Juan Jose Napuri

The Q3 Earnings Season for the precious metals sector has come to a close, and while it wasn’t the best quarter, there’s reason to be optimistic. This is because precious metals prices have firmed up a little, and several stocks sold off but immediately reversed on weaker results, suggesting that the negativity was more than priced into most producers. The other silver lining is that we may have seen peak costs in Q2/Q3 2022 as oil prices retreat from elevated levels and we start to see some moderation of inflation in key commodities.

In First Majestic’s case (NYSE:AG), its solid operational results from Mexico were heavily overshadowed by a rough quarter in Nevada, but I see reasons to be optimistic about 2023. This is because the company will benefit from higher mine production at Ermitano and Jerritt Canyon and what should be reduced sustaining capital at Jerritt Canyon after 18 months of elevated investments to position the asset for a turnaround. Let’s take a closer look at the company’s most recent results below:

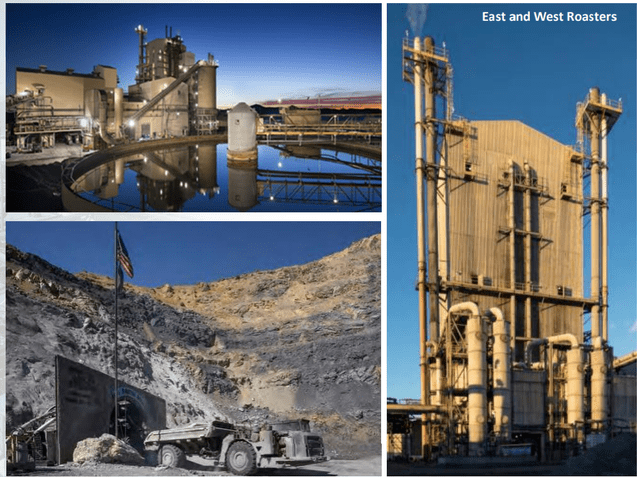

Jerritt Canyon Mine Operations (Company Presentation)

Q3 Production & Sales

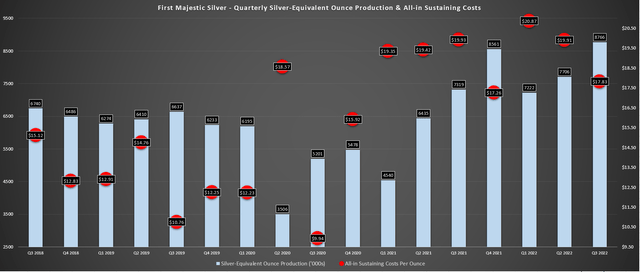

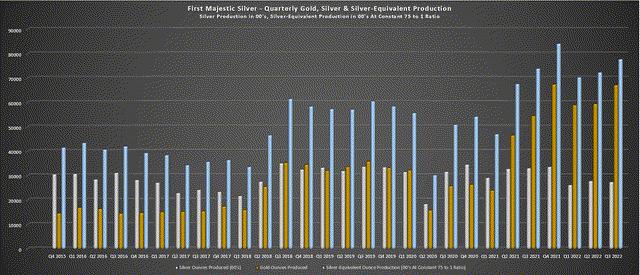

First Majestic released its Q3 results earlier this month, reporting quarterly production of ~2.74 million ounces of silver and ~67,100 ounces of gold. This translated to a sharp increase in gold production year-over-year, offset by a 17% increase in silver production. The shift in production on a year-over-year basis can be attributed to mining the much more gold-rich Ermitano Mine vs. solely Santa Elena in the year-ago period, plus lower grades at La Encantada and lower throughput at San Dimas vs. the year-ago period. Despite the softer production at San Dimas and La Encantada, First Majestic reported near-record silver-equivalent ounce [SEO] production on a constant 75 to 1 gold/silver ratio basis.

