Raphaël Lafrogne-Joussier, Andrei Levchenko, Julien Martin, Isabelle Mejean 24 April 2022

Editors’ be aware: This column is a part of the Vox debate on the financial penalties of warfare.

Imports from Russia are largely made up of power inputs, most notably oil, coal, and pure gasoline. The centrality of those inputs in manufacturing networks implies that shocks affecting the value of power have the potential to propagate downstream, resulting in sizeable amplification of the shock. Nonetheless, latest estimates, recovered from calibrated multi-sector, multi-country fashions with input-output linkages (Bachmann et al. 2022, Baqaee et al. 2022), recommend that the impact of an import ban on Russian oil and gasoline would generate a comparatively restricted GDP contraction.1 Even in a rustic like Germany, reducing Russian power imports – which characterize 30% of German power consumption – would induce a 0.5-3% decline in GDP, a sizeable however manageable financial price.

In sector-level fashions corresponding to these utilized in Bachmann et al. (2022) or Baqaee et al. (2022), such a comparatively small impact outcomes from a non-zero elasticity of substitution amongst corporations’ inputs. If Russian oil and gasoline had been excellent enhances to different inputs (a zero elasticity), GDP would fall one-to-one with power imports. A number of the corporations in sectors depending on Russian power are assumed to have the ability to swap to different suppliers and the identical is true of corporations in downstream sectors, which want to deal with the decreased manufacturing of their suppliers. Particularly, the open-economy construction of the mannequin implies that a number of the inputs that may now not be produced domestically as a consequence of power rationing could be substituted by overseas items.2

The idea that there exist some substitution alternatives in manufacturing networks could seem controversial, as they’re usually considered inflexible constructions formed by relationship-specific investments. Is it extra applicable to as a substitute be conservative and assume a pure Leontief manufacturing construction? Addressing this query is difficult within the absence of direct proof on how applied sciences regulate to power shocks.

Is know-how Leontief on the agency stage?

In a latest paper (Lafrogne-Joussier et al. 2022), we deal with a associated query utilizing the early stage of the Covid disaster as a quasi-natural experiment. On this empirical examine, we use month-to-month panel knowledge on French corporations and examine the dynamics of their gross sales within the first semester of 2020. Our technique exploits corporations’ early publicity to provide chain disruptions induced by the lockdown in China in January 2020. By evaluating corporations that had been uncovered to the productiveness slowdown in China by means of their worth chain with comparable corporations that weren’t, we are able to quantify the extent of the propagation of shocks, on the root of the amplification formalised in fashions of manufacturing networks. By March 2020, when the virus was simply starting to unfold in Europe and France, corporations uncovered to provide chain disruptions from China had been already reporting 7% decrease export gross sales than their unexposed counterparts.

The train additionally makes it doable to look at heterogeneous changes of uncovered corporations to enter disruptions. A primary discovering is that uncovered corporations holding inventories managed to soak up the shock higher. Whether or not managed on the agency stage, as in our instance, or by public authorities, strategic inventories (particularly of gasoline and oil) look like important to assist uncovered corporations mitigate the shock. A second, extra stunning result’s that corporations that had been most depending on Chinese language inputs absorbed a number of the shock by diversifying their provide chain following the early lockdown. Among the many therapy group, corporations that had a non-diversified provide chain have a considerably greater likelihood to begin importing their inputs from elsewhere simply after the disruption induced by the Chinese language lockdown, in February and March 2020 (Determine 1). Whereas such proof doesn’t straight tackle the query of the chances of substitution away from Russian gasoline, it does assist the view that, even within the very brief run, corporations that face necessary disruptions of their enter purchases do regulate.

Determine 1 Impression of the early lockdown in China on uncovered corporations’ variety of overseas companions.

Supply: Lafrogne et al. (2022).

