Thai Liang Lim

In the past decade, the OTA (Online Travel Agency) industry has become more concentrated, with two players emerging on top: Booking Holdings Inc. (BKNG) and Expedia Group, Inc. (NASDAQ:EXPE). These OTAs represent a significant portion of the market-some 92% of the US OTA market-and command considerable pricing power with both consumers and service providers. Additionally, their combined brand portfolios hold significant brand recognition among consumers of all income levels and travel service consumption trends. The global travel market is expected to grow at above GDP levels, averaging 3.5% CAGR to breach just over $1 trillion per year in 2028.

Expedia Group, Inc. (EXPE) | Booking Holdings Inc. (BKNG) | Airbnb, Inc. (ABNB) | |

Closing Price | $137.10 | $3633.16 | $168.59 |

EPS (2024E) | $12.00 | $175.03 | $4.33 |

EPS (2025E) | $15.00 | $205.33 | $4.94 |

EPS (2026E) | $16.65 | $232.02 | $5.93 |

Gross Buyback Authorized (%) | 25.7% | 11.2% | 5.5% |

Gross Buyback Authorized ($B) | $4.8 | $14.0 | $6.0 |

Market Cap. ($B) | $18.7 | $124.0 | $109.0 |

Dividend Yield (2024E) | 0.00% | 1.00% | 0.00% |

Net Income Margin | 5.36% | 20.07% | 48.32% |

EV/EBITDA | 7.1 | 16.0 | 24.7 |

FCF ($B) | $1.8 | $7.0 | $3.9 |

PEG (2024E) | 1.0 | 1.6 | 1.9 |

P/E (2024E) | 11.4 | 20.7 | 38.9 |

P/E (2025E) | 10.9 | 17.7 | 34.1 |

P/E (2026E) | 8.2 | 15.7 | 28.4 |

P/S (2024E) | 1.3 | 5.4 | 9.7 |

P/S (2025E) | 1.2 | 4.9 | 8.7 |

P/S (2026E) | 1.2 | 4.5 | 7.7 |

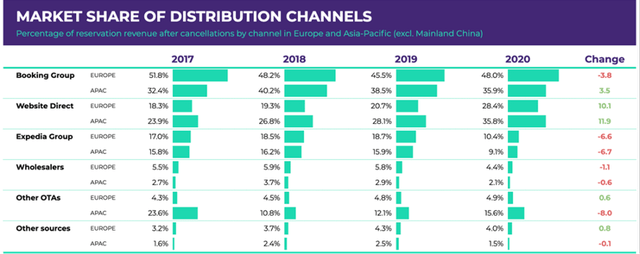

While the post-COVID shakeout of OTAs is still underway, there is still a significant portion of market share to capture across geographies. As it stands in the US, EXPE is undoubtedly the leader, with an estimated 60-75% of the market share by gross bookings. The story is almost exactly the opposite in Europe, with BKNG holding 70-80% of the market share by gross bookings. Both EXPE and BKNG have committed to expanding market share in their rival’s territory. In our view, EXPE’s battle is more uphill. EXPE has relatively little consumer penetration in Europe, and it is focusing heavily on B2B offerings to get a ‘foot-in-the-door’.

A Symbiotic Relationship Embraced

One of the key value drivers for OTAs is their ability to leverage the network effect, creating a virtuous cycle for everyone: customers get more options, service providers get more revenue channels, and OTAs gain brand recognition. EXPE estimates that 80% of all travelers in 2023 utilized an OTA to compare options, even if they didn’t complete a purchase there, with 65% of direct bookings with hotels originating from research started at an OTA.

Growth Factors

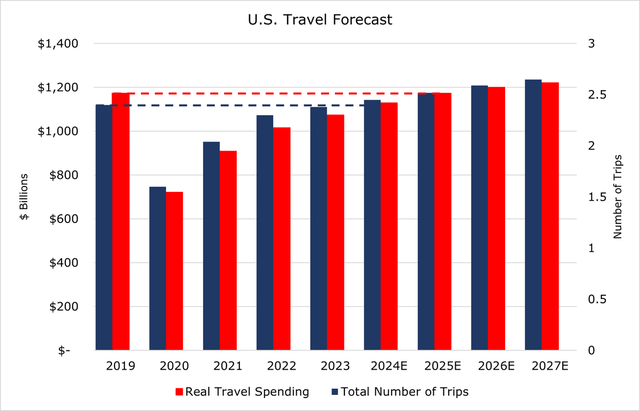

Over the short and medium term, growth will likely come from recouping consumer travel expenditures, with 2024 projected to surpass pre-pandemic volume. Over the long term, the resumption of the intense rivalry between OTAs will likely spur another flurry of M&A activity, particularly in the APAC (Asia Pacific) region, where home-grown OTAs still have a significant market share.

