champc

Written by Nick Ackerman, co-produced by Stanford Chemist.

First Trust Enhanced Equity Income Fund (NYSE:FFA) utilizes a covered call strategy against individual positions and writes calls against indexes as well. The fund runs a relatively narrow portfolio of equity positions and writes against only a portion of its portfolio. That can allow for some upside potential relative to other funds that can sometimes cap upside by writing against 100% of the value of their portfolio.

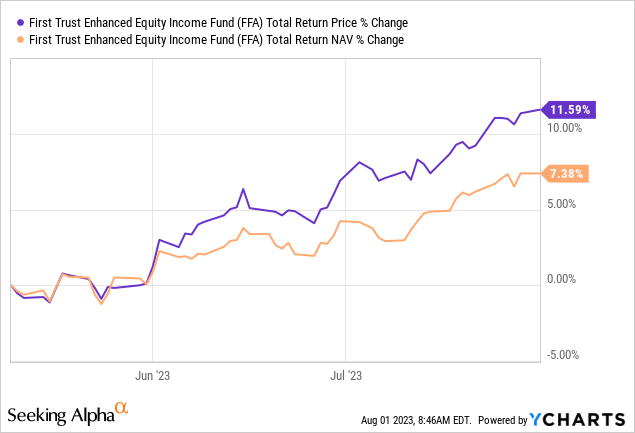

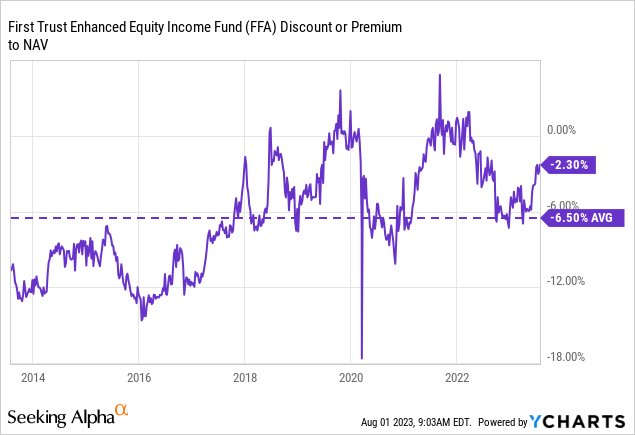

The fund has provided some solid results through 2023 thanks to its heavy tech-oriented portfolio. However, the fund has seen its discount narrow since our last update to drive some of those results even further on a total share price return basis.

YCharts

This represents yet another good example of how closed-end fund discounts and premiums can be exploited. I believe this takes the fund from being a ‘Buy’ down to being more of a ‘Hold’ once again. That being said, the fund still delivers some solid cash flow for investors through its quarterly distribution and can provide attractive long-term results nonetheless. It’s only that history suggests now that returns will come via the portfolio’s performance instead of further discount tightening or pushing into premium territory. Although this fund has traded at premiums on occasion as well.

The Basics

- 1-Year Z-score: 1.79.

- Discount: -2.30%.

- Distribution Yield: 6.89%.

- Expense Ratio: 1.13%.

- Leverage: N/A.

- Managed Assets: $374.4 million.

- Structure: Perpetual.

FFA’s objective is to “provide a high level of current income and gains and, to a lesser extent, capital appreciation.” It attempts to do this by investing in “a diversified portfolio of equity securities.” So, we are looking at a rather simple portfolio. It then utilizes an option strategy “on an ongoing and consistent basis… on a portion of the Fund’s Managed Assets.”

As a smaller fund, entering and exiting the fund for larger investors can be somewhat of an issue. For most retail investors that want to hold longer-term, that is generally less of an issue.

The fund writes calls with a more hybrid approach against individual positions and indexes. The latest update posted the percentage overwrite at 66.55% at the end of June 2023. That’s fairly high, but it is down from the ~69% it was overwritten earlier in the year.

Performance – Consistent Results But Lackluster Current Valuation

FFA has been able to deliver solid results over the life of the fund.