Notes: The determine exhibits the results of an occasion examine design that compares corporations uncovered to Chinese language inputs previous to the lockdown in China (“handled” corporations) and corporations that weren’t (“management” corporations). The therapy group is additional break up into “diversified” corporations that had been linked with a minimum of one different sourcing nation for the enter sourced in China and “non-diversified” corporations that solely relied on China previous to the shock. The estimated equation explains the variety of supply international locations, earlier than and after January 2020, within the group of handled corporations compared with management corporations, utilizing a Poisson estimator. The distinction is normalised to zero in January 2020.

Distributional results of the shock

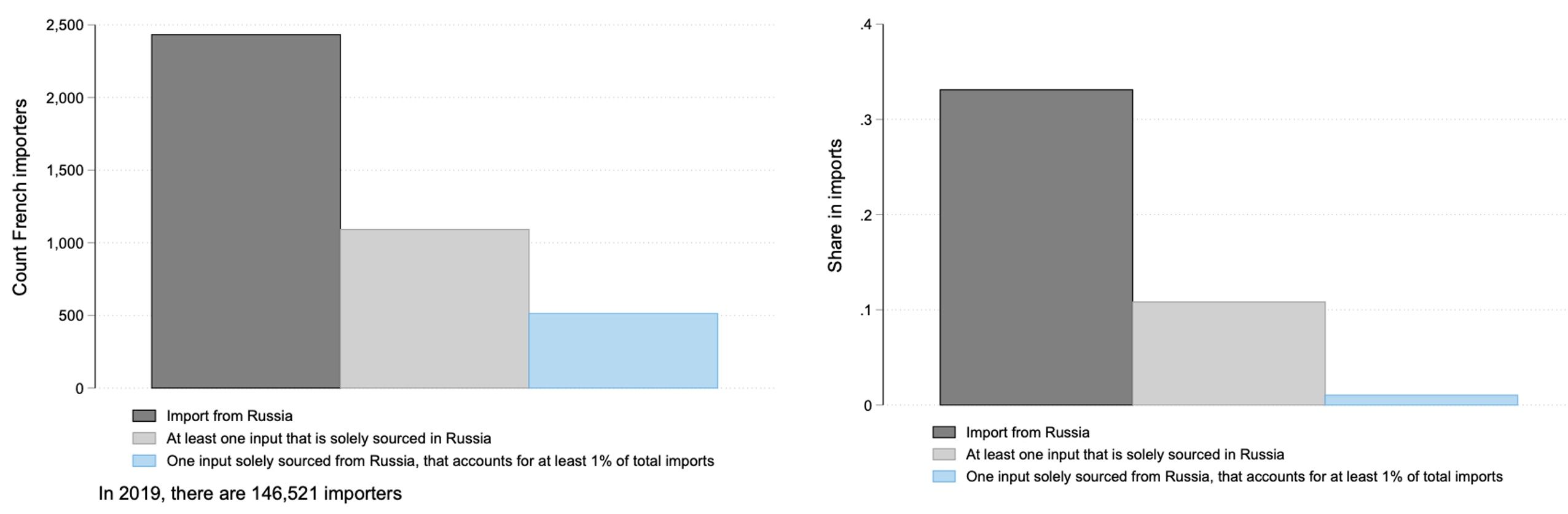

One other margin of adjustment, which textbook sector-level fashions don’t straight incorporate, is substitution inside a sector throughout corporations. Since corporations in the identical sector produce output that’s most likely extra extremely substitutable than inputs inside the agency, heterogeneity in who makes use of Russian gasoline gives one other shock attenuation mechanism (di Giovanni et al. 2020). As mentioned on this paper, heterogeneity in publicity to a overseas shock has vital mixture penalties on the general influence of the shock. The heterogeneity in publicity to Russia from the import facet is illustrated in Determine 2. Out of 150,000 French importers, lower than 2,500 straight imported from Russia in 2019. Nonetheless, these corporations are considerably bigger than the common and their whole imports account for one-third of France’s total imports. Offering uncovered corporations are massive and linked to different home producers, their sensitivity to the shock has mixture penalties. However the heterogeneity additionally has distributional penalties: non-exposed corporations achieve market shares over uncovered corporations. To account for these substitution alternatives, the evaluation in di Giovanni et al. (2020) maps firm-level knowledge for France with the sector-level input-output knowledge utilized in Bachmann et al. (2022) or Baqaee et al. (2022).

