NicoElNino/iStock by way of Getty Photographs

All the time hold your foes confused. If they’re by no means sure who you’re or what you need, they can not know what you’re prone to do subsequent. ― George R.R. Martin

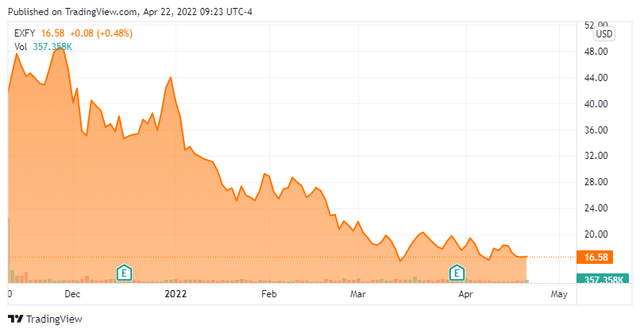

Right this moment, we take our first in-depth have a look at Expensify (NASDAQ:EXFY). The corporate debuted within the fourth quarter of 2021, and the inventory has quickly discovered itself deep in ‘Busted IPO‘ territory. A ‘danger off’ market bears the brunt of the blame for this decline. Can the shares rebound? We try and reply that query by way of the evaluation beneath.

Looking for Alpha

Firm Overview:

Expensify is predicated in Portland, OR. The corporate has developed and offers a cloud-based expense administration software program platform to people, small companies, and firms. Capabilities supplied by the mentioned platform helps companies handle company playing cards, pay payments, scan receipts, generate invoices, accumulate funds, and e book journey. The inventory at present trades round $16.50 a share and sports activities an approximate market capitalization of $1.5 billion.

Fourth Quarter Outcomes:

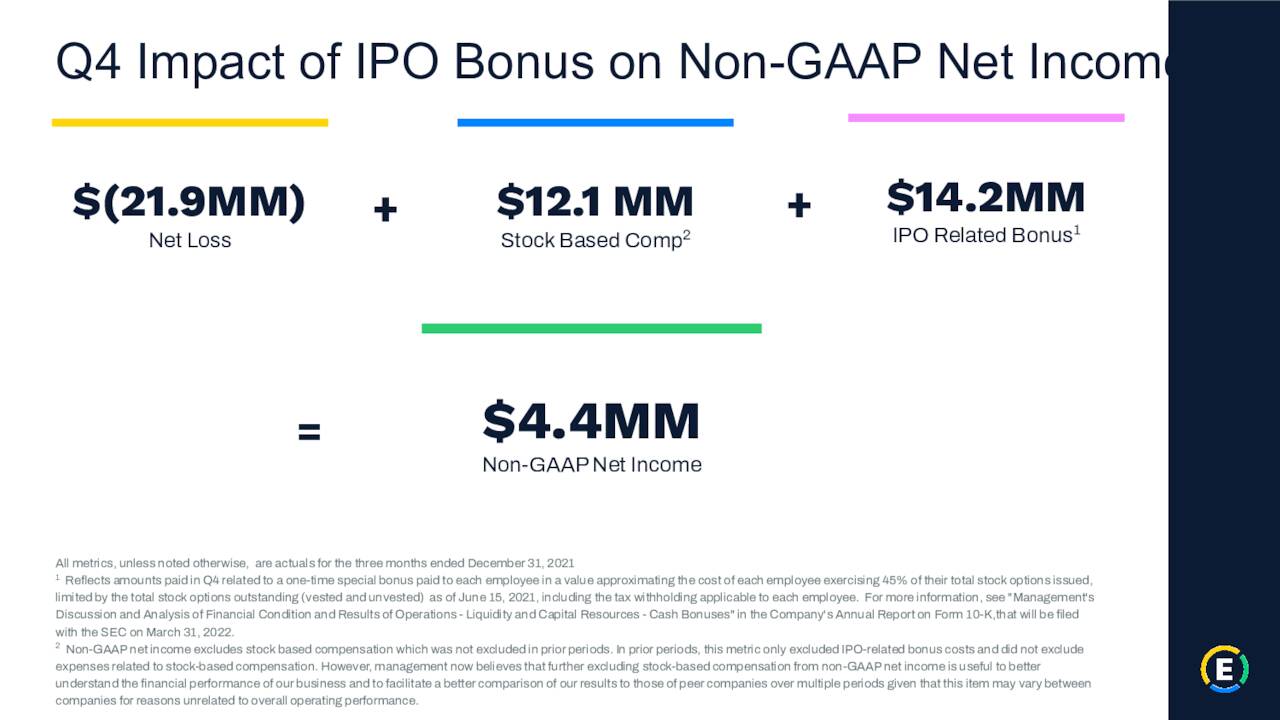

April Firm Presentation

The corporate reported fourth quarter numbers on the finish of March. They had been fairly disappointing. Expensify posted a GAAP lack of 82 cents a share, considerably above the 8 cents a share loss anticipated. The whole internet loss for the quarter was $21.9 million. You will need to word two issues. First, this quantity included a one-time IPO-related bonus expense of $14.2 million. One other $12.1 million was for stock-based compensation. Second, even accounting for that, the GAAP loss was considerably over the consensus whilst administration was intent to deal with the optimistic EBITDA if you happen to simply took out these two objects.

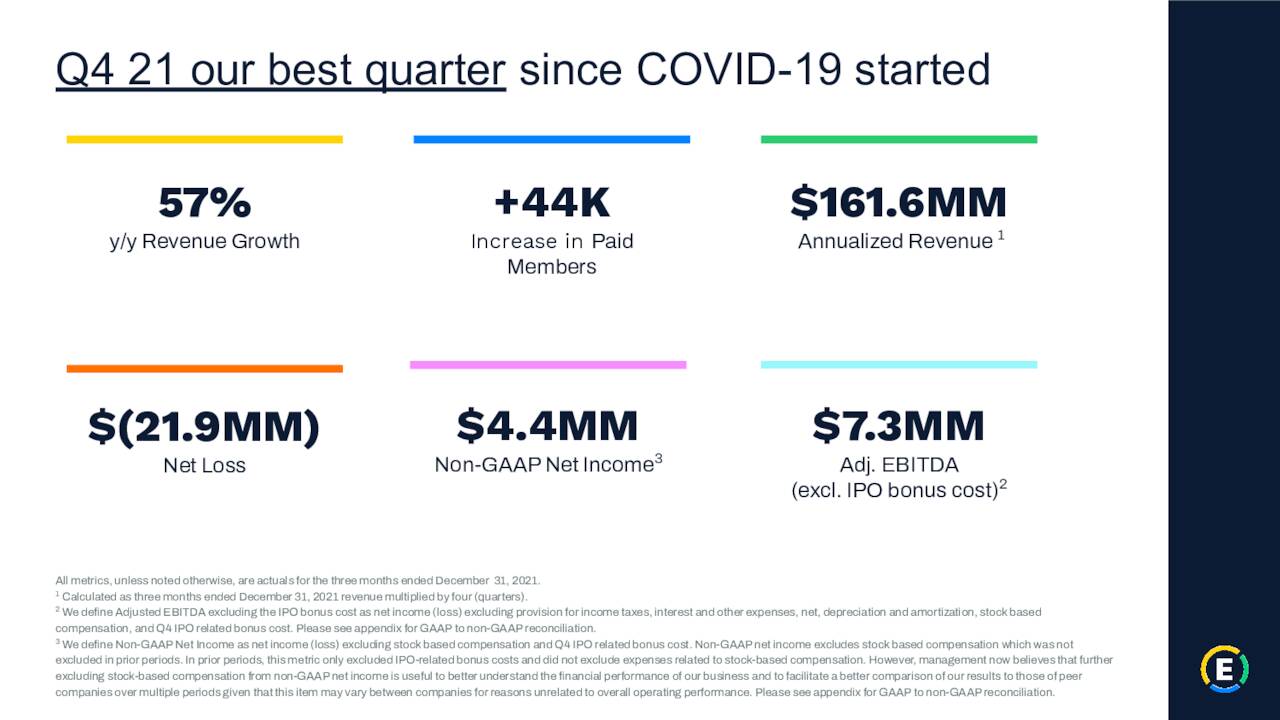

April Firm Presentation

The corporate did see revenues improve 56% on a year-over-year foundation to $40.4 million, which was a bit over the consensus estimate. For FY2021, revenues rose 62% over FY2020’s ranges to $142.8 million. The corporate supplied the next steering for this primary quarter of the brand new fiscal 12 months.

April Firm Presentation

Analyst Commentary & Steadiness Sheet:

Since fourth quarter outcomes posted, 4 analyst companies together with Piper Sandler and JP Morgan have reiterated Purchase scores on the inventory. Albeit, two of them had downward value goal revisions. Worth targets proffered vary from $25 to $47 a share now. Each Financial institution of America ($22 value goal) and Loop Capital Administration ($17, down from $22 beforehand) maintained Maintain scores on the shares.

The corporate ended FY2021 with slightly below $100 million in money and marketable securities on its steadiness sheet towards simply over $50 million in long-term debt. Simply over 12% of excellent shares are at present held brief. There was no insider exercise within the inventory (neither shopping for nor promoting) to this point in 2022.

Verdict:

The present analyst consensus has Expensify incomes roughly 30 cents a share in FY2022 as revenues bounce a projected 25% to simply beneath $180 million. That leaves the corporate promoting for simply over seven occasions FY2022’s projected equating for the subsequent money on the steadiness sheet. Costly, however definitely lower than the 14-15 occasions revenues Expensify was valued at when it first got here public lower than a 12 months in the past.

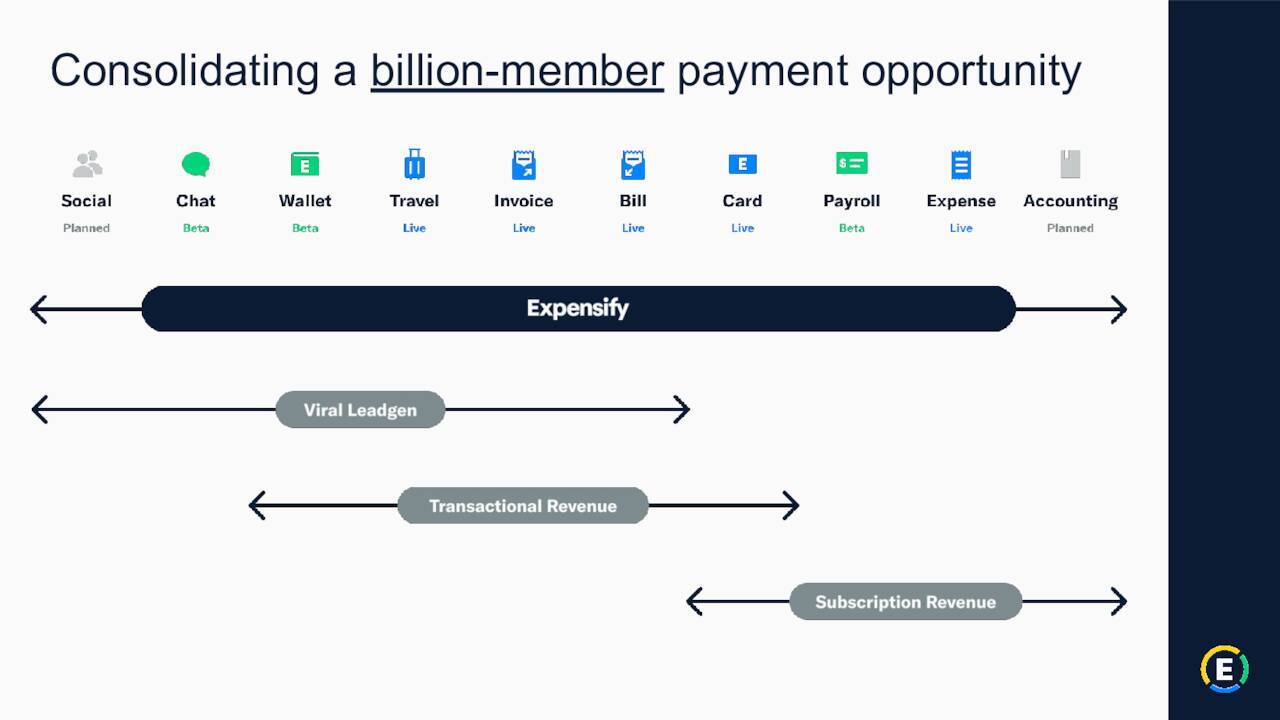

April Firm Presentation

Expensify is transferring to profitability and one might presumably justify paying that premium if one was assured gross sales would develop at a 25% to 35% CAGR for years to return like the corporate’s administration is for the time being.

