Douglas Rissing

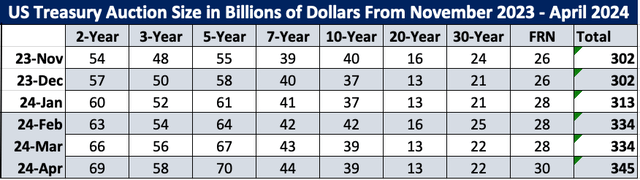

On January 31, the Treasury Department announced a dramatic rise in the number of Treasuries it plans to auction over the first quarter of 2024. This means a net increase of $300-$350 billion in privately-held supply, according to the US Department of the Treasury.

This action will likely put upward pressure on interest rates even as the financial markets are expecting rate cuts. But the Fed has little choice. The government’s budget has soared to record highs and more tax cuts are on the horizon. There is little will on either side of the Congressional aisle to gore political sacred cows to get our nation’s fiscal house in order.

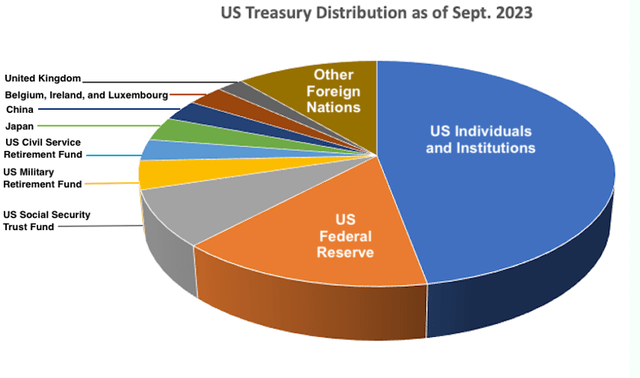

Where Treasury Demand Is Coming From

The Treasury Department is counting on US banks, institutional investors, the US government itself, and other domestic buyers to hoover up this excess supply, a necessity if interest rates are to stay level. There is little chance our biggest foreign customers will be increasing their Treasury purchases over the coming year. We should expect the opposite.

Fig. 1

US Treasury Department

Japan’s Economic Outlook

The Bank of Japan recently announced it plans to reverse a quarter century of Quantitative Easing over the coming year. This is likely in response to inflation, which jumped to 7.3% last year in January 2023. Since then, headline inflation in Japan has dropped to 3.3% as of October, but inflation in the food and beverage sector is still running hot at 8.6%. Reduced local spending power could put downward pressure on Japan’s economy.

Even small incremental rate increases could cause turmoil in the Japanese economy as it is the most indebted country in the world, with a 252% debt-to-GDP.

Furthermore, these rate increases could spell trouble for Japanese banks which are holding massive amounts of bonds with zero, and even negative interest rates. These will quickly lose value if rates increase even slightly, which could translate into billions of dollars of paper losses. In short, Japan’s purchases of US Treasuries are likely to continue a two-year-long downward slide.

China’s Economic Outlook

Our second biggest customer, China, is in even worse shape. China’s share of US Treasuries has already dropped from a high of 14% in 2011 to a mere 3% as of 2024. Considering they are now in the throes of a massive implosion in their real estate sector, their ability to buy Treasuries is likely to further dwindle over the coming year.

Why Fed Rate Cuts Could Wind Up On The Chopping Block

This past December, Fed Chair Jerome Powell indicated there would be three quarter-point rate cuts over the coming year when he claimed, “The appropriate level [of the federal funds rate] will be 4.6% at the end of 2024”

While this statement was ballyhooed on Wall Street, the Fed also made a cryptic prediction that most investors missed. According to the Federal Open Market Committee, inflation will likely reach its target of 2 percent inflation in 2026, two years from now.

Then, on January 31, the Fed announced there will be no rate cuts until they see progress on inflation returning to its 2% target. When you put these two statements together, the Fed seems to be warning Wall Street that the three rate cuts promised for this year could easily be swept off the table.

The Fed Cannot Afford Another Round of Quantitative Easing

There is only one way the Fed can engineer a rate cut and that is by buying up a significant amount of Treasuries to create artificial demand in a maneuver known as Quantitative Easing. According to the laws of supply and demand, when demand increases and the supply remains steady, the price goes up. In the case of Treasuries, a higher price means a lower interest rate.

