joebelanger/iStock via Getty Images

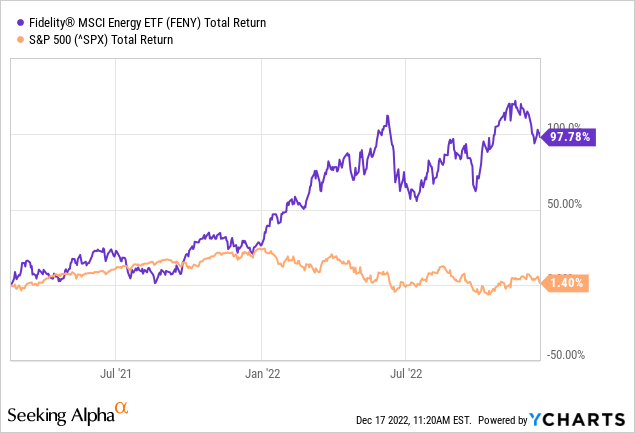

Back in October of 2021, I advised investors to BUY shares of the Fidelity MSCI Energy Index ETF (NYSEARCA:FENY) as the U.S. and the world began to emerge from the drastic demand destruction as a result of the global pandemic (see FENY: A Reopening Thesis). Shares have returned 105% since that time – significantly outperforming the broad S&P500 (see graphic below). And while I still believe there are attractive investment opportunities in the energy sector, I also doubt that performance will be repeated over the next 12-months. Today, I’ll take another look at the FENY ETF and opine on how the global energy markets – as well as the global economic outlook – have changed significantly over the past year.

Investment Thesis

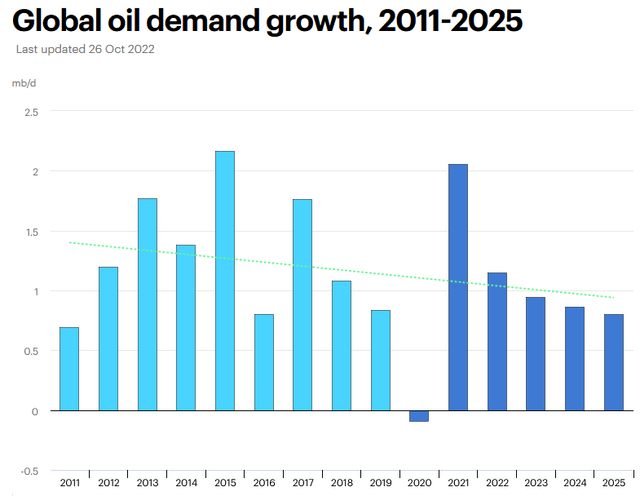

As the old saying goes: “May you live in interesting times.” No doubt – and times change. And they change rapidly in today’s world. The global energy market and global economy have also changed considerably since my “reopening thesis” article on the FENY ETF back in February of 2021. Today, the world (ex-China …) has – relatively speaking – come to grips with Covid-19 and global O&G demand growth has come roaring back from the drastic demand destruction seen in 2020, the “year of the pandemic”:

IEA

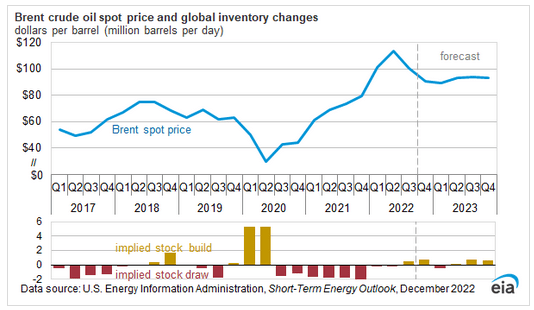

Yet as you can see from the trend-line (green dotted line), global oil demand growth is trending downward and is expected to keep trending downward in the years to come. Meantime, the price of the global oil benchmark (Brent) is expected to remain elevated next year – in the range of $80-$100/bbl:

EIA

That is certainly a high enough price for oil producers to earn big profits and continue the strong free-cash-flow generation they have enjoyed this year. However, that relatively high price for oil means high global gasoline and diesel prices – which will likely to only accelerate the EV transition and, by doing so, likely bend the global oil demand growth trend-line shown earlier to bend more sharply toward the “0” line. That is, I would expect global oil demand growth to peak prior to 2030, which also happens to be the year that EVs are expected to represent 50%+ (per Bloomberg) of all new vehicle sales on the planet. The IEA is even more bullish on EV sales and predicts EV will account for 60% of new vehicle sales by 2030.

Yet, in the short-term, O&G producers will continue to do quite well in the short-term – mostly due to Putin’s horrific war-of-choice on Ukraine that broke the global energy & food supply chains. However, that war has also resulted in massive global inflation and higher interest rates across the globe. Combine that with China’s re-opening struggles and President Xi’s refusal to embrace Western mRNA vaccines, and the global economy is struggling to regain its footing. Global economic growth is slowing.

