blackdovfx

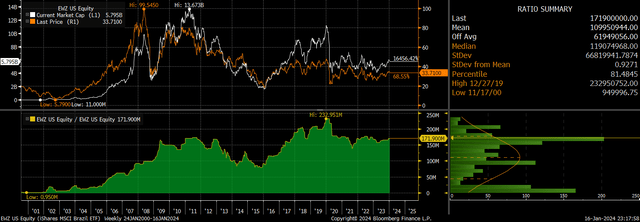

The iShares MSCI Brazil ETF (NYSEARCA:EWZ) continues to outperform its emerging market peers, having risen around 85% relative to the iShares MSCI Emerging Markets ETF (EEM) since its lows in 2021. Since my last article in August, the EWZ has outperformed by a further 11% in total return terms, yet even after these gains, my long-held bullish view remains intact as Brazil’s valuation discount remains at odds with the stable macroeconomic picture. Based on the correlation between valuations and 5-year subsequent returns over the past 20 years, current valuations imply 10-15% annual total returns, depending on the metrics used.

We have started to see an improvement in the market trend, with the EWZ having broken the downtrend from its 2020 highs, and the decline in market-based inflation expectations and credit default risk support a further rise in valuations. After years of portfolio outflows, these conditions could begin to attract renewed inflows, fuelling the next leg of the rally.

The EWZ ETF

EWZ tracks the performance of the MSCI Brazil index and its holdings are heavily weighted towards commodities, with materials and energy making up a combined 38% of the index. Oil major Petrobras is now the largest stock in the index, with a weight of 15%, having taken over from iron ore giant Vale, which has a 12% weighting. Beyond these, financials make up a further 27% due to the presence of Brazil’s large domestic banks. The top 10 holdings represent 56% of the entire portfolio, so it does have high concentration risk, particularly as the country’s banks are also heavily tied to the performance of commodity prices due to their impact on the economy. Like most country-based funds the expense fee is high at 0.59%. These shortcomings are unlikely to prevent strong returns, however, as the ETF currently offers an attractive dividend yield of 5.9%. While this has fallen since my previous article in August as I expected, it is likely to rise over the coming months towards the forward yield on the underlying MSCI Brazil index, which is currently 7.2%.

The EWZ has broken above down trendline resistance from its January 2020 high which is a bullish sign, particularly as this downtrend has been in place since 2010. $40 is the next upside target, and above here would suggest a potential major trend change. Key support comes in around the $32 level, which marks resistance-turned-support from the 2020 highs.

EWZ ETF (Bloomberg)

Valuation Gap Should Close Further

Brazil’s valuation multiples have increased further since my last article in August, but they remain consistent with 10-15% annual 5-year total returns depending on the metric used. This is based on the historical correlation between valuations and 5-year total subsequent returns over the past 20 years. The expected return figure based on the PE ratio is around 15%, but this reflects current elevated margins and so may be on the optimistic side.

Relative to the EM benchmark, the valuation discount has also narrowed, but remains wide. The PE discount has fallen from record highs to the 80th percentile, while the price-to-sales ratio has fallen to its 90th percentile and the dividend yield premium has fallen from record highs to its 86th percentile.

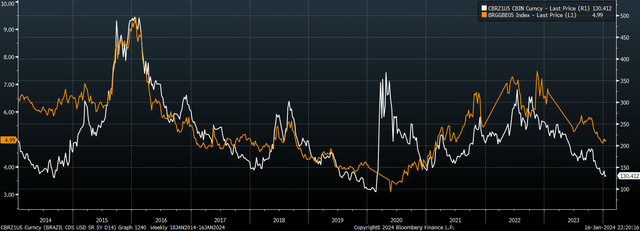

The valuation discount does not seem to be justified by Brazil’s economic fundamentals. Its trade surplus is back at all-time highs and export commodity prices are rising thanks to the recovery in iron ore prices. As the chart below shows, this has put downside pressure on breakeven inflation expectations (orange line), which have fallen to multi-year lows. Furthermore, according to credit default swap markets, default risk is back near pre-Covid levels.

Brazil 5-Year CDS and 5-Year Breakeven Inflation Expectations (Bloomberg)

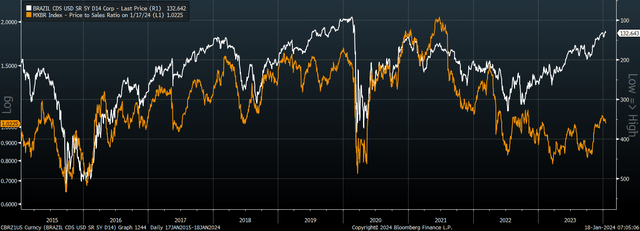

Declining inflation expectations, along with still-high interest rates, should help ensure continued stability in the currency, which is a key factor driving EWZ returns. Meanwhile, low credit risk suggests valuations should continue to move higher. As the chart below shows, the last time default risk was seen as this low, the MSCI Brazil price-to-sales ratio was almost double current levels.