Determine 2 Publicity of French corporations to Russian imports

Supply: French customs knowledge for 2019.

Notes: The determine exhibits the quantity (left panel) and share in mixture imports (proper panel) of corporations that i) import from Russia (darkish gray bar), ii) import considered one of their inputs solely from Russia (mild gray bars) and iii) import considered one of their most important inputs solely from Russia (blue bars). Within the third case, statistics are primarily based on the sub-sample of a agency’s imports that account for a minimum of 1% of the agency’s total imports in 2019.

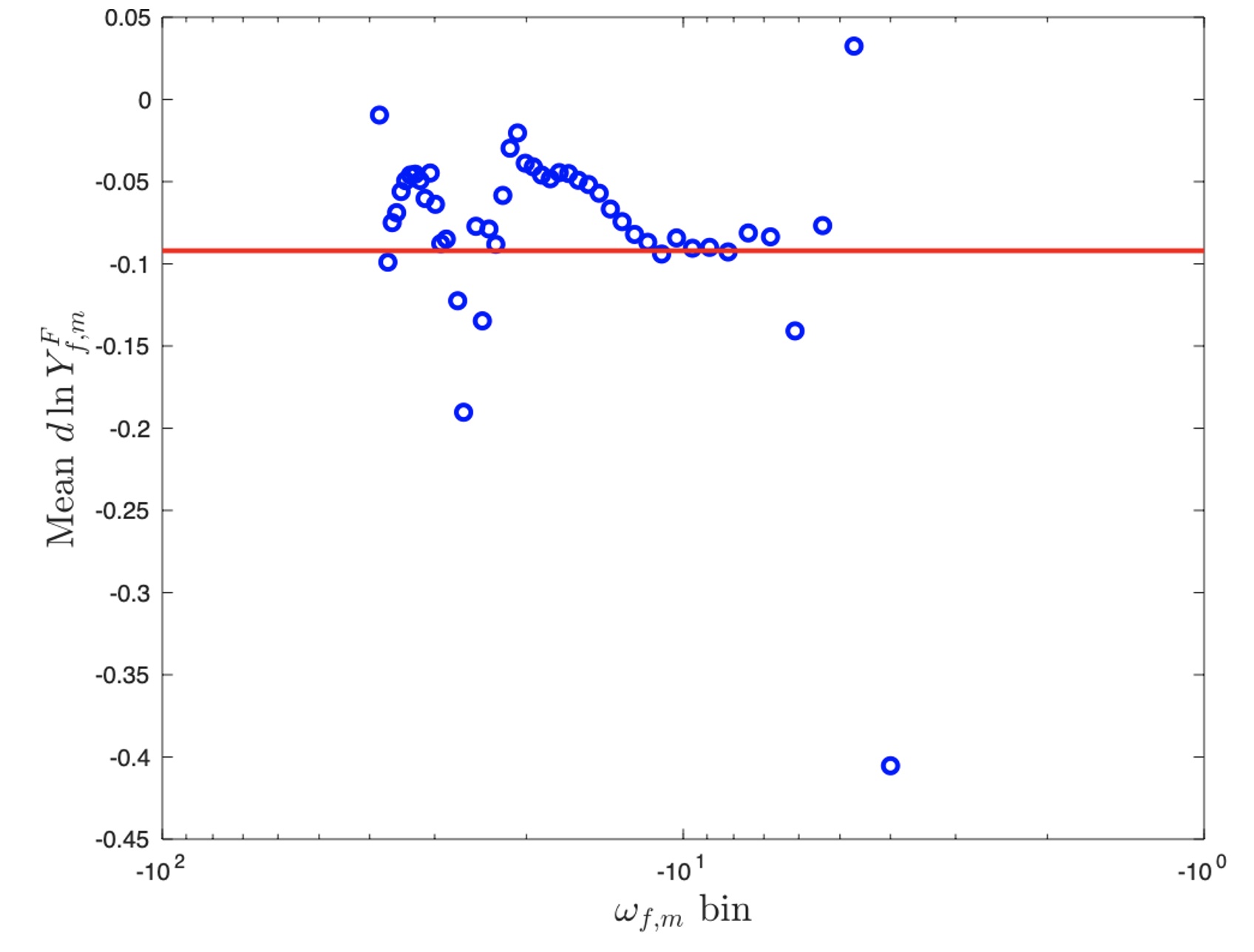

Determine 3 illustrates how heterogeneity in publicity and substitution alternatives impacts the response of French corporations to a ten% drop in Russian productiveness. Below our baseline calibration, the mixture influence of such shock is a 0.9% lower in France’s actual GDP (the purple line in Determine 3). Blue circles show the common firm-level responses relying on the agency’s measurement. Whereas corporations within the high two percentiles of the dimensions distribution expertise a sizeable 4% adjustment, some corporations in decrease percentiles broaden as they achieve market share over essentially the most uncovered corporations. These substitution alternatives usually are not accounted for in textbook fashions with input-output linkages however they may very well be necessary within the context of a doable ban on Russian gasoline if there may be heterogeneity throughout corporations inside a sector of their dependence on Russian gasoline.3

Determine 3 Heterogeneity within the response of corporations to a ten% productiveness drop in Russia

Supply: Authors’ calculation utilizing the mannequin in di Giovanni et al. (2020).

Notes: The determine exhibits the imply elasticity of corporations’ actual worth added to a simulated 10% drop within the mixture productiveness of the Russian financial system. Common elasticities are computed for 50 bins of particular person corporations, grouped by their (worth added) measurement.

Concluding remarks