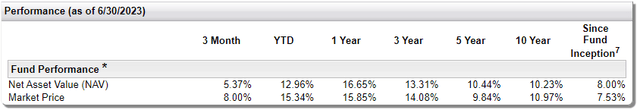

FFA Annualized Performance (First Trust)

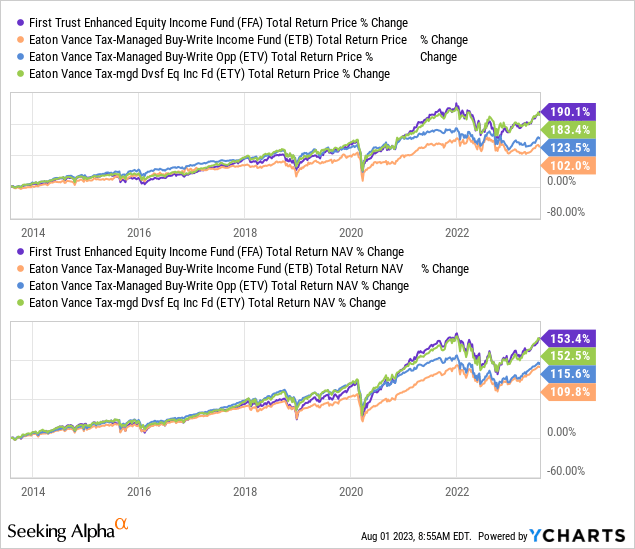

For some context, we can see how FFA has performed against the more popular Eaton Vance call-writing funds over the last decade. When looking at Eaton Vance Tax-Managed Buy-Write Income Fund (ETB) and Eaton Vance Tax-Managed Buy-Write Opportunities (ETV), the fund has meaningfully outperformed. Against the Eaton Vance Tax-Managed Diversified Equity Income Fund (ETY), results have been quite similar.

YCharts

Portfolio positioning will clearly play a role. However, another driving factor goes back to writing options against 100% of a portfolio compared to partially overwriting a portfolio. ETB and ETV both write index options with a target of being nearly 100% overwritten. ETY takes an S&P 500 benchmark approach similar to ETB, but it has a target of overwriting around 50% of its portfolio.

By overwriting a smaller portion of the fund’s portfolio, there can be less of the portfolio being hindered by upside moves in a strong bull market. Of course, historically, we know a strong bull market is what we mostly experienced over the last decade.

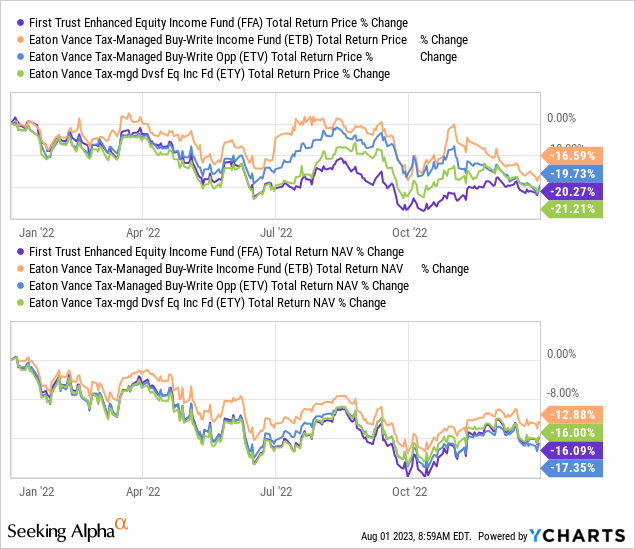

In a down year such as 2022, being overwritten to a larger extent of their portfolio can provide more downside cushion as they collected more options premiums to offset losses. In this case, ETB worked as intended against ETY and FFA’s partial overwrite strategy. For ETV, despite the target of 100% being overwritten, the underlying portfolio is more tech-oriented. This is due to its inclusion of benchmarking not only the S&P 500 but the Nasdaq 100 as well, putting them at a disadvantage.