Brazil 5 Year CDS Vs MSCI Brazil PS Ratio (Bloomberg)

Bullish Trend And Macro Stability Support A Return Of Investment Flows

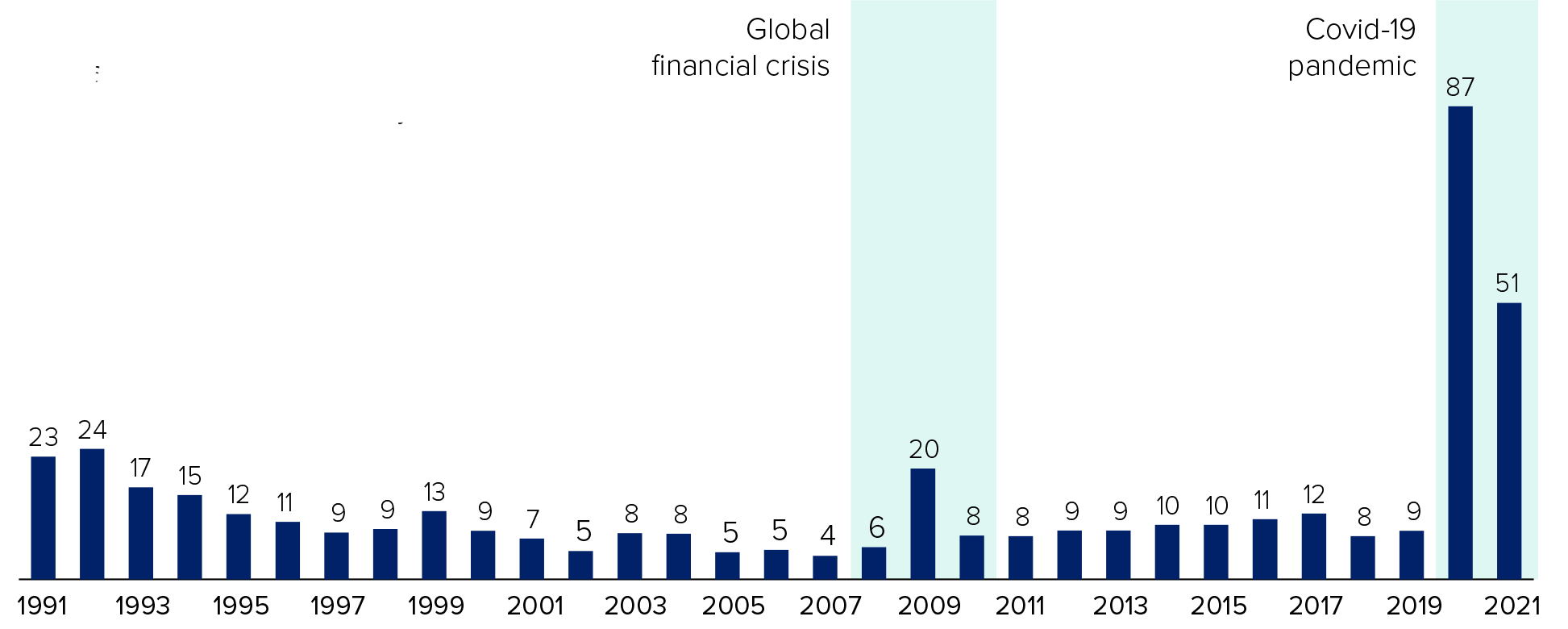

The improving trend of the EWZ and the macroeconomic picture has yet to be reflected in fund flows. Assets under management peaked in 2020 just prior to the Covid crash and remain 26% below their peak. Furthermore, according to the Brazilian Financial and Capital Markets Association, Brazilian net capital market inflows have been negative since 2022 on a rolling basis. We have already seen an improvement in news flow surrounding the Brazilian economy and markets, and I expect this to continue, helping drive a return of investment flows into the country.

EWZ Price And Assets Under Management (Bloomberg)

Main Risk Comes From A Long Fed Pause

The recovery in stocks globally has been closely tied to expectations of Fed rate cuts, with markets now pricing in 170bps of cuts in 2024 alone. This seems highly optimistic. Core inflation remains above the unemployment rate, which are conditions under which the Fed funds rate has been significantly higher in the past. Furthermore, over the past 20 years, the Fed has not cut rates until after a sharp move higher in credit spreads and/or equity market weakness. A prolonged pause in rates could undermine the rally in global stocks seen since October, which poses a risk to the EWZ due to its high beta relative to the S&P500, which has averaged 0.89 over the past three years.

Regarding specific risks to Brazilian corporates, two factors stand out. First is the ongoing widening of the budget deficit, which has widened under President Luiz Inácio Lula da Silva’s public works initiatives and new legal requirements to increase annual spending above inflation. As fiscal sustainability is a key issue for foreign investors, this will be important to watch. Second is Brazil’s increasing economic dependence on China, which is the destination of almost one-third of the country’s total exports. With Chinese stocks crashing in recent days amid renewed economic concerns, there is a risk that this weakness begins to spill over to China’s main trading partners.

Summary

The EWZ has enjoyed an impressive rally over the past few years, outperforming the EM benchmark considerably thanks to a rise in valuation multiples from extremely depressed levels. Despite this outperformance, Brazil’s valuation discount remains high from a historical perspective, and the improvement in macroeconomic conditions suggests further outperformance, particularly if the portfolio outflows seen over recent years reverse. A prolonged pause in interest rates poses the main risk to the EWZ, and it will be important to see how the market reacts to any renewed hawkish rhetoric from the Fed.