Current proof recovered from detailed firm-level knowledge thus helps the view that overseas shocks do diffuse in manufacturing networks. Regardless of the rigidity of recent manufacturing networks, some corporations regulate their know-how, even within the very brief run, when confronted with a disruption of their worth chain. Furthermore, the heterogeneous publicity to the shock has distributional penalties: much less uncovered corporations achieve market shares over the extra uncovered ones. Assuming some substitution throughout inputs in fashions of manufacturing networks is in keeping with this micro-level proof. However what the dialogue additionally exhibits is {that a} ban on Russian imports may have very heterogeneous penalties. Some well-known corporations and a few iconic merchandise shall be strongly affected by the sanctions. Past GDP figures, enormous however concentrated losses could have a stronger influence on public opinion than small subtle losses.

References

Bachmann, R, D Baqaee, C Bayer, M Kuhn, A Loschel, B Moll, A Peichl, Okay Pittel and M Schularick (2022), “What if Germany is lower off from Russian power?”, VoxEU.org, 25 March.

Baqaee, D, C Landais, P Martin and B Moll (2022), “The Financial Penalties of a Cease of Vitality Imports from Russia”, French Council of Financial Advisors.

di Giovanni, J, A A Levchenko and I Mejean (2020), “Overseas Shocks as Granular Fluctuations”, CEPR Dialogue Paper 15458.

Lafrogne-Joussier, R, J Martin and I Mejean (2022), “Provide chain disruptions and mitigation methods”, VoxEU.org, 5 February.

Endnotes

1 Importantly, this result’s recovered from a mannequin wherein the one supply of such contraction is attributable to the propagation of the shock in manufacturing networks. Different detrimental penalties such because the detrimental impact of the wealth shock induced by elevating power costs are assumed to be neutralised.

2 After all, substituting home manufacturing with overseas inputs has different penalties. Notably, greater imports suggest extra manufacturing overseas, and thus an elevated power demand.

3 Whereas this substitution throughout corporations inside a sector is anticipated to assist soak up the shock, quantifying the dimensions of this attenuation mechanism is tough because it varies relying on the elasticity of substitution between corporations’ output and the extent to which components can reallocate throughout corporations. Within the baseline calibration, the elasticity of substitution is ready to three and labour is assumed to reallocate throughout corporations with out frictions.