Cows refusing to come back dwelling for FPI buyers Anthony Lee/OJO Photos through Getty Photos

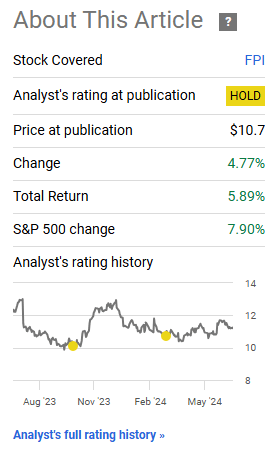

We maintained our impartial score on Farmland Companions Inc. (NYSE:FPI) again in April. Utilizing asset gross sales to deleverage, shopping for again shares, and reducing prices, the corporate was taking the precise steps to fight the market circumstances. Nevertheless, buyers have been pricing in FPI under the online asset worth and consequently the expansion that fairness buyers gravitate in direction of was lacking in FPI. Absent a good greater low cost to NAV, risk-free alternate options like T-Payments made higher investments in our opinion, and we stayed out.

You might have T-bills providing you a good return and you’ll rise up to six% or much more with out taking extreme dangers. For these searching for an inflation hedge Treasury Inflation Safety Securities are literally providing a strong risk-reward. If it was at a large low cost to our NAV estimates, we’d take a punt. We all know that worth equities are at one among their least expensive ranges relative to progress equities. However right here, we do not suppose the risk-reward is nicely balanced, particularly relative to alternate options.

Supply: Farmland Companions: The Retailer Of Worth Thesis

The inventory has performed decently since that piece and stayed nicely above our purchase below worth vary of $8.50 – $9.50.

In search of Alpha

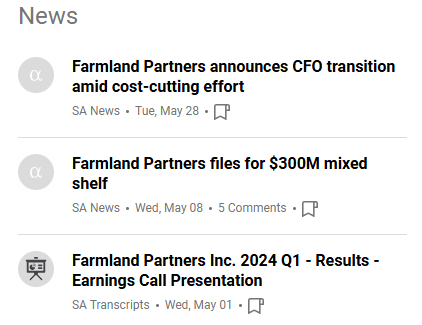

The Q1 outcomes have been introduced in the beginning of Might and in direction of the top of the identical month, the corporate had a change of their monetary guard.

In search of Alpha

Allow us to focus on these occasions and our present outlook for the enterprise subsequent.

Q1-2024

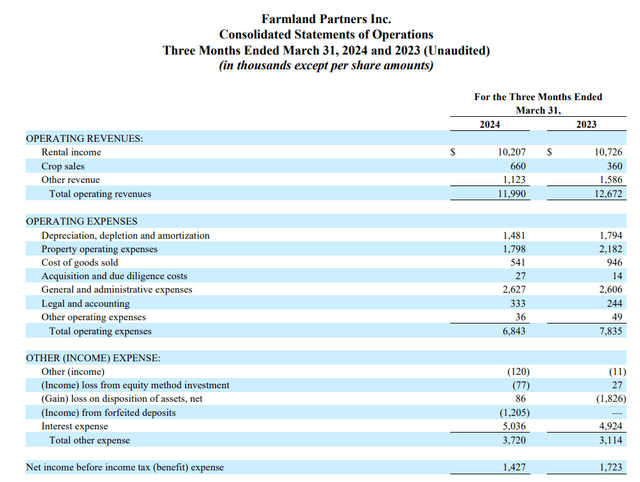

FPI missed their income and funds from operations (FFO) estimates. Income declines have been primarily pushed by asset gross sales performed beforehand, partially offset by rental hikes over the past 12 months. As we have now beforehand talked about, normal and administrative bills proceed to stay very excessive for a agency of this dimension. The impression was even bigger contemplating the revenues dropped by about 5% 12 months over 12 months.

FPI 10-Q

Three different notable objects have been current in the primary numbers. First, there was a sizeable drop in property working bills, little doubt from the identical issue driving income drop, i.e. asset gross sales. Second was the rise in curiosity bills, from already lofty ranges, to $5.036 million. Lastly, we had a further $1.2 million of revenue from forfeited deposits. Clearly, that’s non-recurring in nature. All of this resulted in a web revenue that was under final 12 months’s quantity. After all, we’re not analyzing REITs for web revenue, we’re doing it for FFO. Nonetheless, within the case of farmland, the place there isn’t any depreciation of land and the one depreciation prices are these on tools (and therefore actual), web revenue isn’t the worst factor to take a look at.

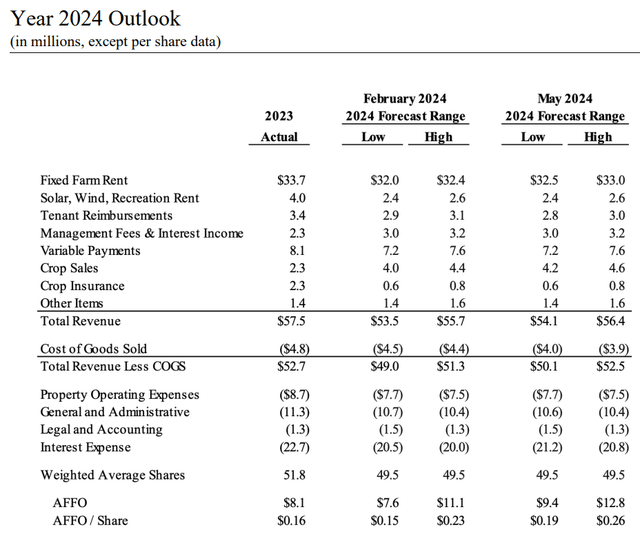

FPI did replace its steering and bumped up its numbers marginally. This resulted in a slight enchancment for its 2024 vary for adjusted FFO (AFFO) per share.