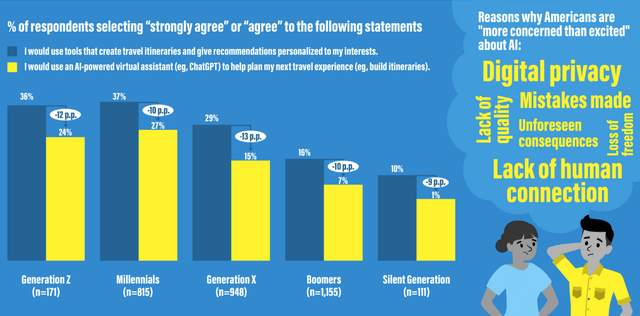

The great equalizer among OTAs is the rise of AI-powered offerings. These offerings aim to integrate experiences like restaurants or tours into suggestions and personalize travel planning to drive loyalty and upselling volume. Generative AI holds significant potential for hyper-personalization in the travel market, which could bridge the gap between customer preferences and OTA listings. With record travel expected in 2024, it will be a key year to observe how travelers receive AI-driven innovations and their impact on the competitive landscape.

State of the Consumer

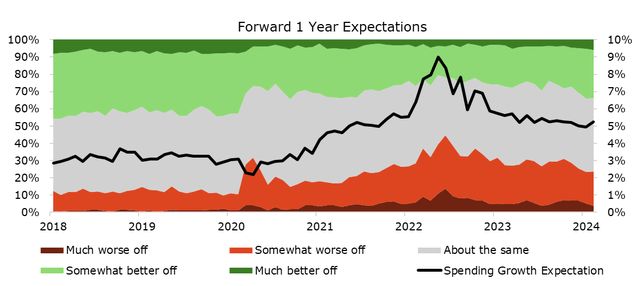

In our article on the state of the consumer, we go into more detail. As restrictions came into effect during the pandemic, aggregate spending on travel declined by 50%, which posed an existential threat to the industry’s volume. Consumers are still grappling with sticky inflation and a rising cost of living. However, there has been some forward movement in both forward spending expectations and how well-off consumers expect to be.

NYFed

Ipsos and Hilton polling show that consumers will increase travel spending over 2024, with 64% of respondents stating that they would cut other areas of spending to prioritize travel. RBC cardholder data for the first quarter of 2024 backs this up, demonstrating that despite eating out far less, consumers are on track for continued strength in the 2024 peak season. Of American consumers, 93% of them plan to travel by July 2024, the highest level in three years.

U.S. Travel Association

Inflation has remained sticky in the US, with the first-rate cut now expected in September, expecting a year-end interest rate of 4.0%. Retail gasoline price decreases and growth in real disposable income are expected to boost consumer spending further, which could pose more inflationary problems. Although the US economy is expected to perform better than the Eurozone, it is still marred by serious uncertainty.

Air travel data remains strong, with the IATA expecting air travel growth trends to breach pre-pandemic levels and finally return to form. Overall, international travel to the US is on the rise but has not fully recovered to pre-pandemic levels, with a full recovery expected in 2025. Economic slowdowns, a strong dollar, and visa delays may hinder growth within the US, with real spending on travel not to reach 2019 levels until 2026. Business travel is growing but at a slower pace, with a full recovery anticipated in 2026.

The eurozone economy likely experienced a mild recession in the second half of 2023, and despite some growth in private consumption, the slowdown in investment was not fully offset. The current ECB rate is 4.0%, and 90% of investors expect that the ECB will begin rate cuts in April 2024, aiming to reduce the deposit rate to the ~2.5% area by year-end. Projections indicate that tourism volume will fully recover in 2024, though originations remain uneven. Chinese arrivals are still significantly below pre-pandemic levels, while North American arrivals have seen substantial recovery, even exceeding pre-pandemic levels.

