Win McNamee/Getty Photos Information

Introduction

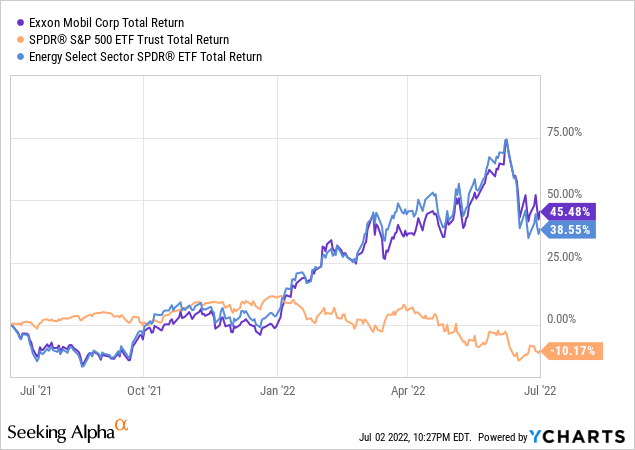

2022 has been a fantastic 12 months for oil shares like Exxon (NYSE:XOM). After the oil crash of 2020, ESG initiatives, and a rising distaste for oil firms, investments within the business dried up and left the world undersupplied with oil, inflicting costs to soar.

As one of many largest producers of oil, Exxon has been one of many largest beneficiaries too:

Since Exxon’s 2020 low of round $33 a share the corporate’s inventory value has almost tripled, that is after its latest retreat down from the $105 stage, settling again all the way down to $88.

However, as traders, we’re confronted with a conundrum: Exxon, and oil firms prefer it, are reaping document income, income that look set to proceed attributable to document low investments, however may a possible recession flip Exxon right into a dropping funding? And moreover, is Exxon one of the best funding among the many main oil producers?

Inside this text I’ll present:

- An replace on Exxon’s enterprise and prospects

- A comparability of the monetary efficiency of Exxon vs Friends

- A valuation of Exxon’s shares below totally different market environments

Exxon Enterprise Replace

Exxon has been a significant beneficiary of the restoration in international oil costs. After a long time of underinvestment, and Russia-induced geopolitical uncertainty, oil shares are shining as soon as once more. Lastly, oil is again in vogue. (XLE) (USO)

Within the first quarter of 2022, Exxon reported some stellar numbers. Money move from operations soared to $14.8B and excluding its Russia exit, earnings would have been up $6B from the prior 12 months to $8.8B.

Adjusted for Russia, Exxon’s earnings went from $2.8B to $8.8B, which is nothing in need of miraculous and speaks to the correlation between Exxon’s efficiency and the worldwide commodities market.

Along with the robust monetary efficiency, Exxon possible made just a few shareholders joyful once they introduced a $30B buyback by means of 2023 (roughly 8% of its present market cap). Add on to its 4% dividend yield, and Exxon appears to be like set to return roughly 12% of its market cap to shareholders this 12 months.

