Unlock the White Home Watch publication free of charge

Your information to what the 2024 US election means for Washington and the world

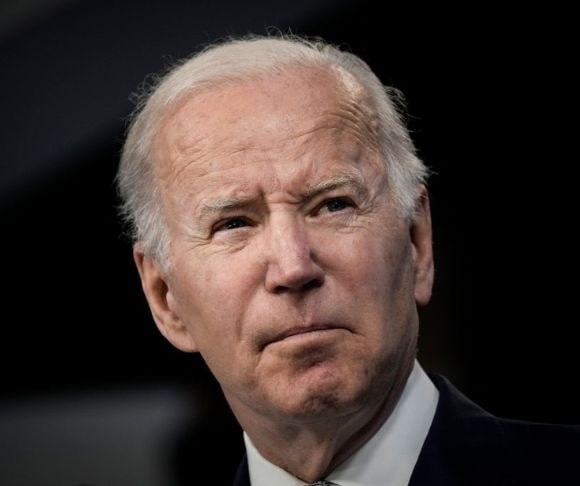

The Federal Reserve has left US rates of interest on maintain and has signalled that it’s in no rush to regulate financial coverage, defying strain from President Donald Trump for deep reductions in borrowing prices.

The central financial institution on Wednesday saved its primary rate of interest at 4.25-4.5 per cent and indicated it was now on pause, with Fed chair Jay Powell saying US rate-setters “don’t must be in a rush to regulate our coverage stance”.

The unanimous resolution got here simply days after Trump insisted that borrowing prices ought to fall “loads” and vowed to “let it’s recognized” if he disagreed with the central financial institution’s resolution.

The Federal Open Market Committee, the central financial institution’s policy-setting panel, stated in its resolution that US inflation remained “considerably elevated” and eliminated an earlier reference noting “progress” in direction of hitting its 2 per cent objective. Powell later clarified that the modifications mirrored a “cleaning-up train” relatively than a shift in coverage.

The Fed’s assertion “tilts a bit of bit hawkish”, stated Sarah Home, senior economist at Wells Fargo. “This can be a Fed that’s much less apprehensive in regards to the state of the labour market.”

The pause adopted three consecutive cuts — together with a 0.5 share level transfer in September — that took the federal funds goal vary down from a 23-year excessive of 5.25-5.5 per cent.

Powell signalled that rates of interest would stay on maintain till the FOMC had extra time to evaluate how Trump’s pledges to lift commerce obstacles, slash taxes and pink tape, and undertake mass deportations would have an effect on its efforts to chill inflation.

The Fed chair stated the brand new administration’s insurance policies had been “not for us to criticise, or to reward”.

He additionally refused to react to Trump’s requires the Fed to scale back borrowing prices considerably, saying he was “not going to have any response or touch upon what the president stated”.

“This fee resolution, which was actually the one viable selection the Fed had at this juncture, will cue the political strain,” stated Eswar Prasad, a professor at Cornell College. “The approaching months will likely be terribly difficult for the Fed if inflation stays sticky above its goal degree at the same time as Trump piles on intense strain to chop charges and produce down borrowing prices.”

US markets broadly took the Fed’s resolution in stride, with authorities bonds coming below reasonable promoting strain.

The policy-sensitive two-year Treasury yield was 0.03 share factors larger at 4.23 per cent by the late afternoon in New York, whereas the benchmark 10-year yield was flat at 4.55 per cent. Yields rise as costs fall.

In fairness markets, the S&P 500 was 0.5 per cent decrease. The technology-heavy Nasdaq Composite was down by an analogous margin, after trimming a few of its losses throughout Powell’s press convention.