China is now the planet’s #1 importer of oil. That being the case, China’s recovery from Covid-19 is a primary factor for oil demand growth (and the global economy …) going forward. Right now, the jury is out on just how successful China might be with its Covid-19 “reopening” plans.

Top-10 Holdings

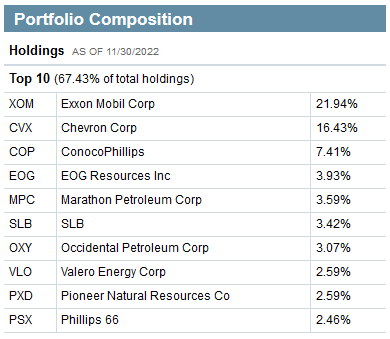

As you can see from the list holdings shown below, which were taken directly from the Fidelity FENY ETF webpage, the top-10 holdings in the FENY equate to a relatively concentrated 67.4% of the entire 118 company portfolio:

Fidelity

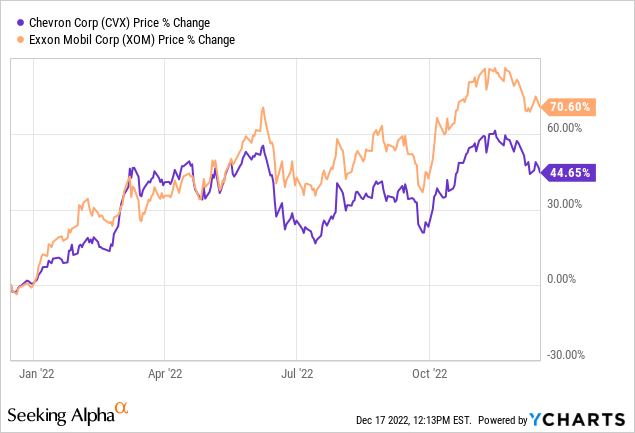

In addition, ~38.5% of the fund is allocated to the top-2 holdings, which also happen to be the two biggest oil & gas companies in the U.S.: Exxon (XOM) and Chevron (CVX). Both have been massive beneficiaries of Putin’s invasion of Ukraine and the resulting increase in global oil & gas prices:

Exxon currently yields 3.5% and Chevron 3.4%. As I reported in my recent Seeking Alpha article Investing in the Age of Energy Abundance, Exxon continues to ramp up its prolific Guyana play, which during Q3 rose to 360,000 boe/d. The current plan is to grow Guyana production to 1 million boe/d by 2030. Using a recoverable reserves estimate of 11 billion boe, a 1 million boe/d production rate would last 30+ years.

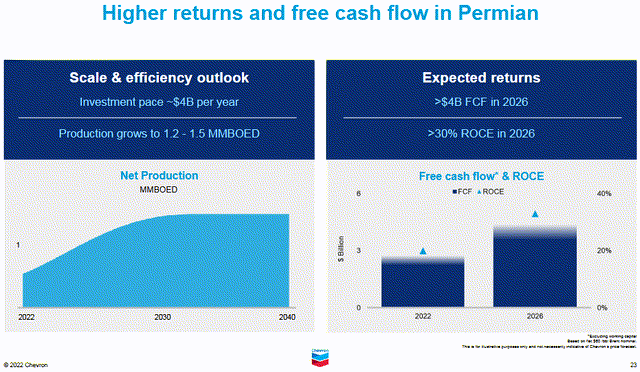

Meantime, Chevron plans to grow Permian production to 1 million boe/d by 2025 before leveling off to between 1.2-1.5 million boe/d out to 2040:

Chevron

The #3 holding with a 7.4% stake is ConocoPhillips (COP). Along with Occidental Petroleum (OXY), EOG Resources (EOG), and Pioneer Natural Resources (PXD), the fund’s top-10 holdings has 17% of the fund allocated to companies that get the majority of their production from domestic shale plays. As I have been reporting Seeking Alpha, these companies have been generating huge free-cash-flow this year with oil prices more than 2x their breakeven price of under $40/bbl WTI (see here, here, and here). As a result, they are rewarding shareholders with strong dividends and share buybacks. For instance, COP generated $4.7 billion of FCF in Q3 alone while total dividends declared and paid during FY22 total $4.49/share. At Friday’s close ($110.44), that equates to a yield of 4.1%. Indeed, in Q3 COP boosted its quarterly dividend by 11% and increased its existing share buyback program by $20 billion (to $45 billion).

The FENY ETF’s top-10 holdings also has 8.6% allocated to the refining sector through #5, #8, and #10 holdings Marathon Petroleum (MPC), Valero (VLO), and Phillips66 (PSX), respectively. Phillips66 has been killing it this year on strong diesel margins due to its higher than peer distillate yield.