April Firm Presentation

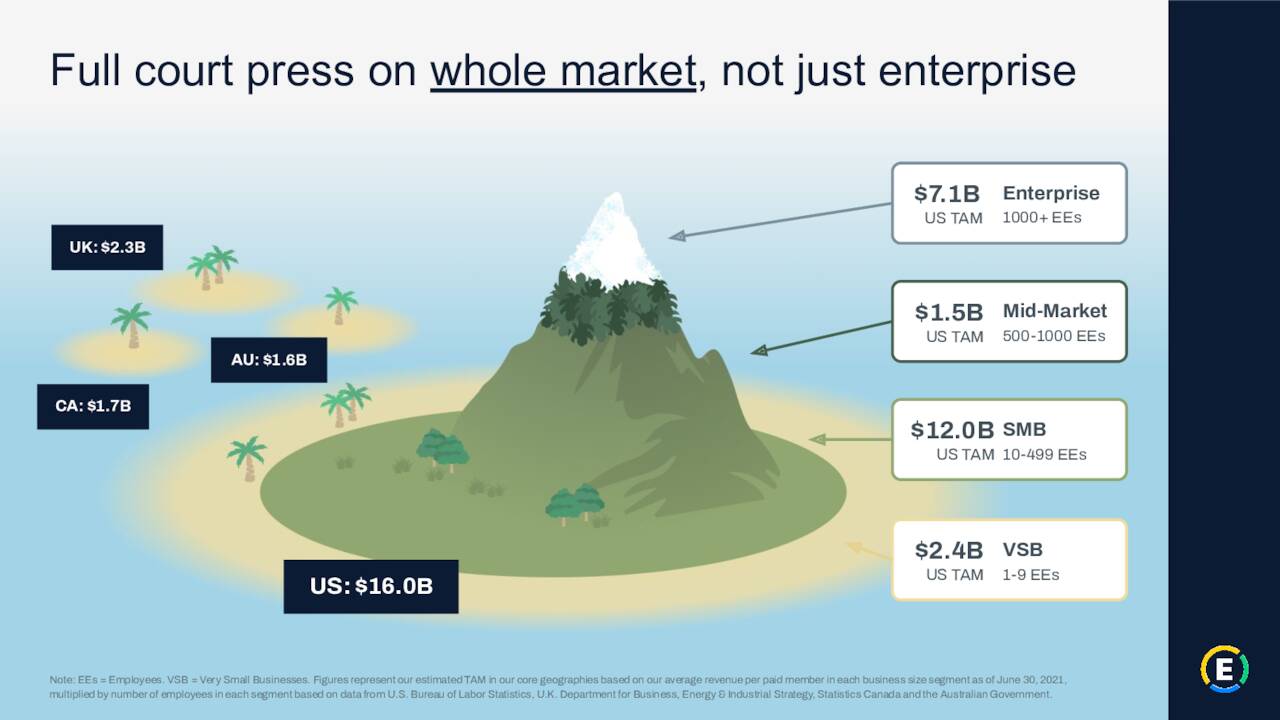

I’m not fairly there but though Expensify is focusing on an enormous potential market. If the market setting wasn’t so dismal to this point in 2022, I might in all probability provoke a small ‘watch merchandise’ holding on this identify. Due to this fact, Expensify is value maintaining a tally of however we now have no funding advice on the inventory for the time being. Possibly when the corporate begins to publish quarterly earnings (with out changes) and/or insiders begin to purchase the dip, we’ll revisit Expensify at the moment and do a standing verify.

April Firm Presentation

Each man ought to lose a battle in his youth, so he doesn’t lose a conflict when he’s outdated.”― George R.R. Martin

Bret Jensen is the Founding father of and authors articles for the Biotech Discussion board, Busted IPO Discussion board, and Insiders Discussion board