mgkaya

Will the Federal Reserve decrease its coverage fee of curiosity or not?

That’s the query.

However, as I preserve writing, is that actually the query that we must be asking?

Some analysts are taking an extended have a look at the actions within the M2 cash inventory.

Issues right here is that the M2 cash inventory has been declining for a considerable time frame.

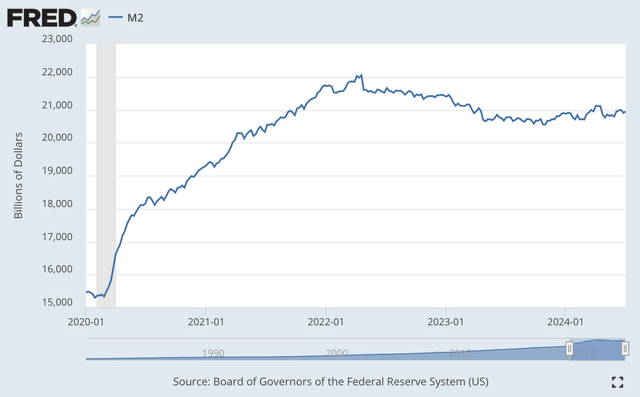

Let us take a look at the chart.

M2 Cash Inventory (Federal Reserve)

The height of the M2 cash inventory numbers comes within the week of April 18, 2022…only a few weeks after the Fed begins its present efforts of quantitative tightening.

The M2 cash inventory reached $22,048.8 billion in that week.

within the week of July 1, 2024, the M2 cash inventory totaled $20,947.5 billion, down $1,101.3 billion from the height.

This 5.0 % downward motion within the M2 cash inventory came visiting 27 months.

Traditionally, this size of a downturn in cash inventory development was related to an financial recession.

The issue with this conclusion is that over the previous 4 years, ending within the first week of July 2024, the annual compound fee of development of the M2 cash inventory was greater than 8.0 %.

This fee of development of the M2 cash inventory may very well be related to a interval of considerable inflation. And, the U.S. financial system has skilled a interval of inflation throughout this time interval.

However, the query may then be requested, why wasn’t inflation over this time interval worse than was skilled?

The reply is that folks didn’t spend cash throughout this era as quickly as that they had executed earlier than.

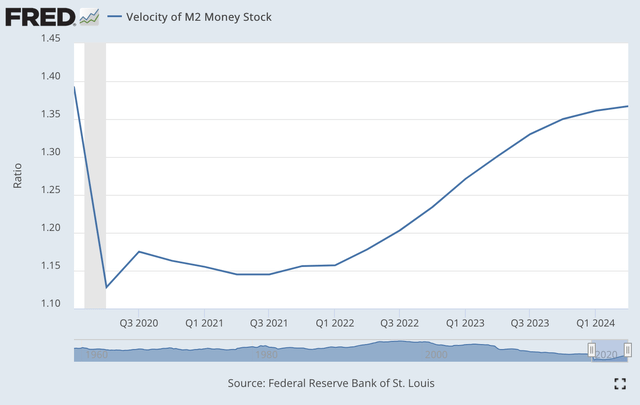

Let’s now check out the rate of circulation for the M2 cash inventory.

Velocity of M2 Cash Inventory (Federal Reserve)

As could be seen, whereas the M2 Cash Inventory was rising very, very quickly, the turnover of the cash inventory dropped precipitously through the quick recession coming in 2020 and solely moved again modestly till the Fed started its effort at quantitative tightening.

As soon as the quantitative tightening started, the M2 velocity of circulation started rising.

Nevertheless, the M2 velocity has not reached the extent it was at simply earlier than the newest recession.

In impact, the M2 cash inventory has grown very, very quickly over the previous 4 years, however…the M2 cash inventory has probably not been “turned over” the way in which it has up to now.

The M2 cash inventory has grown considerably like a “bubble” however the financial system has probably not felt the total “thrust” of this rise within the M2 cash inventory as much as this time limit.

