Bill Oxford/E+ via Getty Images

Ferguson’s (NYSE:FERG) stock on Tuesday rose as much as 4.9% after the distributor of plumbing and heating supplies reported results that beat the average estimates of Wall Street analysts.

Net income rose to $584 million, or $2.85 a share, from $580 million, or $2.72 a share, for its fiscal Q4 a year earlier.

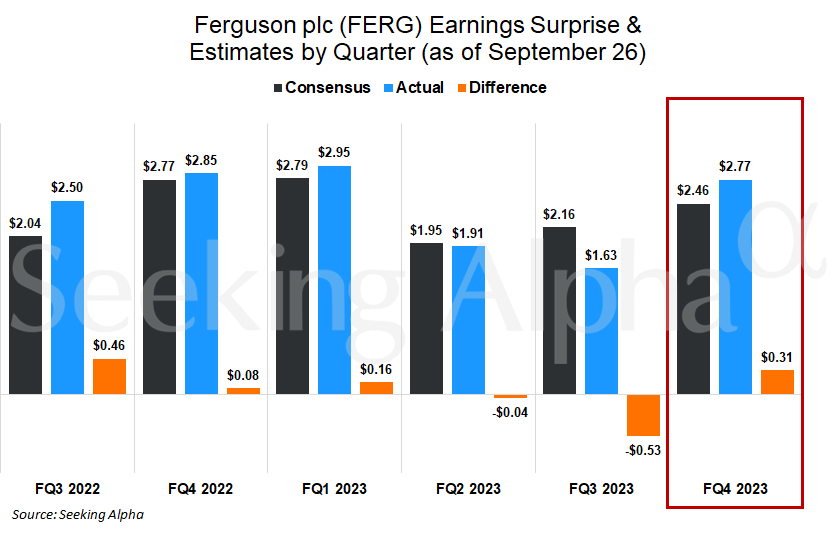

Adjusted EPS of $2.77 beat the consensus estimate of $2.46 for the three-month period ended July 31.

Sales fell 1.7%, or by 5.3% on an organic basis that excludes the effects of foreign exchange, from a year earlier to $7.84 billion. The consensus forecast was $7.57 billion.

Management forecast that net sales for full-year 2024 will be “broadly flat” with the prior year’s.

“FY2024 financial guidance reflects a continued challenging market backdrop, particularly in the first half of our fiscal year against strong prior-year comparables,” Kevin Murphy, CEO of Ferguson (FERG), said in a statement. “Our balanced end market exposure positions us well to leverage emerging multi-year structural tailwinds such as non-residential megaprojects.”