YCharts

With all that being said, that’s why I used these funds to highlight some context of performance relative to FFA, as they have differences in the funds that aren’t directly comparable. Still, it can give us a better color of overall performance as long as we are conscious of the differences.

In terms of the fund’s valuation currently, FFA is relatively expensive based on its history. Of course, we can see that the fund has flirted with a premium on several occasions, too. Still, it looks like there could be more room for some downside compared to the upside from here.

YCharts

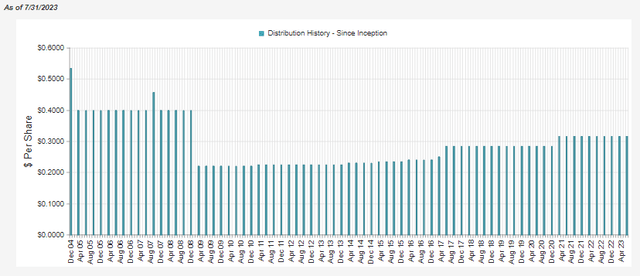

Distribution – Solid and Reasonable

Distribution rates are important for closed-end funds, and I believe that FFA delivers a 6.89% rate. On a NAV basis, it’s more than a reasonable 6.73%. Given the narrow discount, the actual rates are quite close, and that’s another reason that a discount can be enticing when it comes to CEFs. When funds are trading at deep discounts, the rate investors collect can actually be materially higher than what the underlying portfolio has to return.

FFA Distribution History (CEFConnect)

Given this modest rate, I would suspect that FFA could deliver some upside appreciation going forward. On the other hand, the fund could be in a position to raise its distribution too. At the same time, we are in a fairly unpredictable market with the Fed still raising interest rates. The managers could play it more conservatively and keep the distribution where it’s at now, as it will require significant capital gains to fund.

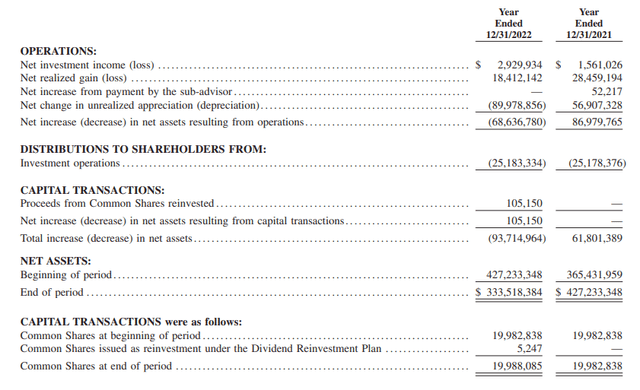

Last year the fund’s net investment income increased, but it was still in a situation where sizeable capital gains were going to be required, and that’s normal for an equity fund.

FFA Annual Report (First Trust)

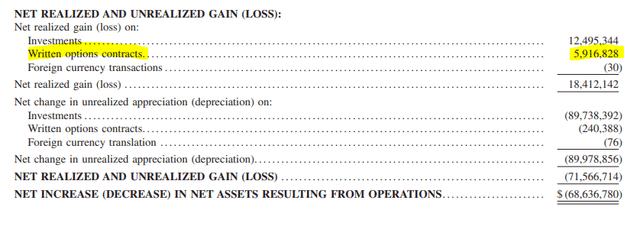

Some of these capital gains can come from the underlying portfolio or the fund’s option writing strategy. In 2023, options written contributed to a meaningful portion of the fund’s realized capital gains in the prior year.

FFA Realized/Unrealized Gains/Losses (First Trust (highlights from author))

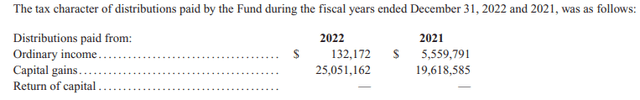

The tax character of the distribution also aligns mostly with what the underlying fund earns as well. That is, limited ordinary income classifications based on low NII coverage and instead mostly identified as capital gains.