First Majestic Silver – Quarterly SEO Production & AISC (Company Filings, Author’s Chart)

First Majestic – Gold, Silver & SEO Production – Constant Ratio Basis (Company Filings, Author’s Chart)

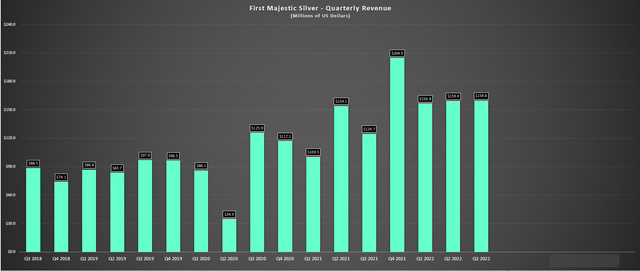

While the production results were solid at most of its Mexican operations, costs were elevated in the period. The major culprit was its new Jerritt Canyon Mine in Nevada, which dragged up consolidated silver-equivalent costs to $17.83/oz. From a sales standpoint, First Majestic reported a 28% increase in revenue year-over-year to $159.8 million. However, the company was up against very easy year-over-year comps, given that it withheld a considerable amount of silver in the year-ago period, which had a $32.2 million impact on revenue.

So, after adjusting for these easier comps, revenue was actually up just over 1% on a year-over-year basis, given that it would have come in at ~$157.8 million in Q3 2021 if not for metal held in inventory. Of course, the limited revenue growth can be attributed to the much weaker silver price ($19.74/oz vs. $23.10/oz). From a cash flow standpoint, First Majestic reported quarterly operating cash flow of $27.7 million, a 23% improvement from the year-ago period due to the much higher revenue. However, year-to-date cash inflows are sitting at just $96 million (same period 2021: $104.9 million), a very paltry figure for a company boasting a market cap of ~$2.60 billion. Let’s take a look at costs and margins:

First Majestic – Quarterly Revenue (Company Filings, Author’s Chart)

Costs & Margins

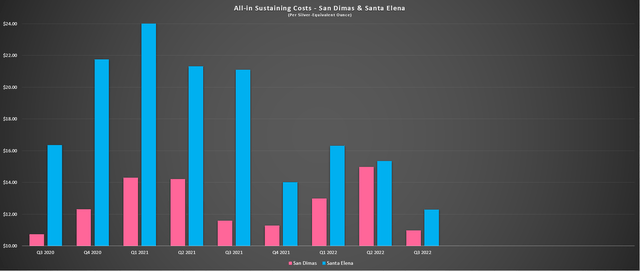

First Majestic reported respectable all-in-sustaining costs [AISC] on a silver-equivalent basis at its two main Mexican operations, with San Dimas producing ~3.77 million SEOs at costs of $10.97/oz and Santa Elena producing ~2.73 million ounces at $12.29/oz. The lower costs on a year-over-year basis benefited from higher production at San Dimas and lower workers’ participation costs, while Ermitano benefited from much higher grades that resulted in increased production, lower royalties, and slightly lower sustaining capital. At La Encantada, costs were higher year-over-year ($18.61/oz vs. 15.28/oz), impacted by the much lower production levels.

It’s important to note that First Majestic was not immune from inflationary pressures like its peer group but noted that it’s continuing to work on cost-cutting and cost-saving initiatives. This is a benefit to being a company of its size vs. some junior producers that can’t afford to invest in projects to claw back lost margins. In addition, the company has already reduced its headcount by 4% and is planning additional reductions. Some examples of cost-savings initiatives and ways to improve productivity include:

