Key Takeaways

- The Fed is anticipated to decrease rates of interest by 25 foundation factors to a spread of 4.25% to 4.5%.

- Elevated market instability is feasible because the occasion looms.

Share this text

The Federal Reserve is scheduled to announce its rate of interest resolution throughout its assembly on Wednesday. Economists broadly predict that the Fed will minimize charges for the third time in a row, bringing the federal funds charge right down to a goal vary of 4.25% to 4.5%.

One other 25-basis-point charge minimize would lead to a complete discount of 1 full proportion level since September. The federal financial institution first diminished rates of interest by 0.5 proportion factors in September after which made one other minimize of 0.25 proportion factors in November.

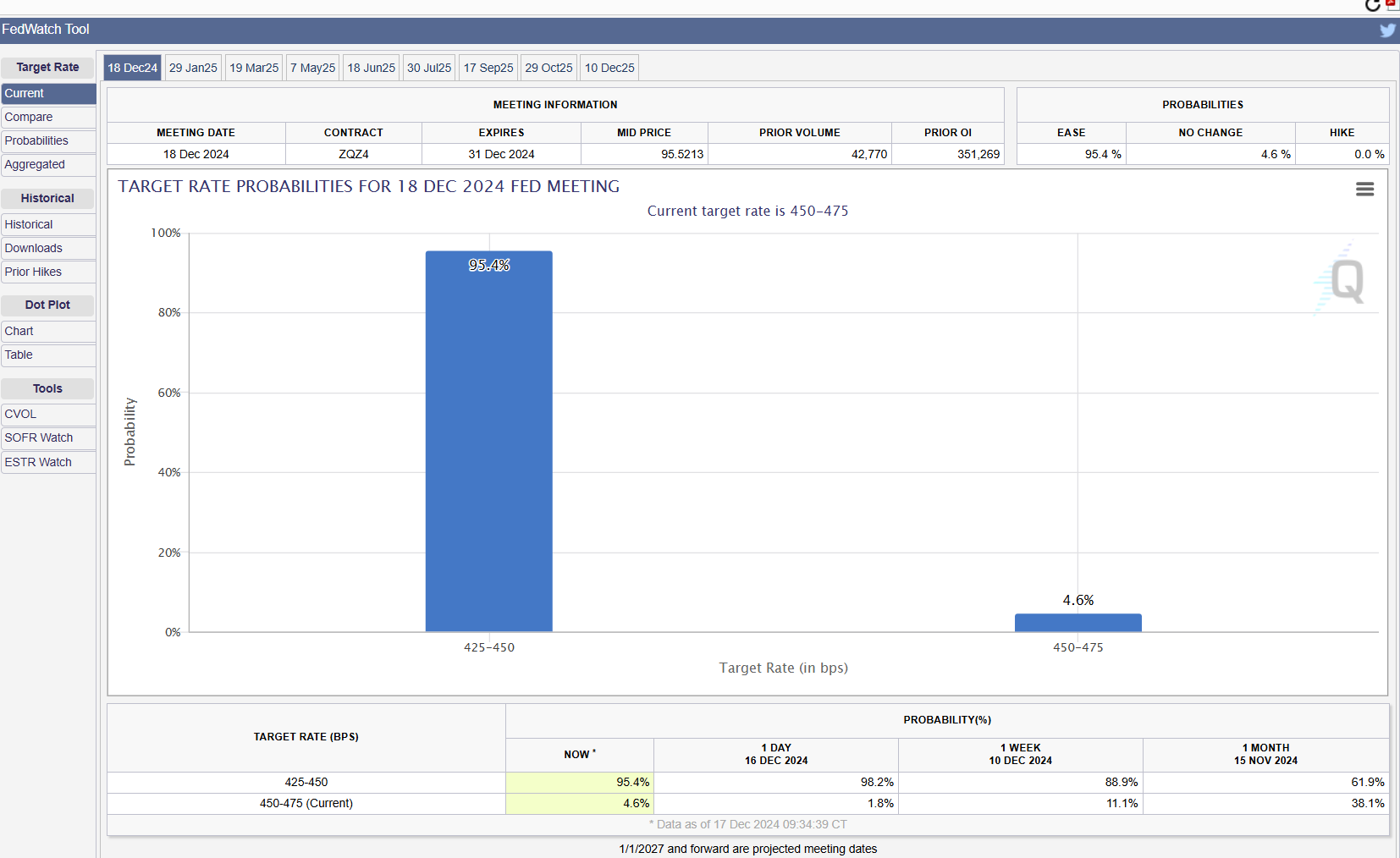

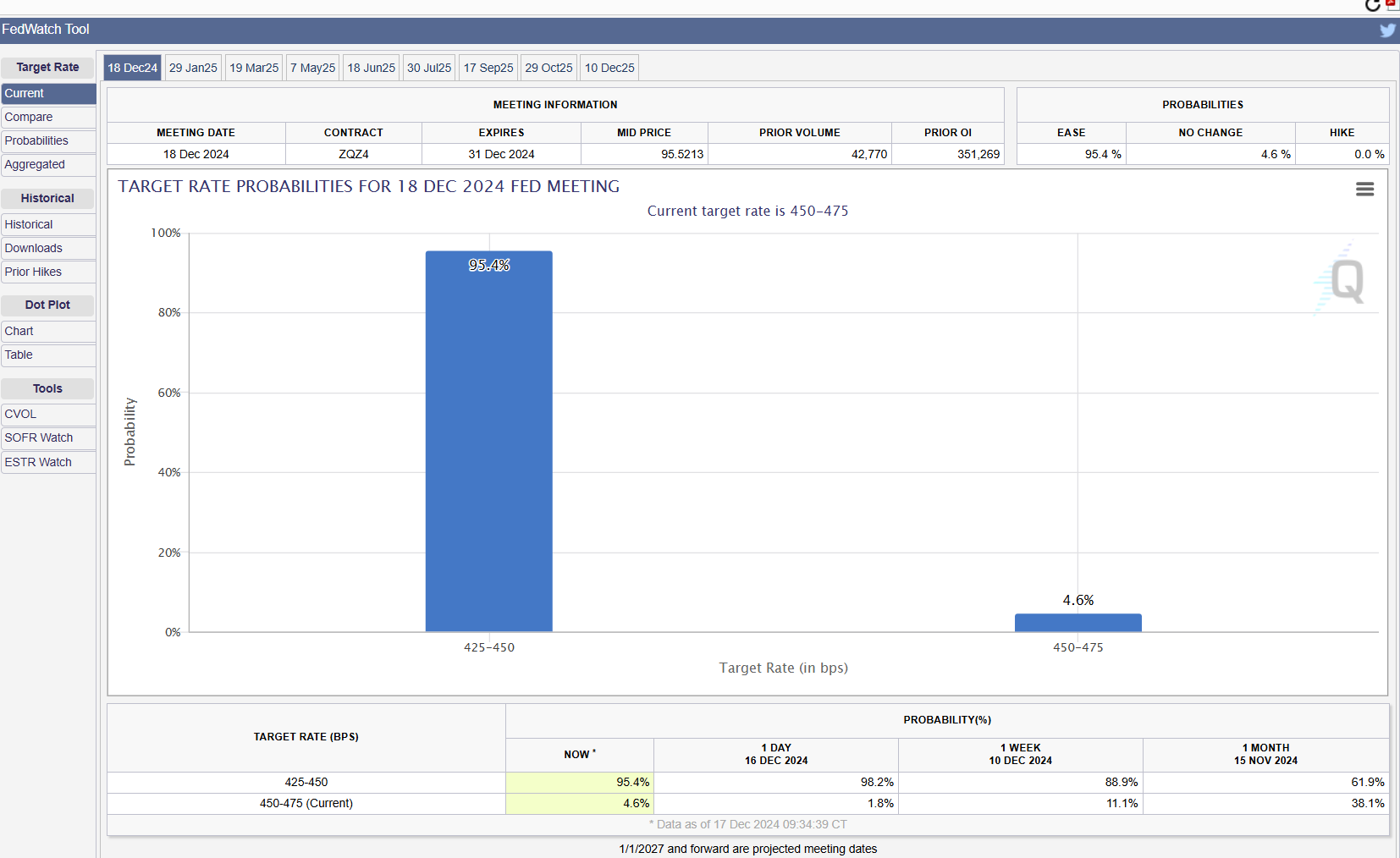

In accordance with the CME FedWatch Instrument, there’s now a 95.4% likelihood of a 25-basis-point charge minimize, whereas the chance of sustaining present charges stands at 4.6%. This displays a slight adjustment from yesterday, when the probability of a charge minimize was round 98%.

Nonetheless, in comparison with final week, expectations for a charge discount have strengthened, significantly after November’s inflation information met expectations and job figures confirmed energy.

In accordance with the Bureau of Labor Statistics (BLS), the US economic system added 227,000 jobs in November, exceeding expectations and displaying a rebound from months disrupted by hurricanes and strikes.

Job development has been strong, significantly in sectors reminiscent of well being care and tourism. Strong job good points contribute to a constructive financial outlook, which may affect the Fed’s decision-making relating to rates of interest.

Final week, the BLS reported that November’s CPI elevated by 2.7% year-over-year, in step with expectations. Instantly after the report, the chances of a charge minimize in December rose to roughly 96%.

