Andrew Harnik

Fed chairman Jerome Powell gave his speech at Jackson Gap, Wyoming this previous Friday.

The takeaway from this speech is as follows:

“The time has come for coverage to regulate.”

“The route of journey is obvious, and the timing and tempo of price cuts will rely upon incoming information, the evolving outlook, and the stability of dangers.”

However, Mr. Powell finally ends up warning us,

“The boundaries of our information demand humility and a questioning spirit targeted on studying classes from the previous and making use of them flexibly to our present challenges.”

The underside line: the Fed will start to regulate its coverage, however…and it is a essential “however”…we, the Fed, will work this coverage out relying upon…one…incoming information…two…the evolving outlook…and three…the stability of dangers.

Mr. Powell, no matter coverage he was selling, has at all times tried to err on one aspect of the state of affairs or the opposite.

When Mr. Powell and the Fed have been attempting to supply reserves to the banking system to battle the disruptions of the Covid-19 pandemic and the next recession, Mr. Powell and the Fed continuously labored to err on the aspect of offering too many reserves in order to cut back the likelihood that the economic system would change into extra of a catastrophe.

As Mr. Powell and the Fed fought inflation over the previous two years or so, Mr. Powell and the Fed have at all times tried to err on the aspect of being tight for a really lengthy time period. The Fed has been conducting its coverage of quantitative tightening for twenty-nine months.

In adjusting at the moment to a brand new stance, Mr. Powell desires to make it possible for he and the Fed are doing the fitting factor for a enough period of time.

So, Mr. Powell and the Fed usually are not going to rush proper into a significant motion into decrease rates of interest.

Mr. Powell and the Fed are going to “really feel” their method into the longer term.

However, the longer term seems to be one the place the Fed’s coverage price of curiosity is falling.

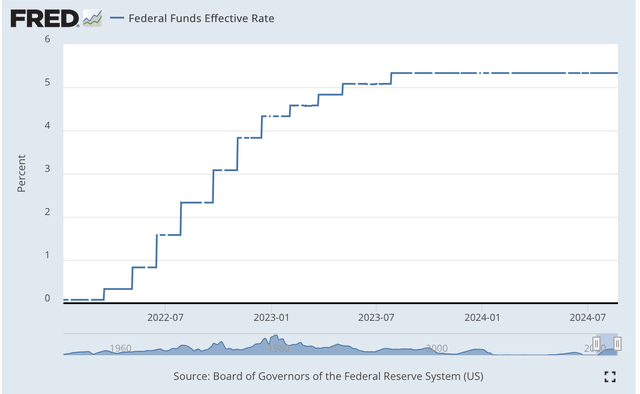

Right here is the image of how the Fed moved up the efficient Federal Funds price over the previous two years.

Federal Funds Efficient Fee (Federal Reserve)

The final motion on this coverage price was in late July 2023. So, this coverage price, an efficient price of 5.33 %, has been in existence for a couple of 12 months.

The Fed coverage has been composed of two components: first, the motion taken, and second, the “ahead steering” that Federal Reserve officers give the markets.

This strategy has, at the moment, introduced traders’ inflationary expectations all the way down to 2.1 % for the subsequent five- to ten-year interval.

So, Fed actions on this a part of the monetary markets have seemingly satisfied the funding group that the Fed is critical about reaching the Fed’s 2.0 % goal for inflation within the economic system.

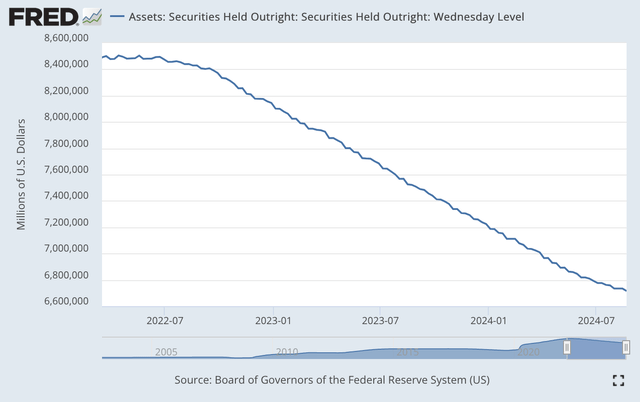

However, this isn’t all that the Federal Reserve has completed over the previous twenty-nine months. The Federal Reserve has additionally performed a coverage of quantitative tightening, the place it has labored to cut back the scale of the Fed’s securities portfolio.

Right here is the Fed’s efficiency over the previous twenty-nine months. The overall discount within the Federal Reserve portfolio has been slightly below $1.8 trillion. As could be seen, this discount has occurred in a really regular and protracted method.

Securities Held Outright (Federal Reserve)

Since June, the Fed has decreased the quantity of securities it’s letting run off the Fed’s stability sheet.

Nonetheless, the Fed has greater than $3.0 trillion of securities in its portfolio than it did on the finish of the time it started to pump reserves into the banking system to fight the consequences of the Covid-19 pandemic and the next recession.

The query has at all times been about when the Fed’s securities portfolio was going to return to a “extra regular” degree. May Mr. Powell and the Federal Reserve start a “new” regime of “quantitative” coverage as they transfer ahead and “regulate”?