- renegotiating contracts and reducing external consultants

- restructuring to optimize workforce and reduce labor costs

- completing the dual-circuit project to improve recovery rates/throughput

- improved dilution at San Dimas and prioritizing LHS at Jessica/Regina veins

- developing the higher-grade Smith Zone 10 and reducing plant downtime

- advancing mining towards Ojeulas/Beca ore bodies at La Encantada

When it comes to Santa Elena, the asset is already benefiting from its connection to lower-cost power at Ermitano (transmission powerline). Meanwhile, the asset will benefit further from the dual-circuit project, which was 96% complete at quarter-end. An additional leaching tank and fourth CCD thickener were added in Q3, and the new 3,000 tonnes per day tailings filter press will be commissioned this quarter. Once the dual-circuit plant is operational by year-end, Santa Elena will benefit from improved recoveries and increased plant capacity. This asset is set up for another strong year when combined with higher mine production rates and contribution from Ermitano in 2023 and fewer ounces sold under the existing streaming agreement.

San Dimas & Santa Elena – All-in Sustaining Costs (Company Filings, Author’s Chart)

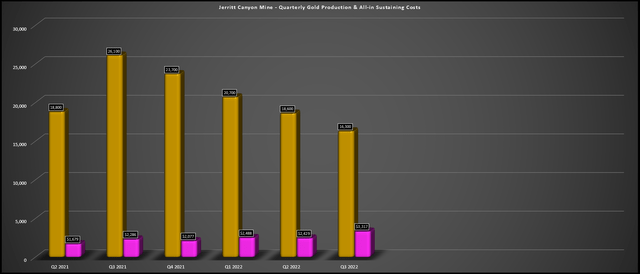

Unfortunately, Jerritt Canyon put up its ugliest quarter to date in Q3 (~16,300 ounces produced at $3,317/oz), but this was a bit of a kitchen sink quarter for the asset. Not only did the operation have to deal with two weeks of planned maintenance for its dual roasters that impacted throughput, but it also saw elevated sustaining capital expenditures ($8.4 million). The combination of higher costs due to elevated sustaining capital and inflationary pressures combined with a low denominator due to the very low production led to very unattractive costs in the period, making First Majestic’s consolidated costs look worse than they were.

Jerritt Canyon – Production & All-in Sustaining Costs (Company Filings, Author’s Chart)

The good news is that First Majestic has successfully made a high-grade discovery near the SSX/Smith connection drift, with grades coming in well above the reserve grade. Meanwhile, this asset is operating at barely half its capacity (4,500 tonnes per day) and should benefit immensely from higher grades at Smith Zone 10 and two new sources of ore feed: Saval II and West Generator. The increased throughput at a rate of ~1.0 million tonnes per annum in 2023 should help to pull down costs, but longer-term, and assuming the ability to push throughput up closer to 4,000 tonnes per day (exploration success or toll-milling agreements), this is an asset that could produce gold 220,000 ounces per annum at sub $1,400/oz costs.

This will not be achieved overnight, but if First Majestic can turn this asset around by filling up additional excess capacity with new mining areas and potentially toll-milling agreements, this could end up being a very smart acquisition for First Majestic, especially given the jurisdictional upgrade.

Jerritt Canyon Mine & Infrastructure (Company Presentation)

To summarize, while it’s easy to rag on this asset, and there’s no shortage of investors that are disgusted with the current production profile, I don’t think it’s fair to judge an asset this shortly after being acquired and while it hobbles along using half of its capacity. While this is certainly no Detour Lake in Ontario, this was another asset that was ridiculed at the time of its acquisition by Kirkland Lake Gold in 2019 and even after the acquisition, with its costs coming in above $1,100/oz.

As we can see today with the benefit of hindsight, this could be Canada’s largest gold mine at sub $850/oz costs with a mine life extending into the 2050s. I am not nearly as bullish on Jerritt Canyon as I am on Detour Lake, and these are two entirely different assets with two very different companies operating them. That said, I think it makes sense to judge this asset by its H2 2023 and FY2024 results, not during its worst period when the company is working to optimize the asset and investing heavily.