Sure, the Federal Reserve has executed some work to take away all of the reserve cash it despatched into the financial system, but when folks actually had been spending cash on the fee that that they had up to now…if the rate of circulation had remained at ranges reached earlier than the final recession…inflation would have been a lot, a lot worse.

And, if the rate of circulation continues to rise and regain the extent it was at earlier than the final recession…nicely…inflation may start to speed up once more.

It is a cause why the Federal Reserve wants to take care of the next stage of its coverage fee of curiosity.

If the rate of circulation continues to rise, look out inflation!!!

Quantitative Tightening

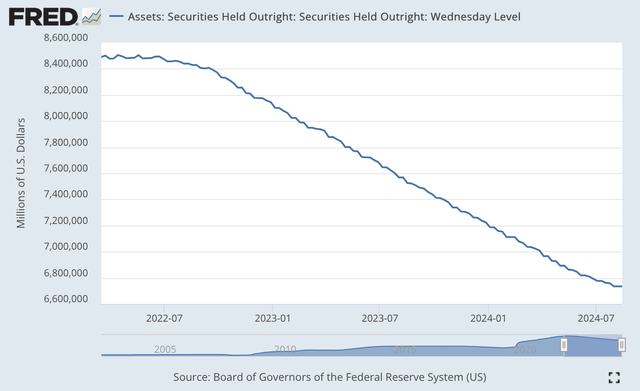

So, what’s the Federal Reserve doing about its quantitative tightening stance?

Earlier the Fed indicated that it’d start decreasing the quantity that it was decreasing the securities portfolio by every month.

The beginning date appeared to be round June 2024.

From June 6, 2024, to August 14, 2024, the Fed’s securities portfolio has solely declined by $84.0 billion.

Securities Held Outright (Federal Reserve)

One can’t actually see the shift clearly from this chart, however, the curve appears to be flattening out on the far right-hand nook.

It seems to be just like the Fed is doing a bit little bit of “slowing down” within the discount effort.

If the Fed has actually slowed down this discount marketing campaign, part I of the quantitative tightening was carried via from the center of March 2022 till the top of Might 2024… twenty-six months.

It is a very prolonged interval of financial “tightening.”

And, now part II of the quantitative tightening started in June 2024, so we’re within the third month of this part.

Nevertheless, the massive query that continues to be is…how way more “tightening” does the Federal Reserve need to do?

The Federal created the massive “bubble” in reserves famous above. That’s what acquired the M2 cash inventory rising.

If the rate of circulation of the M2 cash inventory continues to select up…inflation charges may take off once more.

That is the very last thing the Federal Reserve would need, particularly in any case the trouble it has put into the quantitative tightening of the previous two years, plus.

If one seems to be on the inflation image from this angle, the Fed seems to be prefer it nonetheless has a bit of labor left to do.

Possibly reducing the coverage fee of curiosity may kick off an perspective change within the financial system, one which kicks off an increase within the velocity of circulation…an increase that may certainly lead to a rise within the inflation fee.

It simply appears to me that the Federal Reserve will not be anyplace near “declaring victory” and shifting on to larger financial ease and decrease rates of interest.

The reality is…the Federal Reserve pumped heaps and many cash into the monetary system to fight the issues related to the Covid-19 pandemic and the next recession.

The Fed has executed nicely to date…however, there stay heaps and many “extra funds” hanging round within the financial system that would set off the inflation button as soon as once more.

Buyers?

Properly, buyers have been ready for the Fed to begin reducing its coverage fee of curiosity.

The watch for a transfer has prolonged nicely past the time that buyers believed that adjustments would begin to be made.

But inventory costs continued to rise.

Why did inventory costs proceed to rise?

Due to all the cash that also exists inside the monetary system.

Buyers have continued to guess on shares, regardless that the Federal Reserve has gone via greater than two years of quantitative tightening.

My feeling is that until one thing else occurs to generate a response, a technique or one other by the Fed

is that the Fed will “carry on, keepin’ on” to proceed the discount of its securities portfolio, with perhaps an rate of interest discount right here or there.

If the Fed continues on this means, I see no cause for buyers to cease placing cash within the inventory market…and inventory costs will proceed to hit new historic highs.