FFA Distribution Tax Classification (First Trust)

This isn’t always the case, and it can be one of the main confusing points for investors in CEFs. They tend to conflate tax classifications with fund earnings.

FFA’s Portfolio

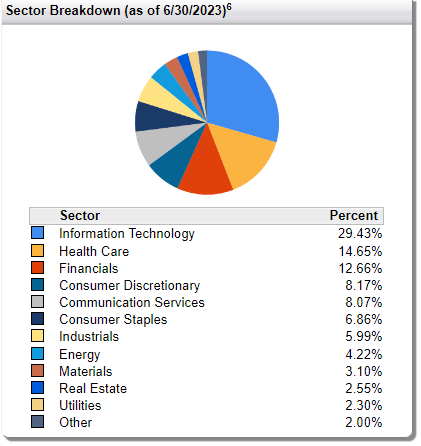

The fund has had a fairly moderate turnover rate of 21% in the last year. The fund has also stuck with a fairly significant overweight allocation of tech, which has proven to be beneficial for the fund over the years. That leads to why the fund has delivered such strong results over the last decade.

FFA Sector Breakdown (First Trust)

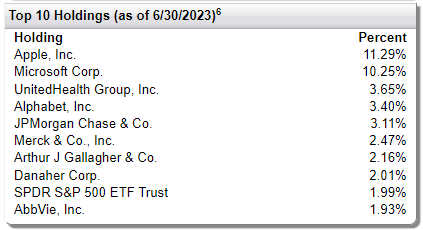

The fund holds a number of the magnificent seven names such as Apple (AAPL), Microsoft (MSFT), and Alphabet (GOOG) (GOOGL) in top spots.

FFA Top Ten Holdings (First Trust)

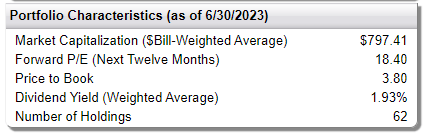

AAPL and MSFT make up significant positions in the fund at over 21% alone. This was up from the under 19% weighting earlier in the year. That’s why the portfolio could be considered fairly narrowly focused despite having 62 total holdings.

That said, the forward P/E of the fund is at 18.4x. NVIDIA (NVDA) had been a holding in the fund earlier in the year but has since been removed. With its forward P/E of almost 60x, that alone would have skewed the ratio higher. Of course, earnings for NVDA are expected and have been growing rapidly, which can justify higher multiples in some cases. So if anything, it would appear that FFA has become a bit more value-oriented since our previous update.

FFA Portfolio Characteristics (First Trust)

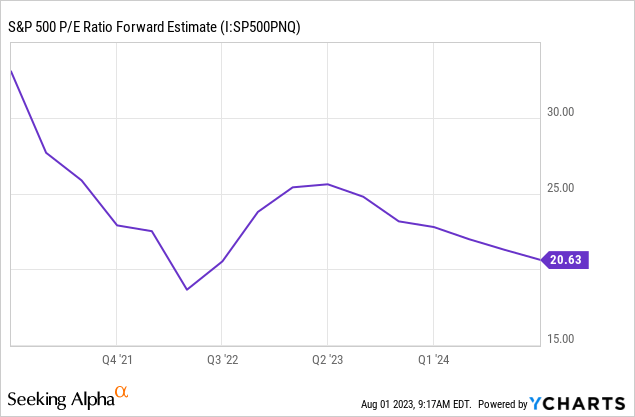

That Forward P/E could be considered historically expensive, but it’s still relatively cheaper than the S&P 500

YCharts

Conclusion

FFA is a solid call writing fund that writes against both individual positions and indexes in an actively managed approach – meaning they don’t target a specific overwrite target of their portfolio. With a partial overwrite strategy, there can often be more upside potential, as call writing can sometimes cap the upside, as history has shown during bull markets. The fund is also in a position to continue paying its attractive quarterly distribution or potentially even increase it as the NAV rate has moderated out with a recovery this year. All that being said, the fund’s valuation is the main drawback for the fund currently and makes it a less compelling investment option for investors wanting to initiate a position.