JHVEPhoto

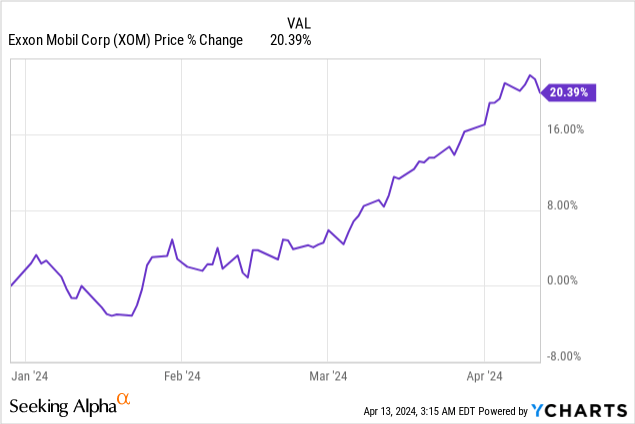

Exxon Mobil (NYSE:XOM) is set to detail how it benefited from the strong price increase for WTI crude oil on April 26, 2024 which is when the company is expected to release first-quarter earnings. The petroleum company has likely seen a drastic increase in the average price for petroleum in Q1’24 which in turn should have led to a major boost to the company’s earnings and free cash flow. With OPEC+ also providing considerable pricing support through the extension of voluntary supply cuts and upside EPS revisions outmatching downward revisions, I believe Exxon Mobil is poised to deliver a strong earnings beat later this month!

Previous rating

I recommended Exxon Mobil in October 2023 as a buy because the petroleum firm acquired another energy company, Pioneer Resources, in a $60B all-stock transaction. This deal boosted the company’s presence in the promising Permian Basin and was set to double Exxon Mobil’s Permian production to 1.3M barrels of oil equivalent per day. Additionally, strong pricing support provided by OPEC+ members as well as a 21% increase in WTI prices in Q1’24 should drive significant free cash flow gains for Exxon Mobil.

Exxon Mobil: positive momentum ahead of Q1

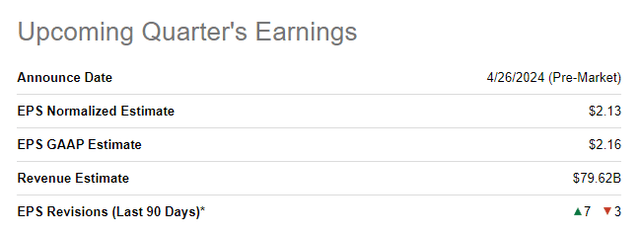

Exxon Mobil has considerable potential to exceed consensus EPS expectations when the company releases first-quarter fiscal earnings on April 26, 2024. EPS revision momentum already indicates that the market is expecting a strong earnings release, as analysts have revised their EPS estimates upward seven times in the last ninety days, compared to just 3 EPS downward revisions.

Seeking Alpha

The uptrend in petroleum prices in Q1’24 implies that Exxon Mobil has likely seen a considerable boost to its free cash flow in the first-quarter as well. Last year, due to the down-trend in petroleum prices, Exxon Mobil saw a contraction in its free cash flows and I believe there is a chance to see a major reversal in Exxon Mobil’s Q1’24 results… which would also make the company more appealing for investors that look for higher capital returns.

In the fourth-quarter, Exxon Mobil’s free cash flow was $8.0B, showing a 35% year-over-year decline. With WTI crude oil prices rising 21% in Q1’24, I believe Exxon Mobil could report a similar-size increase in its free cash flow to around $9.6-9.7B.

Exxon Mobil | FY 2023 | FY 2022 | ||||

$B | Quarter 4 | Quarter 3 | Quarter 2 | Quarter 1 | Quarter 4 | Y/Y Growth |

Cash Flow from Operating Activities | $13.7 | $16.0 | $9.4 | $16.3 | $17.6 | -22.2% |

Proceeds from Asset Sales | $1.0 | $0.9 | $1.3 | $0.9 | $1.4 | -28.6% |

Cash Flow from Operations and Asset Sales | $14.7 | $16.9 | $10.7 | $17.2 | $19.0 | -22.6% |

PP&E Adds / Investments & Advances | ($6.7) | ($5.2) | ($5.7) | ($5.8) | ($6.7) | 0.0% |

Free Cash Flow | $8.0 | $11.7 | $5.0 | $11.4 | $12.3 | -35.0% |

(Source: Author)