“Frictionless Commerce” More Important than Ever

Despite a pre-pandemic trend of OTAs losing some market share to direct channels, they remain popular, especially among younger consumers. OTAs offer a distinct value proposition by reducing the “friction” of the purchasing experience. Many consumers (43% of Americans) find purchasing travel cumbersome, with 45% preferring to book their entire trip through one platform. EXPE estimates that in 2023, 80% of all travelers utilized an OTA to compare options, even if they didn’t complete a purchase there, spending an average of 160 minutes on the OTA site or around 52% of total planning time. While cost is a primary concern for travelers, with 92% prioritizing it, only 13% are strictly focused on finding the cheapest option. Instead, being presented with comprehensive information in a single place is a significant value proposition that OTAs offer and one that consumers prefer.

The Ecosystem

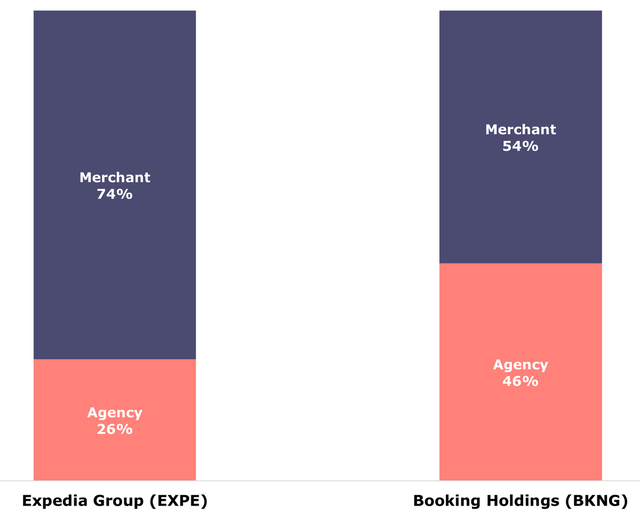

Merchant vs Agency Topline Revenue (EXPE, BKNG)

Agency Model

Traditionally, OTAs operated as successors to brick-and-mortar travel agencies, earning a commission on the value of bookings in a model known as the agency model. In this model, the OTA acts as an intermediary between the customer and the service provider, facilitating the booking process. The OTA earns a commission from the service provider for each booking made through its platform.

- This model is characterized by lower operational risk for the OTA, as it does not involve purchasing inventory upfront.

- OTA commissions can range from 10-30% of the booking value. The industry average is around 15%.

- However, results can have more fluctuations based on seasonality or prices charged by service providers.

Merchant Model

In the early 2000s, OTAs began to adopt what was traditionally reserved for specialist travel agents: the merchant model. In the merchant model, the OTA purchases inventory from the service provider at a wholesale price (typically at a 20-30% discount) and then sells it to customers at a retail price. The difference between the wholesale and retail prices is OTA’s profit.

- This model involves higher operational risk for the OTA, as it assumes the responsibility of selling the inventory. However, it can act as leverage for operating results.

- The merchant model also offers far better revenue stability as OTAs can exercise inventory management practices and a higher level of price control.

- The merchant model allows for easier refunds or rebookings and thus offers a better customer experience.

Rate Parity

What is true of both the merchant and agency models is that they involve rate parity agreements. These agreements are what they sound like; rates offered by OTAs, and service provider direct channels need to be the same or similar. Two levels have begun to take shape in different geographies based on regulations.

- “Wide” rate parity is the harsher of the two. No matter where a customer books, the rates will be the same, or the OTA will have the best rate.

- “Narrow” rate parity came about after European regulators challenged it as cartel-like. Narrow parity allows for a more floating policy regarding price offerings. This usually means that online prices are the same, but agreements cannot dictate direct sales through the phone or in person.

- Of course, there are also “no parity” agreements, in which neither party has a specific obligation to any term of the contract, including availability and rates offered.

A Virtuous Cycle

A trend that began to evolve until the pandemic was service providers taking a harder stance on OTAs eating into their margins. Service providers began to introduce their own booking websites, introduce rewards programs to drive loyalty, and fight several regulatory challenges that began to put OTAs on the back foot. However, the global pandemic and changing consumer habits made service providers begin to see OTAs for what they do best: marketing.

One of the key value drivers for OTAs is their ability to leverage the network effect, creating a virtuous cycle for everyone involved. Customers benefit from a wider range of options, service providers gain additional revenue channels, and OTAs enhance their brand recognition. Over time, enhanced brand recognition among customers and service providers can equally provide OTAs with further leverage in negotiating commission rates or wholesale prices for merchandising.

