gchapel/iStock by way of Getty Photographs

We’re nearing the tip of the This autumn Earnings Season for the Silver Miners Index (SIL) and one of many final corporations to report its outcomes is First Majestic Silver (NYSE:AG). General, the corporate had a strong yr from a manufacturing and gross sales standpoint, reporting a 32% development in annual silver-equivalent ounce [SEO] manufacturing and a greater than 60% enhance in income. If forward to FY2022, this development is about to proceed. Nevertheless, whereas First Majestic has one of many highest projected earnings development charges, a lot of this seems to be priced into the inventory, with AG buying and selling at greater than 33x FY2023 earnings estimates.

First Majestic Silver Operations (Firm Presentation)

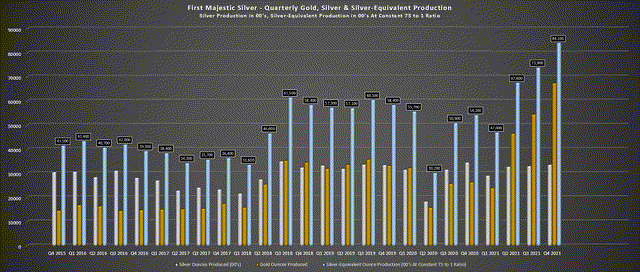

First Majestic Silver launched its This autumn and FY2021 outcomes final week, reporting quarterly manufacturing of ~3.36 million ounces of silver and ~67,400 ounces of gold. This marked the corporate’s highest gold manufacturing on document, helped by elevated gold manufacturing from Ermitano, an enormous quarter from San Dimas, and a big contribution from the corporate’s new Jerritt Canyon Mine in Nevada (~23,700 ounces). The strong end helped to push annual gold manufacturing to ~192,000 ounces, a greater than 40% enhance from pre-COVID-19 ranges (FY2019). Let’s take a more in-depth look beneath:

First Majestic Silver – Quarterly Manufacturing (Firm Filings, Creator’s Chart)

As proven above, First Majestic completed the yr robust, and 2021 was a yr of a number of information. Along with document gold manufacturing in This autumn and FY2021, silver-equivalent manufacturing hit a brand new document of ~8.4 million SEOs (75 to 1 ratio) in This autumn and almost 27 million SEOs for the yr. The key contributor to the rise in manufacturing was Jerritt Canyon, which contributed almost 69,000 ounces final yr. Nevertheless, the energy was broad-based and will proceed in FY2022, with San Dimas having a strong yr (~13.5 million SEOs) and Ermitano now in manufacturing (Santa Elena), which contributes to greater manufacturing at decrease prices.

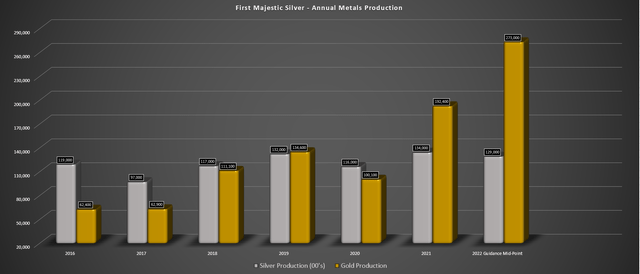

First Majestic Silver – Annual Manufacturing & Ahead Steering (Firm Filings, Creator’s Chart)

If we have a look at First Majestic’s annual manufacturing, we are able to see that silver manufacturing was up 15% year-over-year however missed steerage at ~12.8 million ounces vs. a ~13.4 million-ounce steerage mid-point. The excellent news was that gold manufacturing greater than made up for this, coming in at ~188,000 ounces, up 88% year-over-year. As famous beforehand, this development was not solely natural, provided that Jerritt Canyon contributed greater than 60% of this development, which value the corporate greater than 20% share dilution. Nevertheless, we didn’t see a full contribution from Jerritt Canyon in 2021 (April 2021 deal shut), which is one cause why important development is on deck in FY2022.