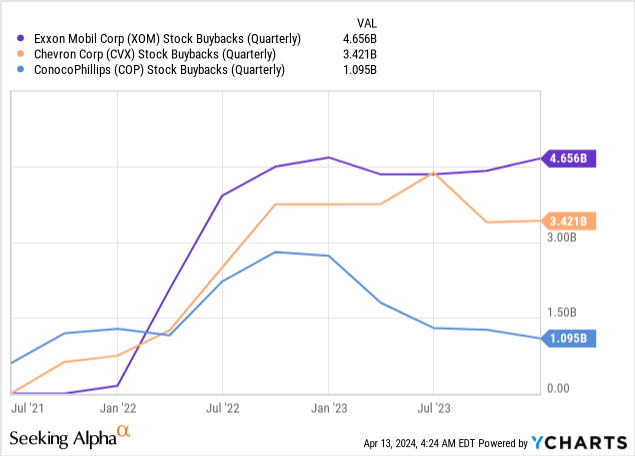

Since Exxon Mobil is so cashed up, I would not be surprised to see aggressive stock buybacks going forward, which could be a means for the petroleum to distribute excess free cash flow without making a permanent capital return commitment. Exxon Mobil, in part due to its free cash flow strength, has been one of the most aggressive buyers of its own shares in the last three years. I expect Exxon Mobil to remain by far the biggest spender of capital on its own shares in FY 2024, assuming that petroleum prices remain above $80 per barrel.

Exxon Mobil is extremely cheap given its free cash flow

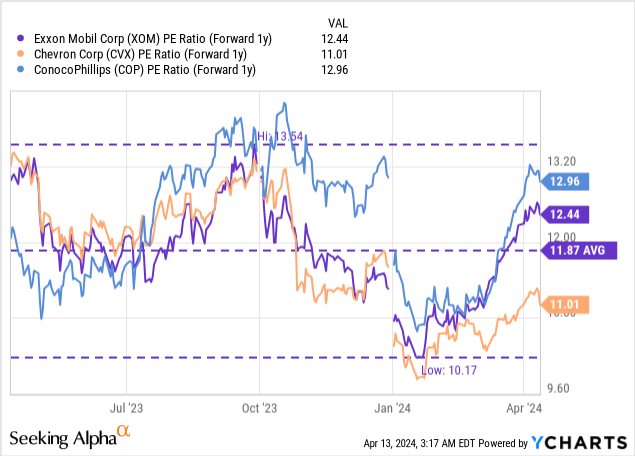

Exxon Mobil’s shares, despite a significant 20% total year-to-date return, is still extraordinarily cheap, in my opinion. The petroleum firm is trading at a price-to-earnings ratio of 12.4X, which compares to a 1-year average price-to-earnings ratio of 11.9X. The rise in Exxon Mobil’s price and valuation in FY 2024 corresponds to the rise in petroleum prices, which were supported by OPEC+’s March 2024 decision to extend supply restrictions to the end of the second-quarter. A continuation of supply cuts into the third-quarter is highly likely and could further provide price support for petroleum markets.

In my opinion, Exxon Mobil could easily trade at 13-14X earnings if petroleum prices remain above $80 and the company continues to grow its net production. Positive news, further supporting earnings growth, could come from the company’s Permian and Guyana’s offshore development assets. In Guyana, Exxon Mobil just received the necessary approvals from the government, which clears the way for another significant capacity expansion. With a fair value P/E ratio of 13-14X, shares of Exxon Mobil could have a fair value of up to $135. This is a dynamic number, and it could go up based off of the company’s production growth in high-potential areas (like Permian and Guyana), the price of petroleum and Exxon Mobil’s incremental capital returns.

Risks with Exxon Mobil

The biggest disappointment for me would be if we saw a sizable increase in the firm’s free cash flow in Q1 without Exxon Mobil making an announcement about incremental capital returns. Exxon Mobil also has considerable risks relating to a down-turn in petroleum prices, obviously, as an energy bear market would directly translate to lower free cash flows and margins. Disappointing production growth in the Permian Basin and Guyana would also likely be headwinds for Exxon Mobil’s shares.

Final thoughts

I believe Exxon Mobil is a promising investment ahead of the first-quarter earnings release due to the company benefiting from an upswing in petroleum prices, which should translate to a significant tailwind for earnings and free cash flow. Exxon Mobil’s EPS estimates have also seen some positive revision momentum in the last 90 days and with the company’s shares still trading at only 12.4X forward earnings, I believe the risk profile and the potential for incremental capital returns is very attractive here!