The billboard effect complements the network effect by providing significant incentives for hotels, other accommodations, and airlines to list their services on OTA platforms. Increased visibility, even through lower-margin channels like OTAs, can increase direct bookings. A significant portion of direct bookings (65%) for hotels originate from customers who initially found the accommodation through an OTA. For many service providers, this far outweighs the potential margin impact of OTAs.

Core Business

EXPE Core Growth: Continued B2B Dominance and International Expansion

EXPE has parted ways with its CEO since 2020 and has appointed Ariane Gorin, former head of the B2B segment as the new CEO. Gorin has been a key leader in the B2B segment since 2014.

Over the course of the pandemic, EXPE entrenched itself in the US and put expansion of international offerings on hold. Through 2024, EXPE expects to restart significant spending to gain market share globally. We feel the sales to other travel agents will be a significant driver of medium-term revenue growth. While the North American and European travel segments are already dominated by EXPE and BKNG, the APAC market still has an extensive list of home-grown competitors. We expect EXPE to conduct M&A in the APAC region over the long term. Over the medium term, local travel agencies are looking for access to US and European inventory to market to the rapidly growing consumer class. By 2025, APAC may surpass the US for gross booking value, with APAC travelers growing average spending per trip by nearly 32% in 2023.

D-Edge

Similar to APAC, we believe that short and medium-term expansion in Europe will come in the form of B2B offerings and partnerships. EXPE is bulking up B2B offerings in Europe with two significant partnerships: Ryanair with “Ryanair Rooms” and Germany’s ADAC. Ryanair, Europe’s largest airline by passenger volume, is seeking to enter the bundled holiday market with Hotel offerings utilizing EXPE’s technology and inventory. ADAC is the German version of AAA and offers several travel discounts for local travel agents across Germany, who will all now have access to EXPE’s inventory. Additional partnerships have been announced, with Turkish Airlines and Iberia Airlines gaining access to more of EXPE’s inventory offerings for European customers. Finally, in 2024, EXPE will roll out the One Key membership program in Europe to directly compete with BKNG’s Genius program and vendor loyalty programs.

Going into 2024, EXPE will continue to consolidate core offerings into the largest three brands: Vrbo, Expedia, and Hotels.com. Initially, this consolidation program was started in 2018 to reduce the burden of having different administrative and tech units for each segment. Thus far, it has been successful in increasing margin and was executed in 2023 on the Vrbo platform. To date, EXPE has decommissioned 17 separate CRM systems and consolidated AI learning from 13 different stacks to a single one that could process 300 million customer data profiles. Better data visibility across segments will undoubtedly enhance potential AI offerings and further increase the penetration of the One Key loyalty membership program.

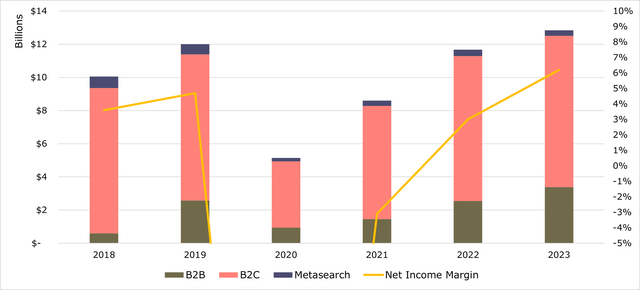

2020 Net Income Margin was -52.5%, excluded for visibility. (EXPE)

The Experience Economy

In Economics, the “experience economy” is a step above the service economy, characterized by premium-priced, highly differentiated experiences. The current “travel experience” market can best be boiled down into tours, attractions, or specialty events.

Tours and Experiences

The two dominant players in this market are the independent GetYourGuide and TripAdvisor’s Viator. Before the pandemic, gross bookings for the sector were only around $254 billion, with Skift estimating growth to $300 billion by 2025. In 2018, 80% of bookings were offline, and while online penetration is increasing, the problem for OTAs is one of comparability. As previously discussed, consumers overwhelmingly want choice without sacrificing value. For flights and hotels, this is easy as they have all but been commoditized. Experiences are still highly differentiated in both content and cost, which radically increases the length of the due diligence process for consumers and OTAs without offering much in the way of margin for OTAs. Despite posting $737 million in revenues for 2023, 41% of TripAdvisor’s total revenue, Viator posted EBITDA just shy of profitability.