Future charge cuts are much less possible

Inflationary pressures have stabilized, however have but to return to desired ranges. The Fed has been working to convey down inflation from a peak of 9.1% in June 2022, and whereas there was progress, the present charge continues to be above their goal of two%.

Jacob Channel, senior economist at LendingTree, stated in a press release to CBS Information that the Fed will possible proceed with a 25-basis-point minimize at its upcoming assembly, however there will not be additional cuts within the speedy future.

The economist additionally famous potential modifications in financial insurance policies beneath President-elect Donald Trump, which “would possibly trigger a resurgence in inflation or in any other case throw the economic system off steadiness.” On this state of affairs, the Fed might select to carry off on additional charge cuts to evaluate their results on the economic system.

Crypto markets brace for volatility forward of Fed charge resolution

The crypto markets are bracing for elevated volatility because the Federal Reserve’s rate of interest resolution attracts close to. Bitcoin (BTC) has fallen by 2% within the final 24 hours, whereas Ethereum (ETH) has dropped by 4%, in line with CoinGecko information.

The general crypto market capitalization at the moment stands at $3.8 trillion, reflecting a 4% decline over the previous day.

Bitcoin dipped to $104,000 after peaking at $107,000 on Tuesday. The pullback triggered a broader decline in altcoins, with Ripple (XRP), Solana (SOL), Doge (DOGE), and Binance Coin (BNB) additionally experiencing slight losses.

The markets might change into extra turbulent as the important thing occasion looms.

Among the many high 100 crypto property, Pudgy Penguins’ PENGU token posted the most important losses at 55%, possible resulting from heavy promoting strain following its airdrop to NFT holders, which triggered a steep decline in each the token’s worth and the ground worth of Pudgy Penguins NFTs.

Share this text