Joe Raedle/Getty Pictures Information

Launched in 2001, Expedia (NASDAQ:EXPE) is likely one of the most generally used journey comparators worldwide and permits you to ebook flights, lodges, cruises, vacation packages and automobile leases all around the world. Simply to say a couple of numbers taken from the Expedia 2020 Annual Report we be aware 2.9m lodging properties obtainable, greater than 800 thousand lodges, 500 airline corporations in addition to actions in additional than 200 nations. Registration is non-obligatory and it’s accessible in over thirty languages. Every person can write critiques on any lodging provided that in possession of a legitimate reservation. At the moment, Expedia is likely one of the world’s largest on-line journey companies. The Firm additionally affords particular providers for enterprise journey and manages quite a few manufacturers together with Inns.com, trivago and lots of others displayed under:

Expedia Manufacturers

Why are we assured?

- Regardless of being one of many largest on-line journey companies, Expedia’s gross reserving represents a single fraction of the entire worldwide journey market;

- Our inner staff is assured that Expedia may be very nicely positioned to extend its market penetration after the COVID-19 outbreak and the cyclical restoration;

- Expedia is especially targeted on the US market, and we imagine that macroeconomics are extra supportive within the States than in Continental Europe; FX may play in favour of US vacation travelling within the EU.

- Throughout the pandemic, the Firm has been reworking itself by unifying manufacturers and communication methods. This can convey vital shareholder worth over the medium-long time period. By way of M&A and simplifying Expedia construction, the Egencia model was offered to Amex GBT (American Categorical World Enterprise Journey). As a part of the transaction, Expedia will personal 14% of the mixed entity and extra importantly it has secured a 10-year contract that can generate virtually $60 million in EBITDA.

- Over time, Expedia has been launching vital cost-saving initiatives. Having centralised back-end operations, tech, advertising & communication, and after the model consolidation as already talked about in level 4, Expedia will be capable to generate extra efficiencies. We forecast a value enchancment of virtually $900 million.

- Different cost-saving contains actual property, complete headcount, and software program. Automation will play an important position in Expedia’s future and the corporate will totally profit from these tendencies that the pandemic has accelerated.

Regardless of the saving initiatives, Expedia has promoted varied campaigns aimed to capitalise on client consciousness on journey.

This autumn outcomes, valuation and related dangers

It goes with out saying that the COVID-19 pandemic has severely restricted Expedia’s enterprise mannequin. Whereas ends in This autumn had been as soon as once more negatively affected by the Omicron variant, administration emphasised that purchasers are persevering with to journey and famous the truth that every new variant has been shorter and fewer extreme.

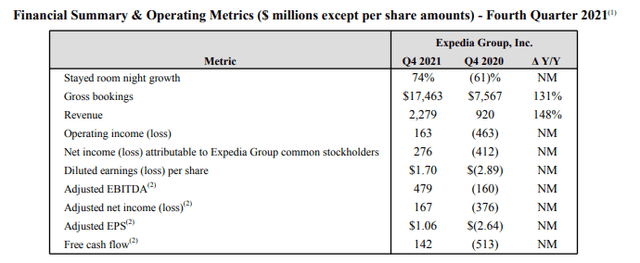

Having mentioned that and having analysed the important thing highlights within the This autumn, we see that income and complete gross bookings are down by 17% and 25% respectively in comparison with pre-COVID-19 ends in 2019.

Expedia Fin Snap

In regards to the valuation, we use a DCF methodology with a long-term progress fee of three% and a WACC of 10%. Primarily based on our inner forecast, the EBITDA determine for 2023 is estimated to be $2.7bn suggesting a base case valuation reaching $230 per share versus the $186 per share on the time of writing. We nonetheless spotlight 1) advertising leverage and value enchancment 2) journey restoration and incremental bookings 3) greater productiveness because of a full transition to the cloud.

Main dangers that would negatively affect Expedia’s inventory worth:

- Macroeconomic occasions;

- Worsening situations from the present well being disaster;

- Increased competitors;

- Modifications in client preferences.

Earlier protection within the journey and leisure business:

- easyJet: Brief Turbulences, Lengthy Upside

- Ryanair: Our Guess On Journey Restoration