In 2023, EXPE unveiled AI-powered offerings that included elements like group trip planning and experience booking for the consumer, which heavily integrates experience listings into suggestions. The advent of artificial intelligence could significantly increase the ease of due diligence for all parties involved as AI learns what a consumer is looking for. While still utilizing the main Expedia brand for experiences, in our view, EXPE will likely use Vrbo to expand into the market as Airbnb has.

Artificial Intelligence

Generative AI holds significant potential for growth in the travel market, particularly through hyper-personalization. As consumers spend extensive time comparing vacation options and exhibit high abandonment rates for online bookings, AI can bridge the gap between customer preferences and OTA listings. Currently, OTAs have the necessary data for hyper-segmentation, but filtering out noise has been challenging and only offered differential gains. With the advent of AI, the cost of analysis could drastically decrease, making hyper-personalization more feasible and economically viable. McKinsey estimates travel firms could see a 15-25% increase in EBIT, while Skift sees a $1.8 billion market for AI-powered chatbots in travel planning. Equally, it could allow for a level of price discrimination between levels of consumers that could drive both volume and margin enhancements.

Skift, McKinsey Research

However, marketing these tools poses a challenge, as consumers appreciate the convenience of AI but are hesitant about its overt use. The technology is still in its infancy but leveraging it could lead to significant growth and market penetration.

EXPE stated that with the final transition of Vrbo to the new tech stack, their AI training would be 8x more effective going into 2024, with 13 different training models being merged into a single one. An initial goal for their AI program is to give the best possible upsells to customers either before or during a trip.

With record travel expected in 2024, it will be a telling indicator of how well travelers will receive AI-driven innovations and how they will affect the competitive landscape. The ability to harness vast amounts of customer data effectively will be a driver of growth and competitiveness in the AI era.

Alternative Accommodation

Once considered a disruptor or competitor with the traditional hotel space, alternative accommodations have grown to make up approximately 20% of global lodging revenue. The segment has become the next domain for the quest for differentiation by hotels and OTAs alike. In 2022, consumer demand for alternative accommodation was 100 million room nights, or only around 10% of total hotel demand. However, it made up approximately 20% of lodging revenue and had almost double the supply of hotel rooms. By far, this area will represent the highest growth by volume for both EXPE and BKNG, with the alternative accommodation market growing at 16.5% CAGR to 2030.

EXPE has been increasingly focusing on its vacation rental platform, Vrbo, which has a well-established customer base and brand recognition in North America. During 2023, spending was down at Vrbo due to the migration of the tech stack, which EXPE expects to make up in 2024. EXPE says that a growth driver for further customer retention and differentiation from competition at Vrbo will be their rewards offerings through their One Key program, which now allows customers to earn and spend rewards points across all EXPE offerings.

Alternative Accommodation Listings (Millions) | |

Booking Holdings Inc. (BKNG) | ~7.2 |

Expedia Group, Inc. (EXPE) | ~2 |

Airbnb, Inc. (ABNB) | 7.7 |

The largest growth area for Vrbo has been the urban market. Currently, Vrbo is not weighted to urban stays like some competitors. While management has not decided to shift on a wide scale to urban areas, in 2024, some urban alternative accommodations will be listed on other EXPE OTA products that are not currently on Vrbo. EXPE expects Vrbo to grow by 10% in revenue, coinciding with a 10% increase in gross booking value. Additionally, the tech stack migration will also bring Vrbo’s EBITDA margin in line with the rest of the company.

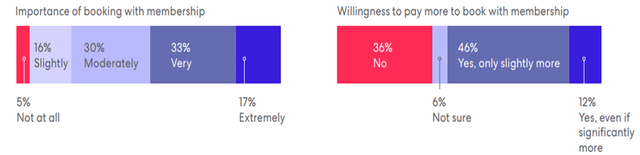

Rewards Offerings: Driving Loyalty and Repeat Business

Traditionally, rewards programs were dominated by non-OTA loyalty programs. EXPE research shows that loyalty is a major factor in booking decisions, with loyalty customers being less price conscious and 61% stating the reason behind this is the collection of points or rewards for future travel.

Importance of Booking with a Loyalty Membership (EXPE Research)

Already, 50% of travelers are members of some rewards program, giving both OTAs a significant value proposition to offer rewards on the total trip rather than just hotel brand or airline. The lack of penetration of OTA loyalty offerings has contributed to a lack of “sticky” customers exercising brand loyalty to an OTA. According to EXPE, it’s One Key members book 3x as many trips as non-members.