Based mostly on First Majestic’s present steerage, the corporate expects to extend gold manufacturing by greater than 45% year-over-year to ~273,000 ounces if it meets its steerage mid-point, whereas silver manufacturing will dip barely. Mixed with the latest energy in gold costs, that is anticipated to translate to important income development and significant development in annual EPS. Nevertheless, it is vital to notice that even in FY2022, with guided manufacturing of ~122,000 ounces at Jerritt Canyon, the Nevada operation will likely be working at nowhere close to its full potential.

As mentioned in earlier updates, Jerritt Canyon could seem like an unsightly duckling primarily based on present operations, with all-in sustaining prices coming in at $2,077/ozin This autumn and prices anticipated to return in above $1,500/ozin FY2022. Nevertheless, it is vital to level out that the corporate spent closely in H2 2022, with a $10.4 million TSF elevate and roaster upgrades. Nonetheless, even in FY2022, the operation will likely be working nicely beneath its full processing capability of 4,000 tonnes per day, a determine that’s 60% above the present charge.

Jerritt Canyon Operation (Firm Presentation)

Assuming the corporate can make the most of this extra processing capability both by means of greater mining charges or utilizing third-party ore, we should always see prices enhance considerably on the asset. The corporate can also be methods to enhance metallurgical recoveries, an space the place the corporate has seen success at its Mexican operations prior to now (high-pressure grinding mills). There isn’t any query that the prices on the operation will nonetheless be excessive. Nonetheless, I do not see any worth in judging Jerritt Canyon primarily based on its This autumn 2021 or H2 2021 outcomes, provided that capital spend was lumpy, and the mine was working nicely beneath its true potential.

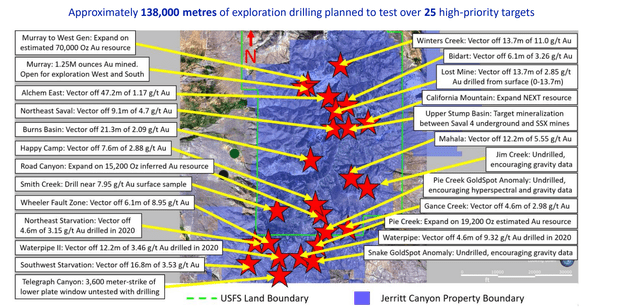

Jerritt Canyon – Exploration Targets (Firm Presentation)

Clearly, these enhancements could not come to fruition, and it is a threat that traders should be comfy with by investing in First Majestic. Nevertheless, with a large land bundle (30,000+ hectares), an organization that has the capital to spend aggressively on exploration on a beforehand uncared for asset, and lowered haulage prices (SSX/Smith Connection), traders must be extra open-minded about this asset, and the potential for 190,000+ ounces each year by 2024. To summarize, although Jerritt Canyon is dragging up First Majestic’s prices for now and looking out like a questionable acquisition to some, I’m assured within the crew turning across the asset and having fun with extra respectable margins.

Monetary Outcomes

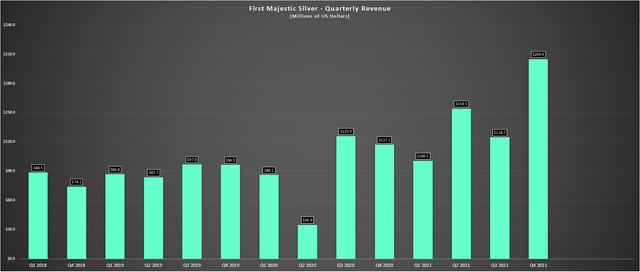

Transferring over to the monetary outcomes, First Majestic loved one of many highest (if not the best) income development charges sector-wide in This autumn, with income up 61% to a brand new document of $204.9 million. This was helped by the drawdown of withheld stock (~1.4 million ounces), greater silver costs, and elevated ounces offered from Jerritt Canyon (no contribution final yr). Regardless of the apparent advantages to manufacturing from incremental Nevada ounces and promoting off withheld stock, this was nonetheless a really spectacular quarter and helped push annual income to a brand new document of ~$584 million.

