Join industry visionaries Pete Flint, Spencer Rascoff, Ryan Serhant and more at Inman Connect New York, Jan. 24-26. Punch your ticket to the future by joining the smartest people in real estate at this must-attend event. Register here.

Finance of America Mortgage, a nonbank lender that went public last year, is shutting down its wholesale and correspondent lending channels after laying off more than 1,000 people this year amid mounting losses.

The Irving, Texas-based lender is also reportedly in negotiations to sell its retail mortgage division, which employs about 1,000 loan originators who work out of more than 200 branch offices nationwide.

Finance of America Mortgage TPO — the division of the company that works with mortgage brokers and correspondent lenders — sent out an email notice Friday informing partners it would no longer fund brokered or purchased loans after Dec. 16.

“We realize this decision will impact your relationships,” the notice said. “The FAM team will continue to ensure that your borrowers and you receive the same exceptional service that you have received from us over the years to ensure that your existing pipeline with us closes smoothly and on time.”

Friday was the last day for mortgage brokers and correspondent lenders to submit a new floating loan or complete a new forward lock to Finance of America, and Oct. 28 will be the last day to lock loans currently in the pipeline or submit credit packages on previously locked loans, the company said.

Finance of America’s commercial and reverse mortgage lending operations “will continue accepting new applications and operate business as usual,” the company said.

Valued at nearly $2 billion when it went public last year in a SPAC merger, Finance of America Mortgage does most of its business through its retail and consumer direct channels.

Finance of America’s loan origination channels

Loan originations by channel, in billions of dollars Source: Finance of America quarterly report to investors

According to the Nationwide Mortgage Licensing System and Registry, Finance of America Mortgage’s retail division sponsors 1,094 mortgage loan originators who work out of 246 branch locations nationwide.

During the second quarter of this year, those retail branches accounted for about 56 percent of the company’s $4.23 billion in total loan originations, with the consumer direct channel’s $256 million in production accounting for another 6 percent.

Wholesale and correspondent lending — in which Finance of America funds loans originated by its partners — accounted for another $1.52 billion in loan production or more than one-third of the total, the company said in its most recent quarterly report to investors.

Although the nation’s biggest wholesale mortgage lender, United Wholesale Mortgage, says it will battle for homebuyer market share, another big player in the competitive wholesale business, Homepoint, has drastically downsized. Some other lenders that only dabbled in wholesale, such as Guaranteed Rate and loanDepot, have elected to shut those channels down.

Like many other mortgage lenders, Finance of America has been forced to downsize as rising mortgage rates have gutted the highly profitable business of refinancing existing homeowner’s loans.

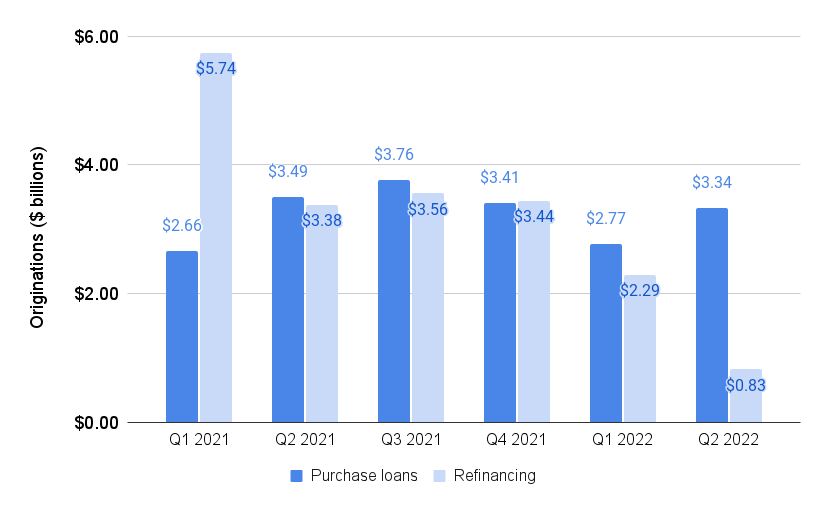

Finance of America mortgage refinancings plummet

Finance of America purchase mortgage originations and refinancings by quarter: Finance of America regulatory filings

During the first quarter of 2021 — when rates on 30-year fixed-rate mortgages hit an all-time low of 2.65 percent — Finance of America refinanced an all-time high of $5.74 billion in mortgages, more than twice the $2.66 billion in purchase loans it funded.

In its most recent quarterly report, Finance of America posted a $168 million second-quarter net loss, with rising mortgage rates severely curtailing refinancings. Although second-quarter purchase loan volume climbed to $3.34 billion, refinancing volume plummeted to $825 million.

Graham Fleming

On an Aug. 4 conference call with investment analysts, interim CEO Graham Fleming said the company had made staffing reductions in mortgage originations “to match capacity with current market demand,” a move that he said was expected to shave $100 million a year in expenses.

According to Finance of America’s 2021 annual report, the company employed about 5,300 people in 2021 including 3,088 in mortgage originations and 1,021 in lender services.

Fleming said that since the beginning of the year, Finance of America had reduced headcount and expenses by 20 percent company-wide — implying the company has downsized by more than 1,000 employees.

“We are optimizing our cost structure through reductions in headcount and other cost management efforts,” Fleming said on the earnings call. “We have moved out of the consumer direct channel that was heavily reliant on refinance leads, and are actively right-sizing each of our branches.”

With purchase loans expected to continue to account for the lion’s share of new businesses, Fleming said Finance of America’s retail business “remains poised to take advantage of this shift. Currently, purchase originations comprised roughly 85 percent of our volume. We also believe there remains substantial opportunity to sell non-mortgage products through our mortgage channel, and are focused on building out this opportunity.”

Since then, Finance of America has reportedly been in negotiations to sell its retail mortgage division, with Guaranteed Rate thought to be the leading suitor.

Finance of America reportedly signed a nonbinding letter of intent with Guaranteed Rate, National Mortgage Professional reported on Sept. 29. But Guaranteed Rate has “walked away from negotiations,” HousingWire reported Friday, citing anonymous sources.

A Finance of America spokesperson told Inman that “It is company policy not to comment on rumors or speculation in the market.”

While investors have soured on Finance of America since last year’s IPO, shares in the company are trading above their all-time low.

After briefly trading above $11 in April 2021, Finance of America’s share price gradually slid to an all-time low of $1.20 on Aug. 31. Rumors of an impending sale of the company’s retail mortgage division buoyed the company’s share price, which bounced 54 percent to a recent high of $1.74 on Oct. 4.

At Friday’s closing price of $1.60, Finance of America has a market capitalization of about $100 million.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter