The combination of economic uncertainty and a lower need for additional warehouse inventory pushed the number of industrial leases of at least 1 million square feet lower in 2023 than in 2022, according to a new report from CBRE.

Among the top 100 industrial leases over the past year, 43 were for at least 1 million square feet, versus a record 63 the previous year.

Last year’s top 100 industrial leases totaled 98.6 million square feet, a notable 8 percent decline from the 2022 total of 106.9 million. In parallel with that, the average size in the top 100 leases slumped to 986,744 from 1.07 million square feet.

READ ALSO: For 2024, Prologis Forecasts Growing Freight Traffic

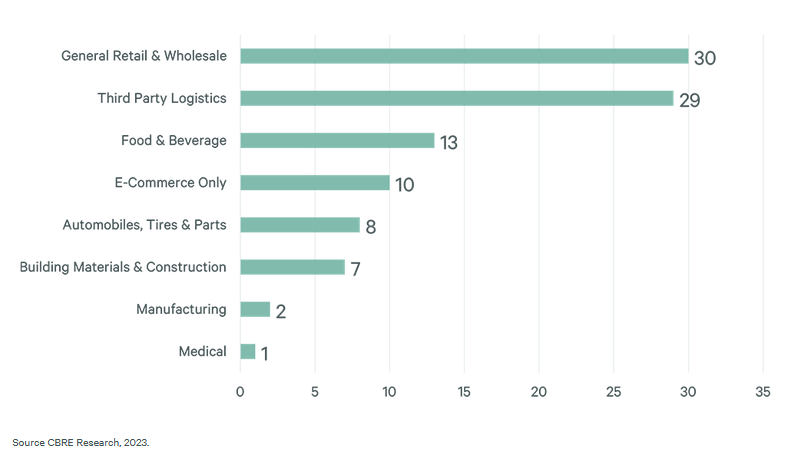

The tenant mix in 2023’s top 100 leases was more diverse than it had been in the previous year. The share of traditional retailers/wholesalers fell from 53 to 30, but the portion of third-party logistics (3PL) operators surged from 11 to 29. The food and beverage, auto, building materials, manufacturing and medical sectors too took larger shares of the top 100, compared with 2022.

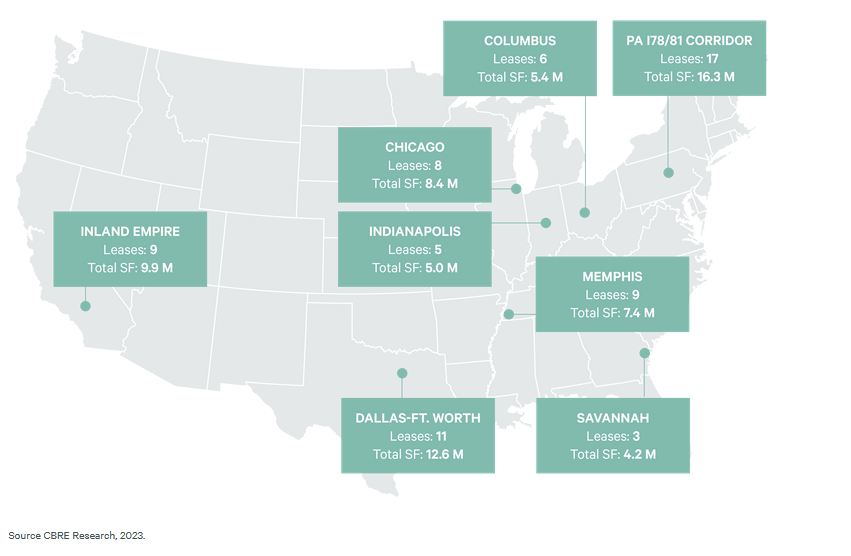

Pennsylvania’s I-78/81 Corridor topped all markets with 17 of the top 100 leases, followed by Dallas–Fort Worth with 11, which in addition led the nation for industrial leases of 1 million square feet or more with eight, followed by the Inland Empire with seven. The latter also ranked third for total square footage in 2023’s biggest 100 industrial leases, surpassing both Chicago and Memphis, Tenn.

Going into 2024, CBRE predicts that demand for mega-warehouses will rise as both the economy and rental rates stabilize.

Rise and decline of “just in case”

Two CBRE experts shared some additional insights on the report’s findings with Commercial Property Executive.

“In 2020, many companies began to rely even more heavily on 3PLs to mitigate pandemic-related supply chain disruptions and episodic demand surges,” John Morris, president of Americas Industrial & Logistics, told CPE. “Many of these companies have since realized that 3PLs can play a vital, strategic role in stabilizing their business models, creating efficiencies and helping create variable, dependable scale quickly.”

“We saw unprecedented supply chain disruptions during the pandemic, forcing occupiers to hold more inventory than they would have previously, ‘just in case’ there were disruptions within their supply chains,” added James Breeze, vice president, Global Head of Industrial & Logistics Research. “Now that our supply chains have moderated, occupiers are more confident current inventory levels will be able to keep up with demand.”