Bruce Bennett

Introduction

I last wrote you about FedEx (NYSE:FDX) on January 17, 2019. This article is an update.

Since the article was published, FedEx investors enjoyed a 60% total return versus 69% via the S&P500. Given a difficult post-C19 macro backdrop and the current macro setup, I am pleased with the performance. I am a long-term investor.

seekingalpha.com

Nonetheless, the go-forward prognosis is what matters.

Updated Investment Thesis

FedEx is likely to generate alpha though improving metrics in two primary areas:

package volume, particularly for FedEx Express

expense management

FedEx package volume is largely a function of broad economic activity. Like most industrial enterprises, when the economy expands, so does the business. Despite uneven macro conditions, in recent years FedEx management has been able to maintain / grow revenue. The drag has been package volume. When the economy improves, package volume will improve. In turn, revenue will bounce.

Expense management has been the second challenge. Costs rose quickly during the C19 crisis. The TNT Express acquisition was an expense disaster. Senior management is now working to align expenses with the business. TNT Express integration costs are now over.

I expect to see good net-net results in FY2024.

Note: operational and financial data contained in this article sourced via the FedEx investor website.

Package Volume

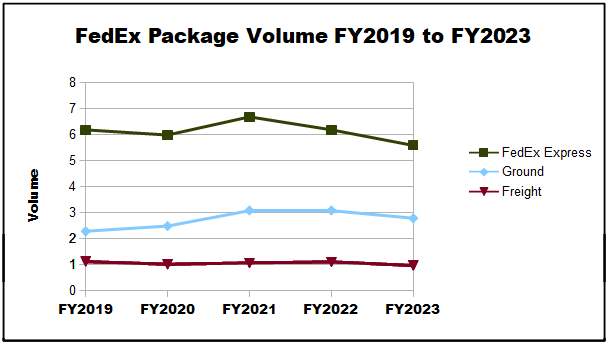

I did a little homework on FedEx package volume. A recap is shown on the chart below:

Author chart / using FedEx data

Unit volume nomenclature varies by segment. FedEx Express volume is measured by packages / day. Ground is measured by annual packages. Freight is measured by shipments / day. The chart shows year-over-year delta volumes for each segment.

Using 2019 as the baseline (pre-C19 crisis), we find all segments declined.

FedEx Express declined 9.7%

Ground increased 22%

Fright declined 13%

The chart illustrates the five-year trajectories of these segments. FedEx Express is the most pronounced. After cresting in FY2021, volumes fell 16 percent in the FY2023 which ended in May.

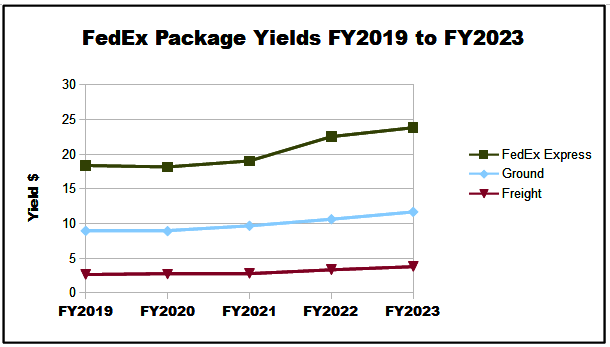

Next, let’s look at a comparable chart highlighting package yields:

Author chart / using FedEx data

In contrast to volume, package yields rose smartly.

Once again using 2019 as the baseline, all segments registered strong yield improvement:

FedEx Express increased 30%

Ground increased 30%

Freight increased 39%

My thesis includes the reason for volume declines were not due to increasing yields. I contend volume declines were a result of softening economies. Management alluded to this in the most recent conference call.

Investors should note FedEx just announced a price increase effective January 1, 2024. FedEx Express and Ground rates will increase 5.9 percent, while Freight will increase rates 5.9 percent to 6.9 percent.

Based upon management guidance, I do not expect a sharp rebound in FY2024 package volumes. However, for investors playing the long game, I believe we are in the late stages of an economic contraction. Once the economy inevitably turns, FedEx will enjoy increased package volumes.

At that time, FedEx will find volume improvement coupled higher package yields are likely to produce a “double whammy” revenue rebound.

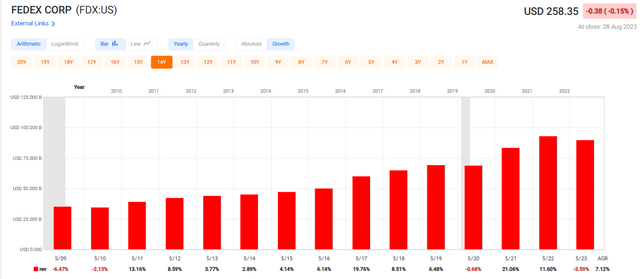

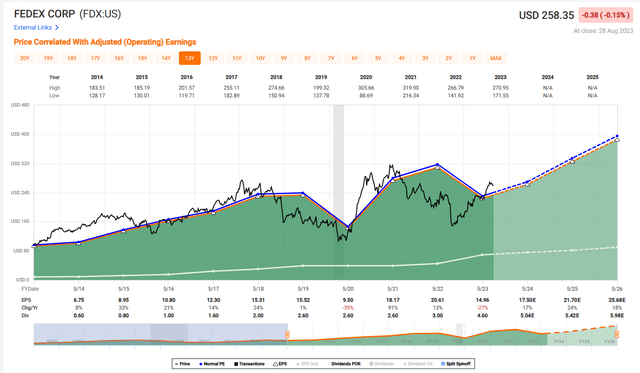

The following Fast graph chart offers long-term perspective:

fastgraphs.com

Historically, we see FedEx has experienced good, long-term revenue growth. Economic contractions slow sales growth for a year or two (see the red YoY markers at the bottom of the chart), but afterwards the upward trend resumes. Currently, one can argue we have been in a technical recession, despite not meeting the conventional definition thereof. Will 2024 be the breakout year? I don’t know, nor is my investment thesis predicated upon it.

My view is eventually the U.S. and other developed economies will revert to undeniable growth. When that happens, FedEx will be a major beneficiary.

Expense Management

The other focus issue for FedEx management (and investors) is expense control. In recent years costs have been too high.

There have been several reasons for this. Trying to manage expenses versus business expectations has been difficult for many companies in a post-C19 world. FedEx proved no exception. When demand jumped in 2021, FedEx geared up staff and equipment to meet it. The bubble was relatively short-lived. Now management is tasked with mopping up the mess.

In addition, the TNT Express acquisition was an unmitigated disaster. Notably, these integration expenses are no longer being called out. The TNT integration is now in the rear-view mirror.

Here’s a chart outlining a big picture; long-term operating (EBIT) margins.

fastgraphs.com

Operating margins tend to rise and fall cyclically.

Historically, FedEx works off 7% to 8% operating margins. Last fiscal year ended with a just a 5.9% marker.

To sharpen the point: since 2019, expenses rose 38 percent, while revenues improved only 29 percent. Negative operating leverage isn’t sustainable. Management gets it.

Here are FYQ42023 remarks by CEO Raj Subramaniam:

Additionally, we continue to aggressively manage headcount, including attrition to align our teams with the network changes underway. We exceeded our target with U.S. headcount down by about 29,000 in FY ‘23. Also included in these cost reductions are ramping benefits from the numerous initiatives we have identified across the 14 DRIVE domains. Given our progress, we are confident that we can deliver on our previous goal for about $1.8 billion in cost reduction benefits from DRIVE this fiscal year and $4 billion of permanent cost reductions in fiscal year 2025.

As we introduced in April, between now and June of 2024, we will be consolidating our operating companies into one unified organization. One FedEx is the next step of this journey to realize our full value potential.

In addition to the usual headcount and other cost-cutting efficiencies, a key comment is found at the end of the quote. (see italics)

FedEx plans to execute a structural change that’s been discussed for several years: consolidating FedEx Express, Ground and Freight segments into one organization. Prior CEO and FedEx founder Fred Smith appeared cool on it.

Current CEO Raj Subramaniam took the role effective June 1, 2022. Now the consolidation and anticipated expense efficiencies are on the front burner.

Indeed, why should FedEx Express and FedEx Ground trucks crisscross each other in the same neighborhood?

Guidance Confirms the Expense / Margin Glidepath

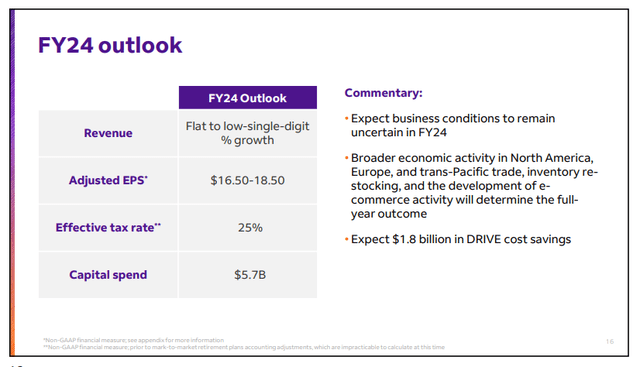

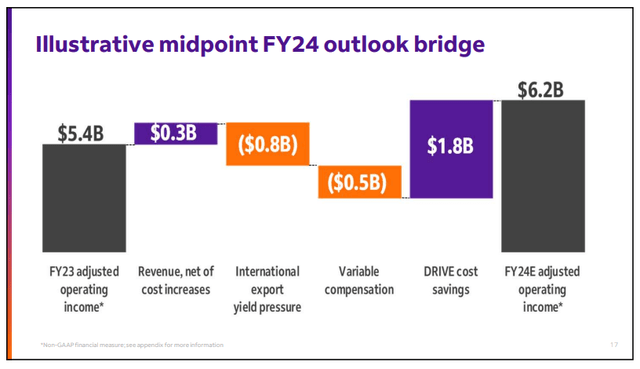

Indirectly, FedEx management offered FY2024 expense expectations in their guidance. Here’s two slides from the Q42023 earnings presentation:

investors.fedex.com investors.fedex.com

In FY2023, FedEx generated $90.2 billion revenue. In the upcoming year, management guided to $90.2 billion and $92.0 billion. That’s flat to up low single digits.