With 10 brands in the portfolio, EXPE had significant horizontal diversification that it had been unable to take advantage of until the tech stack migration. The comprehensive launch of One Key combined more than 100 million rewards members into a single system that enables cross-spending across all EXPE offerings, including Vrbo, flights, and experiences. Through 2023, EXPE indicated that it is seeing better cross-shopping and repeat rates improve as customers realize how broad One Key offerings are. 2024 will see the scaling of the One Key program internationally.

Risks

OTAs face growing competition from those outside the traditional travel service business. These come mainly from search engine aggregators (frequently called Metasearch), new entrants, and direct service provider channels. However, we feel regulatory risk is the largest factor at play.

On a broader level, EXPE has 74% of its operations in the merchant model. The merchant model in the event ticket space has seen increased regulatory scrutiny, including a high-profile antitrust suit against TicketMaster. Additionally, alternative accommodations have begun to come under scrutiny on a local level, with several cities in a wide variety of geographies – including NYC – posing harsh regulatory requirements on those seeking to list their property on short-term rental sites. Vrbo and ABNB have both been vocally fighting this, with BKNG likely to soon join the fight as EU regulators have issued an intent to regulate short-term rentals on a broad scale.

Visibility risk in the travel industry is significantly influenced by the sector’s inherent seasonality, characterized by three distinct periods: peak season (May-September), shoulder season (April and October), and off-season (November-March). This cyclicality poses challenges for OTAs in terms of forecasting demand, optimizing inventory, and setting pricing strategies. Given this seasonality and volatility, it can be challenging to make investment decisions, plan marketing campaigns, or develop new products and services.

Financials

Financials will continue to be driven by substantial tailwinds in the pricing of accommodation, pent-up travel demand, and airline ticket prices. However, we do expect to see a softening in the price of airline tickets as demand reaches above 2019 levels. The tailwinds in accommodation pricing are likely to be stickier in our view, as occupancy rates still have not recovered to pre-pandemic levels and supply growth continues to be constrained.

Expedia Group, Inc. (EXPE) | |

Business Unit | Description |

Expedia | Core OTA |

Hotels.com | Hotel OTA |

Vrbo | Core Alternative Accommodation |

Orbitz | Metasearch |

Travelocity | OTA |

Trivago | Metasearch |

Hotwire | Discount OTA |

Wotif | Australia Hotel OTA |

CheapTickets | Discount OTA |

EXPE’s top-line growth is expected to face some headwinds, particularly in air bookings, early in the year, which will amount to mid-single digit increases in revenue at the end of March 2024. As the travel peak season begins in May, we expect to see top-line growth rates increase both from volume increases and the launch of One Key products globally. According to guidance, growth will be linear through 2024, likely ending the year with a total of 10% year-over-year revenue growth. EXPE’s balance sheet is weaker, with gross leverage of 3.7x, which is moving down toward a target of around 2.0x or lower. EXPE states that they intend to do some early repayments of debt to reach the leverage target.

EXPE ended the year with $4.2 billion in cash on hand and generated $1.8 billion in free cash flow. For the full year 2023, the return on capital employed for EXPE was a more disappointing 13.92%, though largely this is because of front-loaded spending on migration and G&A consolidation. We expect to see continued G&A savings in 2024, and a reduction in Capex spending from EXPE given the migration to a single backend is now largely complete. However, EXPE does expect a one-time $100 million cost impairment regarding a further 8% headcount cut, which will be largely realized in the quarter ending March 2024. In our view, this will translate to net income margin increases in line with last year, which saw around 200 bps of expansion to 5.4%. Gross booking margin has been creeping up, ending 2023 at 12.3%, a 40 bps increase since 2021.

EXPE completed $2 billion in share repurchases in 2023, the largest ever for them which on a diluted basis reduced diluted outstanding share count by ~7.0%. EXPE still has some $4.8 billion in authorization, which on a diluted basis would be ~24% of shares.

Conclusion

EXPE’s recent tech and administrative migration has the company at a turning point, and headwinds dissipating may suggest it is undervalued by the market. The consolidation of customer data across its brands into a single platform and significant administrative savings are both expected to unlock substantial value for both customers and shareholders. Additionally, a focus on new loyalty offerings and a renewed global expansion program indicate a promising outlook for margin expansion, earnings growth, and long-term capital appreciation.