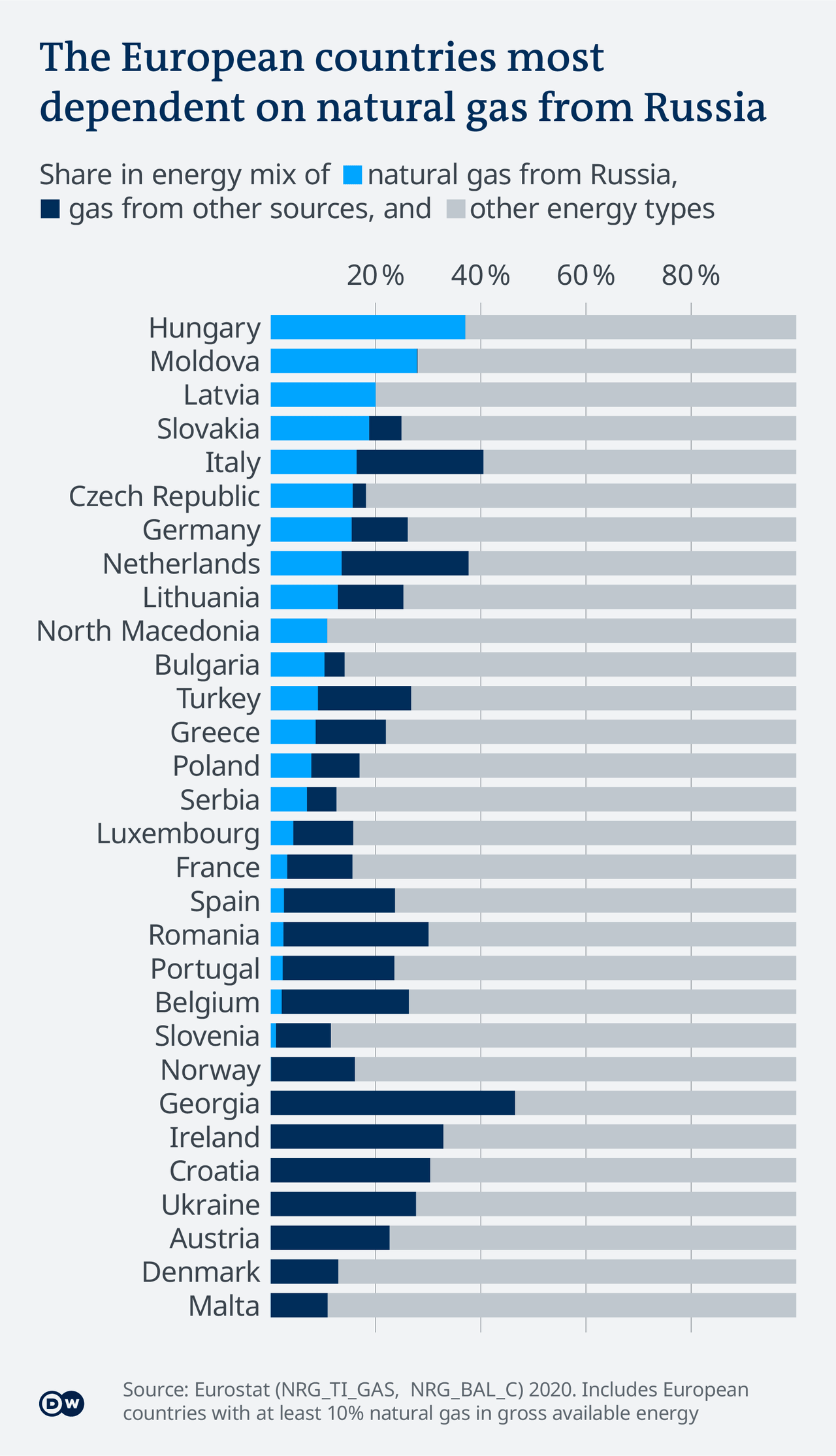

Exterior of oil, Exxon can also be energetic in a variety of LNG initiatives world wide. LNG has develop into extra vital than ever as European international locations are scrambling to interchange Russian fuel dependence.

Russian fuel edging towards extinction in Europe | Enterprise | Financial system and finance information from a German perspective | DW | 11.03.2022 (DW)

International locations like Germany are constructing new LNG terminals and seeking to lock down further various provides. An LNG venture can take years to plan and execute, that means LNG, like oil, is prone to keep in brief provide and costly for a while, fortunately Exxon is constant to make progress on its LNG ambitions.

ExxonMobil continued to progress its international LNG development technique to satisfy rising worldwide demand for dependable fuel provide. Commissioning of the Space 4 Coral South Floating LNG venture in Mozambique is underway, with first manufacturing anticipated this 12 months, and the corporate signed the P’nyang Gasoline Settlement in Papua New Guinea. Moreover, development of the Golden Go liquefaction amenities on the U.S. Gulf Coast stays on schedule.

Monetary Evaluation:

