Anne Czichos

First Republic (NYSE:FRC) cratered 50% on Tuesday as panic filled the company’s earnings report. The company’s market capitalization was pushed to $1.5 billion, from a peak of $30 billion, as even the legendary bank for the rich couldn’t handle the mid-March run on the bank. As we’ll see throughout this article, despite the company’s recent stability, its time has come.

The Run

The first question is how big was the run. Investors had been waiting a while, and with First Republic’s earnings, they got their answer.

First Republic Bank Press Release

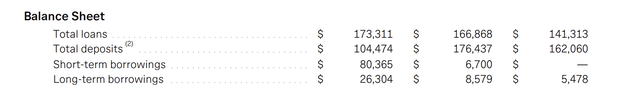

The company’s balance sheet showed total deposits of $104.5 billion. That’s down from $176.5 billion a quarter ago, and $162 billion a year ago. However, a bigger takeaway was the company’s $104.5 billion in remaining deposits included $30 billion in rescue from the big banks. The initial term of the loan was 120 days and it could stay in place longer.

That means the true collapse from the company’s deposits was from $176.5 billion to $74.5 billion. That was combined with a drop in non-interest paying deposits, non-interest bearing checking deposits dropped by $40 billion or 70%. That means the remaining assets that the company has have a much higher yield.

Fed Dollars To The Rescue

In the short-term, the company has been supported by the Fed loan program.

First Republic Bank Press Release

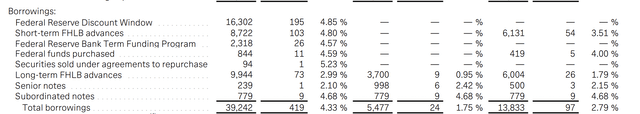

The company now has more than $80 billion in short-term borrowings and $25.5 billion in long-term FHLB advances. For the quarter, the company’s average was $40 billion and for the prior quarter, the company was at $14 billion. That shows how much the company’s federal borrowing ramped up at the end of the quarter.

First Republic Bank Press Release

Unfortunately, that borrowing comes at a much higher interest rate. The company’s $40 billion in total borrowings came at a 4.33% rate. The rate on the Fed borrowings is closer to 5% clocking in at 4.85% for the federal reserve discount window. The true company’s borrowings are almost $110 billion and the average interest rate for that is ~4.8%.

That means the company now has more than $5 billion in annualized interest obligations. It’s worth noting that this doesn’t count for another $2.5 billion in interest payments the company has on deposits?

The True Income

So what’s the problem for First Republic bank?

First Republic Bank Press Release

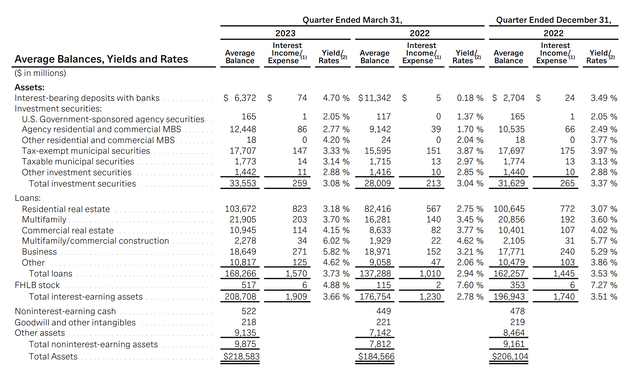

The problem is the different between the company’s borrowings / assets and its loans. The company has $168 billion in loans paying roughly 3.66% or $6.5 billion per year. As we discussed above, the company’s interest expenditures are at least more than $1 billion above that. That means that the company is losing money from its business operations.

That also doesn’t include all of the company’s base costs (i.e. employees, operations, etc.). These costs cost the company roughly $3.5 billion per year, although the company is working to get them down. however, the company is still losing $4 billion / year. That’s a massive loss for a company with a $1.5 billion market cap, it means equity raises are off the table.

So what does the company have. Well it still has positive book value of $77 / share for its almost 200 million shares (roughly $14 billion). That will erode quickly but it is currently almost 10x its share price. That means the company can handle 2-3 years of this, perhaps closer to 2 years with no emergency withdrawals if it loses the $30 billion in large bank deposits.

Our View

However, First Republic will likely not be allowed to sit and let book value decay.

The first reason is the company has a substantial amount of non-FDIC insured deposits. The second is that as the company’s position becomes shakier, there’s a higher chance of another run on the bank. While the company’s earnings indicate the run has stopped, we think it’s most recent earnings report could trigger another.

It’s worth highlighting how big the run was for the company. In a week the company went from $170 billion in assets to roughly $70 billion. Another run could easily cut that in half of more, effectively turning the company into a holding company that borrows federal reserve dollars and uses them to cover its loans.

Without a “rescue” i.e. a substantial amount of cheap long-term loans, we see the company as effectively being dead in the water.

Thesis Risk

There are three ways for First Republic to survive in our view.

The first is if interest rates drop dramatically. That’ll let the company take advantage of Fed borrowing and still earn a net positive interest. Of course with inflation remaining high, the Fed seems committed to keeping interest rates higher for longer. However, a recession could quickly lead to a drop in rates helping the company.

The second is if the company gets deposits back. It continues to have a strong asset management business and a strong reputation. Should the company be able to grow and recover low-interest deposits, potentially through a Fed backstop program for deposits and insurance, that could enable the company to tone down Fed borrowing and recover its business.

The last is a sort of special low-interest recovery program for the company. The lending by other banks is an example. It’d have to last long enough for at least a substantial portion of the company’s loans to mature, or be sold near PAR, enabling the company to restructure itself as a much smaller but alive bank.

We see these three scenarios as relatively unlikely.

Conclusion

First Republic might have seen the run on its bank stop, however, the company is in an incredibly difficult position. Our view is that the company is effectively, in bankruptcy. It’s losing billions of dollars, or several times its market capitalization on an annualized basis. It’s long-term loans now total several times its actual deposits.

Without a long-term source of low-interest cash, whether support from the government/other banks, or a rapid increase in deposits, we see the company as dead in the water. We expect common equity holders to be wiped out by a restructuring similar to Silicon Valley Bank. Let us know your thoughts in the comments below.