In the second chart, management forecast ~$6.2 billion EBIT, a 17 percent improvement versus the prior year.

Management is telegraphing a 6.7% to 6.8% operating margin. Since the operating income uplift isn’t expected to come from higher sales, it means the cost side of the equation is what’s contributing.

That’s a big boost and suggests the company is on the way back to more historical 7% to 8% margins.

A Kicker

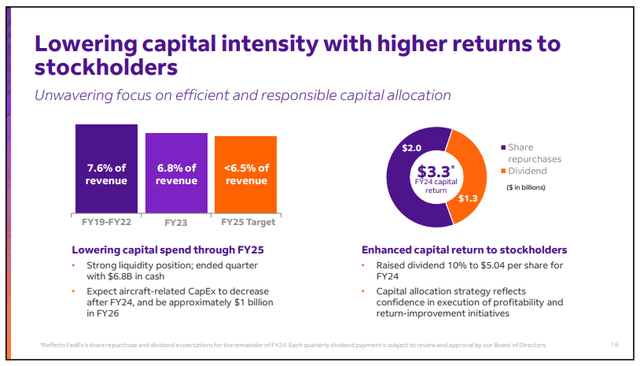

In addition to a transition to historical operating margins, management told investors to expect a reduction in capital intensity. See “Capital Spend” on the first guidance chart above.

Back in 2019, FedEx embarked upon a major capex spend on facilities and airplanes. The Street hated it. FY2023 marked a transition.

investors.fedex.com

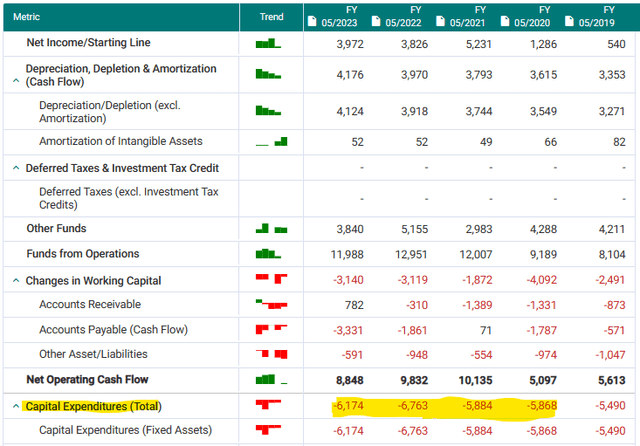

Spending $5.7 billion capex in FY2024 is a step-down from prior years. See the following summary financial statement via Fast graphs:

fastgraphs.com

Presuming management meets its own guidance, FY2024 will see FedEx spend less capital than any year since 2019. The capex intensity reduction is forecast to last through FY2025. Lower capital expenditures beat a path to higher free cash flow. Higher free cash flow often lead to better valuation multiples.

Summary

Since my 2019 article, FedEx stock has provided adequate total returns in the face of a difficult macro environment. Going forward, I believe there are two major items that, if fulfilled and executed, will enable the company to improve earnings meaningfully. These are improving package volumes and reducing expenses.

Volume

Package volume growth is not entirely within management’s control. However, improving economies tend to portend better volumes. Volume growth coupled with increasing package yields are a strong recipe for top line growth.

On the other hand, yields may be controlled by management; effective January 1, 2024, FedEx announced a general ~6 percent increase on top of routine increases in prior years.

Expenses

Curbing expenses is well within management’s purview. Based upon 2024 guidance, senior leadership expects meaningful expense reduction and a corresponding improvement in operating margin; setting up a glide path to restore historical 7% to 8% margins.

Investor Expectations

From here, I do not expect to see FedEx stock move quickly. Shares have seen a good run and may pause as the Street waits for more data points. The fiscal year 1Q2024 earnings report is scheduled for September 20, 2023.

However, for patient investors, I remain constructive on the shares. I am positive about the new CEO. I contend FDX is poised for good gains, presuming management execution and a general improvement in the American and developed global economies.

fastgraphs.com

A twelve-to-eighteen-month price target of $326 is predicated upon the foregoing chart: $21.70 EPS in FY2025 and a 15x P/E multiple. Off a current $258 bid, this suggests 26% capital appreciation.

An approximate 2% dividend yield is modest, but the payout has grown by about 18% per year over the past five years. FDX is a strong dividend growth stock.

Please do your own careful due diligence before making any investment decision. This article is not a recommendation to buy or sell any stock. Good luck with all your 2023 investments.