FPI Presentation

Outlook

The corporate is making an attempt to get the market to see its true worth. Right here, “true worth” might be greatest depicted by NAV. That NAV isn’t one thing that may be assessed with 100% certainty, however we will have an ideal thought a couple of vary for this. Our evaluation and that of the analyst neighborhood is that that is someplace within the neighborhood of $14-$17 per share. To get there, FPI has been making an attempt some intensive capital recycling, the place it sells farmland and buys again shares. Additionally it is shopping for farmland the place it sees it as undervalued. We noticed among the latter this quarter.

Acquisition and Disposition Exercise

Through the three months ended March 31, 2024, the Firm acquired three properties for complete consideration of $16.3 million.

Through the three months ended March 31, 2024, there have been no inclinations of properties.

Supply: FPI Q1-2024 Press Launch

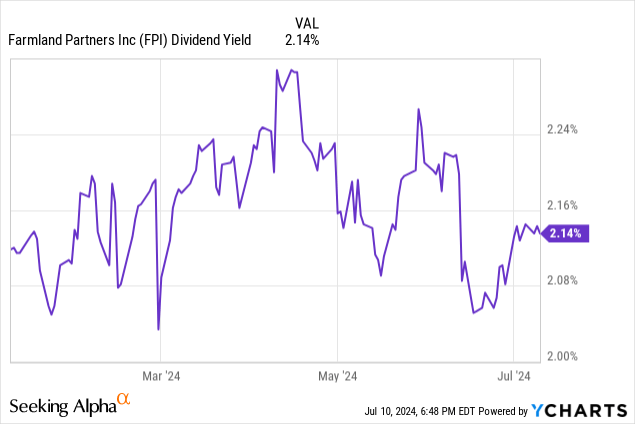

All of this sounds nice on paper, however does not likely work in actuality. FPI is making an attempt to behave like a hedge fund, and we don’t know whether or not there stays such a big pool of undiscovered worth that it may possibly reap the benefits of. If one tried to promote us on the concept that FPI was liquidating and shopping for again shares, we may see some rationale for a better worth. However this forwards and backwards doesn’t persuade us one bit. Within the interim, you will have one of many smallest yields you may get from a REIT. That yield is a lower than half of the risk-free charge.

The inventory trades at round 45X AFFO.

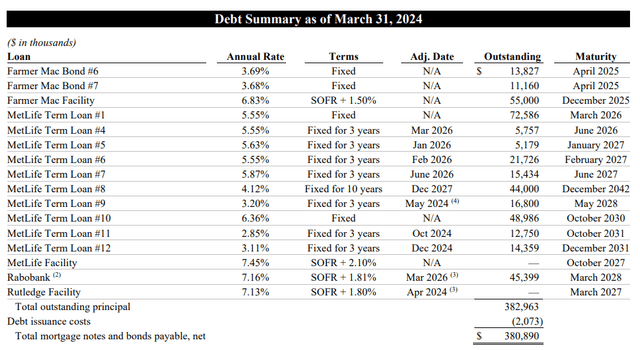

Why would anybody purchase? Sure, the NAV low cost. However we see no catalyst to get there. Now we have liquid CEFs holding liquid securities, yielding 7%-12%, that commerce at huge reductions to their NAV. So the bull case for FPI stay tenuous. Within the interim we have now $381 million of web debt which prevents any huge upside within the money circulate.

FPI 10-Q

FPI is paying as excessive as 7.16% for a few of its borrowings. The potential rate of interest reduce cycle may gain advantage the corporate, however we see the impression as marginal within the quick future. A few of its 2025 borrowings would doubtless be refinanced increased, even in a charge reduce cycle. These 3.68%-3.69% loans have been issued in a ZIRP period.

Verdict

FPI continues to this dance of property purchases and gross sales. They even filed a mixed-shelf for $300 million, which additional muddies the waters. The one lifelike path to huge worth creation is a wholesale liquidation and a dedication to exit the general public markets. You can doubtless see $14-$18 vary of costs in that case. Assuming it occurred over a 12 months or two, it may symbolize some good upside. Even in that situation, one should maintain a modicum of skepticism. Seritage Development Properties (SRG) dedicated to liquidation and the bulls threw $15-$20 as a spread for the honest worth. The inventory sits below $5.00 as quarter after quarter has disenchanted in what might be achieved. Shuffling the administration is unlikely to assist. We preserve a maintain right here and suppose the timber REITs supply a comparatively higher play for many who argue that “we should always purchase land as a result of they aren’t constructing it anymore.” These have potential for a lot increased money circulate in peak lumber worth intervals. We’ll go on FPI.

Please be aware that this isn’t monetary recommendation. It might appear to be it, sound prefer it, however surprisingly, it’s not. Buyers are anticipated to do their very own due diligence and seek the advice of with knowledgeable who is aware of their goals and constraints.