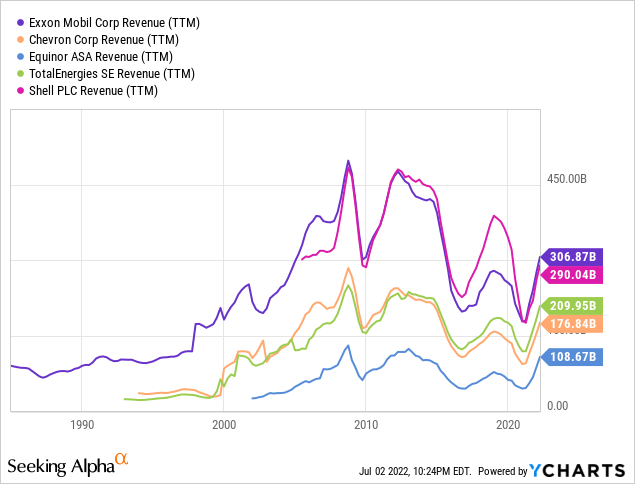

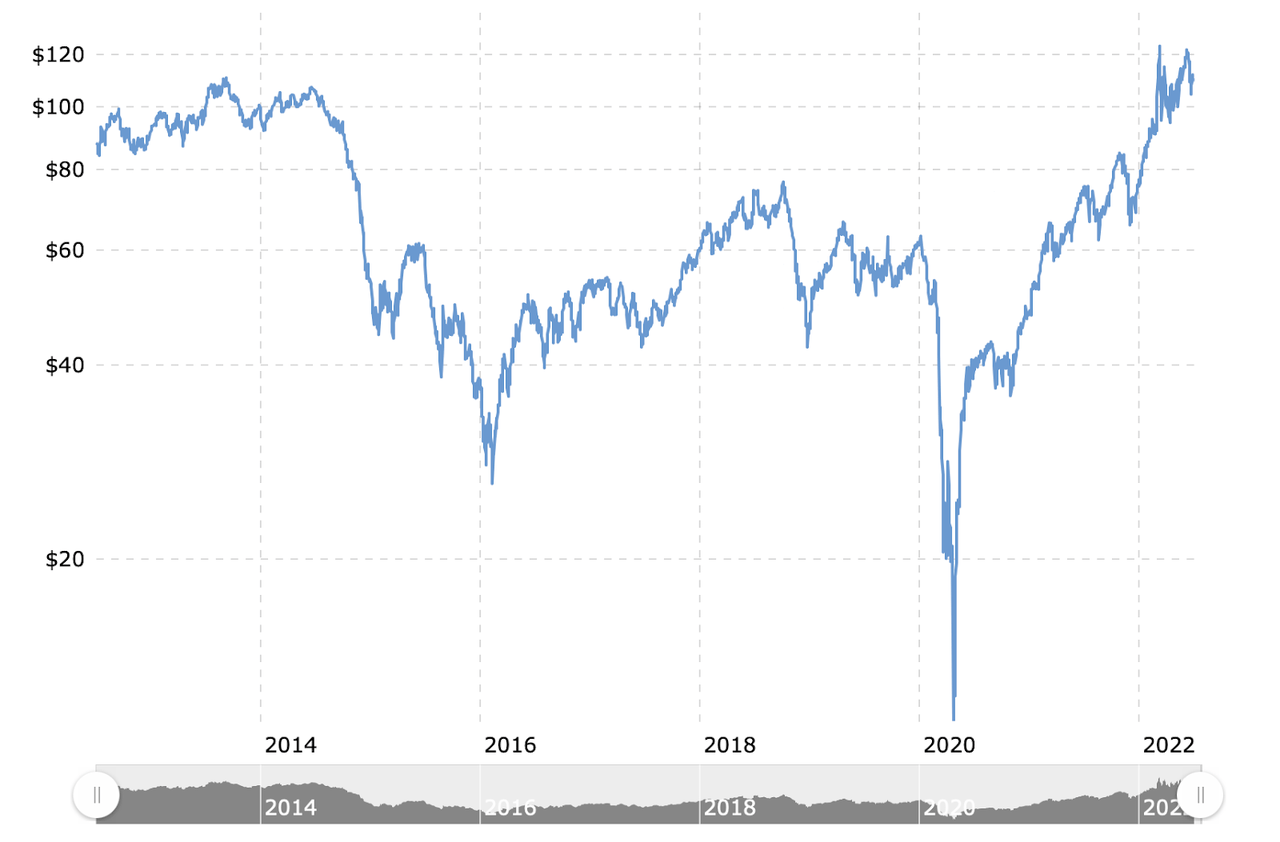

Shifting ahead to the monetary evaluation, let’s examine how Exxon has grown versus friends: Chevron (CVX), Equinor (EQNR), TotalEnergies (TTE), and Shell (SHEL).

Income and Earnings Progress

The oil business has its good instances, and it has its dangerous instances. Nowhere is that extra obvious than within the volatility of each income and earnings for these firms. A few of these firms have sizable non-petroleum operations (Whole and Equinor), however they’re nonetheless by in giant reliant on international oil market pricing. Due to that connection, there are huge fluctuations in earnings and income from 12 months to 12 months.