First Majestic Silver – Quarterly Income (Firm Filings, Creator’s Chart)

Sadly, whereas income was up sharply, margins and earnings per share declined sharply. The previous was associated to greater prices at Jerritt Canyon and the latter was partially associated to a a lot greater share depend (share dilution from Jerritt Canyon Mine acquisition). Nevertheless, it’s price noting that ex-Jerritt Canyon prices got here in at very affordable ranges, with AISC of $11.29/ozat San Dimas and $14.02/ozat Santa Elena. The decrease prices at Santa Elena have been pushed by elevated manufacturing now that Ermitano is on-line, and the operation benefited from no silver stream relevant to Sandstorm Gold (SAND).

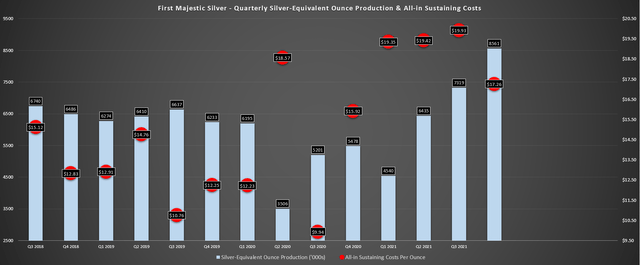

First Majestic Silver – Manufacturing & All-in Sustaining Prices (Firm Filings, Creator’s Chart)

Based mostly on FY2022 steerage, First Majestic ought to see a slight enchancment in prices on a year-over-year foundation, with the AISC steerage mid-point sitting at $17.42/oz. This may be a 7% decline year-over-year from $18.84/ozin FY2021, making First Majestic one of many few producers seeing declining prices year-over-year. Clearly, First Majestic’s prices are nonetheless nicely above the sector common with AISC margins of ~30%, making the corporate extra delicate to metals costs than its friends. Nevertheless, as mentioned above, if the corporate can ship at Jerritt Canyon and attain its aim of 200,000 ounces each year, we should always see this anchor that is weighing down margins be much less of an influence by 2024/2025.

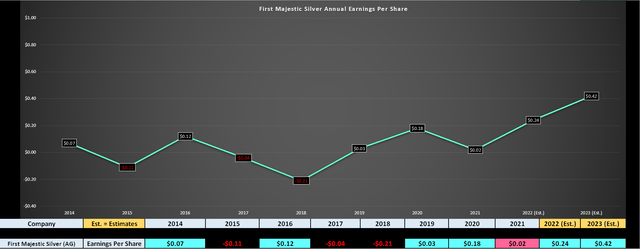

First Majestic Silver – Annual Earnings Per Share & Ahead Estimates (FactSet.com, Creator’s Chart)

Lastly, annual EPS, the headline quantity was actually not fairly, with annual EPS declining massively from $0.18 to $0.02, whereas free money circulate got here in at unfavorable $16.9 million (FY2020: $30.7 million). The excellent news is that we should always see an improved free money circulate profile this yr, assuming metals costs can stay at present ranges, and annual EPS ought to utterly recuperate primarily based on present estimates of $0.25. If we look forward to FY2023 and assume an additional enchancment in metals costs, annual EPS may greater than double vs. FY2020 ranges, pushed by greater margins and considerably greater manufacturing.

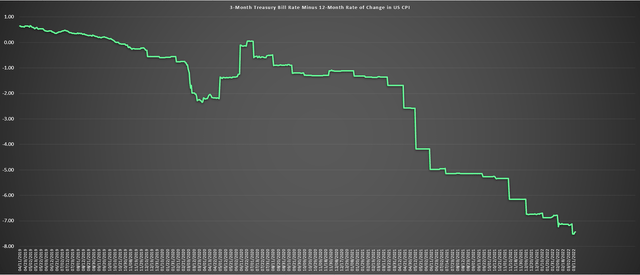

Unfavourable Actual Charges (YCharts.com, Creator’s Chart)

