necati bahadir bermek

By David Brady

Forward of Powell’s massive speech on financial coverage at Jackson Gap on Friday, the place everybody and their canine expects Powell to reiterate the Fed’s hawkish stance on financial coverage, I wish to take a look at the place Gold stands.

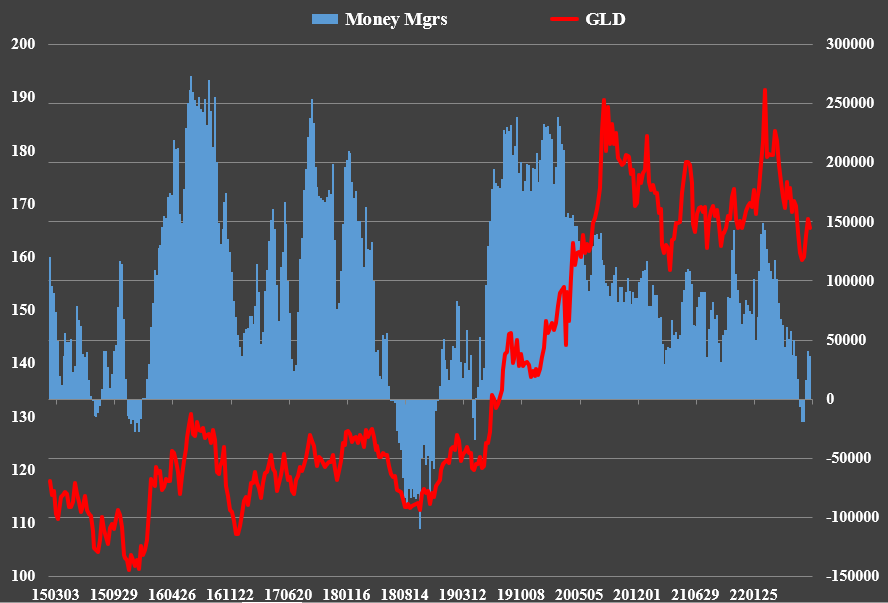

The sentiment is as excessive bearish because it was on the 1,675 lows.

Funds went barely lengthy once more as Gold rose to 1,824 however have been reducing these longs as Gold fell again. Banks added again some shorts however at the moment are tapering them once more. Each positions are, on stability, bullish.

Writer

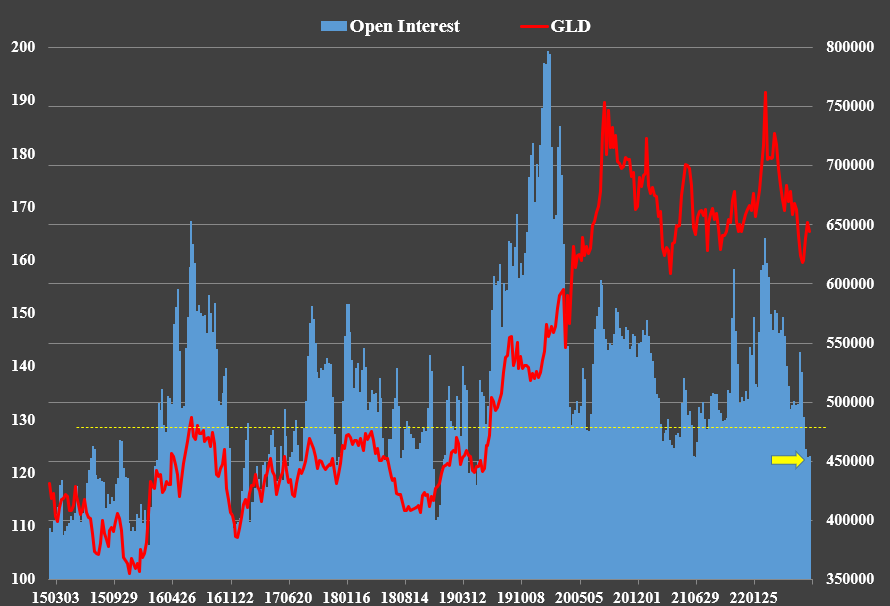

Open curiosity is at its lowest degree since Could 2019, when Gold was within the 1,300s. Once more, bullish.