Performance

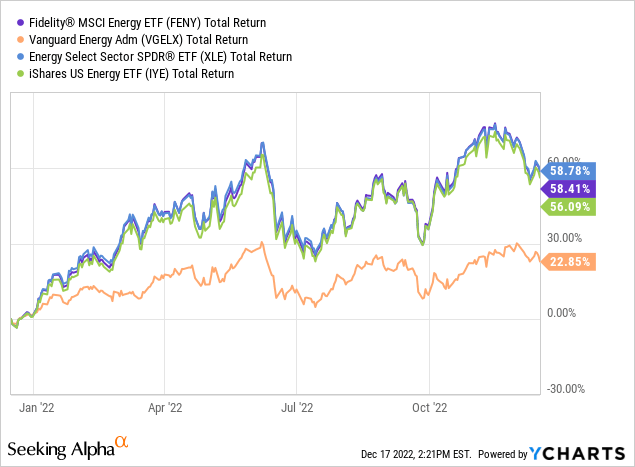

The 1-year total returns performance of the FENY ETF is shown below as compared to some of its peers: the Vanguard Energy Fund Admiral Shares Fund (VGELX), the Energy Select Sector SPDR ETF (XLE), and the iShares U.S. Energy ETF (IYE):

With the glaring exception of the VGELX fund, all of these ETFs have returned 56%+ over the past year, soundly thumping the S&P 500 – which has returned -16%.

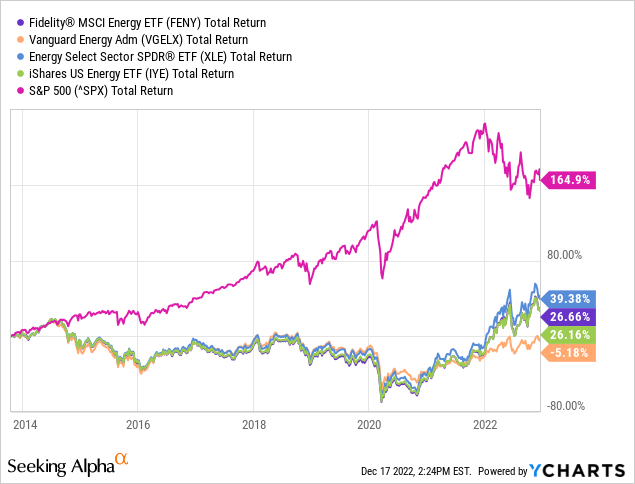

However, over the past decade the picture is much different:

The graphic above clearly shows the “lost decade” during which the idiotic “drill baby drill” strategy – where O&G companies sought to grow production into an already over-supplied market – destroyed $10s of billions of shareholder capital. Things are certainly different today. O&G producers are being very disciplined with spending – even during a time of war and as Americans are suffering from very high inflation and the resulting rapid rise in interest rates to fight that inflation.

Risks

The most obvious risk for O&G producers is lower prices for oil & gas. While demand pull from the EU will likely result in continued strong pricing for domestic natural gas producers, I am not as confident in the price of Brent. While the EIA estimate shown earlier (see graphic above) is quite bullish, it is not as certain as some might believe. That’s because much seems to be dependent on China’s reopening, and it seems to me the Chinese population – with very low exposure and natural immunity due to the previous “Zero Covid” policy – could be in for a massive increase in infections this winter. Meantime, Exxon keeps ramping up Guyana while significantly increasing its cap-ex budget this year, as did Chevron, much of which will go toward growing production in the Permian Basin.

Meantime, the U.S. Federal Reserve and other central banks are intent on reducing inflation. Higher interest rates have already dramatically and negatively impacted the housing market, and lay-off announcements are on the rise. That being the case, odds of a recession next year are rising. A recession would result in lower demand for oil and would put downward pressure on oil prices due to lower and slowing economic growth.

Bottom line: the downside risks for the energy sector have generally risen. Including on the dividends, FENY has a TTM yield of 3%. However, many of the shale companies now have base+variable dividend policies. If O&G prices and FCF were to drop next year, so too could FENY’s dividends as the variable dividends would likely be reduced.

Summary & Conclusion

In my opinion, the risks for the O&G sector have increased substantially as compared to the beginning of the year. While O&G companies have greatly benefited from Putin’s war-on-Ukraine and the subsequent breaking of the global energy supply-chain, the coming months will likely see much more of the negative consequences for these companies: continued high inflation, rising interest rates, and the negative impact of higher gasoline/diesel prices on global demand as consumer behavior continues to shift toward EVs.

I rate the FENY ETF a HOLD, but caution investors to pay close attention to Covid-19 outbreaks in China as they pertain to Chinese oil imports, as well as to U.S. economic data as the full-impact of high-inflation and rising interest rates continue to hammer the U.S. consumer.