This variability is undesirable because it makes forecasting future money flows that rather more troublesome, due to this, I’d count on an oil producer’s valuation to be decrease than different shares with extra predictable money flows.

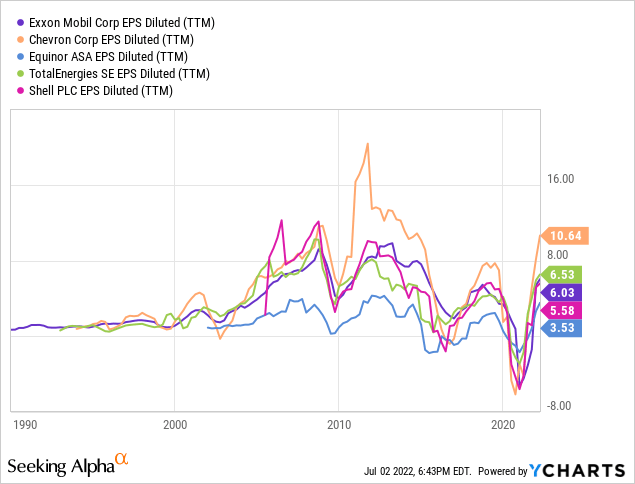

Working Money Move

When evaluating firms, I additionally like to take a look at their working money move. I discover this convenient as a result of it exhibits us how a lot money move their working enterprise generated. Just like the income and EPS charts, there’s important volatility of their working money flows.

Apparently, the 2 US-listed firms on this chart, Exxon and Chevron, each ended the last decade with much less working money move than once they began it, regardless of crude oil costs being increased now than they as soon as have been.

Equinor’s efficiency is especially noteworthy, I’d wager that this is because of their web site’s proximity to Europe which making an attempt to wean off Russian oil and fuel merchandise.

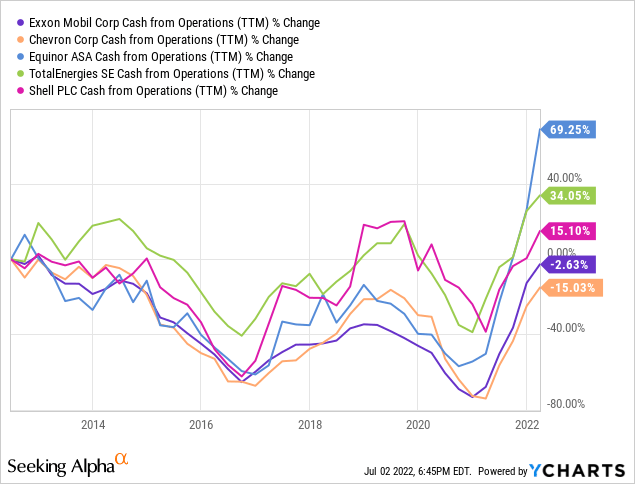

US Crude 10-Yr Chart:

Macrotrends

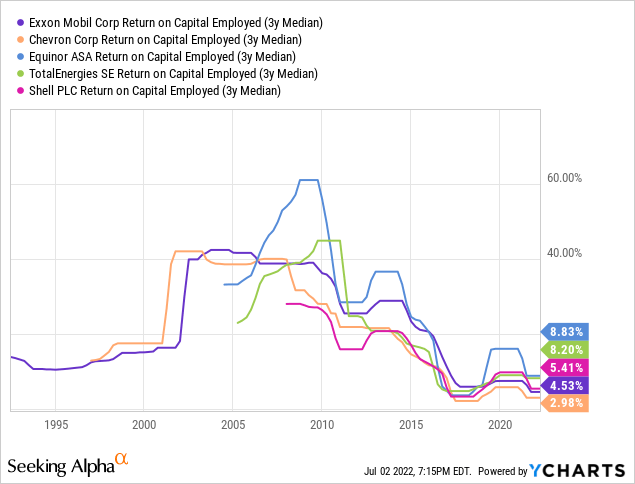

Return on Invested Capital

Return on Invested Capital for these firms has assorted wildly over their existences.

In instances just like the 2000s with oil costs, investments into oil exploration and refineries yielded big returns on capital (upwards of 40%!). However when oil costs are low, as they have been the final two years, investments fail to interrupt by means of single-digit returns.

I’m not a fan of this enterprise mannequin.