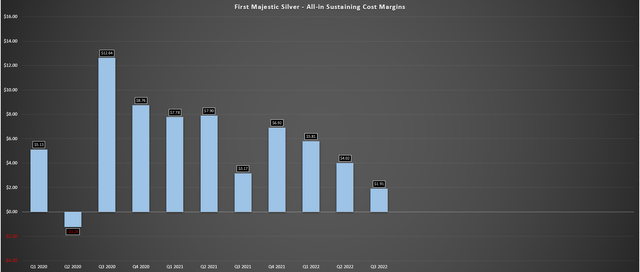

First Majestic – AISC Margins (Company Filings, Author’s Chart)

Despite the lower consolidated costs in the period ($17.83/oz vs. $19.74/oz), which were inflated due to the high costs at Jerritt Canyon, the silver price weakness put a further dent in First Majestic’s AISC margins. As shown in the chart above, AISC margins slid to $1.91/oz, down from $3.17/oz in the year-ago period. While this is certainly not a pretty trend, I don’t really see the value in judging First Majestic based on a quarter with depressed silver prices and high costs at Jerritt Canyon, and I expect a better 2023 ahead from a cost standpoint. Plus, if silver can hold its ground and stay above $20.00/oz, it looks like we may have seen a trough in margins in Q3 2022.

Valuation

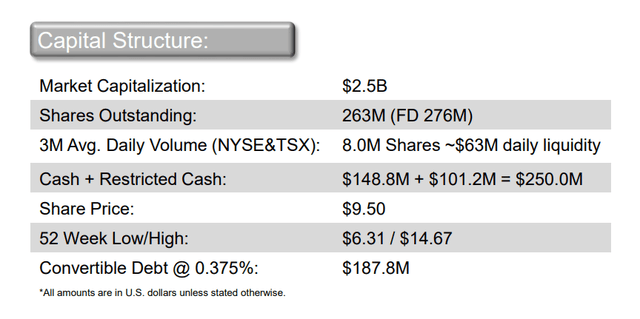

Based on ~276 million shares outstanding and a share price of US$9.50, First Majestic trades at a market cap of ~$2.62 billion. This compares very unfavorably with an estimated net asset value of $980 million, which doesn’t consider any risk related to the Mexican Tax Dispute, which remains ongoing, even if the company looks right in the case of this dispute. If we divide First Majestic’s market cap by its estimated net asset value, we can see that the stock continues to command one of the highest multiples sector-wide, trading at more than 2.50x P/NAV despite more than 70% of revenue coming from a Tier-2 jurisdiction (Mexico) and the company seeing a greater proportion of revenue from gold which should lower its premium multiple vs. being a mostly silver producer (pre-Jerritt Canyon acquisition and shift to Ermitano).

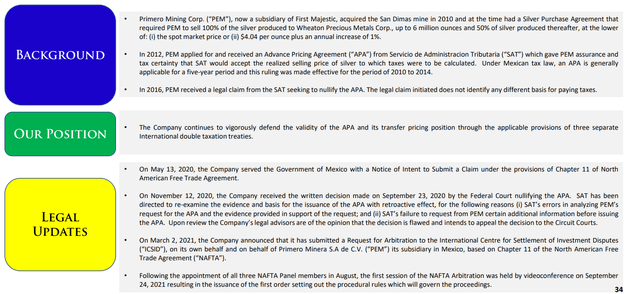

The recent MD&A notes that if the Servicio de Administracion Tributaria’s [SAT] attempts to nullify the Advance Pricing Agreement [APA] with Primero (previous owner of San Dimas) are successful, First Majestic could have to pay tax on its silver revenues at spot prices without any mitigating adjustments, with incremental income tax for 2010-2019 amounting to ~$246 million.