Writer

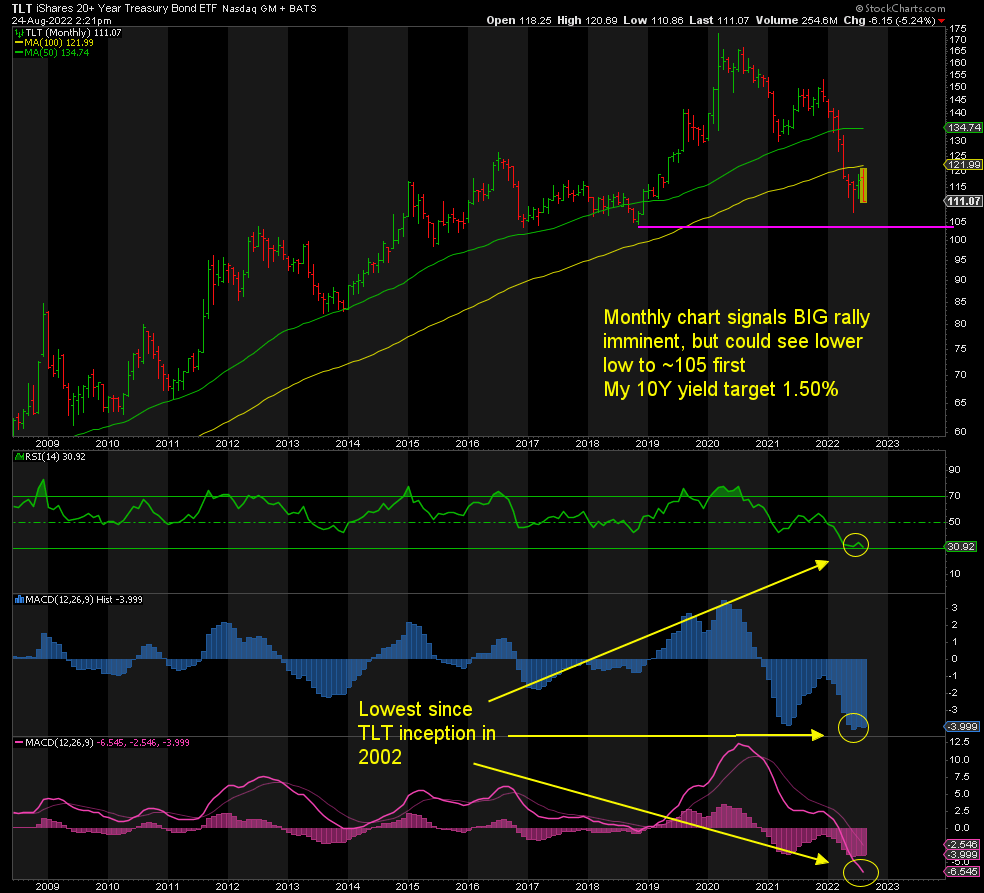

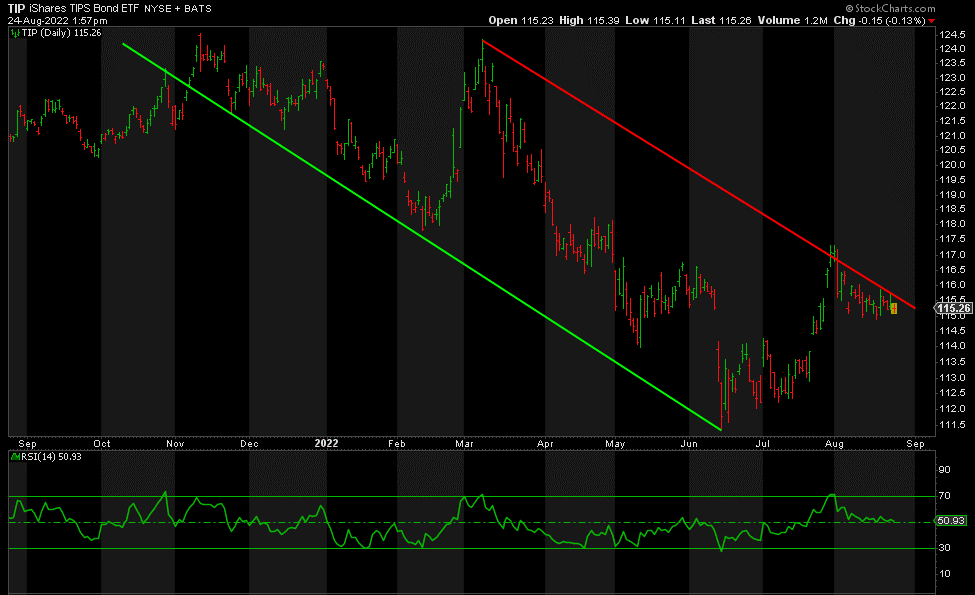

Bonds might have a little bit additional to go on the draw back, however they’re on the point of take off, in my humble opinion, with yields heading a lot decrease:

StockCharts

That is what I at the moment see in TIP, the inverse of actual yields, a bullish channel/flag…

