPS of $0.40 missed expectations. Management explained some of the quarterly volatility in the timing of orders while projecting optimism for the rest of the year.

The company reiterated full-year earnings guidance, targeting sales around $3.5 billion, and EPS between $7.00 and $8.00, consistent with the current consensus estimates.

source: company IR

FSLR Stock Price Forecast

We rate FSLR as a buy with a price target for the year ahead at $300 representing a 22.5x multiple on the consensus EPS for 2024. The way we see it playing out is that an improved cadence of bookings over the next few quarters given the new domestic content tax rule clarity should work to push earnings estimates higher.

We don’t place too much weight on chart analysis over an entire decade, but it’s worth noting that FSLR is currently trading at its highest level since 2008. The ongoing multi-year growth story could be enough to ultimately drive shares to a new all-time high.

On the downside, the macro backdrop is one question mark. Evidence that the global economy is sputtering into a deeper recession would undermine the earnings trajectory. Monitoring points into Q2 include the gross margin and volumes sold as a reflection of management’s strategy execution.

Seeking Alpha