Mexican Tax Dispute (Company Presentation)

If we compare this valuation to producers like Agnico Eagle Mines (AEM) at ~1.0x P/NAV, which has over 90% of revenue from Tier-1 jurisdictions with multiple world-class assets, a robust pipeline, and industry-leading margins, First Majestic’s valuation makes little sense (150% premium to Agnico). Meanwhile, if we compare First Majestic to an emerging producer like i-80 Gold (IAUX), which has a similar Nevada jurisdictional profile to Jerritt Canyon but much lower operating costs and has recently made a major new polymetallic discovery, First Majestic also stacks unfavorably. In fact, First Majestic has ~66% of the estimated net asset value of i-80 Gold ($980 million vs. $1.47 billion) yet trades at nearly four times the fully-diluted market cap ($2.62 billion vs. $770 million).

First Majestic Capital Structure (Company Presentation)

To summarize, I continue to see First Majestic as very richly valued with no margin of safety in the current valuation, and I don’t see any way to justify being long the stock from an investment standpoint. As a matter of fact, one could argue First Majestic is one of the most expensive ways to play the sector. Even if we assume that the company was to make new discoveries at Ermitano and Jerritt Canyon to help fill in its valuation, it would still trade near 2.0x P/NAV. Hence, I don’t have any issue with the company selling its expensive currency (stock) under its At-The-Market Equity Program, with ~2.5 million shares sold after quarter-end at US$8.59 per share.

Technical Picture

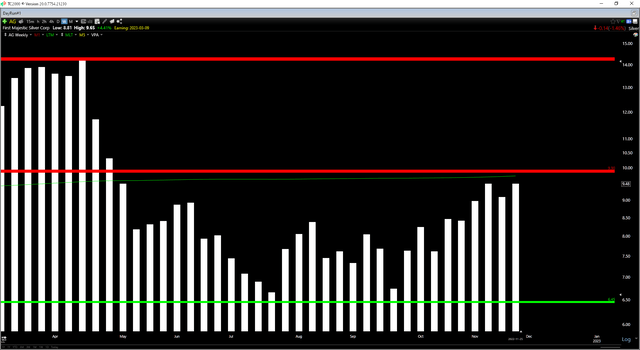

Moving to the technical picture, I previously noted in June that while the valuation left much to be desired, the stock would become more interesting at $7.80, where AG would become oversold short term. While the stock initially overshot this area in September, it has since roared back with a vengeance, up nearly 50% off its lows, and is now back above most of its weekly moving averages. The issue is that with the $7.80 level violated, AG’s new support doesn’t come in until $6.45, and its next resistance level comes in just overhead at $9.90. Given that I prefer a minimum 5/1 reward/risk ratio to justify buying sector laggards and the fact that AG currently trades at a reward/risk ratio of 0.16 to 1.0 (distance from support to resistance from current price), I don’t see any way to justify chasing the stock above $9.50.

AG 1-Year Chart (TC2000.com)

Obviously, a rising tide will lift all boats, and if gold and silver continue to trend higher into this more favorable seasonal period (November to late February), there’s little stopping First Majestic from heading higher. In fact, First Majestic has considerable torque in a rising precious metals environment, evidenced by its massive outperformance from its 2016 lows (~650% rally in seven months). That said, I prefer to invest in undervalued companies even in a flat metal price environment, given that it can be tough to rely on precious metals to cooperate with one’s investment goals. Under this framework, First Majestic does not make the cut, and I continue to see more attractive opportunities elsewhere in the sector.

Summary

First Majestic should have a better year ahead from a cost standpoint, with Jerritt Canyon ramping up to higher throughput rates, the benefit of a stronger year at Ermitano, and continued investments in its Mexican operations (dual-circuit project at Santa Elena Plant & low-cost power connection to Ermitano). However, AG’s valuation continues to leave a lot to be desired, and its reward/risk setup is less desirable after it has run nearly 50% off its lows. So, if I were looking to put new capital to work currently, my preference would be Sandstorm (SAND) which has triple First Majestic’s gross margins & a more attractive business model yet trades at a fraction of its P/NAV multiple (~0.85x vs. ~2.60x) and remains oversold across most time-frames.