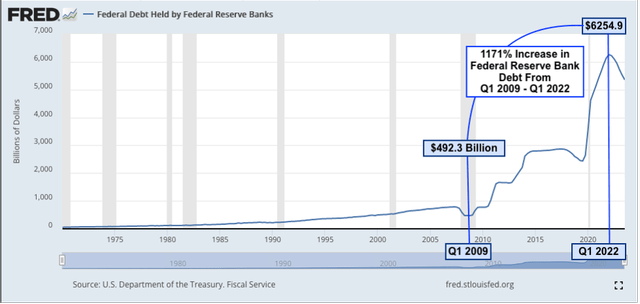

Wall Street has come to assume that Quantitative Easing is an “easy button” the Fed can hit anytime there’s so much as an uncomfortable pinch in the stock market. But the sheer size of the debt held by the Federal Reserve bank tells another story.

Fig. 2 Federal Debt Held by Federal Reserve Banks

US Department of the Treasury

Notice in the chart above that from the first quarter of 2009, when the Fed first launched its Quantitative Easing program, until the first quarter of 2022, the Fed has increased the amount of its Treasury holdings by a whopping 1,171%. Since the advent of Quantitative Tightening, which began in June of 2022, the Fed has brought its holdings down a mere 14%, hardly enough to claim victory over the matter.

To assume the Fed can continue to load up on US Treasuries when they are already gorged with a massive amount of Federal debt, an amount which has no precedent in history, is quite possibly naïve on the part of both the Fed and Wall Street. To put it in pedestrian terms, Uncle Sam’s credit cards are just about maxed out.

In the table of US Treasury Auctions below, notice the upward trend in the amount of Treasuries auctioned month-over-month as shown in the right column. Those climbing numbers indicate the Treasury Department’s obligation to keep up with the US government budget.

Fig. 3

US Department of the Treasury

Interest Rates Still Trending Up

Another indication that Treasury rates are in an overall upward trend can be seen in the historical chart for the 10-Year Treasury Note below. Ever since the Fed announced its plan to reverse Quantitative Easing at the end of 2021, the rates have been marching steadily upward with the occasional sharp pullback, as we have just experienced over the past few months. But even though the 10-year T-bill made a sharp downturn after touching 5% in October, the rate is still hovering above its 50-day moving average, and still soaring above the 200-day moving average.

Fig. 4

Finance.Yahoo Chart

Considering the financial landscape, it’s puzzling as to why the Fed would promise rate cuts in 2024 when all the economic indicators are pointing toward an involuntary rate increase that the Fed may be powerless to stop.

But when one puts themselves in the Fed’s shoes, it does make sense. There’s no doubt the Fed would very much like to cut rates in the near future, albeit their promises are based more on wishful thinking than market fundamentals. However, if they were to convince bond investors that rates were more likely to increase than decrease over 2024, that could spell disaster for the bond market. Such a revelation would only encourage would-be investors to hold off and wait for higher rates in the months to come and this could send rates soaring in a feedback loop scenario.

Conversely, if Wall Street is convinced that rates will soon go down, bond investors will be motivated to take advantage of these current higher rates before the promised lower rates come to pass.

Treasury Secretary Janet Yellen seems to be well aware of these circumstances. On January 26, she suggested there was a possibility that interest rates could settle back to where they were before the pandemic. She then quickly followed up with this remark. “But the strength of the economy also suggests that perhaps productivity growth and potential output growth have increased and the level would be higher.”

It appears Yellen is suggesting that, in the near future, interest rates could go higher. The financial data and economic trend lines suggest she could be right.

In a prior article I suggested that a good hedge against this oncoming financial uncertainty was to invest in short-term Treasuries and CDs, anything between 3 months and 1 year. I have not changed my stand in this regard. Due to a steep yield curve inversion, rates on short-term bonds are higher than some long-term bonds.

The risk in this wealth preservation strategy is that an investor could lose out on further increases in the stock market. Or, if rates were to come down in the coming months and years, one could miss out on locking in higher rates for those interested in long-term bonds.

Summary

A soaring US government budget has forced the Treasury Department to put a historical amount of Treasuries up for auction over the coming year. This will likely put upward pressure on interest rates. While the Fed and Treasury Secretary have been sending mixed signals regarding where rates are heading, it is in the best interest of the Treasury Department and the Fed that the upcoming Treasury auction is attractive to investors.