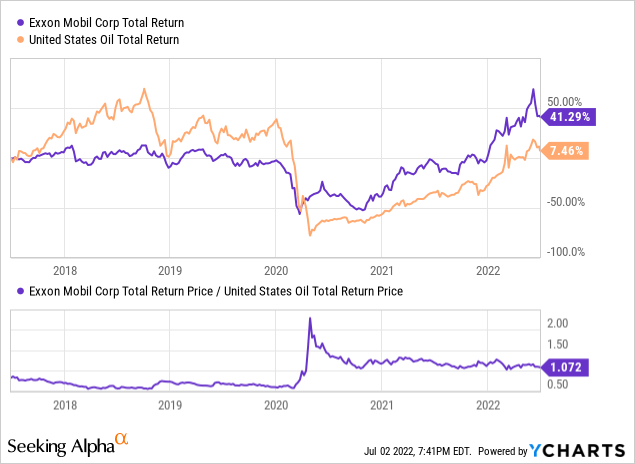

Exxon’s Correlation to US Oil Fund

Given the robust correlation of Exxon’s earnings to grease costs, it is no shock the inventory’s value is just too. As you possibly can see, over the past 5 years Exxon has exhibited an exceptionally robust correlation to the value of crude (estimated vis-a-vis (USO) ), particularly throughout risky durations like Spring by means of Summer season of 2020.

This may very well be considered as both a professional or a con, in case you’d like publicity to crude oil it is clearly a energy. However for myself, somebody who prefers to put money into firms that aren’t as reliant on macro elements to succeed, I see this as a adverse.

Valuation

There are lots of methods to worth an organization, however two of my favorites are the discounted money move evaluation and evaluating ahead PEs vs friends. The rationale I usually make use of these two totally different fashions is that they assist me accomplish just a few totally different objectives. First, utilizing the ahead PE evaluation I can take away any biases I’ll maintain (if I can determine the precise friends). And secondly, within the discounted money move evaluation I can regulate all of the inputs to my expectations and account for development a lot additional into the long run. Let’s begin with the Ahead PE evaluation.

Ahead PE Evaluation

|

Firm |

Present Inventory Worth |

EPS 2023 Est. |

2023 P/E |

|

XOM |

$88 |

$8.99 |

9.7 |

|

CVX |

$147 |

$14.77 |

9.9 |

|

TTE |

$53 |

$10.71 |

4.9 |

|

EQNR |

$34 |

$4.70 |

7.2 |

|

SHEL |

$52 |

$9.37 |

5.5 |

|

Common PE (excl. XOM) |

6.9 |

Supply: Yahoo Finance, Analyst Expectations, and Authors Calculations

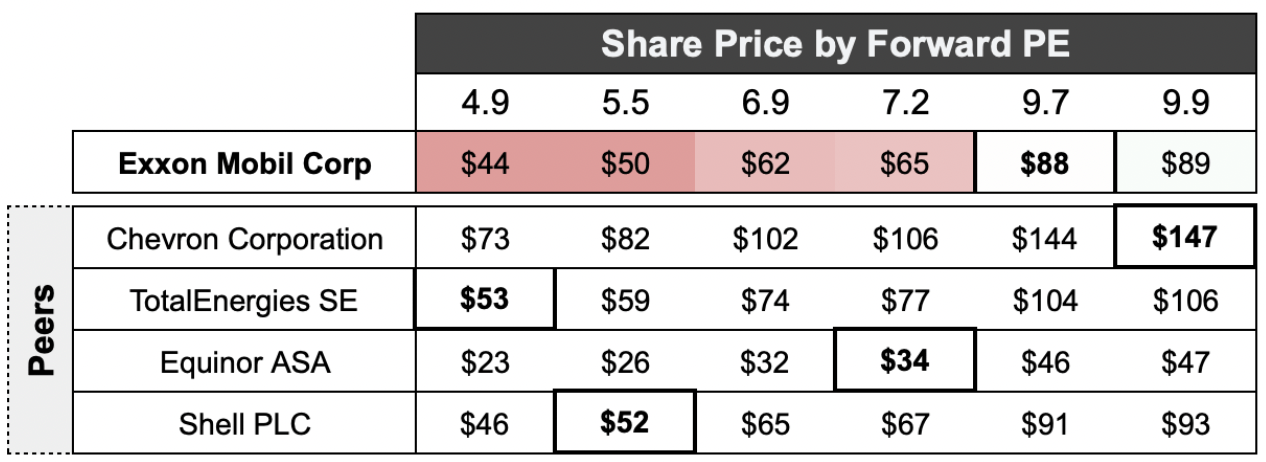

Trying on the chart above, we are able to see that Exxon is without doubt one of the most extremely valued oil majors with a ahead PE ratio of 9.7x. Based mostly on the typical analyst expectation, Chevron is the one oil main priced extra richly at 9.9x.

