eyesfoto/E+ via Getty Images

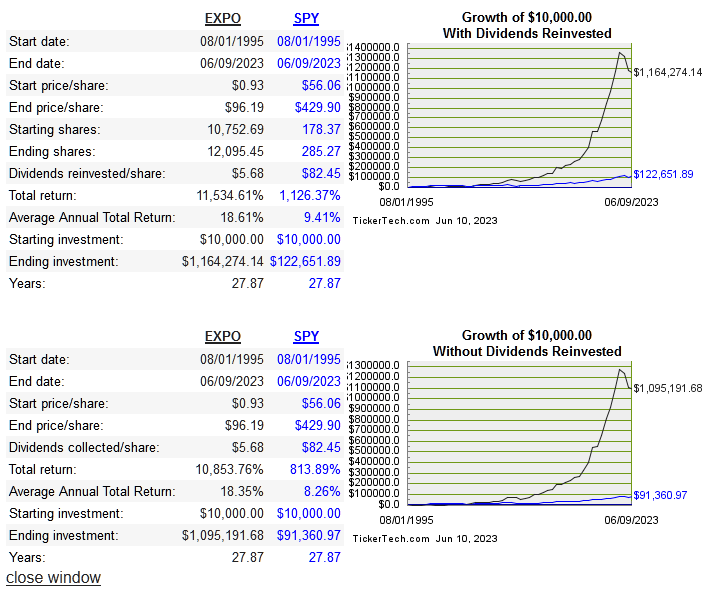

Exponent Inc. (NASDAQ:EXPO) is a consulting firm that specializes in sciences and engineering. It was founded in the late 60’s and became public in 1990. It has been a great growth story over the long run as the returns below show:

dividend channel

If your timing was near perfect, the stock returned around 200x over the long run.

dividenchannel

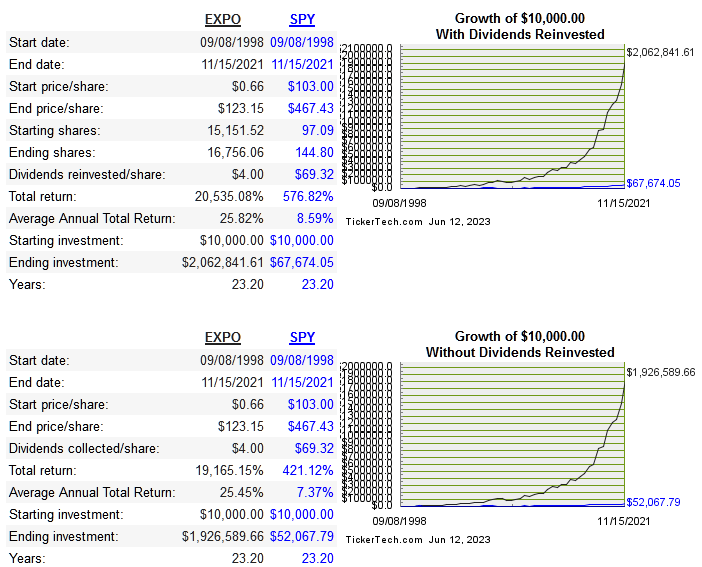

Their two operating segments break down into Engineering and Other Scientific, then Environmental and Health. Their revenue is below:

EXPO 2022 10-K

Next are the return on capital metrics versus peers:

Company | Rev 10-Year CAGR | Median 10-Year ROE | Median 10-Year ROIC | EPS 10-Year CAGR | FCF/Share 10-Year CAGR |

EXPO | 5.8% | 20.5% | 19.9% | 11.7% | 1.9% |

TTEK | 2.6% | 13.8% | 10.1% | 11.5% | 10.9% |

CLVT | 23.7%* | n/a | n/a | n/a | n/a |

Capital Allocation

This is an interesting case where the leadership of the company is mostly led by PHD scientists. As a smaller, growth company, this has been very appropriate. The question is whether management can effectively allocate capital now that the company is more mature and growth has slowed.

They began seriously returning capital to shareholders via dividends and repurchases in 2013, thus indicating that the fastest growth years were over as the company advances through its life cycle.

Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

EBIT | 56 | 64 | 69 | 62 | 72 | 91 | 85 | 83 | 109 | 141 |

FCF | 56 | 43 | 53 | 63 | 75 | 85 | 118 | 66 | ||

Dividends | 8 | 13 | 19 | 22 | 27 | 33 | 34 | 43 | 49.2 | |

Repurchases | 26 | 31 | 24 | 12 | 28 | 22 | 7 | 155 |

Source

Unfortunately, capital allocation can only be accurately scored in hindsight. So far I would say the capital allocation has been good, not great. I hold a strong preference for companies that return all capital via buybacks instead of dividends, but the ratio that EXPO has used isn’t out of line. For any profitable and growing company to not be seduced into a continuous M&A strategy is comparatively impressive and not to be ignored. Moreover, the fact that EXPO hasn’t used excessive debt or dilution is a great sign. At its core, talent is the biggest asset of this or any consulting firm, so CAPEX can be relatively low while the business grows.

Risk

The company has proven its quality, especially the last decade. Operating margins rose from 18.9% to 27.4% and net margins expanded from 13% to 19.4%. The company is clearly successful in their niche, and the risk of competitors taking away significant market share is minimal. The balance sheet is in great shape with $12 million in long term debt and $125 million in cash. This leaves the biggest risk being related to valuation and expecting more business growth than will actually happen.

Valuation

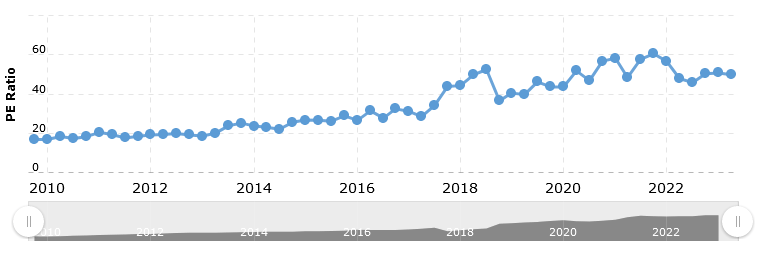

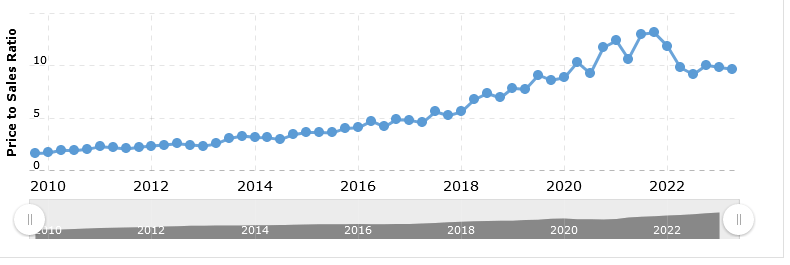

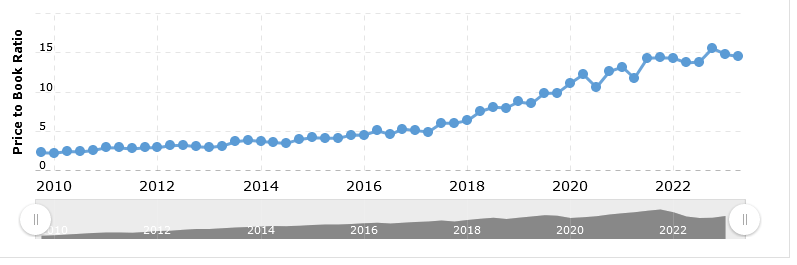

First we will look at the multiples comp followed by historical multiples:

Company | EV/Sales | EV/EBITDA | EV/FCF | P/B | Div Yield |

EXPO | 9.2 | 34.4 | 61.7 | 14.5 | 1% |

TTEK | 2.4 | 22.8 | 35.8 | 6.2 | 0.6% |

CLVT | 3.9 | 10.5 | 22.7 | 0.8 | n/a |

macrotrends

macrotrends

macrotrends

While I do like to see aggressive and consistent share reduction strategies, the high multiples leave me concerned about the actual accretion from the repurchases. On one hand it is good to see a company admitting that its ROIIC has peaked and it’s time to implement shareholder yield. On the other hand, EXPO has been trading at high multiples for many years now. The market has given a deserved premium on this capital-light growth company.

Interest rates affect equities valuation, and the same is true for a company allocating its own capital in regards to buybacks as a possibility. In December 2021, the yield on T-bills bottomed out at 0.05%. Flash forward to today, that yield has raised to 5.3%. Why buy shares in your own business when you can sit in cash and actually earn more than a few basis points? This is a decision many allocaters will be forced to make. There’s no shame in letting your cash balance build up, especially if an ideal M&A deal comes up, but in excess it can attract activist investors who want to see that cash distributed. Also Exponent is not an acquirer, I would rather see them go all in on repurchasing shares consistently, in spite of the multiples being too high for me as an investor right. They have, in fact, ramped up repurchases big time in 2022, but I’m waiting to see if this new level stays consistent over time.

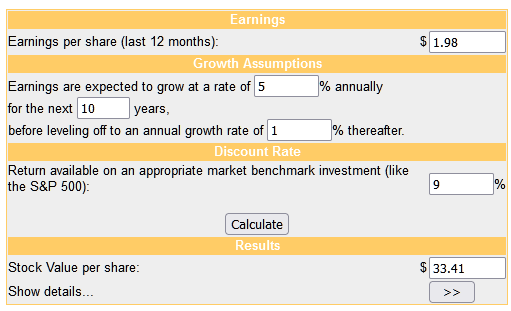

Next is the DCF model with a moderate growth estimate:

moneychimp

The current dividend yield doesn’t offer much support to the capital appreciation part of your potential returns at a mere 1%. The market has rewarded the growth and quality of this company, and then some. Shares are down only 16% since the 2021 peak. Unlike so many other high flying growth stocks during that time. This shows that it didn’t get as overheated as others did during the boom, but there is little chance this company will ever have a low multiple again. So on an intrinsic and multiples basis, the stock is clearly overvalued and a hold for me right now.

Conclusion

The journey of EXPO is a good case study of a capital-light growth company. The returns for long term investors are great, but the situation is different today. The market has rewarded the company mightily, into what I consider overvalued territory. There is no way that the combination of fundamental growth and shareholder yield will provide alpha at this valuation. This stock is a hold for me right now but it should definitely be considered for your watchlist if you are interested in quality.