SYDNEY and KUALA LUMPUR, Might 24 (IPS) – A category warfare is being waged within the title of combating inflation. All too many central bankers are elevating rates of interest on the expense of working folks’s households, supposedly to verify worth will increase.

Compelled to deal with rising credit score prices, persons are spending much less, thus slowing the financial system. However it doesn’t should be so. There are a lot much less onerous different approaches to sort out inflation and different modern financial ills.

Quick-term ache for long-term acquire?

Central bankers are agreed inflation is now their greatest problem, but in addition admit having no management over elements underlying the present inflationary surge. Many are more and more alarmed by a attainable “double-whammy” of inflation and recession.

Nonetheless, they defend elevating rates of interest as essential “preemptive strikes”. These supposedly forestall “second-round results” of staff demanding extra wages to deal with rising residing prices, triggering “wage-price spirals”.

In central financial institution jargon, such “forward-looking” measures convey clear messages “anchoring inflationary expectations”, thus enhancing central financial institution “credibility” in combating inflation.

They insist the ensuing job and output losses are solely short-term – momentary sacrifices for long-term prosperity. Keep in mind: central bankers are by no means punished for inflicting recessions, regardless of how deep, protracted or painful.

However elevating rates of interest solely makes recessions worse, particularly when not brought on by surging demand. The most recent inflationary surge is clearly because of provide disruptions due to the pandemic, warfare and sanctions.

Elevating rates of interest solely reduces spending and financial exercise with out mitigating ‘imported’ inflation, e.g., rising meals and gas costs. Recessions will additional disrupt provides, aggravating inflation and worsening stagflation.

Wage-price spirals?

Some central bankers declare current situations of wage will increase sign “de-anchored” inflationary expectations, and threaten ‘wage-price spirals’. However this paranoia ignores modified industrial relations and pandemic results on staff.

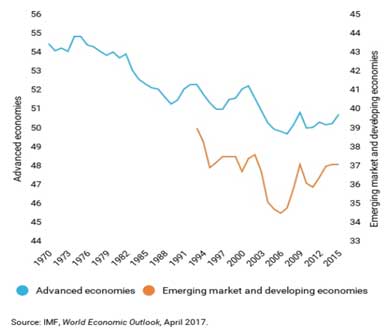

With actual wages stagnant for many years, the ‘wage-price spiral’ risk is grossly exaggerated. Over current many years, most staff have misplaced bargaining energy with deregulation, outsourcing, globalization and labour-saving applied sciences. Therefore, labour shares of nationwide revenue have declined in most international locations for the reason that Nineteen Eighties.

Labour market restoration, even tightening in some sectors, obscures hostile total pandemic impacts on staff. In the meantime, hundreds of thousands of staff have gone into casual self-employment – now celebrated as ‘gig work’ – growing their vulnerability.

Pandemic infections, deaths, psychological well being, training and different impacts, together with migrant employee restrictions, have all harm many. Contagion has particularly harm weak staff, together with youth, migrants and ladies.

Ideological central bankers

Financial insurance policies by supposedly unbiased and educated technocrats are presumed to be higher. However such naïve religion ignores ostensibly educational, ideological beliefs.

Usually biased, albeit in unspoken methods, coverage decisions inevitably assist some pursuits over – even in opposition to – others. Thus, for instance, an anti-inflation coverage emphasis favours monetary asset house owners.

Politicians just like the notion of central financial institution independence. It allows them to conveniently blame central banks for inflation and different ills – even “sleeping on the wheel” – and for unpopular coverage responses.

After all, central bankers deny their very own position and duty, as an alternative blaming different financial insurance policies, particularly fiscal measures. However politicians blaming central bankers after empowering them is just shirking duty.

Within the wealthy West, governments lengthy bent on fiscal austerity left the heavy lifting for restoration after the 2008-2009 world monetary disaster (GFC) to central bankers. Their ‘unconventional financial insurance policies’ concerned preserving coverage rates of interest very low, enabling company shenanigans and zombie enterprise longevity.

This enabled unprecedented will increase in most debt, together with personal credit score for hypothesis and sustaining ‘zombie’ companies. Therefore, current financial tightening – together with elevating rates of interest – will set off extra insolvencies and recessions.

German social market financial system

Inflation and coverage responses inevitably contain social conflicts over financial distribution. In Germany’s ‘free collective bargaining’, commerce unions and enterprise associations interact in collective bargaining with out state interference, fostering cooperative relations between staff and employers.

The German Collective Bargaining Act doesn’t oblige ‘social companions’ to enter into negotiations. The timing and frequency of such negotiations are additionally left to them. Such versatile preparations are stated to have helped SMEs.

Though Germany’s ‘social market financial system’ has no nationwide tripartite social dialogue establishment, labour unions, enterprise associations and authorities didn’t hesitate to democratically debate disaster measures and coverage responses to stabilize the financial system and safeguard employment, e.g., throughout the GFC.

Dialogue down beneath

The same ‘social dialogue’ strategy was developed by Australian Labor Prime Minister Bob Hawke from 1983. This contrasted with the extra confrontational approaches pursued in Margaret Thatcher’s UK and Ronald Reagan’s USA – the place punishing rates of interest inflicted lengthy recessions.

Though Hawke had been a profitable commerce union chief, he started by convening a nationwide summit of staff, companies and different stakeholders. The ensuing Costs and Incomes Accord between the federal government and unions moderated wage calls for in return for ‘social wage’ enhancements.

This consisted of higher public well being provisioning, pension and unemployment profit enhancements, tax cuts and ‘superannuation’ – involving required staff’ revenue shares and matching employer contributions to a staff’ retirement fund.

Though enterprise teams weren’t formally celebration to the Accord, Hawke introduced massive companies into different new initiatives such because the Financial Planning Advisory Council. This consensual strategy helped scale back each unemployment and inflation.

Such consultations have additionally enabled tough reforms – together with floating alternate charges and decreasing import tariffs. In addition they contributed to the developed world’s longest uninterrupted financial progress streak – with no recession for practically three many years, ending in 2020 with the pandemic.

Social partnerships

Quite a lot of such approaches exist. For instance, Norway’s kombiniert oppgjior, from 1976, concerned not solely industrial wages, but in addition taxes, salaries, pensions, meals costs, baby assist funds, farm assist costs, and extra.

‘Social partnerships’ have additionally been essential in Austria and Sweden. A sequence of political understandings – or ‘bargains’ – between successive governments and main curiosity teams enabled nationwide wage agreements from 1952 till the mid-Nineteen Seventies.

Consensual approaches undoubtedly underpinned post-Second World Conflict reconstruction and progress, of the so-called Keynesian ‘Golden Age’. However it’s also claimed they’ve created rigidities inimical to additional progress, particularly with speedy technological change.

Financial liberalization in response has concerned deregulation to attain extra market flexibilities. However this strategy has additionally produced extra financial insecurity, inequalities and crises, moreover stagnating productiveness.

Such adjustments have additionally undermined democratic states, and enabled extra authoritarian, even ethno-populist regimes. In the meantime, rising inequalities and extra frequent recessions have strained social belief, jeopardizing safety and progress.

Policymakers ought to seek the advice of all main stakeholders to develop acceptable insurance policies involving honest burden sharing. The true want then is to design different coverage instruments by means of social dialogue and complementary preparations to deal with financial challenges in additional equitably cooperative methods.

IPS UN Bureau

Follow @IPSNewsUNBureau

Observe IPS Information UN Bureau on Instagram

© Inter Press Service (2022) — All Rights ReservedUnique supply: Inter Press Service