Exxon’s European friends Whole, Equinor, and Shell are all priced considerably decrease than both Exxon or Chevron. In my opinion, that is possible because of the heightened regulatory setting overseas.

That mentioned, at 9.7x. Exxon’s shares will not be overvalued when in comparison with the market as a complete, particularly tech shares. In a previous article, I calculated that Microsoft’s (MSFT) ahead PE is roughly 23x, so 9.7x may nonetheless be thought of fairly a discount. However many will agree that Microsoft is prone to develop quicker, and for longer than Exxon or an oil firm. In different phrases, it’s a little bit of a toss-up.

Share Worth by Ahead PE (Created by Writer)

Talking on a relative foundation, based mostly on my evaluation, Exxon’s shares look like overvalued versus its friends. The typical ahead PE on this group labored out to be 7.2x earnings implying Exxon may commerce all the way down to $65 a share.

TotalEnergies appears to be like to be one of the best worth, if its shares are traded like Chevron, Whole may see its shares double to $106.

Discounted Money Move Evaluation

As I alluded, let’s have a look at how Exxon’s valuation modifications when you contemplate varied future development situations and low cost charges. For my base case, I’m assuming no modifications to the share rely, a ten% low cost charge, 1% income development after 2023 by means of 2028 (analyst expectations for ’22 and ’23), and -2% thereafter.

|

2022 |

2023 |

2024 |

2025 |

2026 |

|

|

Income |

$442,520 |

$394,310 |

$398,253 |

$402,236 |

$406,258 |

|

Web Earnings |

$43,768 |

$37,871 |

$38,249 |

$38,632 |

$39,018 |

|

Money Move |

$39,000 |

$36,630 |

$36,996 |

$37,366 |

$37,740 |

|

Intrinsic Worth per Share ($USD) |

$78 |

|

Present Share Worth ($USD) |

$88 |

|

Upside Potential |

-10.4% |

Supply: Yahoo Finance, Analyst Expectations, and Authors Calculations

Utilizing the inputs from my base case, I come to a good worth per share of $70, a bit greater than 10% under the present share value.

Given the setting of elevated oil costs and low funding in exploration, I consider oil costs may doubtlessly be sustained over the medium/long run. However the oil market has been particularly risky since 2020 began which makes it particularly troublesome to foretell the place oil costs will go sooner or later.

Due to that, I included just a few different development situations utilizing totally different low cost charges.

Sensitivity Evaluation

|

8% Low cost Fee |

10% Low cost Fee |

12% Low cost Fee |

|

|

Bull Case: +5% Income Progress |

$125 |

$99 |

$81 |

|

Base Case: 1% Income Progress |

$95 |

$78 |

$67 |

|

Bear Case: -5% Income Progress |

$68 |

$59 |

$52 |

|

Terminal Progress Fee For: |

|

|

Bull Case |

0% |

|

Base Case |

-2% |

|

Bear Case |

-5% |

In my sensitivity evaluation, three of 9 situations work out to be cash makers, largely relying on if the value of oil might be sustained/improve over time.

With Exxon, I feel it is prudent to type an trustworthy analysis of your individual data and ask your self to what diploma you perceive the oil business and the place costs will go from right here. Frankly, I’m not a macro-economic professional, due to that and my doubts in predicting future oil value traits, I require the next low cost charge to compensate me for the extra danger.

Dangers

Talking of dangers, earlier than I current my ultimate value goal and verdict on the corporate, let’s first contemplate a few of the dangers dealing with Exxon, and the oil business writ giant.

ESG: Inventory costs are fickle. Within the brief time period, costs might be affected by a myriad of things, particularly sentiment. As Benjamin Graham mentioned:

Within the brief run, the market is a voting machine however in the long term it’s a weighing balance.

However what occurs when sentiment is completely destroyed?

