NoDerog

Introduction

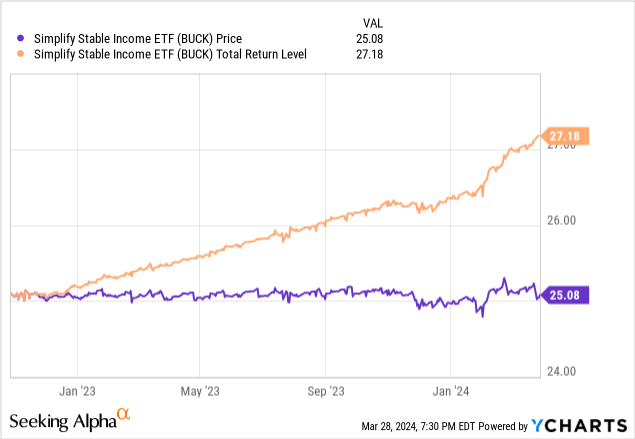

When CDs finally, after a decade, started paying investors decent returns, meaning over 5%, plain vanilla fixed income ETFs that focused on US Treasuries or upper-rated corporate bonds didn’t have the dance floor to themselves, there were even safer options for fixed income investors. To meet this challenge, managers came out with strategies to enhance the income without taking on too much, if any extra risk. Here, I examine one such approach, adding option writing, as executed by the Simplify Stable Income ETF (NYSEARCA:BUCK).

President Truman was famous for his sign, “The Buck Stops Here” that he kept on his desk. After reviewing this recently discovered ETF, I give BUCK only a Hold rating and would say to investors, you can safely pass the buck on this one (sorry for the bad pun)!

Simplify Stable Income ETF review

Seeking Alpha describes this ETF as:

The investment seeks to provide monthly income. The fund’s investment adviser seeks to fulfill the fund’s investment objective by using two income strategies: (1) an interest income strategy and (2) an income generating option strategy. The fund invests primarily in interest income producing U.S. Treasury securities such as bills, notes, and bonds and fixed income ETFs that invest primarily in U.S. Treasuries. To generate additional income, the fund employs an option spread writing strategy on equity ETFs and fixed income ETFs. The ETF started in late 2022.

Source: seekingalpha.com BUCK

BUCK has collected $117m in just over one year’s time. The managers charge investors 35bps in fees, reasonable but not great in today’s world, even for an actively managed ETF. The TTM yield is very respectful at 6.4%.

Simplify defines their ETF’s strategy like this:

The Simplify Stable Income ETF seeks to provide monthly income. The fund is actively managed with the goal of creating high risk-adjusted yield through efficient short-term fixed income positioning and structural option-writing opportunities. The fund is intended to be a cash or fixed income alternative, as it seeks to enhance typical yields of a more traditional, passive investment in short-dated fixed income.

Source: simplify.us/etfs/buck

Strategy explained

The following strategy details were taken from the SEC registration statement for BUCK.

- The Fund invests primarily in interest income producing U.S. Treasury securities such as bills, notes, and bonds and fixed income ETFs that invest primarily in U.S. Treasuries. The Fund targets an average securities portfolio duration of one year or less but does not restrict individual security maturity.

- To generate additional income, the Fund employs an exchange-traded and over-the-counter (“OTC”) option spread writing strategy on equity, fixed income, volatility, commodity, and currency ETFs and exchange traded products (“ETPs”).The adviser focuses on index-based domestically-traded ETFs.

Call Spread Sub-Strategy: When the adviser believes an ETF’s price will decrease, remain unchanged, or only increase slightly it employs a call spread strategy. In a call option spread, the Fund sells (writes) an out of the money (above current market price) call option while also purchasing a further out of the money call option.

Put Spread Sub-Strategy: When the adviser believes an ETF’s price will increase, remain unchanged, or only decrease slightly it employs a put spread strategy. In a put option spread, the Fund sells (writes) an out of the money (below current market price) put option while also purchasing a further out of the money put option.

This is one of the few option-writing strategy ETFs that I have seen using multiple option strategies or spread strategies either. Like JPMorgan Equity Premium Income ETF (JEPI), enhancing income via Covered Calls is the most commonly employed strategy.