The important thing will likely be if metals costs can proceed their climb, however because it stands, First Majestic has among the finest earnings development charges sector-wide and is on monitor for an earnings breakout this yr (new multi-year excessive in annual EPS). Given the place of actual charges (deep in unfavorable territory) and that treasured metals are due for some outperformance vs. the main market averages, these earnings estimates look achievable, assuming the corporate can develop manufacturing nearer to 40 million SEOs in FY2023. Let’s check out the valuation:

Valuation

Sadly, whereas First Majestic ranks very excessive on development, it ranks poorly on worth. It is because First Majestic has a market cap of ~$3.81 billion at a share worth of $14.30 (~266 million totally diluted shares). This determine dwarfs my estimate of the corporate’s mixed Challenge After-Tax NPV (5%) of ~$1.0 billion. It is price noting that this doesn’t embrace any potential impacts from the tax dispute with the Servicio de Administracion Tributaria [SAT], the income service of the Mexican Authorities. Therefore, even with out factoring in any potential unfavorable impacts from this dispute, the inventory trades at over 3x P/NAV. For these unfamiliar, the SAT has issued reassessments of ~$260 million.

If we examine this valuation with extra diversified treasured metals producers like Agnico Eagle (AEM) and Newmont (NEM), First Majestic trades at a large premium to the trade group. That is though Agnico Eagle (~1.1x P/NAV) and Newmont (~1.3x P/NAV) have extra engaging jurisdictional profiles (60% or extra of manufacturing from Tier-1 jurisdictions) and extra engaging margin profiles. So, from solely a valuation standpoint, it is troublesome to justify paying up for First Majestic at present costs.

From a price-to-earnings standpoint, the valuation would not stack up nicely both, with First Majestic buying and selling at roughly 31x FY2023 earnings estimates ($0.42) vs. friends like Newmont at ~22x earnings and Agnico Eagle at ~20x earnings. So, regardless of the way you slice it, First Majestic seems to be like a case of development at an unreasonable worth. Some traders will argue that First Majestic instructions a premium provided that silver sometimes outperforms gold in bull markets. Whereas it is a honest level, I do not see any option to justify paying a 50% premium to web asset worth for any miner, not to mention greater than 3.0x P/NAV for First Majestic.

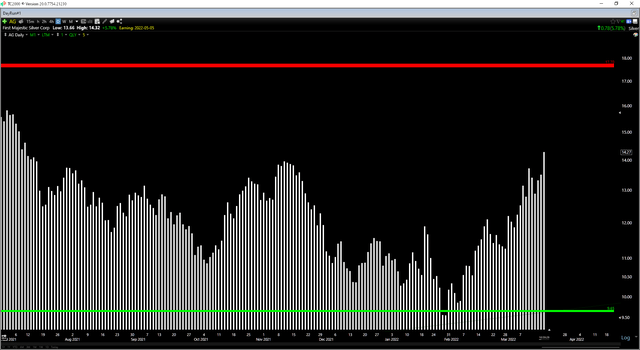

AG Each day Chart (TC2000.com)

Transferring over to the technical image, we are able to see that First Majestic has rallied sharply after discovering assist within the $9.30 vary, however it’s now discovered itself within the higher portion of its anticipated buying and selling vary. That is primarily based on robust resistance at $17.70 and up to date assist at $9.65. Based mostly on $3.40 in potential upside to resistance and $4.65 in potential draw back to assist, First Majestic has an unfavorable reward/threat ratio of 0.73 to 1.0 at present ranges, beneath my most well-liked reward/threat ratio of 4.0/1.0. The unfavorable reward/threat ratio doesn’t suggest that the inventory cannot head greater, however this isn’t what I’d take into account a low-risk purchase level.

First Majestic Silver Operations (Firm Presentation)

First Majestic Silver had a strong yr and primarily based on FY2022 steerage and present earnings estimates, the corporate ought to see important output development and luxuriate in significant development in annual EPS. Nevertheless, with the inventory buying and selling at ~31x subsequent yr’s earnings estimates and greater than 3.0x P/NAV, I do not see anyplace close to sufficient margin of security to justify paying up for the inventory at $14.30. Actually, if we have been to see the inventory head above US$15.90 earlier than Could, I’d view this as a chance to ebook some income.