StockCharts

‘When’ we break that trendline resistance in pink, TIP will rally in a giant method, actual yields will fall, and Gold follows TIP increased. Weekly and month-to-month charts are screaming to the upside.

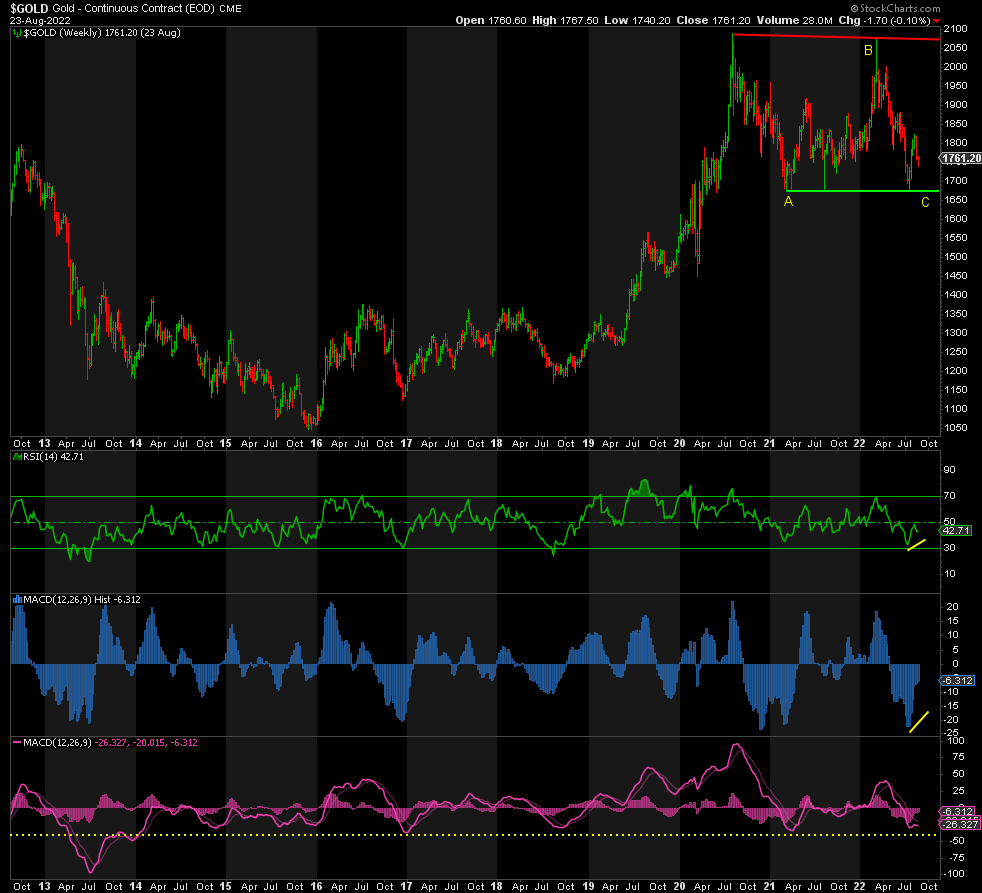

The charts for Gold recommend two main eventualities. First the weekly chart:

StockCharts

We backside in wave C of this correction since August 2020 at ~1,663, the place the scale of wave C = A. There’s a good set-up in each the RSI and MACD Histogram for such an end result. The MACD Line would additionally register its lowest degree since 2013, 9 years in the past. Discuss excessive oversold! Extra so than at 1,045 in 2015, 1,124 in 2016, and 1,167 in 2018.

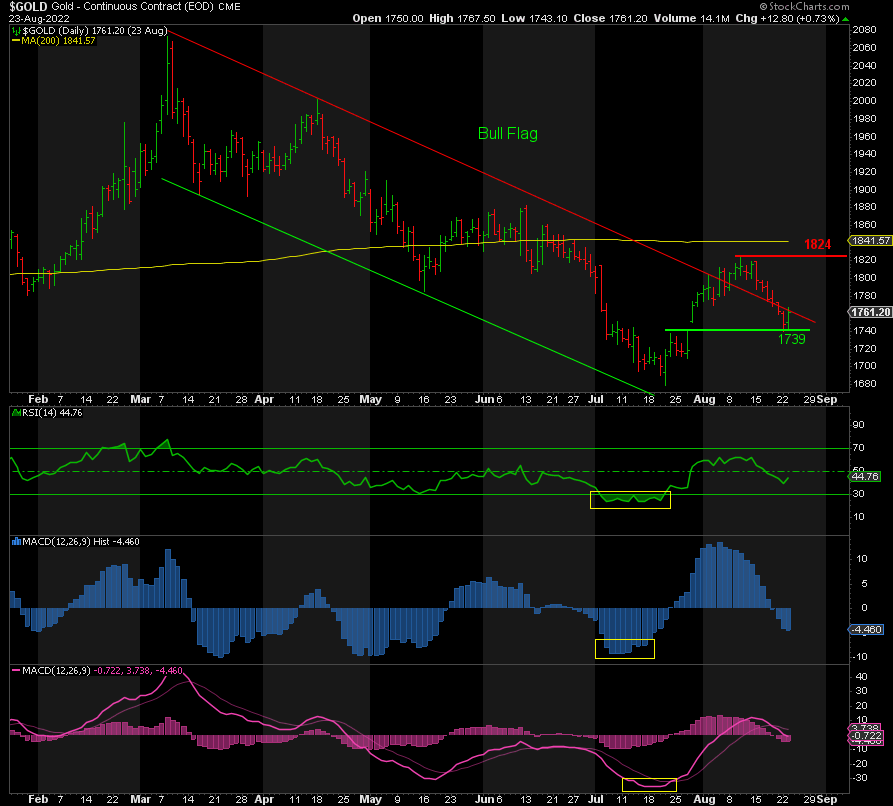

Now for the each day chart:

StockCharts

The choice is that we have now bottomed out in wave 2 at ~1,740, coming off the excessive of 1,824. This additionally simply occurs to be the 61.8% retracement of the rally from 1,678 to 1,824, normal for a wave 2. Subsequent, we head upwards in wave 3, the cash wave.

Both method, we’ve bought a drop of an additional ~$75 or the underside is already in place. That’s a bullish threat/reward profile primarily based on chances.

There may be yet one more chance of a far deeper dive in Gold together with shares and better actual yields, however that’s comparatively small right now. Solely under 1,650 does that develop into a better likelihood.

All in all, every part is pointing north, besides maybe an important issue, Fundamentals, and which means the Fed. The Fed persists with additional tightening of financial coverage. We have to see at the least a pause in price hikes or an abandonment of QT to verify that the rally to new file highs in Gold has begun. If Powell is much less hawkish and extra dovish than anticipated on Friday, the underside could possibly be in place.

Authentic Submit

Editor’s Observe: The abstract bullets for this text had been chosen by Looking for Alpha editors.