Authored by Charles de Quinsonas through BondVigilantes.com,

With the US Treasury curve yielding above 4%, excessive yield (HY) bonds nonetheless supply mid-single digit yields.

As of the top of September, US excessive yield, European excessive yield and rising markets (EM) company excessive yield bonds have been providing 7.0%, 6.1% and seven.4% respectively.

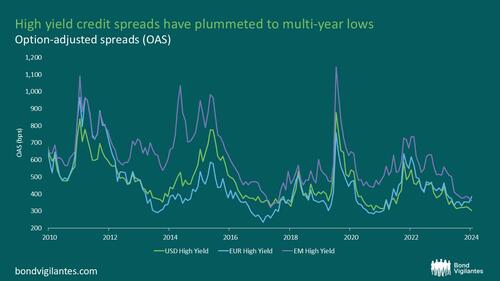

Credit score spreads, nonetheless, have plummeted to multi-year lows and the everlasting debate between all-in yield vs credit score spreads continues.

Supply: M&G, BofA World Analysis, as at 30 September 2024

Credit score spreads matter as a result of, at an index degree, they should overcompensate for future defaults.

In any other case, there can be no motive to spend money on excessive yield bonds, as adjusted for default loss, excessive yield returns can be in keeping with the risk-free charge (or worse, if default losses have been higher than credit score spreads).

Subsequently, credit score spreads have two primary elements:

(i) default-implied spreads, which give a forward-looking view on future defaults and restoration, and

(ii) extra spreads, which, merely put, signify the overcompensation of default danger.

Lively administration will intention to scale back default loss and improve extra unfold.

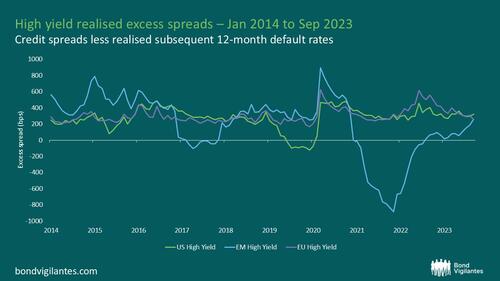

To calculate the precise extra spreads throughout the US, European, and rising markets excessive yield markets, one can subtract from credit score spreads the realised subsequent twelve month default charge (adjusted by restoration worth).

For instance, the US excessive yield market had credit score spreads of 440bps in September 2014. The following 12 months (to Sep-2015) noticed a 3% default charge with a restoration charge of 40%, resulting in a default lack of 1.83%.

Subsequently, traders who purchased US excessive yield in September 2014 loved an precise extra unfold of 257bps (440bps minus 183bps of default loss).

Supply: M&G, as at 30 September 2024

The outcomes over time are shocking.

Whereas the surplus unfold within the European excessive yield market persistently overcompensates for default danger, US excessive yield and rising markets company excessive yield extra spreads have been detrimental throughout some intervals, i.e. realised one-year default losses have been higher than credit score spreads a 12 months earlier.

Nonetheless, this may be defined by one-off occasions, specifically COVID-19 for US excessive yield and the Russia/Ukraine battle for rising markets excessive yield.

With that in thoughts, we imagine median numbers are extra consultant.

Between January 2014 and September 2023, the median extra spreads of US, European and rising markets excessive yield have been remarkably comparable, starting from 280 to 310bps.

Taking in the present day’s traditionally tight excessive yield credit score spreads and utilizing 300bps as our base case extra unfold, we will derive the implied default loss expectation of the marketplace for the subsequent 12 months. As of finish of September 2024, the implied default loss expectations have been 0.1% for US excessive yield, 1.4% for European excessive yield, and 0.9% for rising markets excessive yield. This compares to dealer analysis expectations of two.5-3% default charges for 2025, throughout the US, European and rising markets excessive yield markets.

Even when adjusted for restoration charges, subsequent 12 months’s default losses are anticipated to be higher than what present credit score spreads are pricing in.

Which can prevail within the subsequent 12 months: extra optimism or extra spreads?