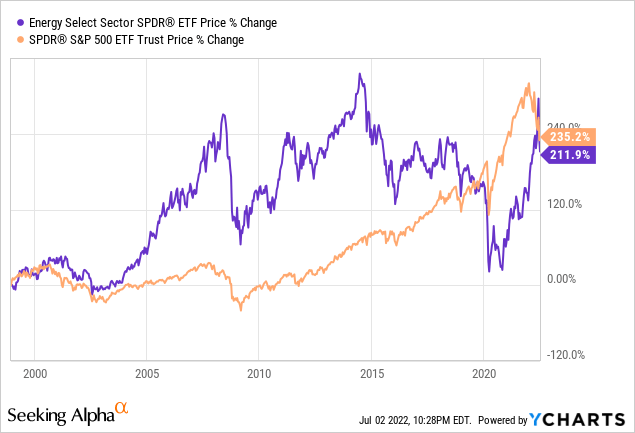

I ponder if that’s maybe what has gone on with oil shares. For the reason that rise of ESG investing firms have been inspired to embrace “stake-holder” capitalism whereby the businesses ought to place equal weight on all stakeholders, together with the setting. Whereas I don’t personally purchase into this philosophy, it appears clear to me that many traders do.

Consequently, ESG has solid a shadow over oil firms, usually blaming them for a lot of what’s fallacious on the earth. It is truly led to some funds divesting from oil firms totally.

If, over the long term, these ESG considerations are now not related, then maybe we may see an additional appreciation in share value. Personally, I don’t count on ESG to go away anytime quickly. And, based mostly on that, I do not see the earnings multiples ever coming again to the place they as soon as have been.

Regulation: One other headwind dealing with oil firms is regulation, now greater than ever. Some international locations in Europe have carried out so-called “windfall” taxes on oil firms to tax them at an elevated charge now that costs are excessive once more. To say nothing of the environmental rules, it needs to be widespread sense that rules desensitize additional investments to extend provide.

So maybe regulation may very well be a tailwind as it is going to trigger increased oil costs… However even in that case, I feel it is possible the first beneficiaries of that will be non-democratic international locations that may extra simply ignore societal calls for.

Recession: I’ll maintain these final couple of dangers succinct. Recessions result in demand destruction. As demand is destroyed much less oil is consumed throughout your complete international economic system. Much less journey being carried out, fewer items being produced and transported, and many others.

That is particularly worrisome given the Fed’s mandate of value stability and the continuing QT which can trigger a recession.

Electrical Autos: The rise of digital autos may threaten the long-term oil demand. First are vehicles, subsequent can be semi-trucks, after which later we may see planes and boats shift in the direction of electrical. As renewable vitality comes down in value, EVs will develop in demand. This may possible be a sluggish multi-decade shift, but it surely does seem we’re originally of a robust pattern, at the least on this writer’s thoughts.

Conclusion

Exxon is the precise firm, for the precise time. Within the phrases of Sam Elliott, within the Large Lebowski:

Generally, there is a man, properly, he is the person for his time and place. He matches proper in there.

And properly, Exxon is the “man” for this time. Inflation fears run rampant, and provides for each oil and LNG look like with us for the lengthy haul. Exxon is the corporate that may present each LNG and Petroleum after we want it most. So their shares have rightly soared.

So far as monetary efficiency goes, properly, it is checkered. They’re performing properly now. However how lengthy will it final? Effectively, that’s anybody’s guess.

Provide is prone to be low for a while however the odds of demand destruction vis-a-vis a recession appear increased than they have been earlier within the 12 months.

Valuing Exxon was a specific problem as a result of a lot of its future money flows will hinge on commodity costs. With that in thoughts, my value goal and suggestion can be based mostly on the typical ahead PE in its group.

I charge Exxon a “Promote” with a 1-year value goal of $65 a share.

At $65 a share, Exxon could be consistent with the typical ahead PE in its peer group, 7.2x.

So, to reply the query is Exxon one of the best of the oil majors? Based mostly on what I’ve seen, no. No, it isn’t. Its development charge is comparatively consistent with its friends, but it surely trades for the next a number of, I’d reasonably put money into (TTE) or (SHEL) at these ranges.

Thank You!

As at all times, thanks for studying.

I attempt to interact with all my readers, so if one thing has you, or when you’ve got a query, please be at liberty to remark. I’ll do my greatest to get again to all of you with a response!

Which firm do you assume is one of the best oil main? Be happy to let me know.