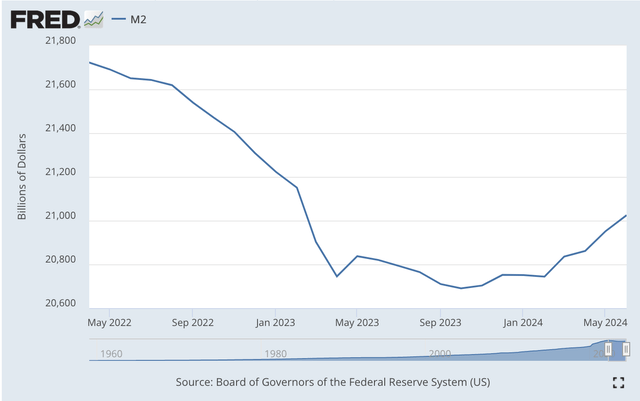

Then there’s a third concern that gaining the eye of analysts today and that’s the concern over the discount within the price of development of the M2 cash inventory.

The M2 cash inventory has been declining since April 2022. The U.S. economic system has by no means gone by means of a interval of financial contraction this lengthy with out an financial recession going down.

M2 Cash Inventory (Federal Reserve)

Economists and market members are getting nervous over the opportunity of a recession taking place due to what the Federal Reserve has completed.

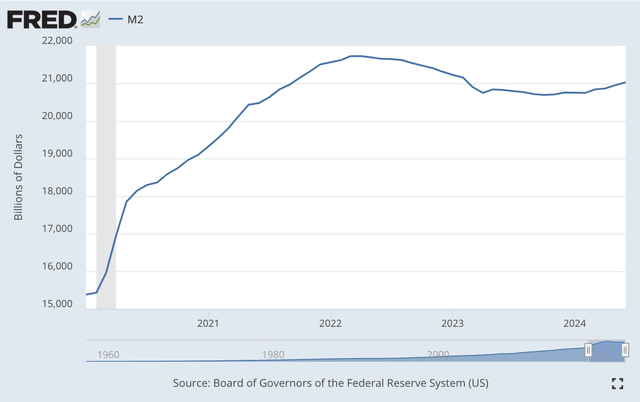

As readers of my posts know, I’m not as involved with this risk due to all the cash the Federal Reserve pumped into the economic system because it was combating the disturbances brought on by the Covid-19 pandemic and following recession.

I imagine that we have to add a number of earlier months to the above chart.

M2 Cash Inventory (Federal Reserve)

This image, I imagine, places the present discount within the M2 cash inventory into the correct perspective.

The compound annual price of development of the M2 cash inventory throughout this time of growth is over 8.0 %.

Traditionally, this places the present interval into the category of “extreme” financial development.

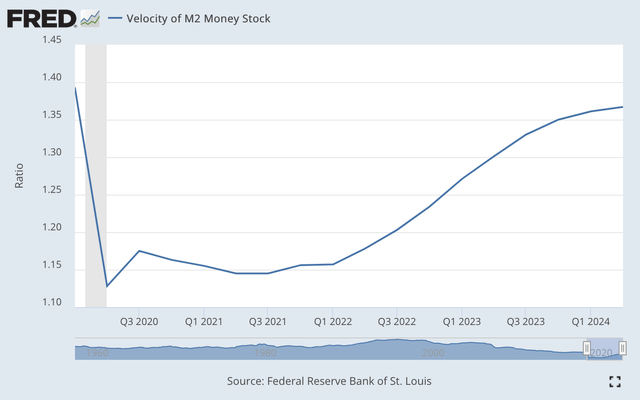

The one motive, seemingly, that inflation didn’t get extra “out-of-hand” is that folks didn’t use the cash inventory on the similar tempo that they previously had completed. That’s the velocity of financial circulation fell.

Velocity of M2 Cash Inventory (Federal Reserve)

Though the speed of circulation of the M2 cash inventory has picked up, it has nonetheless not returned to earlier ranges.

As a consequence, as I’ve often been writing about, there’s some huge cash “mendacity round” within the monetary system.

For instance, the business banking system has about $3.3 trillion in “vault money.”

That is one motive that the U.S. economic system remains to be acting at a comparatively passable price, and it’s also the explanation why the inventory market has hit all of the “historic highs” it did whereas the Federal Reserve was conducting a coverage of quantitative tightening.

In actual fact, Mr. Powell, in his Jackson Gap speech, opinions the state of the economic system and professes that the economic system is in a comparatively good place.

Financial development, in keeping with Mr. Powell, “continues…at a strong tempo.”

“Costs have risen 2.5 % over the previous 12 months.”

“The labor market has cooled significantly from its previously overheated state.” That is the results of “a considerable improve within the provide of employees and a slowdown from the beforehand frantic tempo of hiring.” Not that dangerous.

So, the economic system is in fairly good condition, however there are points within the monetary sector that should be handled.

It’s a time for coverage adjustment.

However, Mr. Powell reiterates, the Federal Reserve shouldn’t go overboard in attempting to get every part proper within the subsequent few months.

The Federal Reserve will transfer…however, simply do not count on it to maneuver too quickly.