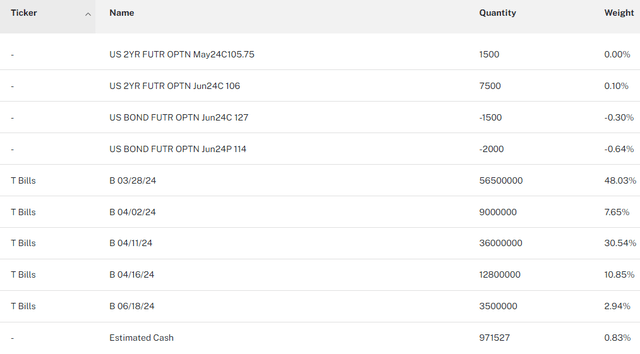

Holdings review

simplify.us/etfs/buck holdings

Besides the T-bills, which go out until June, they hold a pair of option positions that execute their spread strategy. They are long on the 2-Yr options with a very narrow spread of only $.25. This pair also contains a one-month calendar spread. The second pair is using a wider $13 spread, short strategy against the US bond which combines Calls and Puts. This is known as a short straddle. where you want the bond price to be between the two strikes when the options expire this June. The USM ticker (not listed) indicates these are based on the US Long bond.

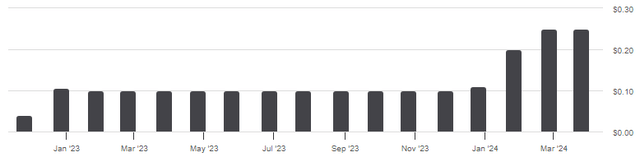

Distributions review

seekingalpha.com DVDs

So, after basically paying $.10 each month since inception, the most recent payments jump to $.20, then $.25 for the last two. Digging deeper, all the 4th quarter payouts relied on STG/LTG and ROC to cover the payment; with 75% of the first bump in 2024 coming from ROC, though the last two currently are listed as 100% ordinary income. If that monthly rate holds, the yield would be near 12%, which potentially would change my rating on this ETF to a Buy.

BUCK versus other short-term government bond ETFs

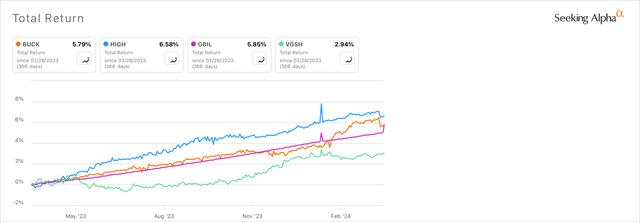

I chose to compare BUCK to these ETFs. BUCK’s short history comprises the value of this analysis as could my choice of comparison ETFs.

- Simplify Enhanced Income ETF (HIGH)

- Vanguard Short-Term Treasury ETF (VGSH)

- Goldman Sachs Access Treasury 0-1 Yr ETF (GBIL)

seekingalpha.com charting

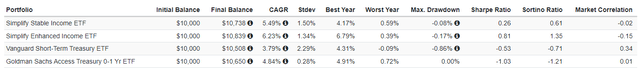

To get risk data, I used PortfolioVisualizer.com.

PortfolioVisualizer.com

As with the more complete CAGR data from Seeking Alpha, we see the best of the bunch is the Simplify Enhanced Income ETF (HIGH) based on both the Sharpe and Sortino ratios. That ETF has several articles published.

Portfolio strategy

There are multiple ways investors look at the fixed income part of their portfolio allocation. Aggressive investors might think it’s a waste and have little in those assets. Folks like my father-in-law are so conservative they own no stocks, or at least that was the case prior to CD rates disappearing. Between those extremes are those of us who set the allocation and risk level based on various factors such as:

- Do we need a large amount of cash in the near future?

- Age with the standard practice being the allocation to these assets increases as our age does.

- Our need for income which influences both the percent and risk taken. Here, relative yield compared to other assets plays a major role.

With a greater selection of funds to invest in, selection decisions are becoming as complicated as picking stocks. Besides ETFs, there are plenty of CEFs to pick from, which adds leverage and premium/discount factors to the decision matrix. At least all these choices reduces the risk our parents might have faced when individual bonds were the leading assets brokers would buy for their clients.

Conclusion

With its sub two year history p, it was unlikely I would have given the BUCK ETF any rating better than a Hold unless it’s CAGR was much better than competing ETFs. Being that it trails its sister HIGH ETF, one suggestion to BUCK holders is sell this ETF and buy HIGH to replace it, especially if sitting on a loss with the first. Potential investors though should track payouts and see if BUCK can maintain the $.25 monthly level without having to use non-income sources.